Stone Flooring Market Size, Share, Trends, Industry Analysis Report: By Type (Granite, Marble, Limestone, Sandstone, Slate, and Others), Finished Product, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5197

- Base Year: 2024

- Historical Data: 2020-2023

Stone Flooring Market Overview

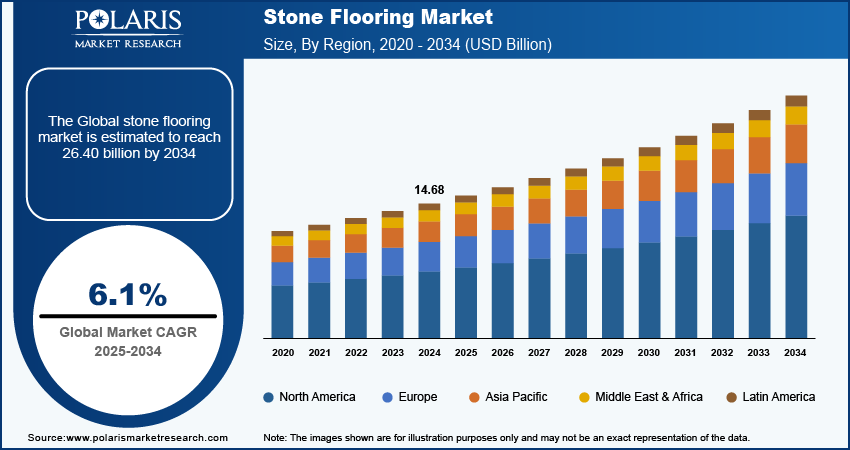

The stone flooring market size was valued at USD 14.68 billion in 2024. The market is projected to grow from USD 15.55 billion in 2025 to USD 26.40 billion by 2034, exhibiting a CAGR of 6.1% during 2025–2034.

The stone flooring market focuses on the production, distribution, and sale of flooring materials made from natural stones such as granite, marble, limestone, slate, sandstone, and others. The construction and interior design industries are the major end users of the market.

The stone flooring market is experiencing robust growth owing to the rising renovation activities as homeowners are upgrading outdated flooring and preferring premium stone flooring to increase property value and appeal. The growing confidence among builders and buyers in stone flooring encouraged investments in high-quality materials. This factor underscores the role of stone flooring in crafting luxurious, durable, and attractive living and commercial spaces.

The National Association of Home Builders (NAHB) reported a notable increase in the Housing Market Index (HMI), rising from 44 in January 2024 to 51 in April 2024. This data shows that the index has surpassed the neutral threshold of 50 for the first time since July 2023, indicating that more builders view current sales conditions as favorable. Thus, the rising housing industry drives the demand for high-quality materials such as stone flooring in residential and commercial construction.

To Understand More About this Research: Request a Free Sample Report

The customization options available with stone flooring, such as bespoke patterns and finishes, allow for personalized design that meets the specific aesthetic preferences of clients. This demand for visually compelling and unique flooring solutions drives the growth of the stone flooring market as it meets the evolving expectations of homeowners and commercial property developers.

Stone Flooring Market Drivers Analysis

Rising Demand for Aesthetically Appealing Stone Flooring

Consumers are increasingly prioritizing the visual appeal of their living spaces. They are seeking materials that offer a sophisticated and timeless look. Stone flooring, with its natural variations and special textures, provides an elegant solution that aligns with contemporary design trends. The rising popularity of marble and granite in premium residential and commercial projects fuels the demand for stone flooring.

In September 2023, Daltile launched new collections, including Artcrafted’s artisanal ceramics, Divinium’s 3D mosaics with Microban protection, Acreage’s durable wood-look porcelain, Calgary’s slip-resistant stone, Pure’s minimalist ColorBody porcelain, and Gamma’s luxurious natural stone mosaics to cater various aesthetic preferences and functional needs in residential and commercial spaces. These stones enhance the aesthetic quality of spaces and also offer a sense of luxury and refinement, catering to homeowners and designers who are willing to invest in premium materials to achieve a distinctive and upscale ambiance. Therefore, the growing demand for aesthetically appealing products is significantly driving the stone flooring market.

Increasing Urbanization and Construction Spending on Stone Flooring

The expansion of cities in emerging economies and surging infrastructure projects boost the demand for durable and stylish flooring options. According to the United States Census Bureau, total construction spending in the US in June 2024 was at a seasonally adjusted annual rate of USD 2,148.4 billion, reflecting a 0.3% decrease from May but a 6.2% increase from June 2023, with private construction at USD 1,664.6 billion and public construction at USD 483.9 billion. Stone flooring meets these needs with its robustness and aesthetic appeal, making it a popular choice for new residential, commercial, and public buildings. The rising emphasis on high-quality materials in urban development fuels the demand for stone flooring, which offers longevity and a sophisticated look.

The renovation of existing structures in urban areas boosts the stone flooring market. Older buildings undergoing updates and refurbishments often opt for stone flooring to align with modern design trends and enhance durability. This reflects a broader investment in premium materials and sophisticated design solutions, reinforcing the growing preference for stone flooring in rapidly developing urban environments. Thus, increased urbanization is driving the growth of the stone flooring market.

Stone Flooring Market Segment Analysis

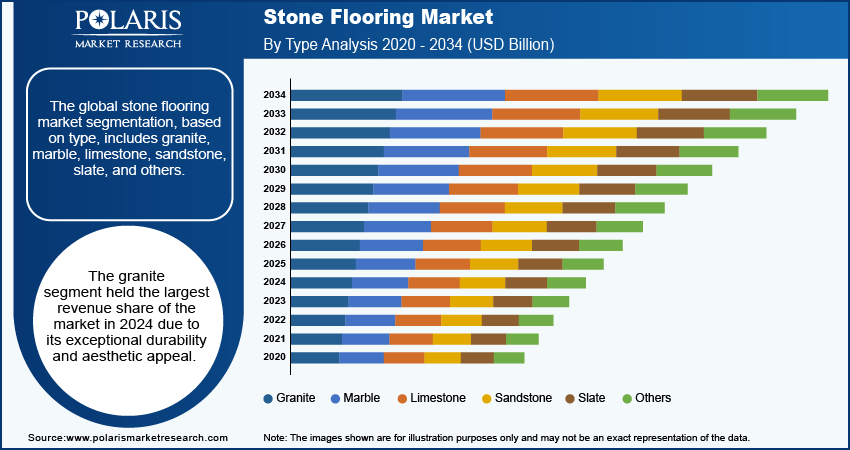

Stone Flooring Market Breakdown – by Type Insights

The global stone flooring market segmentation, based on type, includes granite, marble, limestone, sandstone, slate, and others. The granite segment held the largest revenue share of the market in 2024 due to its exceptional durability and aesthetic appeal. This engineered stone is highly resistant to scratches, stains, and heat, making it ideal for residential and high-traffic commercial spaces. In May 2022, Niro Ceramic Group launched Niro Granite’s latest tile collections, including Tangle Stone, Legnix, Bergamo, and I’Pietra, featuring advanced Slip-Stop technology and biophilic designs for modern spaces. Also, its wide range of colors and unique patterns offers a luxurious and customizable look that enhances any interior design and drives segmental growth in the market.

Granite flooring demand is boosted by its low maintenance requirements. It requires only periodic sealing and straightforward cleaning routines. Granite remains a practical and cost-effective choice over time. Its strength and versatility ensure that it meets various needs, reinforcing its dominant position in the stone flooring market.

Stone Flooring Market Breakdown – by Application Insights

The global stone flooring market segmentation, based on application, includes residential and nonresidential. The residential segment dominated the market in 2024 due to increased completions of housing construction and rising disposable incomes. More single-family homes are built, especially in emerging markets, and consumers are investing in high-quality materials such as stone flooring, which is associated with luxury and durability. Economic growth has enabled homeowners to prioritize aesthetic appeal and long-lasting solutions in their flooring choices.

Urbanization and changing demographics are influencing consumer preferences toward stone flooring. Homeowners undertake renovations to enhance their living spaces, and stone flooring is often selected for its ability to improve aesthetics and property value.

Stone Flooring Market Regional Insights

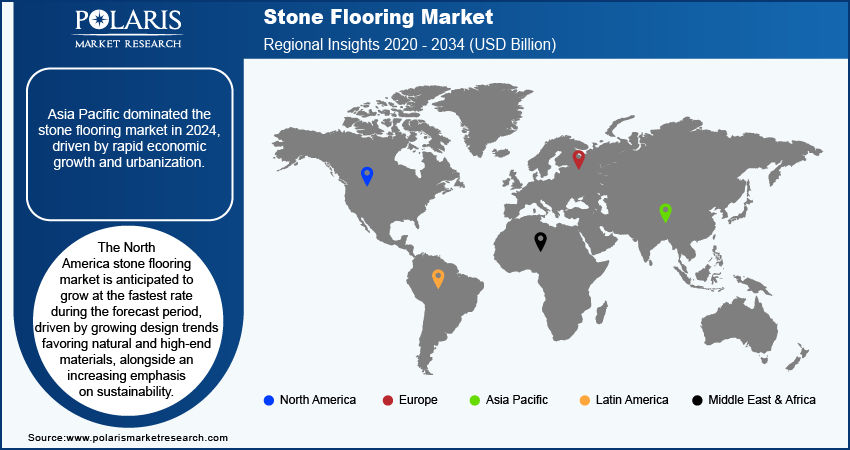

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the stone flooring market in 2024, driven by rapid economic growth and urbanization. Countries such as China and India are experiencing significant increases in population and rise in incomes. Thus, there is a surging demand for durable and aesthetically pleasing flooring solutions. The ongoing expansion in residential and commercial real estate, supported by government initiatives and investments, has led to a surge in construction activities. This is particularly evident in luxury housing and upscale commercial developments, where stone flooring options are mostly utilized.

The commercial sector’s increasing preference for stone flooring in hotels, office buildings, and shopping malls emphasizes the market’s growth potential. As urban infrastructure continues to expand and the demand for high-quality flooring solutions rises, Asia Pacific is anticipated to maintain its position in the global stone flooring market during the forecast period.

The North America stone flooring market is anticipated to grow at the fastest rate during the forecast period, driven by growing design trends favoring natural and high-end materials, alongside an increasing emphasis on sustainability. Consumers and businesses are drawn to stone flooring for its durability, aesthetic appeal, and eco-friendly attributes. This is evident in residential and commercial sectors, with materials such as granite, marble, slate, and limestone being popular choices. Key markets include the US, with high demand in states such as California, Texas, and New York, and Canada, with notable activity in cities such as Toronto and Vancouver.

Major players in the market include large multinational companies and specialized regional suppliers such as Mohawk Industries, Daltile, and Marazzi. These players focus on innovation in stone processing and design to meet evolving consumer preferences. The robust growth and dynamic nature of the market are shaped by these factors, reflecting a strong and evolving industry landscape.

Stone Flooring Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will drive the stone flooring market growth during the forecast period. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market scenario, stone flooring industry players must offer cost-effective products.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global stone flooring industry to benefit clients. A few major players in the stone flooring market are Arcat; Asian Granito India Limited; BC Stone; Daltile; Emser Tile; Farmington; Island Stone; Levantina y Asociados de Minerales, S.A; Mohawk Industries, Inc.; OWSI Flooring & Design; Polycor Inc.; Shaw Industries Group, Inc.; Stone Source LLC; Templeton Floor Company; and Universal Marble & Granite Group Ltd.

Mohawk Industries, Inc. is a manufacturer and distributor of flooring solutions designed for residential and commercial spaces. Their extensive product line encompasses a diverse array of floor coverings tailored for North American and European markets. In June 2022, Mohawk Industries acquired Vitromex from Grupo Industrial Saltillo for USD 293 million to enhance Mohawk’s presence in the Mexican ceramic tile market.

Daltile specializes in ceramic, metal, porcelain, glass, and stone tiles, as well as mosaics, exteriors, countertops, extra-large slabs, and roofing tiles. Its products are distributed through more than 250 company-owned sales centers, stone slab yards, and design galleries, serving a broad network of trade customers. They are also available through independent flooring retailers. In April 2024, Daltile showcased its latest tile and stone collections, including Indoterra and Marble Attaché, at the HD Expo + Conference 2024 in Las Vegas, which was held from April 30 to May 2.

Key Companies in the Stone Flooring Industry Outlook

- Arcat

- Asian Granito India Limited

- BC Stone

- Daltile

- Emser Tile

- Farmington

- Island Stone

- Levantina y Asociados de Minerales, S.A

- Mohawk Industries, Inc.

- OWSI Flooring & Design

- Polycor Inc.

- Shaw Industries Group, Inc.

- Stone Source LLC

- Templeton Floor Company

- Universal Marble & Granite Group Ltd

Stone Flooring Industry Developments

August 2024: Daltile introduced three new extra-large quartz slab designs, Outer Banks, Calacatta Bolt, and Telluride, into its ONE Quartz program, offering marble and stone visuals with enhanced durability for residential and commercial use.

July 2024: Antolini launched AzerocarePlus, a patented process that enhances the durability and stain resistance of natural stones such as marble, onyx, and quartzite, making them more resistant to acid-based substances and UV damage.

May 2024: Howdens unveiled new products such as kitchen color options, Chasewater granite sinks, Silestone quartz worktops, a drop-down microwave, Elmbridge joinery, and water-resistant laminate flooring in the Oake & Gray range.

Stone Flooring Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Granite

- Marble

- Limestone

- Sandstone

- Slate

- Others

By Finished Product Outlook (Revenue – USD Billion, 2020–2034)

- Tiles

- Slabs

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Residential

- Nonresidential

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Stone Flooring Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.68 billion |

|

Market Size Value in 2025 |

USD 15.55 billion |

|

Revenue Forecast by 2034 |

USD 26.40 billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global stone flooring market size was valued at USD 14.68 billion in 2024 and is anticipated to reach USD 26.40 billion by 2034.

The global market is projected to register a CAGR of 6.1% during 2025–2034

Asia Pacific accounted for the largest share of the global market in 2024.

A few key players in the market are Arcat; Asian Granito India Limited; BC Stone; Daltile; Emser Tile; Farmington; Island Stone; Levantina y Asociados de Minerales, S.A; Mohawk Industries, Inc.; OWSI Flooring & Design; Polycor Inc.; Shaw Industries Group, Inc.; Stone Source LLC; Templeton Floor Company; and Universal Marble & Granite Group Ltd.

The granite segment dominated the market in 2024.

The residential segment held a larger share of the global market in 2024.