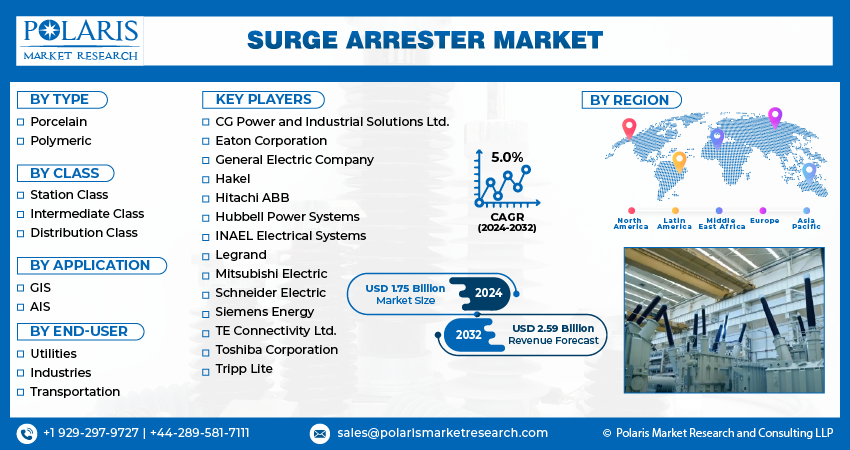

Surge Arrester Market Share, Size, Trends, Industry Analysis Report, By Type (Porcelain, Polymeric); By Class; By Application; By End-User; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3977

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global surge arrester market size and share is projected to witness robust growth. It was valued at USD 1.67 billion in 2023 and is projected to grow to USD 2.59 billion By 2032 exhibiting a CAGR of 5.0% in the forecast period 2024 – 2032

Increasing demand for energy all over the world, rapid rate of industrialization and urbanization, and continuous development in the global electrical industry are among the primary factors driving the demand and sales of surge arresters globally. In addition, the surge in the number of favorable government initiatives across various countries worldwide to improve or enhance their electrical power supply and provide investments and funding for the modernization of existing infrastructure led to increased demand for surge arresters to be used in these efforts, and are pushing the market growth forward at a rapid pace.

The surge arrester, as the name indicates, is an instrument that safeguards other electrical apparatus by arresting or discharging surge stream generated by external, such as lightning, or internal, such as switching events vehemence. It is also known as a surge protection device or, infrequently, a voltage surge suppressor. As they execute more or less similar functions on paper majority of people puzzle surge arresters with lightning arresters. But the lightning arresters are deployed outdoors, and surge arresters are deployed indoors.

Surge arresters restrict overvoltage owing to lightning or switching surges are surges that take place when functioning situations in the electrical system are instantly altered. The surge arrester market size is expanding as they are not outlined to safeguard against an undeviating lightning strike if ever one should occur. However, they provide some standard of safeguarding against electrical fliting generated by lightening strikes when they take place within the usual region of the conductor.

To Understand More About this Research: Request a Free Sample Report

- According to Enerdata, global energy consumption in 2022 grew by 2.1% as compared to the total energy consumption in 2021. China was the leading consumer of energy with over 3,801 Mtoe, followed by the United States and India with 2,182 and 1,005 Mtoe, respectively.

Surge arresters play a crucial role in distribution and transmission networks, as they help protect electrical equipment and electrical lines from surges. Thereby, a significant increase in the number of energy and electrification projects across various countries and their network expansion plans are likely to have a positive impact on sales of surge arresters globally.

- For instance, the global investment in energy transition technologies & projects, including energy efficiency, has reached around USD 1.3 trillion in 2022, and investments in renewable energy also reached USD 0.5 trillion.

Furthermore, major operators in the market are continuously focusing on the enhancement of their product offerings to provide better protection against voltage surges, which mainly includes advancements in surge rating, response time, and energy handling capacity to ensure more reliable protection for sensitive electronic devices, which in turn, likely to generate huge growth potential for the market over the coming years.

The surge arrester market study is a compilation of first-hand data, quantitative and qualitative assessments by industry experts, and inputs from the most relevant stakeholders in the value chain. It uses a number of analytical tools to study and assess the data of key industry players and their surge arrester industry share. Analytical tools used to prepare the report include SWOT analysis, Porter’s Five Forces analysis, feasibility study and investment return analysis, amongst others.

However, increasing competition from the unorganized and local market players and a lack of people's awareness about the importance of surge arresters for surge protection are the major challenges and factors expected to hamper the global market growth.

Industry Dynamics

Growth Drivers

- Growing deployment of smart grid infrastructure driving the product sales and demand

The rapid increase in the deployment of smart grid infrastructure and drastic increase in investments in T&D networks across the world are leading to the adoption of surge arresters due to their effective stabilizing features, that is crucial in various electrification projects, are major factors boosting the global surge arrester market.

Smart grids heavily rely on various electronic and electrical equipment such as sensors, communication devices, data centers, and control systems. These types of components are highly sensitive to voltage spikes and surges. Thereby, surge arresters are installed at several key points in the smart grid to protect equipment from damage and ensure uninterrupted operation.

Report Segmentation

The market is primarily segmented based on type, class, application, end-user, and region.

|

By Type |

By Class |

By Application |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Polymeric segment accounted for the largest market share in 2022

The polymeric segment accounted for the largest market share, mainly due to its widespread adaptability and various beneficial features such as dependable performance in challenging settings, ease of handling & installation, superior breaking resistance, and low operational costs compared to other types available in the market. In addition, the significant demand for polymeric arresters from numerous businesses in order to effectively combat system faults and investments in improving existing power infrastructure will also propel the segment market over the coming years.

By Class Analysis

- The station class segment is expected to hold a significant market share in 2022.

The station class segment is expected to hold a significant market share in terms of revenue in 2022, which is majorly driven by its significant use to protect electrical equipment and infrastructure from voltage surges and its ability to improve the overall reliability of the electrical grid. Apart from this, station-class surge arresters also comply with government regulations required for the installation of surge arresters in several types of critical infrastructure that have fueled the product's use globally.

The distribution class segment is expected to register the highest growth rate over the next coming years on account of the increased need to upgrade or improve outdated distribution networks, which offer stronger overvoltage protection. The rising need and proliferation for flexible distribution grids with high protection capabilities and zero internal watt loss are also likely to boost the sales of distribution class surge arresters.

By Application Analysis

- The industry segment is anticipated to register the highest growth over the projected period.

The industry segment is anticipated to grow at the highest growth rate throughout the study period, which is mainly attributable to the exponential growth of various industrial sectors worldwide, such as manufacturing, petrochemicals, automotive, and many others, that lead to higher electricity consumption and increased risk of voltage surges. Besides this, the growing adoption of renewable energy sources such as wind and solar power in the industrial sector also necessitates surge protection for sensitive electronics in the application of power generation and distribution systems.

The utilities segment led the industry market with substantial revenue share in 2022, mainly due to rising penetration for aging infrastructure replacement with new and modern surge arresters in various utilities worldwide and growing investments by utilities in grid modernization projects to enhance the efficiency and resilience of their electrical grids.

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market in 2022 with a considerable share and is also projected to continue its market dominance over the forecast period. The regional market growth is highly attributable to a significant rise in EHV and UHV transmission investments in major developing countries like India and China and a substantial increase in the region’s electricity generation to conveniently accommodate the burgeoning population and various industrial and commercial sectors across the region. According to the CEIC, total electricity production in China reached 846,170 GWh in July 2023, with a significant increase from the previous month's electricity production of 739,900 GWh.

North America will grow at a rapid pace, owing to the higher proliferation of electronic devices in industrial, residential, & commercial settings and the growing need to replace aging power grid infrastructure across many parts of the region. Apart from this, the region is prone to severe types of weather events, such as thunderstorms, hurricanes, and tornadoes, that can cause power surges and could result in huge damage to equipment and infrastructure. Thus, the need for surge protection solutions like arresters has increased substantially over the years.

Key Market Players & Competitive Insights

The surge arrester market is highly competitive, with the presence of several regional or global market players. The leading companies in the market are significantly expanding their range of surge protection solutions in order to cover a wider range of voltage levels, applications, and industries. Market players are also focusing on developing new innovative surge arrester products with enhanced features, higher compatibility, and improved performance.

Some of the major players operating in the global market include:

- CG Power and Industrial Solutions Ltd.

- Eaton Corporation

- General Electric Company

- Hakel

- Hitachi ABB

- Hubbell Power Systems

- INAEL Electrical Systems

- Legrand

- Mitsubishi Electric

- Schneider Electric

- Siemens Energy

- TE Connectivity Ltd.

- Toshiba Corporation

- Tripp Lite

Recent Developments

- In November 2021, ICM announced the launch of its new comprehensive line-up of innovative surge protective devices that are specially designed with HVAC/R, Appliance, Electrical, and pool and spa. The new line-up includes a single-phase option coupled with the four configurations of 3 phases of SPD.

- In December 2022, DITEK introduced its new digital training platform with partnership with SecurityCEU.com & the CMOOR Group. With this partnership, the future courses will be developed by DIEK in conjunction with the other two companies and offer online and interactive training courses.

Surge Arrester Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.75 billion |

|

Revenue Forecast in 2032 |

USD 2.59 billion |

|

CAGR |

5.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Class, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Navigate through the intricacies of the 2024 surge arrester market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.