Surface Mount Technology Market Size, Share, Trends, Industry Analysis Report: By Equipment, Service (Designing, Test & Prototyping, Supply Chain Services, Manufacturing, and Aftermarket Services), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM3551

- Base Year: 2024

- Historical Data: 2020-2023

Surface Mount Technology Market Overview

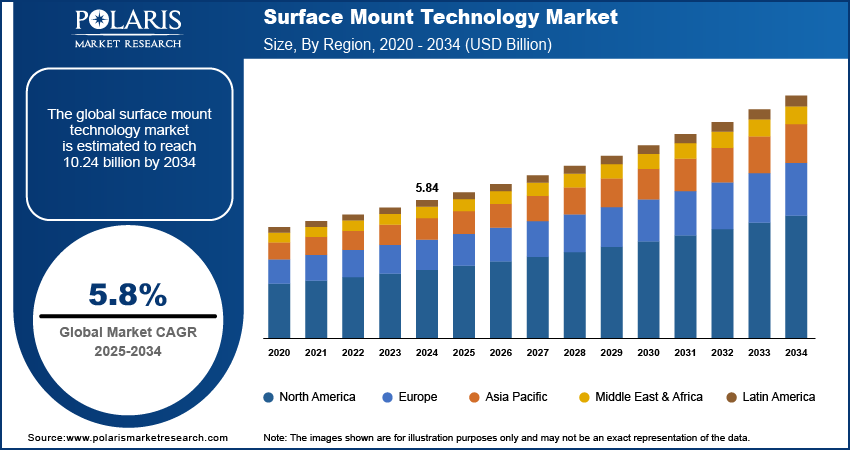

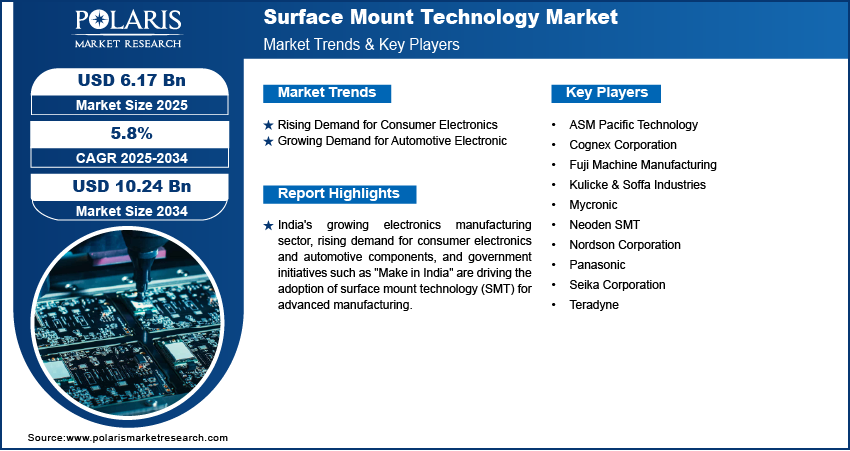

The global surface mount technology market size was valued at USD 5.84 billion in 2024. The market is projected to grow from USD 6.17 billion in 2025 to USD 10.24 billion by 2034, exhibiting a CAGR of 5.8% during 2025–2035.

Surface mount technology (SMT) is a method of assembling electronic components directly onto the surface of printed circuit boards (PCBs) without the need for through holes. It allows for smaller, more compact designs and higher production speeds compared to traditional through-hole technology.

Technological advancements have led to a growing demand for smaller and more compact electronic devices. Surface mount technology (SMT) plays a key role in this process, allowing denser component placement on PCBs. Compared to traditional through-hole components, surface mount technology components are smaller, lighter, and more efficient, which enables manufacturers to create more compact and powerful devices. The need for smaller electronics is driving the adoption of surface-mount technology, thereby driving the surface mount technology market demand.

To Understand More About this Research: Request a Free Sample Report

Surface mount technology is preferred by manufacturers due to its cost-effectiveness and efficiency. SMT components are smaller and lighter, reducing material costs and allowing for better use of space on printed circuit boards (PCBs). Additionally, SMT offers faster production speeds compared to traditional through-hole technology. This means manufacturers can produce more units in less time, which lowers labor costs and increases overall productivity. The combination of reduced costs, faster production, and high-quality results makes surface-mount technology an attractive choice for companies, thereby driving the surface mount technology market growth.

Surface Mount Technology Market Dynamics

Rising Demand for Consumer Electronics

The demand for consumer electronics products such as smartphones, tablets, wearables, and smart home appliances has been rapidly growing. According to Apple's Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022, showcasing the growing demand for consumer electronics. These products require highly efficient, compact, and reliable electronic components. SMT provides these benefits, allowing manufacturers to produce smaller, more reliable, and higher-performance devices at a faster rate. The need for SMT is increasing as consumers demand more advanced technology in their everyday devices. The high demand for smart electronics, coupled with the benefits SMT offers in terms of manufacturing speed and quality, is boosting the surface mount technology market development.

Growing Demand for Automotive Electronics

Modern vehicles rely increasingly on electronic systems, including advanced driver assistance systems (ADAS), in-car entertainment, and electric vehicle (EV) components. These systems demand high-density, reliable, and compact electronic components. Surface mount technology is well-suited to meet this need, as it enables the use of smaller, more reliable components capable of handling the complexities of automotive electronics. The growing integration of electronics in vehicles for safety, connectivity, and performance fuels the demand for SMT. Additionally, growing vehicle sales globally are further driving the demand for the surface mount technology. According to the International Organization of Motor Vehicle Manufacturers, motor vehicle sales rose by 12% in 2023 compared to 2022, showcasing the growth in vehicle sales. Thus, growing demand for automotive electronics is driving the surface mount technology market growth.

Surface Mount Technology Market Segment Analysis

Surface Mount Technology Market Assessment by Equipment Outlook

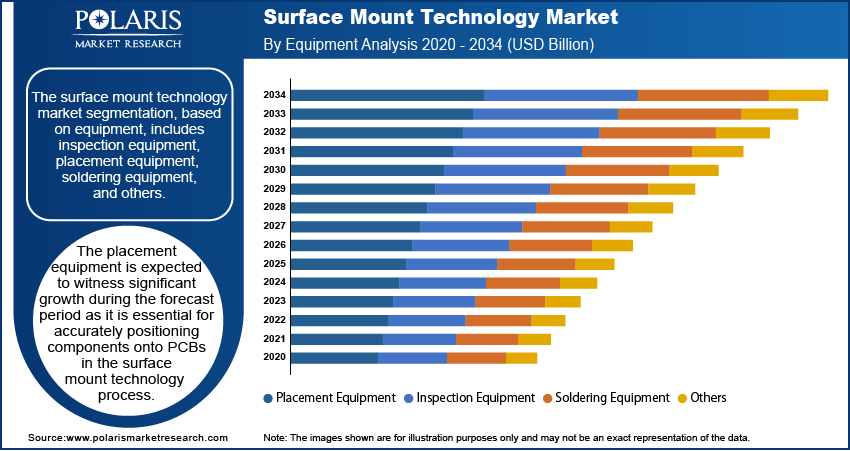

The surface mount technology market segmentation, based on equipment, includes inspection equipment, placement equipment, soldering equipment, and others. The placement equipment is expected to witness significant growth in the forecast period. Placement equipment is essential for accurately positioning components onto printed circuit boards (PCBs) in the surface mount technology process. The need for precise and efficient placement equipment is increasing as the demand for smaller, more complex electronic devices is growing. Additionally, technological advancements in placement machines, such as improved speed, accuracy, and flexibility, are driving segmental growth.

Surface Mount Technology Market Evaluation by Service Outlook

The surface mount technology market segmentation, based on services, includes designing, test & prototyping, supply chain services, manufacturing, and aftermarket services. The designing segment dominated the surface mount technology market share in 2024. The designing phase plays a crucial role in ensuring that electronic components are correctly placed on printed circuit boards (PCBs) for optimal performance. This includes designing the layout, selecting the right components, and ensuring compatibility for manufacturing. The need for precise and efficient designs is growing as industries are demanding more advanced and customized electronic devices. Companies are investing more in design services to meet these requirements, leading to segmental dominance in the global surface mount technology market.

Surface Mount Technology Market Regional Analysis

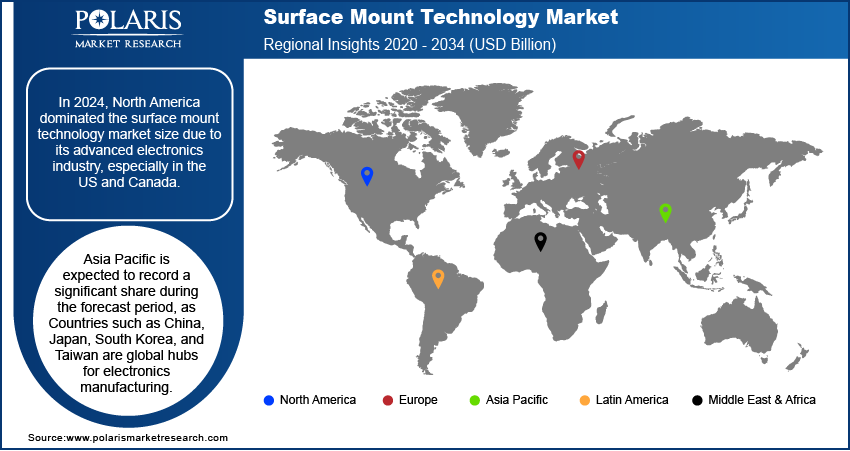

By region, the study provides the surface mount technology market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the surface mount technology market revenue, due to its advanced electronics industry, especially in the US and Canada. The region is home to numerous electronics manufacturers, particularly in sectors such as automotive, healthcare, and consumer electronics. The demand for high-quality and reliable electronic components has led to the widespread adoption of surface mount technology. Additionally, ongoing advancements in technology, including 5G and IoT, are driving the surface mount technology market expansion in North America.

Asia Pacific is expected to record a significant share in the forecast period. Countries such as China, Japan, South Korea, and Taiwan are global hubs for electronics manufacturing. The region is home to some of the world’s largest electronics companies, and the demand for SMT is driven by the booming consumer electronics, automotive, and telecommunications industries. The adoption of advanced SMT equipment and services continues to grow as the region leads in technological advancements. Additionally, cost-effective manufacturing and labor in the region contribute to the rapid Asia Pacific surface mount technology market expansion.

The India surface mount technology market is experiencing substantial growth due to its rapidly expanding electronics manufacturing sector. The country’s demand for consumer electronics, automotive components, and industrial electronics is on the rise, driving the adoption of surface mount technology. India’s increasing focus on digitalization, along with government initiatives such as "Make in India," is encouraging more companies to invest in advanced manufacturing technologies such as SMT. Additionally, India is witnessing a rise in electronics exports, further boosting the demand for surface mount technology.

Surface Mount Technology Market Key Players & Competitive Analysis Report

The surface mount technology market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. According to the surface mount technology market outlook, these companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive surface mount technology market trend is amplified by continuous progress in product offerings. A few major players in the market are ASM Pacific Technology, Cognex Corporation, Fuji Machine Manufacturing, Kulicke & Soffa Industries, Mycronic, Neoden SMT, Nordson Corporation, Panasonic, Seika Corporation, and Teradyne.

Panasonic Holdings Corporation is a Japanese multinational electronics company founded in 1918 by Kōnosuke Matsushita. Initially known as Matsushita Electric Housewares Manufacturing Works, it was later renamed Matsushita Electric Industrial Co., Ltd. in 1935. In 2008, the company changed its name to Panasonic Corporation to align with its global brand, and in 2022, it reorganized into Panasonic Holdings Corporation, with its Lifestyle Updates Business Division taking the Panasonic Corporation name. It is headquartered in Kadoma, Osaka Prefecture, Japan, but with operational headquarters in Tokyo. Panasonic operates across several business segments. The company produces consumer electronics such as TVs, refrigerators, washing machines, and microwave ovens under its appliances segment. It also offers lighting fixtures, home automation systems, and ventilation equipment under life solutions. Additionally, Panasonic provides electronic component mounting systems, welding machines, projectors, and in-flight entertainment systems. The automotive segment focuses on automotive electronics, including cockpit systems and navigation systems. The company also supplies industrial robots, welding equipment, and electronic components, as well as lithium-ion batteries and solar cells. Panasonic operates globally with a presence in Asia, Europe, the Americas, and other regions. Japan serves as the primary hub in Asia, with operations extending across the continent. In Europe, Panasonic is headquartered in Amsterdam, Netherlands, with subsidiaries such as Panasonic Europe Ltd. and Panasonic Marketing Europe GmbH. The company also has operations in the US and other countries in the Americas. Panasonic's SMT solutions offer high-quality mounting through modular placement machines such as the NPM-G series, featuring advanced automation and precision for efficient PCB assembly.

Fuji Machine Manufacturing, now part of Fuji Corporation, was established in 1959 as a machine tool manufacturer. Over time, the company has developed into a significant player in the surface mount technology (SMT) industry, focusing on assembly solutions. Fuji Corporation operates through two main divisions: the robotic solutions division and the machine tools division. The robotic solutions division primarily produces SMT pick and place machines (mounters), which make up a substantial portion of Fuji's sales. These machines are essential for placing electronic components onto printed circuit boards, a critical process in electronics manufacturing. The Machine Tools Division manufactures industrial machines such as lathes, which are used for metal cutting and precision control. Fuji Corporation has operations in several regions. In Asia, it operates through subsidiaries in countries such as Singapore, Malaysia, Thailand, the Philippines, Vietnam, and Indonesia. In North America, Fuji Machine America handles sales and support for its products in the US. Additionally, the company has a presence in Europe. Headquartered in Chiryu, Japan, Fuji maintains a strong presence in its home country, contributing to the local manufacturing sector.

List of Key Companies in Surface Mount Technology Market

- ASM Pacific Technology

- Cognex Corporation

- Fuji Machine Manufacturing

- Kulicke & Soffa Industries

- Mycronic

- Neoden SMT

- Nordson Corporation

- Panasonic

- Seika Corporation

- Teradyne

Surface Mount Technology Industry Development

In January 2025, JUKI launched Fast Smart Modular Mounter RS-2. It achieved an industry-leading placement speed of 50,000 CPH, enhancing component placement efficiency for PCB assembly.

In September 2023, Panasonic Smart Factory Solutions launched the new NPM-G Series SMT machines, including the NPM-GH modular mounter and NPM-GP screen printing machines in India for automated production lines.

Surface Mount Technology Market Segmentation

By Equipment Outlook (Revenue USD Billion, 2020–2034)

- Inspection Equipment

- Placement Equipment

- Soldering Equipment

- Others

By Service Outlook (Revenue USD Billion, 2020–2034)

- Designing

- Test & Prototyping

- Supply Chain Services

- Manufacturing

- Aftermarket Services

By Application Outlook (Revenue USD Billion, 2020–2034)

- Consumer Electronics

- IT & Telecommunication

- Automotive

- Industrial

- Healthcare

- Other

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surface Mount Technology Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.84 billion |

|

Market Size Value in 2025 |

USD 6.17 billion |

|

Revenue Forecast by 2034 |

USD 10.24 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The surface mount technology market size was valued at USD 5.84 billion in 2024 and is projected to grow to USD 10.24 billion by 2034.

The global market is projected to register a CAGR of 5.8% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are ASM Pacific Technology, Cognex Corporation, Fuji Machine Manufacturing, Kulicke & Soffa Industries, Mycronic, Neoden SMT, Nordson Corporation, Panasonic, Seika Corporation, and Teradyne.

The designing segment dominated the market in 2024 as it is an initial and crucial stage for manufacturing.

The placement equipment is expected to witness significant growth during the forecast period as it is essential for accurately positioning components onto printed circuit boards (PCBs) in the surface mount technology process.