Surgical Sponges Market Size, Share, Trends, Industry Analysis Report: By Type, Material, Shape, Sterility (Sterile Surgical Sponge and Non-Sterile Surgical Sponge), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5266

- Base Year: 2024

- Historical Data: 2020-2023

Surgical Sponges Market Overview

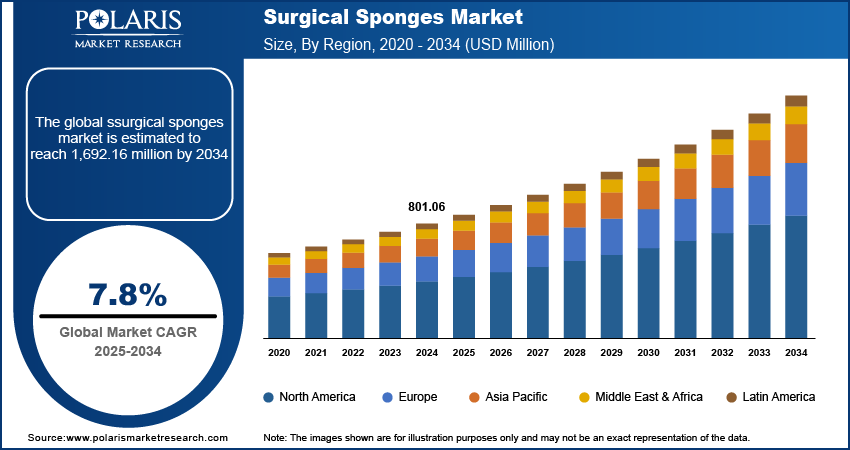

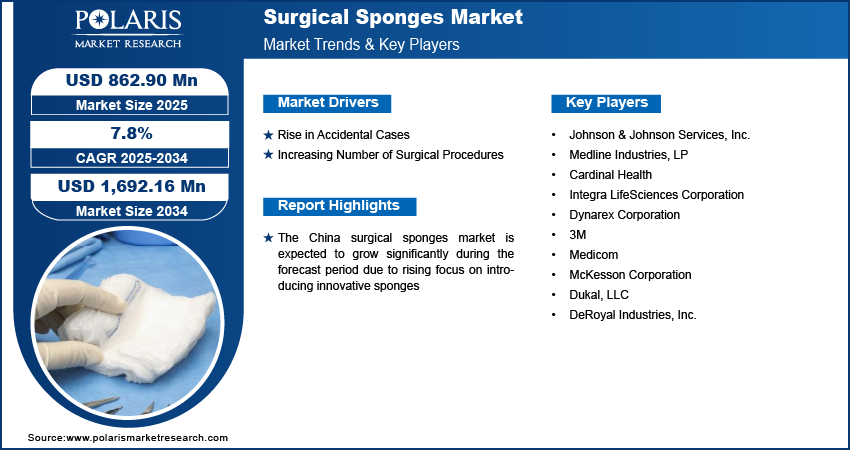

The surgical sponges market size was valued at USD 801.06 million in 2024. The market is projected to grow from USD 862.90 million in 2025 to USD 1,692.16 million by 2034, exhibiting a CAGR of 7.8% during 2025–2034.

Surgical sponges are sterile, absorbent pads or swabs used during surgeries and medical procedures to manage blood and bodily fluids. These are made from materials such as cotton or synthetic fibers. The sponges help maintain a clean surgical field by absorbing excess blood and fluids, which improves visibility for the surgeon. Surgical sponges are also used to apply pressure, protect organs and tissues, and hold open areas of the body during procedures.

The adoption of advanced surgical techniques, including robotic and laparoscopic surgeries that require precise fluid management, contributes to the growing use of surgical sponges. Furthermore, stringent regulatory requirements and higher safety standards in healthcare systems worldwide demand the use of high-quality surgical supplies, which is boosting the surgical sponges market growth.

The increasing number of ambulatory surgical centers performing outpatient surgeries drives the demand for efficient, cost-effective surgical products, including surgical sponges. Moreover, increased healthcare spending in emerging markets, coupled with greater healthcare accessibility, has led to a rise in the demand for surgical sponges due to growing surgical volumes, thereby propelling the surgical sponges market expansion.

To Understand More About this Research: Request a Free Sample Report

Surgical Sponges Market Trend Analysis

Rising Incidence of Accident Injuries

There is a rise in accidental cases, including traumatic injuries, road accidents, and workplace incidents. For instance, in 2022, data from the Insurance Institute for Highway Safety (IIHS) revealed that the US recorded a total of 42,514 fatalities attributed to motor vehicle collisions. The data shows a mortality rate of 12.8 deaths per 100,000 populations and an incidence rate of 1.33 fatalities per 100 million vehicle miles traveled. Incidents result in a higher number of emergency surgeries and trauma-related procedures, increasing demand for surgical sponges. The need for high-quality, sterile sponges to reduce infection risks and enhance patient safety is growing alongside the rising volume of accident-related surgeries. Thus, the surge in trauma cases, particularly in emergency departments and trauma centers, due to accidental injuries is significantly contributing to the surgical sponges market expansion.

Increasing Number of Surgical Procedures

The prevalence of chronic diseases, aging populations, and demand for elective surgeries are rising across the world, leading to more surgeries being performed annually. For instance, according to estimates from the World Health Organization (WHO), there were ∼20 million new cancer cases recorded in 2022, and by 2050, the number of patients could exceed 35 million. All these factors create the demand for surgical procedures. The growing volume of complex and minimally invasive surgeries is accelerating the demand for high-quality, sterile surgical sponges. Furthermore, heightened awareness around surgical safety and infection control has led to greater focus on using reliable and efficient tools, such as surgical sponges, to improve patient outcomes. Thus, the surge in the number of surgeries and evolving healthcare practices fuel the surgical sponge market demand.

Surgical Sponges Market Segment Analysis

Surgical Sponges Market Assessment, by Sterility Outlook

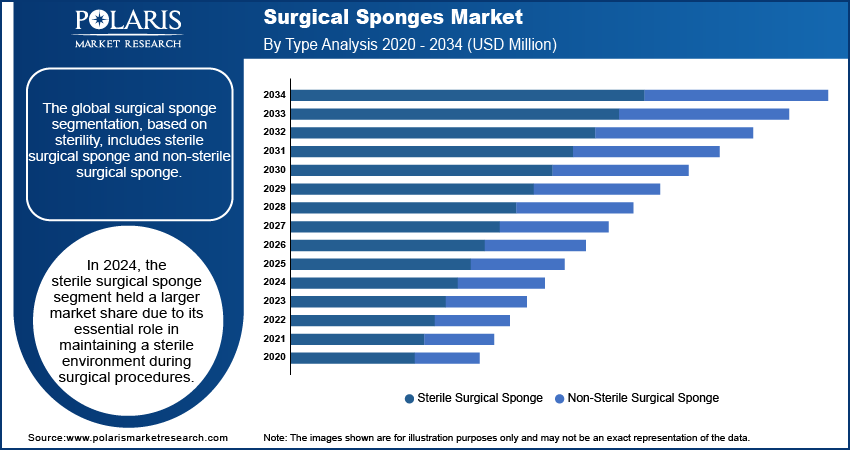

The global surgical sponge segmentation, based on sterility, includes sterile surgical sponge and non-sterile surgical sponge. In 2024, the sterile surgical sponge segment accounted for a larger market due to its essential role in maintaining a sterile environment during surgical procedures. Sterile surgical sponges are crucial for preventing infections, controlling blood loss, and ensuring optimal visibility for surgeons during operations. The growing emphasis on patient safety, infection prevention, and stringent healthcare regulations boost the demand for sterile, single-use surgical sponges. Additionally, the increasing number of surgeries, especially in hospitals and trauma centers, and the rising number of minimally invasive procedures have increased the demand for sterile surgical sponges.

Surgical Sponges Market Outlook, by End User Outlook

The global surgical sponges market segmentation, based on end user, includes hospitals & ambulatory surgery centers and specialty clinics. The hospitals & ambulatory surgery centers segment is expected to witness a higher CAGR during the forecast period due to the increasing number of surgical procedures performed. Ambulatory care services have gained popularity due to their cost-effectiveness, faster recovery times, and ability to perform less complex surgeries. Furthermore, as more patients prefer outpatient procedures, the demand for surgical sponges, especially sterile surgical sponges, continues to grow. Additionally, hospitals and ASCs are adopting advanced surgical techniques that require high standards of hygiene and infection control, further driving the need for reliable surgical sponges. The growing emphasis on improving patient outcomes and ensuring safety during surgical procedures fuels the surgical sponges market development for the hospitals & ambulatory surgery centers segment.

Surgical Sponges Market Regional Outlook

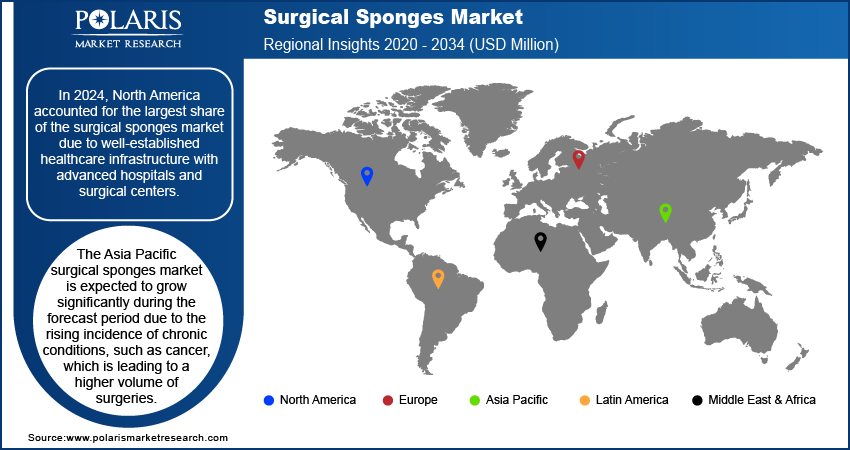

By region, the study provides surgical sponges market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to well-established healthcare infrastructure with advanced hospitals and surgical centers, driving the demand for surgical sponges. These facilities are equipped with advanced technologies and medical supplies, including high-quality surgical sponges, to ensure optimal patient outcomes during surgical procedures. The growing number of surgical procedures in North America contributes to the high demand for surgical sponges. For instance, the American Heart Association reports that around 127.9 million Americans aged 20 and above have cardiovascular disorders (CVD), which constitutes 48.6% of the adult population. Excluding hypertension, ∼28.6 million adults (i.e., 9.9%) are affected by other forms of CVD.

The US surgical sponges market is expected to grow significantly during the forecast period due to enhanced hospital infrastructure, technological advancements in sponge materials, and increased awareness about surgical safety are further supporting demand.

The Asia Pacific surgical sponges market revenue is expected to rise significantly during the forecast period due to the rising prevalence of chronic conditions. Increasing cases of chronic conditions, such as cancer, are leading to a higher volume of surgeries. The World Economic Forum reports that Asia accounts for 45% of global breast cancer cases and 58% of cervical cancer deaths. Cases of both cancers are projected to rise more rapidly in the region than elsewhere, with breast cancer cases expected to increase by 21% and cervical cancer incidence by 19% between 2020 and 2030. Cancer treatment often requires complex surgical procedures, which increases the demand for surgical sponges to manage bleeding and absorb fluids during operations.

The China surgical sponges market is expected to grow significantly during the forecast period due to rising technological advancements. Innovations in the design and materials used for surgical sponges, including the development of antimicrobial sponges, sponges with better absorbency, and enhanced patient safety features, are driving the market in China.

Surgical Sponges Market – Key Players and Competitive Insights

The competitive landscape of the surgical sponges market is characterized by the presence of several key players, ranging from large multinational corporations to regional and local manufacturers. Major global players dominate the market, leveraging their extensive distribution networks, advanced manufacturing capabilities, and strong brand recognition. Major companies focus on innovation, offering a variety of surgical sponges that cater to different surgical needs, such as antimicrobial, highly absorbent, and safety-enhanced sponges equipped with radiofrequency identification (RFID) tags to reduce the risk of retained surgical items (RSIs). Furthermore, companies are increasingly adopting strategies such as partnerships, joint ventures, and mergers and acquisitions to expand their market reach and product portfolios. Regional players, particularly in emerging markets within Asia Pacific and Latin America, are also gaining traction by offering cost-effective alternatives to the premium products of multinational companies. The players often focus on catering to local demand and adjusting their products to meet the specific requirements of regional healthcare systems.

Regulatory compliance and quality assurance are critical competitive factors. With growing patient safety awareness, companies are under pressure to adhere to stringent regulatory standards set by authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The increasing trend toward medical tourism in Asia Pacific is also driving market competition, with local manufacturers ramping up production to meet the needs of high-volume surgical centers. A few key major players are Johnson & Johnson Services, Inc.; Medline Industries, LP; Cardinal Health; Integra LifeSciences Corporation; Dynarex Corporation; 3M; Medicom; McKesson Corporation; Dukal, LL; and DeRoyal Industries, Inc.

Johnson & Johnson Services, Inc. is a multinational corporation based in New Brunswick, New Jersey, USA. The company operates through pharmaceuticals, medical devices, and consumer health products operations. The company's subsidiary, Janssen Pharmaceuticals, Inc., develops and markets drugs in various therapeutic areas, including neuroscience, oncology, infectious diseases, and immunology. Janssen Pharmaceuticals, Inc. is creating many well-known drugs, such as Risperdal (risperidone), Remicade (infliximab), and Zytiga (abiraterone). Johnson & Johnson Services, Inc. SURGIFOAM Powder, saturated with sterile sodium chloride solution, is used in surgical procedures (except ophthalmic) for hemostasis when traditional methods are ineffective. It is used with thrombin for enhanced hemostasis.

3M is an industrial machinery manufacturing company. 3M has four business segments—safety & industrial, transportation & electronics, healthcare, and consumer. The company offers over 60,000 products, including laminates, personal protective equipment, adhesives, paint protection films, window films, dental and orthodontic products, healthcare software, connecting and insulating materials, medical products, electrical and electronic car-care products, electronic circuits and optical films, under several brands.

Key Companies in Surgical Sponges Market

- Johnson & Johnson Services, Inc.

- Medline Industries, LP

- Cardinal Health

- Integra LifeSciences Corporation

- Dynarex Corporation

- 3M

- Medicom

- McKesson Corporation

- Dukal, LLC

- DeRoyal Industries, Inc.

Surgical Sponges Industry Developments

In November 2023, Stryker launched the SurgiCount + Safety-Sponge System, an advanced surgical sponge counting solution designed to improve sponge management in the operating room. This intelligent system allows healthcare providers to count and scan sponges efficiently while integrating with hospital electronic medical records.

Surgical Sponges Market Segmentation

By Type Outlook (Revenue, USD Million; 2020–2034)

- X-Ray Detectable Sponges

- Cotton Gauze Sponges

- Laparotomy Sponges

- Nonwoven Sponges

- Other Surgical Sponges

By Material Outlook (Revenue, USD Million; 2020–2034)

- Cotton

- Rayon

- PVA

- Other Materials

By Shape Outlook (Revenue, USD Million; 2020–2034)

- Round & Cylindrical

- Square & Rectangle

- Other Shapes

By Sterility Outlook (Revenue, USD Million; 2020–2034)

- Sterile Surgical Sponge

- Non-Sterile Surgical Sponge

By Application Outlook (Revenue, USD Million; 2020–2034)

- General Surgery

- Neurosurgery

- Laparotomy

- Dental Surgery

- ENT Surgery

- Other Applications

By End Use Outlook (Revenue, USD Million; 2020–2034)

- Hospitals & Ambulatory Surgery Centers

- Specialty Clinics

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surgical Sponges Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 801.06 million |

|

Market Size Value in 2025 |

USD 862.90 million |

|

Revenue Forecast by 2034 |

USD 1,692.16 million |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global surgical sponges market value reached USD 801.06 million in 2024 and is projected to grow to USD 1,692.16 million by 2034.

The global market is projected to register a CAGR of 7.8% during the forecast period.

In 2024, North America accounted for the largest market share due to well-established healthcare infrastructure with advanced hospitals and surgical centers.

A few key players in the market are Johnson & Johnson Services, Inc.; Medline Industries, LP; Cardinal Health; Integra LifeSciences Corporation; Dynarex Corporation; 3M; Medicom; McKesson Corporation; Dukal, LLC; and DeRoyal Industries, Inc.

In 2024, the sterile surgical sponge segment accounted for a larger market share due to its essential role in maintaining a sterile environment during surgical procedures.

The hospitals & ambulatory surgery centers segment is expected to register a higher CAGR during the forecast period due to the increasing number of surgical procedures performed.