Structured Cabling Market Size, Share, Trends, Industry Analysis Report: By Product Type (Copper Cabling, Fiber Optic Cabling, Coaxial Cables, and Others), Application, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1822

- Base Year: 2024

- Historical Data: 2020-2023

Structured Cabling Market Overview

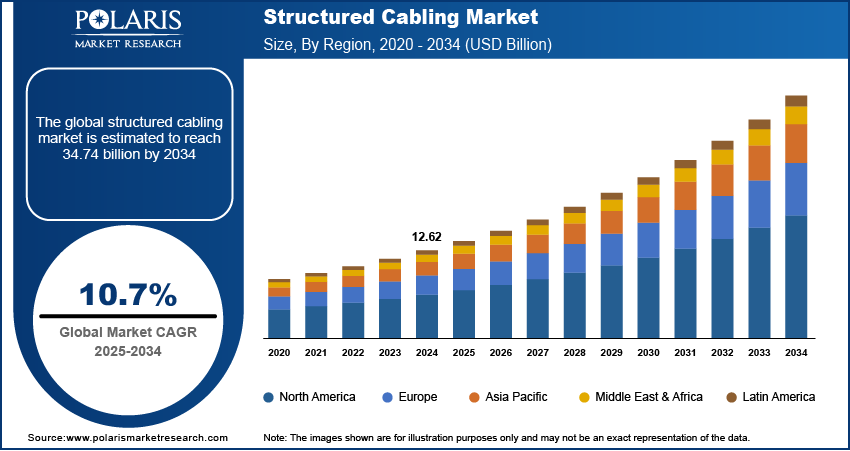

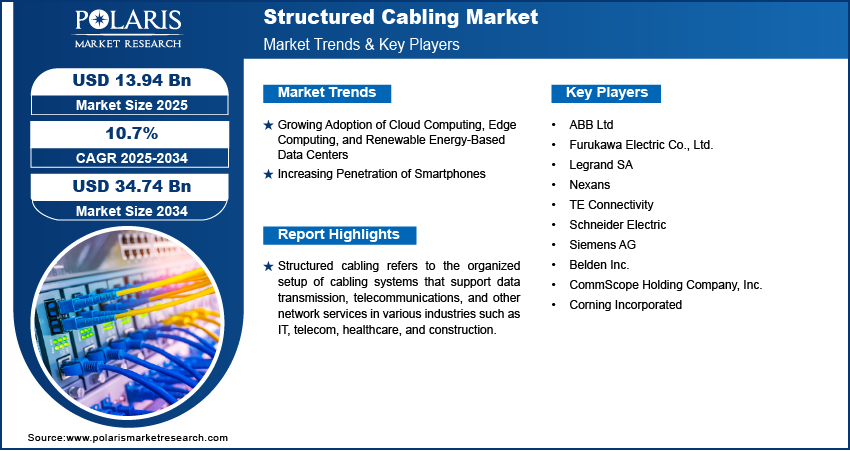

The global structured cabling market size was valued at USD 12.62 billion in 2024. The structured cabling market is projected to grow from USD 13.94 billion in 2025 to USD 34.74 billion by 2034, exhibiting a CAGR of 10.7% during 2025–2034.

Structured cabling refers to the organized setup of cabling systems that support data transmission, telecommunications, and other network services in various industries such as IT, telecom, healthcare, and construction. The structured cabling market development is driven by the increasing demand for high-speed data connectivity, digitization, and advancements in communication technology.

Structured cabling has become a backbone for modern communication systems with the rapid adoption of smart systems, IoT devices, and cloud-based infrastructures. The surge in data center deployments and the rise in need for enhanced network scalability and efficiency are further propelling the structured cabling market demand. According to data published by the United States International Trade Commission, there are over 2,600 data centers spread across the US.

To Understand More About this Research: Request a Free Sample Report

Structured Cabling Market Driver Analysis

Growing Adoption of Cloud Computing, Edge Computing, and Renewable Energy-Based Data Centers

Cloud and edge computing rely on seamless data transmission and low-latency connectivity, which structured cabling ensures with its organized and scalable design. Consequently, renewable energy-based data centers require robust cabling systems to support energy-efficient operations and sustainable practices. Therefore, the growing adoption of cloud computing, edge computing, and renewable energy-based data centers propels the structured cabling market expansion.

Increasing Penetration of Smartphones

The increasing penetration of smartphones is fueling the structured cabling market growth. According to the State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population owns a smartphone. Telecommunication providers need to handle higher traffic volumes and ensure low latency as more people rely on smartphones for streaming, gaming, communication, and business applications. Structured cabling provides the scalability and reliability needed to support these high-speed networks, enabling seamless data transfer and uninterrupted service. Additionally, the rise of 5G networks, driven by smartphone adoption, increases the demand for advanced cabling systems to manage the increased bandwidth and connectivity requirements effectively.

Structured Cabling Market Segment Assessment

Structured Cabling Market Insight by Product Type

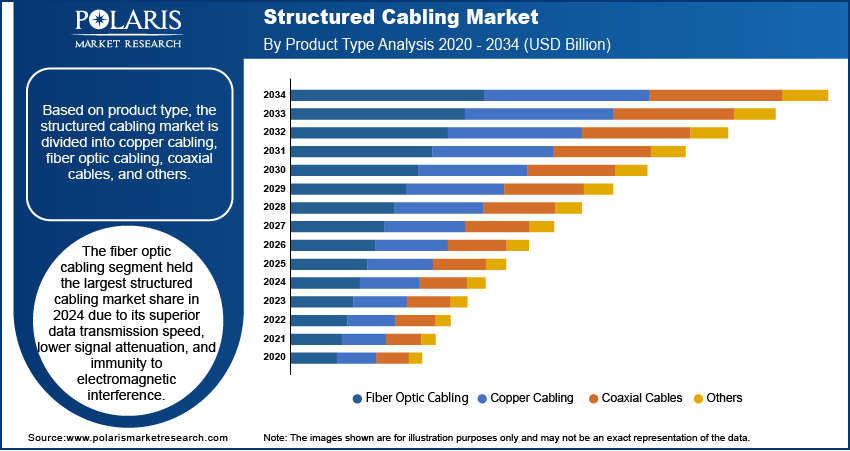

Based on product type, the structured cabling market is segmented into copper cabling, fiber optic cabling, coaxial cables, and others. The fiber optic cabling segment held the largest structured cabling market share in 2024 due to its superior data transmission speed, lower signal attenuation, and immunity to electromagnetic interference. The rapid expansion of 5G networks and the increasing adoption of high-speed internet services worldwide are propelling the demand for fiber optic cabling.

Structured Cabling Market Evaluation by Application

In terms of application, the structured cabling market is categorized into data centers, local area networks (LAN), and telecommunication. The data centers segment dominated the structured cabling market revenue share in 2024, owing to the rising demand for cloud storage, big data analytics, and edge computing solutions. The increasing deployment of hyperscale and colocation data centers globally has driven investments in structured cabling infrastructure.

Structured Cabling Market Outlook by Regional Analysis

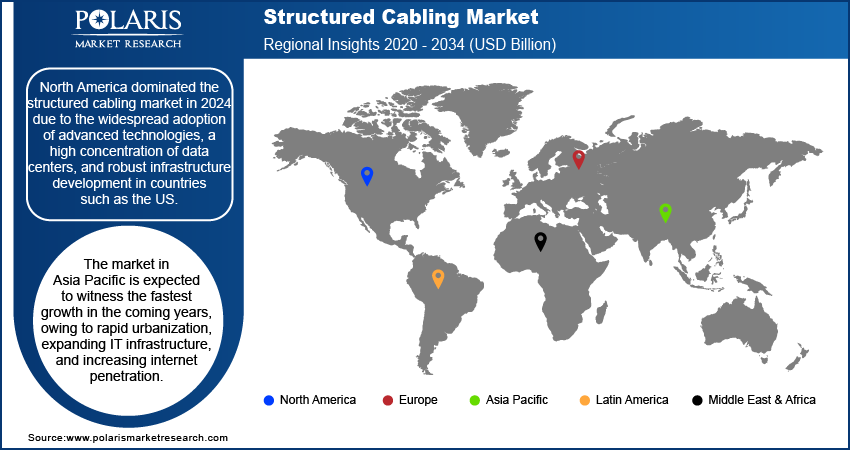

By region, the report provides structured cabling market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global structured cabling market in 2024 due to the widespread adoption of advanced technologies, a high concentration of data centers, and robust infrastructure development in countries such as the US. The US held the largest share of the regional market owing to significant investments in IT infrastructure, 5G deployment, and cloud computing initiatives. Additionally, the presence of key market players such as Belden Inc. and Nexans contributed to North America’s dominance.

Asia Pacific is expected to witness the fastest growth in the coming years, owing to rapid urbanization, expanding IT infrastructure, and increasing internet penetration. According to a report published by Google, 440 million people (or 75%) population are online in Southeast Asia. The aggressive 5G rollout, extensive smart city projects, and substantial investments in data center construction in countries such as India and China are driving the structured cabling market in the region. Additionally, the growing focus on digital transformation and government initiatives to enhance broadband connectivity supports the structured cabling market growth in Asia Pacific.

Structured Cabling Market – Key Players and Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will help the structured cabling market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

ABB Ltd., a Swedish-Swiss multinational corporation, is a key company in global electrical engineering, particularly in the field of structured cabling systems. Established in 1988 through the merger of Sweden's ASEA and Switzerland's Brown, Boveri & Cie, ABB has evolved into a prominent player in electrification and automation technologies, with its headquarters located in Zurich, Switzerland. The company is dedicated to driving innovation and sustainability across various sectors, including utilities, industries, and infrastructure, with a workforce of around 110,000 employees operating in over 100 countries. ABB's structured cabling solutions are designed to support a wide range of applications, from residential installations to large-scale industrial systems. The company offers a comprehensive portfolio that includes copper and fiber optic cables, connectivity solutions, and enclosures that ensure reliable performance and scalability.

Belden Inc., a prominent player in the global networking and connectivity solutions market, has established itself as a major player in the structured cabling market. Founded in 1902 and headquartered in St. Louis, Missouri, Belden specializes in designing, manufacturing, and distributing high-performance cables and connectivity products that cater to various industries, including industrial automation, broadcast, telecommunications, and smart buildings. The company is committed to delivering innovative solutions that meet the increasing demands of an interconnected world, with a workforce of ∼8,000 employees and operations spanning the Americas, Europe, the Middle East, Africa, and Asia Pacific.

List of Key Companies in Structured Cabling Market

- ABB Ltd

- Belden Inc.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Furukawa Electric Co., Ltd.

- Legrand SA

- Nexans

- Schneider Electric

- Siemens AG

- TE Connectivity

Structured Cabling Industry Developments

December 2022: Belden, a global supplier of network infrastructure solutions, announced the launch of its DCX System, an innovative, high-density, end-to-end fiber infrastructure solution with built-in futureproof functionality for any data center. It provides extremely high fiber termination density in a small footprint.

July 2021: STL, an integrator of digital networks, launched NetXs, a new-age suite of structured cabling solutions to deliver superior performance in data transmission for advanced networks across the globe.

Structured Cabling Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Copper Cabling

- Fiber Optic Cabling

- Coaxial Cables

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Data Centers

- Local Area Networks (LAN)

- Telecommunication

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- IT and Telecom

- Healthcare

- Industrial Manufacturing

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Structured Cabling Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.62 billion |

|

Market Forecast Value in 2025 |

USD 13.94 billion |

|

Revenue Forecast by 2034 |

USD 34.74 billion |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global structured cabling market size was valued at USD 12.62 billion in 2024 and is projected to grow to USD 34.74 billion by 2034.

The global market is projected to register a CAGR of 10.7% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are ABB Ltd; Furukawa Electric Co., Ltd.; Legrand SA; Nexans; TE Connectivity; Schneider Electric; Siemens AG; Belden Inc.; CommScope Holding Company, Inc.; and Corning Incorporated.

The fiber optic cabling segment dominated the structured cabling market in 2024.