Sun Care Cosmetics Market Share, Size, Trends, Industry Analysis Report, By Product (Adult Sun Cream, Baby Sun Cream, After Sun, Fake Tan/Self Tan, Tanning); By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3234

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

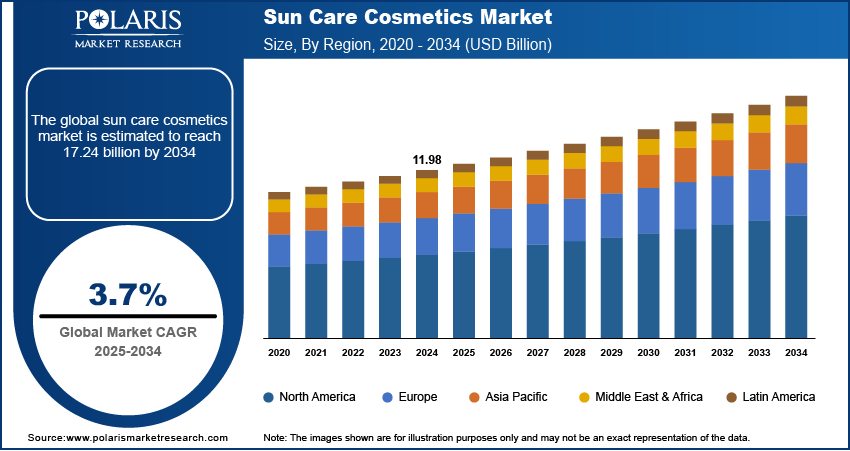

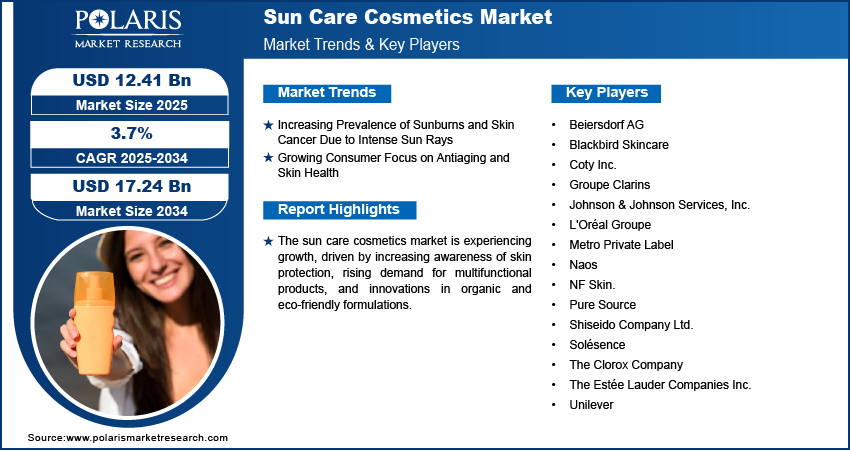

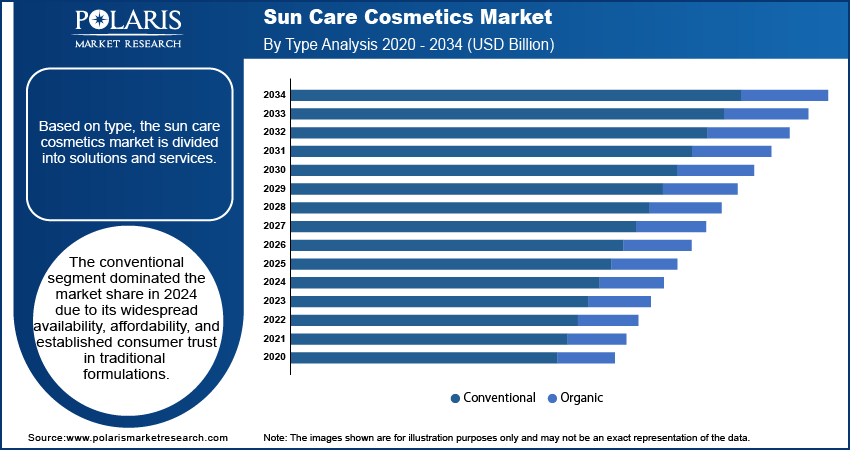

The size of the global sun care cosmetics market was estimated at USD 11.56 billion in 2023, and it is anticipated to rise at a CAGR of 3.7% from 2023 to 2032. The main reasons driving market expansion and innovation are growing concerns about the harmful effects of sunlight and increased public awareness of skin cancer. Today's consumers seek multipurpose cosmetics that offer anti-aging, makeup/beauty, and protection against skin conditions like skin cancer, sunburns, dark spots, wrinkles, and dryness. Consequently, the greatest method for players to acquire traction is through innovation in cosmetic items, especially sun care cosmetics.

Know more about this report: Request for sample pages

Customers are searching for assistance to discover sun care cosmetic items on these platforms and obtain the necessary knowledge connected to skin and hair care routines as a result of greater access to the internet and social media platforms like Instagram and YouTube. These applications feature a wide variety of information that satisfies the needs of novices as well as specialists, with extensive tutorials on everything from how to know your skin/hair type to what kind of night/day routines to follow. By expanding their online presence on social media applications and working with influencers on these platforms, brands are further facilitating access to product information.

Consumers' choices for sun care cosmetics depend on a variety of cultural, social, and individual factors. The cost of the product is a significant determinant of its uptake. When compared to their less expensive competitors, expensive products are thought to be of higher quality. As a result, product discounts can significantly affect consumers' purchasing decisions. Also, marketing messages have a big impact on how consumers use products. In their marketing campaigns to reach consumers, players can concentrate on elements like brand image, product efficacy, and the ethical and ecological aspects of the product. The ease of product accessibility has an impact on consumer product uptake and purchase decisions.

The COVID-19 has affected customers' spending patterns and buying decisions, which has resulted in a modest slowdown in market growth. This is because of several government-imposed measures meant to halt the COVID-19's spread. This aspect caused customers all across the world to restrict their travel in 2020 for leisure, recreation, and sporting events, which in turn decreased consumer consumption of sun care products.

Industry Dynamics

Growth Drivers

The need for sun care products has increased due to increased awareness of skin cancer and other skin issues, and this demand is expected to continue to expand during the anticipated time frame. Also, these solutions are becoming more and more well-liked among consumers because to their multipurpose abilities to prevent wrinkles and provide sun protection.

When the body skin is exposed to intense sunlight for an extended amount of time, it is susceptible to sunburn, ageing, and cancer. Also, the rising demand for anti-aging creams and sun care products is being driven by skin-related issues caused by UV exposure. For instance, according to the survey "Youth Risk Behavior Surveillance," in the United States in 2017, roughly 78.8% of questioned female participants who were white (non-Hispanic) had sunburnt themselves the year before.

Moreover, campaigns launched by cancer support groups to raise sun protection awareness will increase demand for the items. For instance, every year from November 17 through November 23, the Cancer Council and the Australasian College of Dermatologists host "National Skin Cancer Action Week." This event raises awareness of early skin cancer detection and encourages Australians to take precautions to protect their skin from the sun. Thus, there will be a greater need for this kind of care product due to the growing need to protect the skin from sunburns.

Report Segmentation

The market is primarily segmented based on product, distribution channel and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

In 2022, the hypermarkets and supermarkets dominated the market, accounting for the largest market share.

In 2022, the industry was led by the hypermarkets and supermarkets category, which brought in 34.00% of the total revenue. Many consumers around the world continue to like this delivery method. Products come in a wide range of varieties and alternatives at supermarkets and hypermarkets, all under one roof.

The segment for online distribution channels is anticipated to experience the fastest growth. Many companies just use the e-commerce channel for their business. These portals provide consumers with large discounts, which increases visibility and sales. According to information provided by Blucore, the average rise in global online sales of skincare and cosmetics between June 2019 and June 2020 was 127%. During the epidemic, online purchasing became more popular with customers.

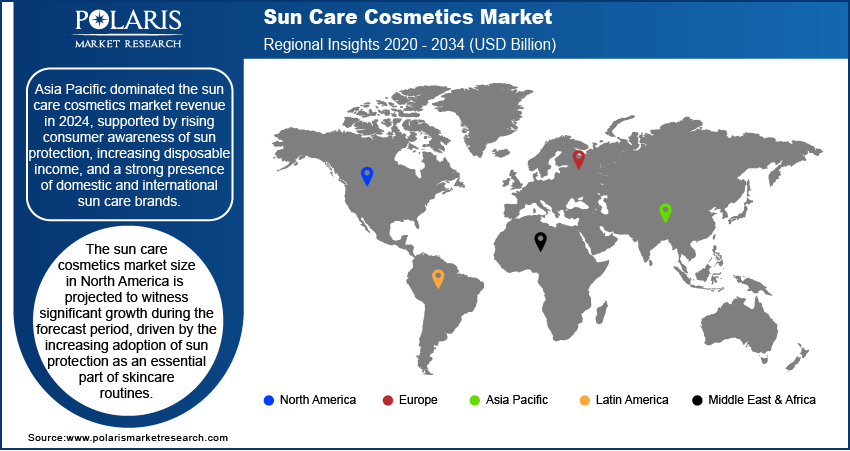

The demand in Asia Pacific is expected to witness significant growth.

In 2022, Asia Pacific dominated the market, contributing the highest percentage of the total revenue. Long-term exposure to ultraviolet radiation (UVR), whether from the sun or from man-made sources like sunbeds, is the main cause of skin cancer. The demand for sun care cosmetic goods in the region is anticipated to increase due to rising consumer awareness of the negative effects of UV radiation.

Australia and New Zealand were the two countries with the highest overall rates of skin melanoma in 2020, according to the World Cancer Research Fund (WCRF) International.

Competitive Insight

Some of the major players operating in the global sun care cosmetics market include Beiersdorf AG, Johnson & Johnson Services, Inc, Coty Inc, Shiseido Company Ltd, L'Oréal Groupe, The Estée Lauder Companies Inc, Unilever, Groupe Clarins and The Clorox Company.

Recent Developments

- L'Oréal, a cosmetics business, unveiled new UV filtering technology in May 2022, calling it the biggest development in sun care in the previous 30 years. UVMune 400 is intended to provide the skin with efficient protection from ultra-long UVA radiation, which makes up 30% of sunlight that was previously unfiltered. L'Oréal's La Roche-Posay Anthelios franchise is the first company brand to include the technology into its product line.

Sun Care Cosmetics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.95 billion |

|

Revenue forecast in 2032 |

USD 16.02 billion |

|

CAGR |

3.7% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Distribution Channel and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Beiersdorf AG, Johnson & Johnson Services, Inc, Coty Inc, Shiseido Company Ltd, L'Oréal Groupe, The Estée Lauder Companies Inc, Unilever, Groupe Clarins and The Clorox Company |

FAQ's

The sun care cosmetics market report covering key segments are product, distribution channel and region.

Sun Care Cosmetics Market Size Worth $16.02 Billion By 2032.

The size of the global sun care cosmetics market anticipated to rise at a CAGR of 3.7% from 2023 to 2032.

Asia Pacific is leading the global market.

key driving factors in sun care cosmetics market are increased awareness of skin cancer.