Sunglasses Market Size, Share, Trends, Industry Analysis Report

By Product, Material (CR-39, Polycarbonate, Polyurethane, Other); By Channel (Offline and Online); By Region – Market Forecast 2025–2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM1547

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

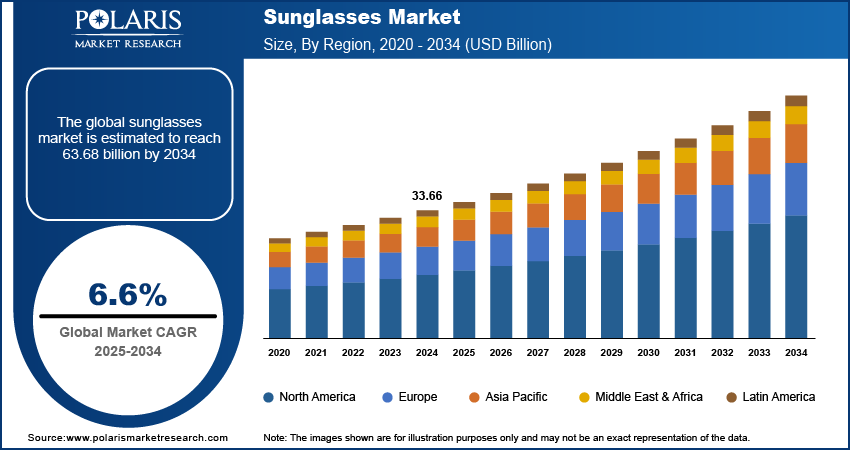

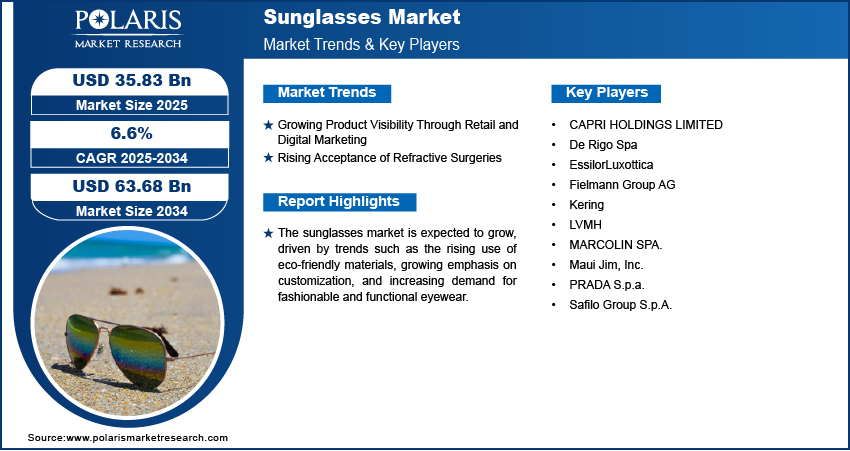

The sunglasses market size was USD 33.66 billion in 2024; it is projected to grow at a CAGR of 6.6% from 2025 to 2034. The primary aspect that drives the demand for sunglasses is the consideration given to the specific requirements of the end use while designing these products. For example, sunglasses for sports activities are manufactured using impact-resistant materials to ensure safety and also have tints.

Market Insights

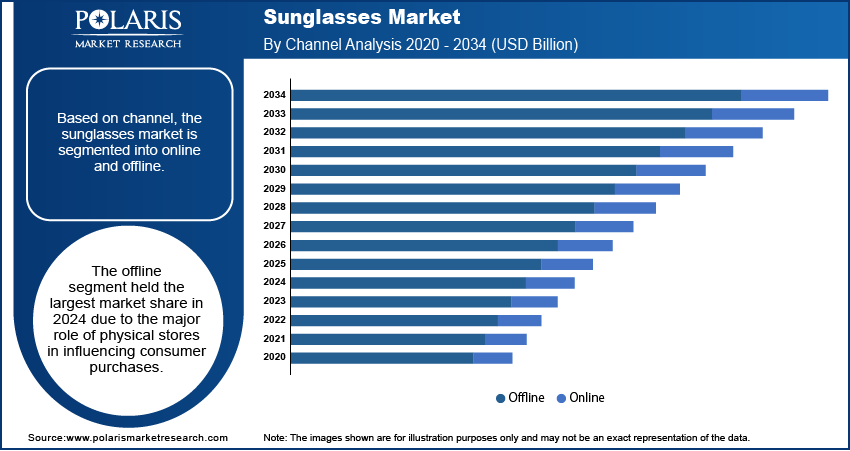

- The offline channel segment held a dominant share of the sunglasses market in 2024, primarily due to the significant influence of physical stores on consumer purchases. A personalized in-store experience appeals to many consumers when selecting eyewear, underscoring the popularity of offline channels.

- The polarized segment is expected to register a higher CAGR during the forecast period. The demand for polarized sunglasses is increasing as outdoor activities, such as driving, fishing, and sports, become more popular.

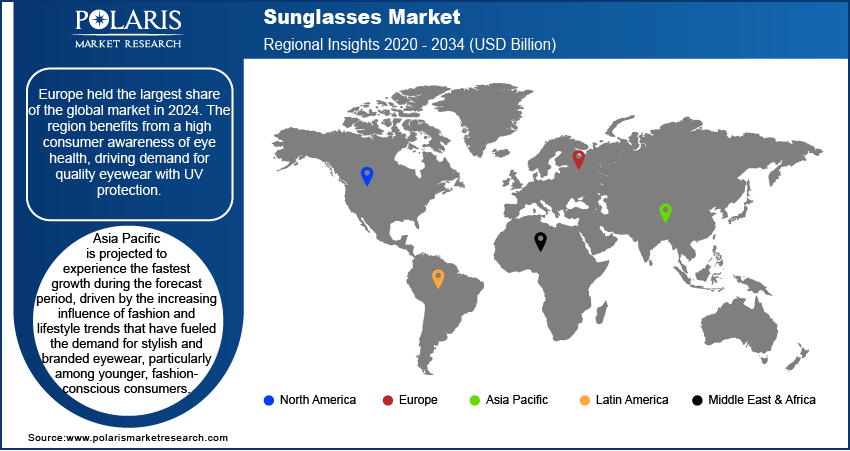

- Europe held the largest market share in 2024. The high consumer awareness of eye health drives the demand for quality eyewear with UV protection features in the region.

- The Asia Pacific sunglasses market is expected to experience the fastest growth during the forecast period. The market growth will be driven by the increasing influence of fashion and lifestyle trends, particularly on younger demographics, fueling the demand for stylish eyewear.

Market Dynamics

- Growing product visibility through retail and digital marketing as well as celebrity endorsements, and the e-commerce boom are the key factors bolstering the sunglasses market.

- The rising acceptance of refractive surgeries is driving demand for high-quality sunglasses. Individuals undergoing LASIK and PRK often experience sensitivity to light after surgery, which drives the need for sunglasses.

- Advancements in lens technology, including polarized and photochromic lenses, mark enhanced product functionality, driving their popularity among tech-savvy consumers and individuals engaging in outdoor activities.

- The competitive landscape of the market encourages major brands to focus on innovation and sustainability to cater to evolving consumer preferences, which presents a significant opportunity for their growth.

- Vast competition and market saturation, resulting from the emergence of independent or local manufacturers, can hinder market growth.

Market Statistics

Market Size in 2024: USD 33.66 billion

Projected Market Size in 2034: USD 63.68 billion

CAGR, 2025–2034: 6.6%

Largest Regional Market, 2024: Europe

AI Impact on Sunglasses Market

- AI features have been introduced to unlock personalized shopping experiences for online buyers. AI-powered virtual try-on tools and facial recognition help them select sunglasses that best suit their face shape and skin tone.

- Sunglass manufacturers and marketing teams closely monitor social media and fashion trends, and consumer behavior data using AI-based analytics to predict demand for styles, colors, and materials.

- AI tools assist in inventory planning and supply chain optimization in manufacturing facilities. For example, predictive analytics improve stock management, reducing overproduction and ensuring the timely availability of popular designs.

- Brands can leverage dynamic pricing and marketing approaches by employing AI algorithms to adjust prices in real time and run highly targeted marketing campaigns.

- Some brands are striving to develop smart sunglasses with activity tracking features, voice assistants, or adaptive lenses through the integration of AI.

- AI-based authentication tools aid in counterfeit detection, helping brands and retailers combat the risks posed by fake sunglasses.

To Understand More About this Research: Request a Free Sample Report

Sunglasses are protective eyewear designed to shield the eyes from harmful ultraviolet (UV) rays and bright light. They are designed in accordance with their end use. For example, sunglasses for usage in sports activities are manufactured using impact-resistant materials to ensure safety and also have tints. Sunglasses that are designed for casual wear or fashion purposes are made using materials of lower resilience as they do not require the same degree of robustness.

Rising awareness about eye protection and the growing adoption of sunglasses as a fashion accessory are a few of the key factors driving the sunglasses market growth. Growing disposable income, rising urbanization, and a shift towards premium eyewear products are also driving market demand. Additionally, advancements in lens technology, including polarized and photochromic lenses, have enhanced product functionality. For instance, Transitions Optical's latest Gen S lenses, introduced in March 2024, change from clear to fully sun-protective in about 25 seconds and revert to clear in less than two minutes, offering a 39% faster adaptation to varying light conditions compared to previous models.

The e-commerce boom and celebrity endorsements further contribute to expanding consumer reach. The market's competitive landscape features major brands focusing on innovation and sustainability to cater to evolving consumer preferences.

Market Dynamics

Growing Product Visibility Through Retail and Digital Marketing

Retail channels and digital marketing play a key role in enhancing consumer awareness and accessibility. Retail stores provide a physical shopping experience, allowing customers to try on sunglasses and make informed decisions. Meanwhile, digital marketing leverages social media, influencer endorsements, and targeted advertisements to reach a broader audience. For instance, in November 2024, Hawkers Sunglasses announced the use of Amazon's Virtual Try-On (VTO) service to improve customer engagement by offering virtual try-ons and minimizing returns. This approach underscores the commitment to mixing technology, social media, and sustainability, providing a customer-centric, interactive shopping experience that drives continued growth and strengthens brand loyalty. E-commerce platforms further boost sales by offering convenience, competitive pricing, and a wide range of options. The dual approach of retail and digital marketing effectively caters to both traditional and tech-savvy consumers, driving sunglasses market growth and brand loyalty.

Rising Acceptance of Refractive Surgeries

Refractive surgeries, such as LASIK and PRK, often increase sensitivity to light post-surgery. Patients are advised to wear sunglasses to protect their eyes from harmful UV rays and reduce glare, fueling demand for high-quality eyewear. Additionally, the emphasis on eye care following surgery encourages individuals to invest in premium sunglasses with advanced lens technologies. For instance, in July 2024, Johnson & Johnson invested in TECLens, a start-up developing a non-incisional refractive correction procedure using corneal cross-linking (CXL) technology. This innovative, non-invasive treatment offers personalized eye care with enhanced precision, providing a promising solution for patients who are not suitable candidates for traditional refractive surgeries. The rising popularity of refractive surgeries globally, coupled with heightened awareness about post-operative eye protection, has contributed to the sunglasses market expansion.

Segment Insights

Market Assessment by Channel Outlook

The global sunglasses market segmentation, based on channel, includes online and offline. The offline segment held the largest sunglasses market share in 2024 due to the major role of physical stores in influencing consumer purchases. Physical retail outlets provide customers with the opportunity to try on sunglasses, ensuring a better fit and enhancing the overall shopping experience. In addition, the in-store experience allows for personalized assistance, which appeals to many consumers, especially when selecting eyewear. Despite the growth of online sales, the physical and experiential nature of offline shopping remains a significant driver, boosting consumer confidence in their purchase decisions. This trend is particularly noticeable in regions with strong traditional retail infrastructure.

Market Evaluation by Product Outlook

The global sunglasses market segmentation, based on product, includes polarized and non-polarized. The polarized segment is expected to witness the fastest sunglasses market growth during the forecast period due to increasing consumer demand for improved visual clarity and protection. Polarized lenses reduce glare caused by reflective surfaces such as water, snow, and roads, offering superior comfort and eye protection. The demand for polarized sunglasses is rising as outdoor activities such as driving, fishing, and sports gain popularity. Additionally, growing awareness about the harmful effects of UV rays is encouraging consumers to opt for sunglasses with advanced protective features, driving the demand for polarized eyewear. This market trend is expected to continue as more consumers seek high-performance sunglasses for both style and functionality.

Regional Analysis

By region, the study provides the sunglasses market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe held the largest sunglasses market share in 2024. The high consumer awareness of eye health is driving demand for quality eyewear with UV protection in the region. Additionally, Europe has a well-established retail infrastructure, with numerous luxury and fashion brands that contribute to a strong market presence and consumer loyalty. For instance, in July 2021, Kering Eyewear acquired Lindberg, a Danish eyewear manufacturer known for its titanium optical frames and customizable designs. This acquisition aims to strengthen Kering Eyewear’s position in the luxury eyewear market by integrating Lindberg’s expertise and expanding its product offerings. The increasing popularity of outdoor activities, such as sports and travel, also plays a role in boosting sunglasses sales. Furthermore, European consumers are highly receptive to trends in both fashion and technology, leading to a growing demand for innovative sunglasses with advanced lens technologies.

The Asia Pacific sunglasses market is expected to experience the fastest growth during the forecast period. The increasing influence of fashion and lifestyle trends has fueled the demand for stylish and branded eyewear, particularly among younger, fashion-conscious consumers. Economic growth, rising disposable incomes, and an expanding middle class, especially in countries such as China and India, are contributing to greater consumer purchasing power. Technological advancements in eyewear, such as enhanced lens technology and innovative frame designs, are further shaping consumer preferences. Additionally, cultural factors such as outdoor activities, tourism, and the growing awareness of UV protection are promoting the widespread adoption of sunglasses across the region.

Key Players and Competitive Insights

The competitive landscape of the global sunglasses market features a mix of well-established global players and emerging regional brands, all aiming for market share through innovation, strategic partnerships, and regional expansion. Leading global companies such as EssilorLuxottica, Kering Eyewear, and Safilo leverage strong research and development capabilities, expansive distribution networks, and diverse brand portfolios to offer a wide range of stylish, functional, and technologically advanced eyewear. Sunglasses market trends show increasing demand for polarized sunglasses, smart eyewear, and eco-friendly materials, reflecting advancements in design and technology. The sunglasses market is projected to grow, fueled by rising consumer awareness of UV protection, the influence of fashion trends, and the growing adoption of eyewear as a lifestyle accessory.

Regional players, especially in the Asia Pacific, are capitalizing on local consumer preferences and economic growth, offering affordable, stylish products to meet the demand of an expanding middle class. Sunglasses market competitive intelligence and strategies include mergers and acquisitions, collaborations with fashion and technology brands, and the development of innovative eyewear solutions to cater to the evolving needs of consumers. These developments highlight the role of technological innovation, fashion trends, and regional market dynamics in driving the growth of the market. A few key major players are EssilorLuxottica; PRADA S.p.a.; Safilo Group S.p.A.; Fielmann Group AG; De Rigo Spa; Kering; CAPRI HOLDINGS LIMITED; MARCOLIN SPA.; Maui Jim, Inc.; and LVMH.

EssilorLuxottica is a global leader in the designing, manufacturing, and distribution of ophthalmic lenses, eyewear frames, and sunglasses. Formed in 2018 from the merger of Essilor and Luxottica, the company has established itself as a powerhouse in the optical industry, operating in over 150 countries. EssilorLuxottica emphasizes innovation and quality across its extensive product range, which includes corrective lenses, reading glasses, and a variety of sunglasses catering to diverse consumer needs. The company’s portfolio features both proprietary and licensed brands, such as Ray-Ban and Oakley, reflecting its commitment to high-quality vision care products that resonate with consumers globally. EssilorLuxottica's business model is characterized by vertical integration, which allows it to control every aspect of the eyewear production process, from research and development to manufacturing and distribution. This approach enhances product quality and it also streamlines operations across its global supply chain. The company's investment in cutting-edge technology and sustainable practices underscores its dedication to addressing contemporary challenges in vision care. Its "Eyes on the Planet" initiative aims for carbon neutrality and promotes circularity within the industry. In addition to its strong market presence, EssilorLuxottica is committed to social responsibility through initiatives such as the OneSight EssilorLuxottica Foundation, which focuses on providing inclusive vision access worldwide. This foundation plays a crucial role in advancing the company's mission to eliminate uncorrected poor vision by 2050. EssilorLuxottica continues to set new standards in eyewear design and consumer experience by combining innovation with a robust distribution network that includes both physical stores and e-commerce platforms.

Prada S.p.a., founded in 1913, is an Italian luxury fashion house renowned for its innovative designs and high-quality craftsmanship. Initially established as a leather goods shop in Milan, the brand has evolved into a global icon. The brand's eyewear collection, especially its sunglasses, reflects its commitment to elegance and sophistication. Prada sunglasses are characterized by bold silhouettes, luxurious materials, and meticulous attention to detail, making them functional accessories and fashion statements that embody individuality and style. The sunglasses range from classic aviators to contemporary cat-eye shapes, catering to diverse tastes and preferences. Each pair is crafted using high-quality materials such as acetate, metal, and nylon. Acetate frames are lightweight and vibrant, while metal frames offer a sleek, modern aesthetic. Nylon is often used for sporty designs that require durability without compromising comfort. The variety in frame shapes, ranging from round and oval to square, ensures that there is a perfect fit for every face type. Prada sunglasses also feature various lens types tailored to different needs. Gradient lenses provide a stylish transition between light conditions, while solid lenses offer consistent sun protection. Mirror lenses are particularly popular for outdoor activities as they reflect light away from the eyes. The color palette of Prada sunglasses includes timeless options such as classic black and trendy white, along with vibrant shades that appeal to fashion-forward consumers.

List of Key Companies

- CAPRI HOLDINGS LIMITED

- De Rigo Spa

- EssilorLuxottica

- Fielmann Group AG

- Kering

- LVMH

- MARCOLIN SPA.

- Maui Jim, Inc.

- PRADA S.p.a.

- Safilo Group S.p.A.

Sunglasses Industry Developments

In January 2024, TAG Heuer reentered the high-end eyewear market through a long-term partnership with LVMH's Thélios, which will develop, manufacture, and distribute sunglasses and optical glasses. The new collection was unveiled at LVMH Watch Week in Miami and Milan, blending performance, style, and innovation.

In September 2024, EssilorLuxottica extended its partnership with Meta Platforms, signing a long-term agreement to develop multi-generational smart eyewear products. This collaboration builds on their successful partnership since 2019, which led to the launch of two generations of Ray-Ban smart glasses.

In September 2024, Bluebell Group expanded its partnership with OWNDAYS, opening two new stores in Sydney, Australia, as part of a broader strategy to grow the brand’s presence in the region. This follows a successful collaboration in Hong Kong and OWNDAYS' merger with Lenskart in 2022.

Sunglasses Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Polarized

- Non-Polarized

By Material Outlook (Revenue, USD Billion, 2020–2034)

- CR-39

- Polycarbonate

- Polyurethane

- Others

By Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 33.66 billion |

|

Market Size Value in 2025 |

USD 35.83 billion |

|

Revenue Forecast by 2034 |

USD 63.68 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global sunglasses market size was valued at USD 33.66 billion in 2024 and is projected to grow to USD 63.68 billion by 2034.

• The global market is projected to register a CAGR of 6.6% from 2025 to 2034.

• Europe held the largest share of the global market in 2024.

• A few key players in the market are EssilorLuxottica; PRADA S.p.a.; Safilo Group S.p.A.; Fielmann Group AG; De Rigo Spa; Kering; CAPRI HOLDINGS LIMITED; MARCOLIN SPA.; Maui Jim, Inc.; and LVMH.

• The offline segment held the largest market share in 2024.

• The polarized segment is expected to witness the fastest growth during the forecast period.