Sugar Substitutes Market Share, Size, Trends, Industry Analysis Report, By Type (High Intensity Sweeteners, Low Intensity Sweeteners, High Fructose Syrup); By Source; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4295

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

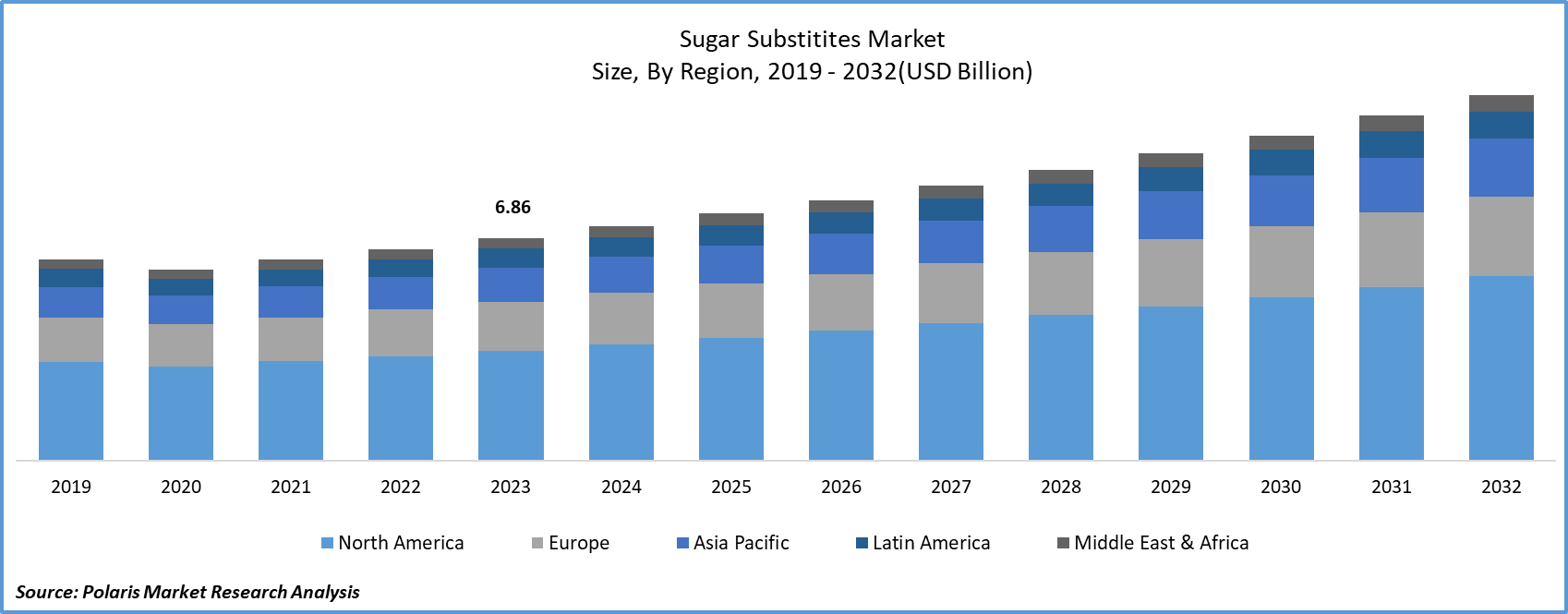

The global sugar substitutes market was valued at USD 6.86 billion in 2023 and is expected to grow at a CAGR of 5.7% during the forecast period.

A sugar substitute is a dietary supplement that has a sweet taste similar to sugar but contains far fewer calories than sugar-based sweeteners. As a result, it is a calorie-free or low-calorie option. These substitutes are derived from natural sources or manufactured synthetically using chemicals and preservatives.

The sugar substitutes market is growing as consumer preferences inclination toward lower-calorie and healthier food options. Furthermore, the rising prevalence of lifestyle diseases such as cholesterol, diabetes, and cardiovascular issues associated with obesity is driving the growth of the market.

For instance, according to the International Food Information Council (IFIC), no/low-calorie sweeteners are preferred by 31% of Generation Z, 30% of millennials, and 23% of Generation X consumers. This trend is most likely influenced by a growing public awareness of the negative health effects of sugar consumption.

To Understand More About this Research: Request a Free Sample Report

A sugar substitute is a low-calorie and non-nutritive alternative to sugar. Food manufacturers use it to provide consumers with healthier options in both food and beverages. While simulating the sweetening effect of sugar, this food additive contains fewer calories. Low-calorie sweeteners (LCS) deliver sweetness without the associated caloric content and have a higher sweetening potency per gram than sugar.

The COVID-19 has a significant impact on the sugar substitutes market. The global emergence of the COVID-19 pandemic has brought multiple industries to a slow down especially the food and beverage sector, had a negative impact on the global economy through disruptions in manufacturing and transportation. These disruptions had an adverse impact across interconnected sectors, resulting in a global economic slowdown. During this time, there were evident changes in consumer behavior. Consumers reacted with apprehension as governments around the world implemented stringent lockdown measures without specifying the duration, leading to preserving of various food and beverage products.

Furthermore, manufacturing companies have experienced supply chain disruptions, primarily as a result of transportation restrictions during the pandemic's peak phase. This has hampered the import and export of raw materials, resulting in a slowdown in the procurement of items such as stevia leaves, which are essential to the manufacturing process. As a result, the need for raw materials has slowed product manufacturing, limiting the company's ability to introduce new products to the market. The effects on product production have also had an impact on finished goods exports. These disruptions have not only delayed the delivery of end products but have also unsettled the production operations of interconnected industries that rely on these products as critical components of their manufacturing processes.

Consumers are increasingly inclined towards natural and plant-derived sweeteners as healthier alternatives to conventional sugar and artificial sweeteners. Because of their natural origins and low-calorie profiles, stevia, monk fruit, and erythritol are gaining popularity. Consumers are becoming more aware of the ingredients in their food and beverages, prompting them to prioritize sugar alternatives with clean labels, no artificial additives, and easily identifiable ingredients.

Industry Dynamics

Growth Drivers

Increasing Prevalence of Obesity-Linked Lifestyle Diseases like Cardiovascular Diseases, Diabetes, and Cholesterol Will Drive the Growth of the Market

The rising prevalence of obesity-linked lifestyle diseases such as cardiovascular diseases, diabetes, and cholesterol will drive the market growth. As people's living standards and economic progress improve, there is a growing trend in the popularity of functional nutrition and food additives, particularly sugar substitutes. These substitutes add sweetness and flavor to food without adding extra calories. The American Diabetes Association and the American Heart Association both support artificial sweeteners as a viable substitute for sugar, aiming to reduce the risks associated with obesity, metabolic disorders, diabetes, and heart disease while also assisting individuals in calorie management.

Increased fat consumption, decreased physical activity, and excessive sugary food consumption are fueling the global obesity epidemic. This widespread health problem, a major contributor to type 2 diabetes, is expected to worsen globally by 2030. The growing preference for healthier dietary options has resulted in the widespread adoption of low-calorie diets. Artificial sweeteners, which are 200 times sweeter than sugar, are gaining popularity in the food and beverage industries, particularly among those suffering from diabetes and obesity. This is anticipated to drive the growth of the sugar substitutes market.

Report Segmentation

The market is primarily segmented based on type, source, application, and region.

|

By Type |

By Source |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The High-Intensity Sweeteners Segment Accounted for the Largest Revenue Share in 2023

In 2023, the high-intensity sweeteners segment held the largest revenue share. The rising prevalence of noncommunicable diseases, the growing desire for low-calorie sweeteners, the various health benefits provided by sugar substitutes, and a renewed emphasis on natural and environmentally friendly alternatives to traditional sugar are all significant trends. The global trend toward health and wellness is anticipated to accelerate the adoption of high-intensity sweetness in the coming years.

On the other hand, the low-intensity sweeteners segment is expected to witness fastest growth during the forecast period. Many low-intensity sweeteners do not contribute to tooth decay because they do not produce enamel-damaging acids like sugar. Sweeteners with beneficial properties include erythritol, xylitol, mannitol, and sorbitol. These sweeteners are incorporated into a variety of food products to reduce glycemic and obesity levels, contributing to the fastest growth in this segment.

By Application Analysis

The Beverage Segment Accounted for the Highest Market Share During the Forecast Period

The beverage segment held the highest market share during the forecast period, owing to the rising demand for calorie-free and no added sugar drinks amidst the population. Sugar substitutes such as stevia and neotame are continually used in low-calorie meals and beverages. Neotame has a sweetness that is 7,000 to 13,000 times that of sugar, whereas stevia is 200 to 300 times sweeter. Stevia is commonly found in a variety of food and beverage products, including teas and juices. Companies such as Cargill, ED&F Man/Unavoo Food Technologies Ltd., and Tate & Lyle have devised natural sugar substitutes with improved sweetness levels that are specially designed for use in beverages. Iced tea, soft drinks, energy drinks, flavored water, chocolate milk, and soft drinks all use these substitutes.

On the other hand, health and personal care are anticipated to witness fastest growth during the forecast period. Sugar substitutes are becoming more common in a variety of food categories as consumer preferences and understanding of low-calorie food options and dairy products evolve. This shift benefits many products, including soft drinks, powdered drink mixes, baked goods, and canned foods. Non-nutritive sweeteners are increasingly employed to enhance the sweetness of these items, replacing traditional sugars like corn syrup, agave nectar, honey, and sucrose. The benefit is that these sweeteners, which are naturally sweeter than sugar, can be used in smaller amounts to attain desired sweetness levels.

Regional Insights

North America Accounted for the Largest Market Share in 2023

In 2023, North America held the largest market share in the sugar substitutes market. The rising demand for sugar substitutes in the region is being driven by the prevalence of obesity, diabetes, and other health problems associated with excessive sugar consumption. The United States is the primary market for sugar substitutes in North America, with the largest market share. Rising health consciousness among North American consumers has increased their preference for low-calorie food and beverage options, propelling the region's sugar substitute market forward. Primarily, sugar substitutes are in high demand in the soft drink and confectionery industries. To meet the growing demand for healthier options, many regional food and beverage companies are incorporating sugar substitutes into their products.

Asia Pacific is accounted for the fastest growth in the sugar substitutes market, owing to the changing dietary habits of consumers and the rising urbanization. China and India appear as crucial markets in the region, fueled by rising health concerns and an increase in disposable incomes, which fuels the desire for low-calorie and natural food items. The growing health consciousness among consumers, combined with a growing preference for healthier alternatives to conventional sugar, are the primary drivers driving the growth of the sugar substitutes market in the Asia Pacific.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Ajinomoto Co.

- Archer Daniels Midland Company (ADM)

- Cargill, Inc.

- E. I. DuPont De Nemours

- Ingredion Inc.

- JK Sucralose, Inc.

- The NutraSweet Company

- PureCircle

- Roquette Freres

- Tate & Lyle

Recent Developments

- In July 2022, Swerve, a plant-based sweeteners manufacturer based in U.S., launched customized sweeteners packets and products for the U.S. consumers.

- In March 2022, Cargill launched stevia products with EverSweet + ClearFlo technology, providing a more sophisticated flavor profile. This advanced sweetener system seamlessly combines stevia sweetener with a distinct flavor, providing numerous benefits such as improved flavor dynamics, dispersion, and increased stability and solubility in various formulations.

- In December 2021, B.T. Sweets launched Cambya, a plant-derived sweetener crafted from soluble fibers, monk fruit, and carefully chosen botanicals. This adaptable product is suitable for use in a wide range of temperature conditions, including hot, dry, and cold applications.

Sugar Substitutes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.22 billion |

|

Revenue forecast in 2032 |

USD 11.25 billion |

|

CAGR |

5.7% from 2024 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

Browse Our More Top Selling Reports:

Shuttlecock Market Size & Share

Carbon Credit Market Size & Share

Software Consulting Market Size & Share

FAQ's

The global sugar substitutes market size is expected to reach USD 11.25 billion by 2032

Key players in the market are Ajinomoto Co., Archer Daniels Midland Company (ADM), Cargill, Inc., E. I. DuPont De Nemours, Ingredion Inc

North America contribute notably towards the global sugar substitutes market

The global sugar substitutes market is expected to grow at a CAGR of 5.7% during the forecast period.

The sugar substitutes market report covering key segments are type, source, application and region.