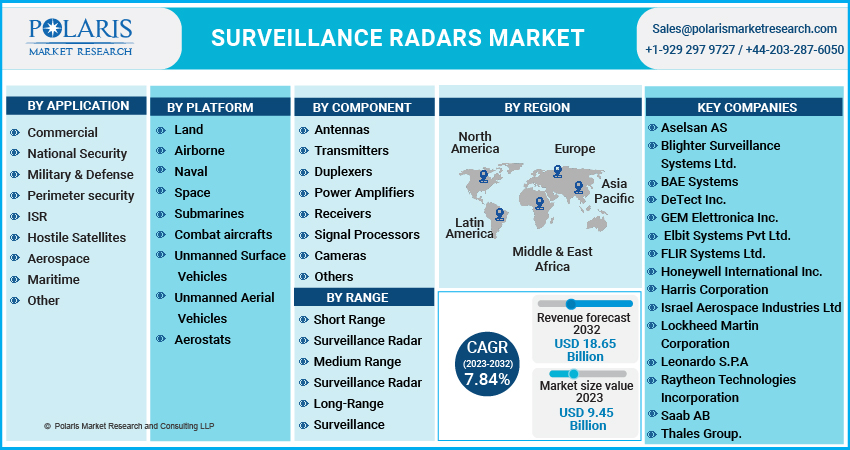

Surveillance Radars Market Share, Size, Trends, Industry Analysis Report, By Application Type (Commercial, National Security, Military & Defense, Perimeter security, ISR, Hostile Satellites, Aerospace, Maritime, and Others); By Platform; By Component; By Range; By Region; Segment Forecast, 2023-2032

- Published Date:Apr-2023

- Pages: 114

- Format: PDF

- Report ID: PM3152

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

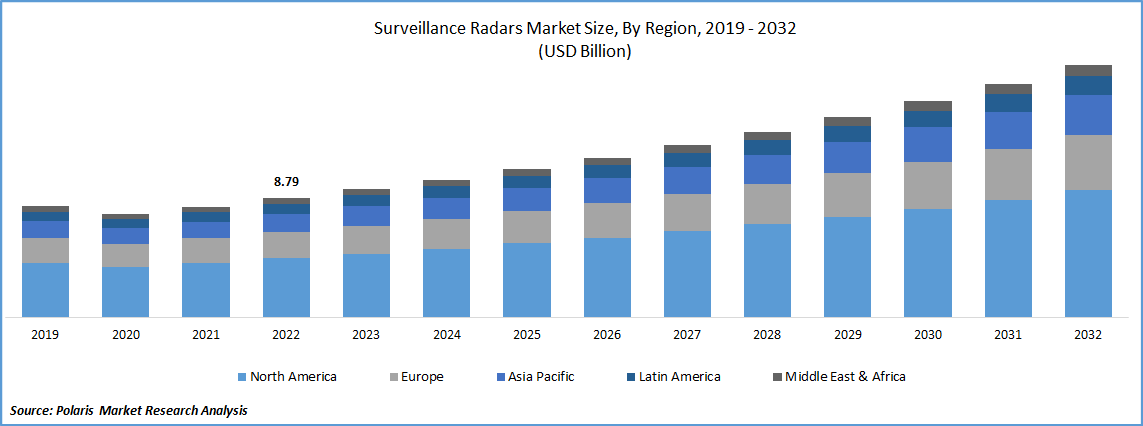

The global surveillance radars market was valued at USD 8.79 billion in 2022 and is expected to grow at a CAGR of 7.84% during the forecast period. Surveillance radar is frequently used for military and commercial purposes, including border surveillance, aircraft pilot aid, air traffic management at commercial airports, and other uses. Surveillance radar systems monitor numerous activities around vital sites and infrastructure, including airports, barracks, borders, and harbors. For national security, these radars are used to find and follow moving, non-linear, and hostile targets.

Know more about this report: Request for sample pages

Additionally, it is applied to strengthen perimeter security in the commercial and defense sectors. These radar systems can function on land, at sea, in the air, and in space. In the defense industry, border security activities often include using surveillance radars. The majority of surveillance radars operate in the S-Band frequency band. In essence, search and targeting activities use these technologies.

It is projected that rising military spending will drive the expansion of the surveillance radar demand during the forecast period. For instance, in February 2022, Radar said it had secured USD 55 million in Series C investment at a USD 365 million capitalization. By expanding current and new platform building blocks, expanding the Radar team, and having a greater impact in important industries like retail, quick-service restaurants, logistic support, travel, accommodation, and the entertainment business, the new capital will be employed to scale Radar's market lead quickly. This spending is increasing to purchase fighter jets with cutting-edge radar technology to improve defense systems.

Additionally, for purposes of airborne and maritime security, surveillance radars can be used to screen various targets, such as helicopters, ultralights, ramblers, unmanned aerial vehicles (UAV), unmanned aerial vehicles, unmanned aerial vehicles, and unmanned aerial vehicles systems (UAS), boats, and ships. Thus, the surveillance radar serves as the military and defense forces' eyes while on a tactical operation in uncharted territory.

Governments in all the major nations have declared a lockdown because of the COVID-19 pandemic, which has caused a halt to business. Several countries have cut their defense spending in response to the global economic crisis and growing emphasis on health care, which impacts the need for surveillance radars. The pandemic also had a negative impact on commercial aviation, which affected their need for surveillance radars. Governmental limitations and a decrease in the demand for new defense contracts have caused a significant decline in revenue. Additionally, the qualified workforce needed to construct the software for surveillance radars was unavailable due to social distance and travel restrictions.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The modernization of defense forces is a top priority for many emerging nations. The demand for modernizing conventional military equipment has grown due to warfare and battlefield management changes. To stay up with technological advancements during combat, modernization is required. For instance, India said in 2019 that it would spend around USD 130 Bn over the following five to seven years to upgrade the combat capability of its defense forces. As a result, the market is anticipated to develop due to the demand for upgrades. Technology advancement, excellent reliability, and cost-effective solutions are further modernization goals.

Additionally, the surveillance radars market is anticipated to develop due to the rise in new aircraft orders and the requirement for military aircraft fleet modernization projects. The U.S. government and major defense businesses have increased their contracts for modernizing military systems. Moreover, the military's use of sophisticated surveillance radar equipment has increased. As a result, during the projected period, the market for surveillance radars is anticipated to rise rapidly.

Report Segmentation

The market is primarily segmented based on application, platform, component, range, and region.

|

By Application |

By Platform |

By Component |

By Range |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The military and defense segment is expected to witness the fastest growth in 2022

The demand for modernizing traditional military and defense equipment has grown due to a shift in warfare and how battlefields are managed. To stay up with technological advancements in combat, modernization is required. So, the market is anticipated to rise due to the demand for upgrades. Aside from improving technology, modernization also seeks to offer solutions that are very reliable and economical.

The short-range surveillance segment industry accounted for the highest market share in 2022

The short-range sector has the largest market share, As it is most frequently utilized in ground-based industrial and military applications. In January 2022, Purchasing 12 short-range ground-based mission radars from the Weibel Doppler XENTA series solidified the partnership between Thales and Weibel Scientific. With its cutting-edge Ground Based Air Defence (GBAD) offering, Thales offers a best-in-class radar range owing to its position as the world's leading radar manufacturer and the highly sophisticated Weibel Doppler outstanding radar capabilities. Thales is still strengthening its ties to the Danish defense sector and following through on its promise to make local investments through industrial collaborations. Therefore, the rising investment in purchasing short-range surveillance radars has boosted segment growth.

The long-range segment category is predicted to develop with the greatest CAGR during the projection period due to the growing demand for over-the-horizon (OTH) radars, which are used to identify targets from a distance of thousands of kilometers (long-range). Also, the contracts among the governments and the major players for maintaining long-range surveillance radar systems are the major factor bolstering segmental growth. For instance, in January 2023, to support the S1850M radar used by particular NATO navies, Thales was awarded a contract. The Organisation for Joint Armament Co-operation (OCCAR) has contracted with Thales to provide and maintain the S1850M long-range air surveillance radar in favor of the French, Italian, and British Ministries of Defense (MoDs) since the investment has been beneficial for the development of radars that have driven the long-range radars segment.

The demand in North America is expected to witness significant growth during forecast period

North America dominated the market due to the presence of the major players and government initiatives for developing surveillance radar systems. The need for surveillance radar systems is anticipated to increase during the review period as more European military organizations adopt cutting-edge technology for conducting intelligence, surveillance, and reconnaissance tasks.

Furthermore, Israel and Saudi Arabia hold the highest market share for advanced radar-based systems. The market in the area will grow as a result. The rising number of new aircraft orders by airlines in the United Arab Emirates and Saudi Arabia, the Middle East, and Africa are predicted to grow substantially throughout the projected period.

Asia-Pacific region is anticipated to have the highest CAGR. In addition, as surveillance radars have significant implications for air traffic regulations, increased passenger traffic from developing nations like China and India is predicted to spur market expansion. In South America, the government of countries like Brazil and Argentina has increased military expenditure on modernizing their ground-based radar equipment, which has fueled the market's expansion.

Competitive Insight

Key players in the global market include Aselsan, Blighter Surveillance, BAE Systems, DeTect, GEM Elettronica, Elbit Systems, FLIR Systems, Honeywell International, Harris Corporation, Israel Aerospace, Lockheed Martin, Leonardo, Raytheon Technologies, Saab AB, & Thales Group.

Recent Developments

- In November 2022, Saab has been granted a contract modification to supply the US Navy with two more AN/SPN-50(V)1 shipboard air traffic radar (SATR) systems.

Surveillance Radars Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 9.45 billion |

|

Revenue forecast in 2032 |

USD 18.65 billion |

|

CAGR |

7.84% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Application, By Platform, By Component, By Range, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aselsan AS, Blighter Surveillance Systems Ltd., BAE Systems, DeTect Inc., GEM Elettronica Inc., Elbit Systems Pvt Ltd., FLIR Systems Ltd., Honeywell International Inc., Harris Corporation, Israel Aerospace Industries Ltd, Lockheed Martin Corporation, Leonardo S.P.A, Raytheon Technologies Incorporation, Saab AB, and Thales Group. |

FAQ's

The surveillance radars market report covering key segments are application, platform, component, range, and region.

Surveillance Radars Market Size Worth $18.65 Billion By 2032.

The global surveillance radars market expected to grow at a CAGR of 7.84% during the forecast period.

North America is leading the global market.

Key driving factors in surveillance radars market are rise in new aircraft orders and the requirement for military aircraft.