Global Surgical Suction Instruments Market Size, Share, Trends, Industry Analysis Report: By Type, By Usability (Disposable, Reusable), By Application, By End Use, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 118

- Format: PDF

- Report ID: PM4999

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

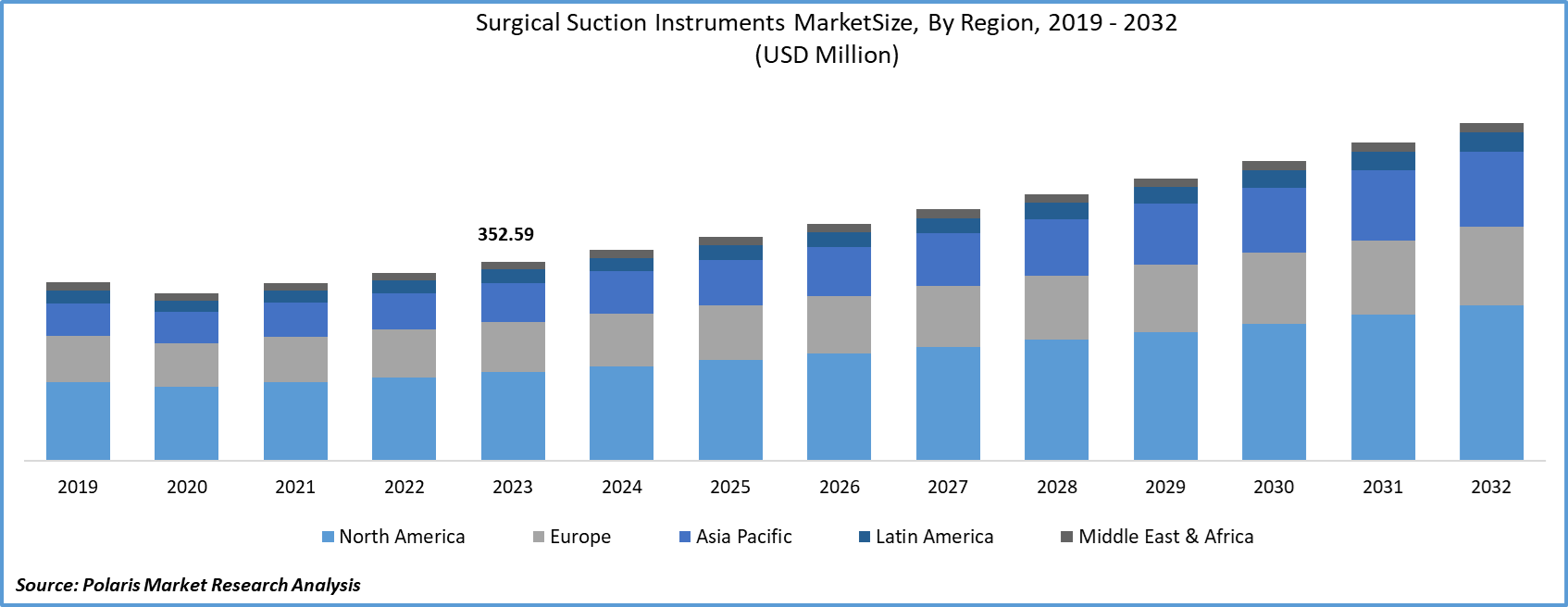

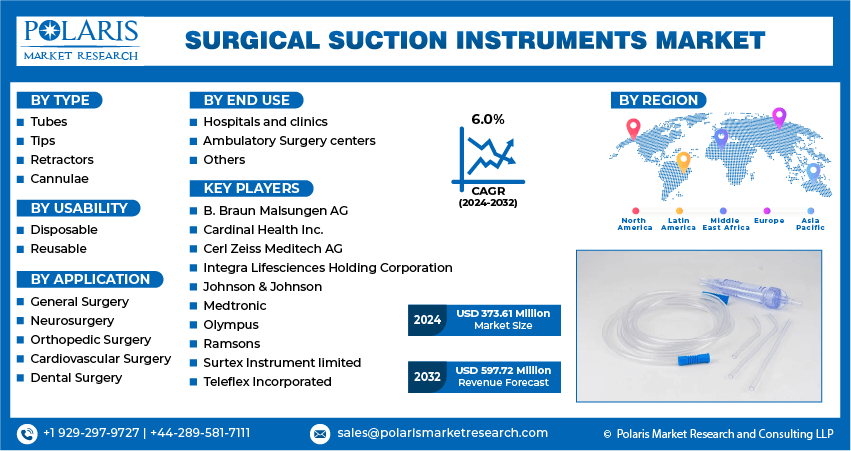

Global surgical suction instruments market size was valued at USD 352.59 million in 2023. The surgical suction instruments market industry is projected to grow from USD 373.61 million in 2024 to USD 597.72 million by 2032, exhibiting a compound annual growth rate (CAGR) of 6.0% during the forecast period (2024 - 2032).

The expansion of healthcare, through the establishment of new hospitals and clinics, is leading to a considerable rise in demand for surgical instruments, mainly suction devices. Additionally, the global increase in the elderly population has resulted in a higher incidence of health conditions that necessitate surgical intervention. This trend is expected to drive the demand for surgeries and, subsequently, surgical suction instruments, contributing to the growth of the surgical suction instruments market.

To Understand More About this Research: Request a Free Sample Report

Various advantages, including quicker recovery times and reduced risks of complications, drive the increasing demand for minimally invasive surgeries. Surgical suction instruments play a key role in these procedures by ensuring clear visibility and effective management of bodily fluids, thereby fueling surgical suction instruments market expansion. Additionally, the ongoing innovations in surgical suction technology, which focus on developing more precise and efficient instruments, have enhanced their overall performance. These advancements are improving the effectiveness of surgical procedures and contributing to the growth of the surgical suction instruments market.

For instance, in June 2021, medical startup TissueFlow developed an advanced surgical suction handle using CYROLITE from Röhm, which is a high-quality transparent plastic designed for medical technology. This instrument is specifically intended for orthopedic surgery and is engineered to facilitate the self-healing of injured bones. Such innovations create a significant demand for surgical instruments, including suction devices.

Surgical Suction Instruments Market Trends

Increasing Number of Surgical Procedures is Driving the Market Growth

The market CAGR for surgical suction instruments is propelled by the escalating prevalence of chronic diseases and the expanding number of surgical procedures worldwide. This trend drives demand for surgical suction instruments, which are pivotal in maintaining optimal visibility during surgeries. These instruments are increasingly essential for achieving efficient and successful operations as surgical procedures increase globally. Their role in ensuring a clear surgical field highlights their importance in modern medical practice, supporting improved patient outcomes and surgical precision.

For instance, according to the World Health Organization (WHO), there were an estimated 20 million cancer cases in 2022. Projections indicate that the number of new cancer cases will surpass 35 million in 2050, signifying a substantial 77% increase from 2022. This surge in cancer incidence is poised to create heightened demand for surgical procedures, thereby stimulating expansion in the surgical suction instruments market.

Rise in Trauma and Accident Cases is Driving the Market Growth

The rising frequency of trauma and accident cases necessitating surgical procedures has led to an increased need for surgical suction instruments. During emergency surgeries, these instruments are essential for removing blood and other fluids from the surgical site, thereby improving visibility and maintaining a sterile environment for surgeons to carry out crucial procedures. This highlights the critical role of high-performing surgical suction devices in trauma care, as they greatly contribute to surgical efficacy.

For instance, according to the Insurance Institute for Highway Safety (IIHS), in 2022, the United States experienced 42,514 fatalities from motor vehicle crashes, resulting in a rate of 12.8 deaths per 100,000 individuals and 1.33 deaths per 100 million miles traveled. This surge in accidents has resulted in an increased demand for emergency surgeries, wherein surgical suction instruments are crucial for extracting excessive blood or fluid from the site of operation. This rising incidence of accidents is expected to grow the surgical suction instruments market share during the forecast period.

Surgical Suction Instruments Market Segment Insights

Surgical Suction Instruments Application Insights

The global surgical suction instruments market segmentation, based on application, includes general surgery, neurosurgery, orthopedic, cardiovascular, and dental. In 2023, the orthopedic segment held the largest market share due to rising surgeries for orthopedic procedures globally, including joint replacements, fracture repairs, and spinal surgeries. Also, the rising number of elderly individuals and the growing incidence of musculoskeletal conditions such as arthritis and osteoporosis have led to a surge in these surgeries, creating a significant need for surgical suction instruments.

For instance, according to WHO, the worldwide elderly population aged 60 and above is estimated to reach 1.4 billion by 2030, a substantial increase from 1 billion in 2020. The elderly population are more prone to osteoporosis and subsequent knee or hip replacements. This demographic trend is anticipated to spur a rise in orthopedic surgeries. Consequently, it will lead to a notable surge in the demand for surgical suction devices, driving the growth of surgical suction instruments market share.

Surgical Suction Instruments Type Insights

The global surgical suction instruments market segmentation, based on type includes tubes, tips, retractors, and cannulae. The tubes category is expected to be the fastest-growing market segment during the forecast period due to its application in various surgical procedures, such as general, orthopedic, cardiovascular, and neurological surgeries. The capacity to efficiently eliminate fluids, blood, and debris from the surgical site makes them indispensable in the operating room. Furthermore, advancements in suction tube design, such as enhanced flexibility and durability, have significantly improved their performance. Utilization of advanced materials and manufacturing techniques ensures that modern suction tubes meet the rigorous demands of a surgical setting.

Moreover, suction tubes have obtained regulatory approvals and certifications, ensuring their safety and efficacy in clinical use. Compliance with stringent regulatory standards enhances their acceptance and usage in healthcare facilities, contributing to the growth of the surgical suction instruments market.

Surgical Suction Instruments Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the rest of the world. The North American surgical suction instruments market dominated in 2023, primarily due to the escalating incidence of cardiovascular disease (CVD) in the adult population. The surge in CVD cases has intensified the need for surgical suction instruments. Unhealthy dietary patterns, characterized by excessive consumption of processed foods, high sugar levels, and unsaturated fats, are significant contributors to the onset of cardiovascular diseases. Inadequate and irregular sleep patterns further escalate the risk of hypertension, diabetes, and other conditions detrimental to cardiac health, leading to an increased demand for cardiovascular surgeries. This has consequently led to a substantial surge in the market share of surgical suction instruments utilized in these procedures.

For instance, the American Heart Association estimates that approximately 127.9 million Americans aged 20 or older, constituting 48.6% of the population, are affected by cardiovascular disorders (CVD), such as coronary heart disease, heart failure, stroke, or hypertension. Excluding hypertension, approximately 28.6 million American adults, or 9.9% of the population, suffer from some form of CVD. As a result, there has been a notable upsurge in the requirement for cardiovascular surgeries, precipitating a rise in the market share of surgical suction instruments employed during these procedures.

The U.S. surgical suction instruments market is expected to experience significant growth during the forecast period due to the rising obesity rate in the country. Obesity is a risk factor for cardiovascular disease. The prevalence of obesity has been steadily increasing due to sedentary lifestyles, poor diet, and lack of physical activity. Obesity leads to a higher likelihood of developing conditions such as atherosclerosis, coronary artery disease, and heart failure.

For instance, according to the Food Research & Action Center, the latest data indicates that 39.6% of adults in the U.S. are classified as obese. Additionally, 31.6% are considered overweight, and 7.7% are classified as severely obese. The increasing prevalence of obesity is driving up the incidence of cardiovascular disease and subsequent heart surgeries, thereby fueling the expansion of the surgical suction instruments market.

Asia Pacific surgical suction instruments market is expected to grow at the fastest CAGR due to rising disposable incomes, investment in healthcare services, and advanced medical devices, particularly surgical instruments. Moreover, the region is witnessing a significant rise in breast cancer cases, driven by a combination of demographic shifts, lifestyle changes, and increased awareness and screening efforts. As a result, rising surgical procedures are increasing the demand for surgical suction instruments market share.

For instance, according to the World Economic Forum, Asia currently accounts for a staggering 45% of all global breast cancer cases and 58% of cervical cancer deaths worldwide. Also, cases of both cancer types are expected to rise faster in APAC than in the rest of the world. In Asia, breast cancer cases are anticipated to rise by 21%, and cervical cancer incidence is expected to rise by 19% between 2020 and 2030. The increasing number of surgical procedures is expected to result in a significant rise in the need for surgical suction devices, thereby driving expansion in the market share of surgical suction instruments.

Further, India's surgical suction instruments market is expected to experience significant growth in the forecast period. India's healthcare infrastructure is undergoing considerable advancements with the development of new hospitals and healthcare centers. These enhanced facilities are expanding the capacity for surgical procedures, leading to a heightened demand for surgical suction instruments.

Surgical Suction Instruments Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the surgical suction instruments market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the surgical suction instruments industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global surgical suction instruments industry to benefit clients and increase the market sector. In recent years, the surgical suction instruments industry has witnessed some technological advancements. Major players in the surgical suction instruments market include B. Braun Malsungen AG, Cardinal Health Inc., Cerl Zeiss Meditech AG, Integra Lifesciences Holding Corporation, Johnson & Johnson, Medtronic, Olympus, Ramsons, Surtex Instrument Limited, and Teleflex Incorporated.

Johnson & Johnson is engaged in research, development, manufacturing, and global sales of diverse healthcare products. Johnson & Johnson offers the ENDOPATH Electrosurgery PROBE PLUS II System, a novel product integrating irrigation, suction, and cautery functions into a single device. This system is engineered to enhance surgical efficiency by minimizing instrument exchanges, achieved through the use of interchangeable shafts enabling various configurations.

Olympus Corporation is a manufacturer and distributor of machinery and instruments. They operate in multiple segments like the scientific solutions business, therapeutic solutions business, endoscopic solutions business, and others. In January 2024, Olympus Corporation completed the acquisition of Taewoong Medical Co., Ltd., a reputable manufacturer of medical devices based in Korea. This strategic acquisition is expected to bolster Olympus's GI Endo Therapy product portfolio and enhance its capacity to provide comprehensive solutions aimed at improving patient outcomes.

Key companies in the surgical suction instruments market include:

- B. Braun Malsungen AG

- Cardinal Health Inc.

- Cerl Zeiss Meditech AG

- Integra Lifesciences Holding Corporation

- Johnson & Johnson

- Medtronic

- Olympus

- Ramsons

- Surtex Instrument limited

- Teleflex Incorporated

Surgical Suction Instruments Industry Developments

- In May 2023, Stryker completed the acquisition of Cerus Endovascular Ltd., a company specializing in the design and development of neurointerventional devices for the treatment of aneurysms. This acquisition has expanded Stryker's portfolio of aneurysm treatment solutions with Cerus Endovascular's innovative products.

- In February 2021, Mindray Medical International acquired Excelsior Union Limited, a prominent medical device company headquartered in the UK. This strategic move is intended to broaden Mindray's range of offerings, particularly in the area of suction devices, while also strengthening its foothold in the worldwide market.

- In May 2020, Medela announced a new U.S.-based production line for its Vario 18 AC portable suction pumps, with a capacity of up to 10,000 units to be manufactured and shipped to healthcare facilities and local hospitals.

Surgical Suction Instruments Market Segmentation:

Surgical Suction Instruments Type Outlook

- Tubes

- Tips

- Retractors

- Cannulae

Surgical Suction Instruments Usability Outlook

- Disposable

- Reusable

Surgical Suction Instruments Application Outlook

- General Surgery

- Neurosurgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Dental Surgery

Surgical Suction Instruments End Use Outlook

- Hospitals and clinics

- Ambulatory Surgery centers

- Others

Surgical Suction Instruments Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surgical Suction Instruments Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 352.59 million |

|

Market Size Value in 2024 |

USD 373.61 million |

|

Revenue Forecast in 2032 |

USD 597.72 million |

|

CAGR |

6.0% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global surgical suction instruments market size was valued at USD 352.59 million in 2023 and is projected to grow to USD 597.72 million by 2032

The global market is projected to grow at a CAGR of 6.0% during the forecast period, 2024-2032.

North America held the largest share in the global market

The key players in the market are B. Braun Malsungen AG, Cardinal Health Inc., Cerl Zeiss Meditech AG, Integra Lifesciences Holding Corporation, Johnson & Johnson, Medtronic, Olympus, Ramsons, Surtex Instrument Limited, and Teleflex Incorporated.

The orthopedic surgery category dominated the market in 2023.

The tube segment had the largest share in the global market.