Supply Chain Management Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Software, Services); By User Type; By Deployment Model; By End-Use Industry; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 112

- Format: PDF

- Report ID: PM2510

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

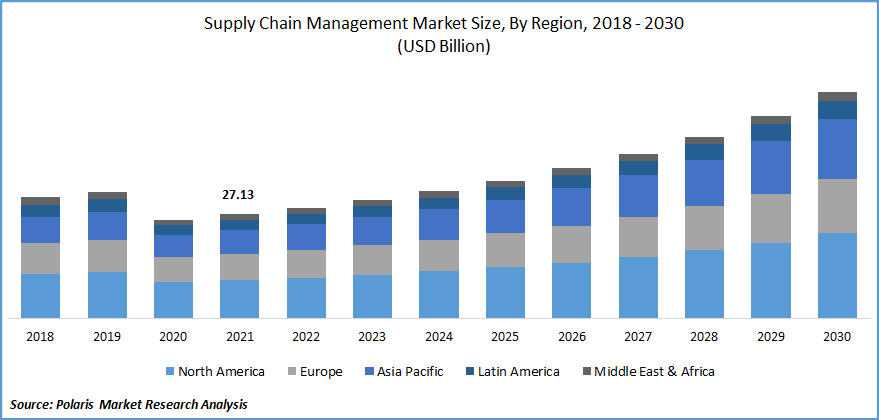

The global supply chain management (SCM) market was valued at USD 27.13 billion in 2021 and is expected to grow at a CAGR of 9.4% during the forecast period. SCM involves centralized management of the flow of goods and services including processes such as planning and forecasting, purchasing, product assembly, moving, storage, distribution, sales, and customer service.

Know more about this report: Request for sample pages

Supply chain management focuses on the development and delivery of goods with higher efficiency and greater speed. Industry players are developing digital SCM systems to improve efficiency in material handling and delivery. The use of supply chain software enables suppliers, manufacturers, logistics providers, and retailers to efficiently manage product creation, order fulfillment, and information tracking.

Integration of advanced technologies such as AI, machine learning, IoT, and automation into SCM enhances processes like manufacturing, maintenance, and distribution, resulting in greater efficiency. These technologies are capable of predicting failure before it happens to enable uninterrupted flow of the supply chain. These technologies are increasingly being adopted for enhanced transparency, visibility, connectivity, and SCM utilization.

Supply chain management offers greater control over manufacturing processes for improved product quality, decreased risk of recalls, and stronger consumer brands. It also assists in maintaining control over shipping procedures to provide enhanced customer service and address shortages or inventory oversupply. Efficient supply chain management offers growth opportunities for companies to strengthen large and international operations.

The COVID-19 pandemic has influenced the growth of the supply chain management market. The market has been impacted by operational challenges, travel restrictions, and workforce impairment. Manufacturing activities have been halted due to various government regulations across the globe. Industries such as transportation, automotive, and food and beverages have all been adversely affected by the pandemic.

However, growth in e-commerce during the pandemic has encouraged supply chain management industry players to automate and digitalize processes to cater to the growing demand. The rising need for seamless product manufacturing, distribution, and delivery has encouraged small and medium businesses to adopt efficient supply chain solutions.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global supply chain management market is fueled by increasing demand for enhanced supply chain transparency and greater demand for demand management solutions from large and medium-sized enterprises. The growth in e-commerce across countries such as China, Japan, and India, rising industrialization, and growing demand from the food and beverage sector supplement the market growth.

Global players are expanding into these countries to tap supply chain management market potential. Technological advancements and increasing adoption of advanced technologies such as artificial intelligence and machine learning further support the supply chain management market growth. New product launches and acquisitions by leading players in the market, coupled with increasing use in the adoption of cloud-based SCM solutions, have resulted in greater demand for SCM across the globe.

E-commerce platforms have gained popularity, especially during the pandemic. Online platforms offer a plethora of options to consumers on a single portal, offering convenience and saving time & effort. Rigorous online marketing supplemented with attractive offers and discounts offered by companies has increased the popularity of e-commerce in recent years. The growth in the e-commerce sector has encouraged market players to adopt SCM solutions for efficient management, planning, and prompt delivery of goods to customers.

Report Segmentation

The market is primarily segmented based on component, user type, deployment model, end-use industry, and region.

|

By Component |

By User Type |

By Deployment Model |

By End-Use Industry |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The software segment accounted for a major share

Software such as purchase management software and inventory management software is used for vendor management, quality management, and logistics and distribution. Organizations use increasingly adopting SCM software to avoid risks and failures. SCM software offers benefits such as enhanced visibility, increased efficiency, analytics, reduced costs, greater agility, and increased compliance, among others.

It assists in automating major processes such as order processing, invoicing, and shipment tracking, resulting in reduced time and administrative costs. SCM software is also used for the identification of excess materials and costs associated with logistics, warehousing, and manufacturing.

Small and medium sized enterprises expected to witness high growth

In 2021, the large enterprises segment accounted for the highest market share owing to the availability of the massive amount of data and resources and the greater need to build a strong network and brand identity.

However, small and medium-sized businesses are increasingly investing in SCM for efficient and secure operations, improved customer experience, and higher productivity. Small and medium-sized enterprises are turning toward cloud-based SCM solutions owing to their flexibility and cost-effectiveness.

Cloud-based segment expected to experience fastest growth

The cloud-based segment is expected to experience significant growth during the forecast period owing to greater flexibility and adaptability to change. Cloud-based applications can be easily modified to address fluctuating circumstances. These applications can be easily integrated with advanced technologies to cater to specific business needs, eliminating the need for a full-scale migration.

Decreasing the cost of data storage coupled with the growing adoption of cloud computing accelerates the growth of this segment. Enterprises are increasingly shifting towards cloud-based products and services owing to their greater processing capabilities, storage, cost-effective pricing models, and reduction in operational overhead.

Retail and Consumer Goods accounted for a significant share

The demand from the retail and consumer goods sector is expected to increase during the forecast period. The outbreak of COVID-19 has further put pressure on retailers to deliver quality products on time. A massive increase in the use of mobile devices, greater adoption of e-commerce platforms, and strict health regulations associated with goods and beverages have boosted the growth of this segment.

FMCG companies are increasingly using supply chain solutions for real-time supply chain visibility, business intelligence, and lower operating costs. Regulatory pressures regarding cleaner and efficient warehouses and the introduction of safety regulations further boost the adoption of SCM solutions in this sector. Same-day delivery of goods and greater consumer expectations regarding individualization and customization of products support the growth of this segment.

North America is expected to hold the largest share

Businesses are increasingly turning towards SCM solutions due to a greater need for increased growth in e-commerce and an increase in demand for transparency in processes across the supply chain. Established technological infrastructure in the region combined with the high adoption of advanced technologies fuels the growth of the market in the region.

North America accounts for a major share of the global market owing to various mergers and acquisitions taking place between leading vendors. The industry leaders are expanding and strengthening their presence in the region, leading to supply chain management market growth.

Competitive Insight

Major players in the supply chain management market are Blue Yonder, BluJay, Epicor Software Corporation, Coupa, GEP, IBM Corporation, Infor, Jaggaer, Kinaxis Inc., Körber, Logility, Manhattan Associates, Oracle Corporation, SAP, The Descartes Systems Group Inc., and Zycus among others. These companies are taking initiatives to strengthen their market presence by introducing advanced solutions for its customers. These players are also collaborating with other market leaders to expand their offerings and acquire new customers.

Recent Developments

In March 2022, Logility, Inc., introduced upgrades to its software for improved planning capabilities across the product lifecycle. The new upgrade offers visualization of the global relationships of users with their interconnected network through supply chain network maps. The software also exhibits new Product Lifecycle Management (PLM) dashboards for improved analysis of product performance and speed-to-market.

In April 2020, Körber collaborated with VARGO, which is a provider of warehouse execution software, material-handling systems integration, and equipment solutions for fulfilment and distribution centres. Through this collaboration, Körber provides VARGO’s offerings such as Continuous Order Fulfillment Engine, and warehouse execution system among others in North America. The collaboration also focuses on distribution of Körber’s warehouse management system by VARGO as part of its design solutions.

Supply Chain Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 27.13 billion |

|

Revenue forecast in 2030 |

USD 58.89 billion |

|

CAGR |

9.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By User Type, By Deployment Model, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Blue Yonder, BluJay, Epicor Software Corporation, Coupa, GEP, IBM Corporation, Infor, Jaggaer, Kinaxis Inc., Körber, Logility, Manhattan Associates, Oracle Corporation, SAP, The Descartes Systems Group Inc., and Zycus. |