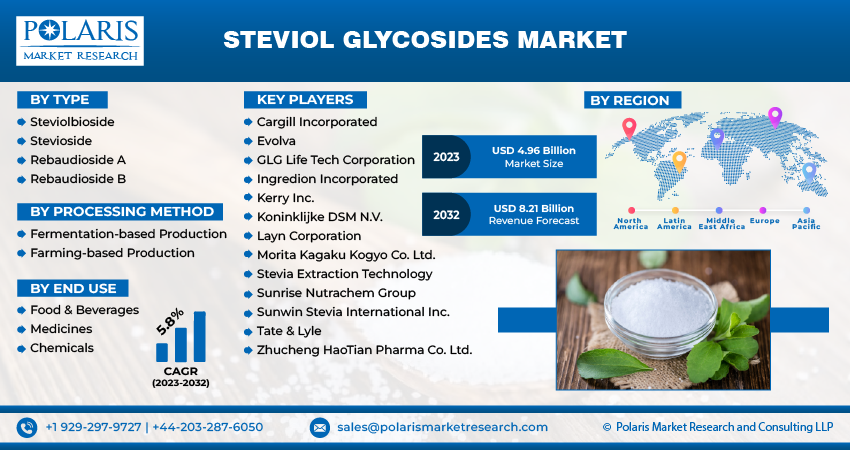

Steviol Glycosides Market Share, Size, Trends, Industry Analysis Report, By Type (Steviolbioside, Stevioside, Rebaudioside A, Rebaudioside B); By Processing Method; By End Use; By Region; Segment Forecast, 2023 – 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM3931

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

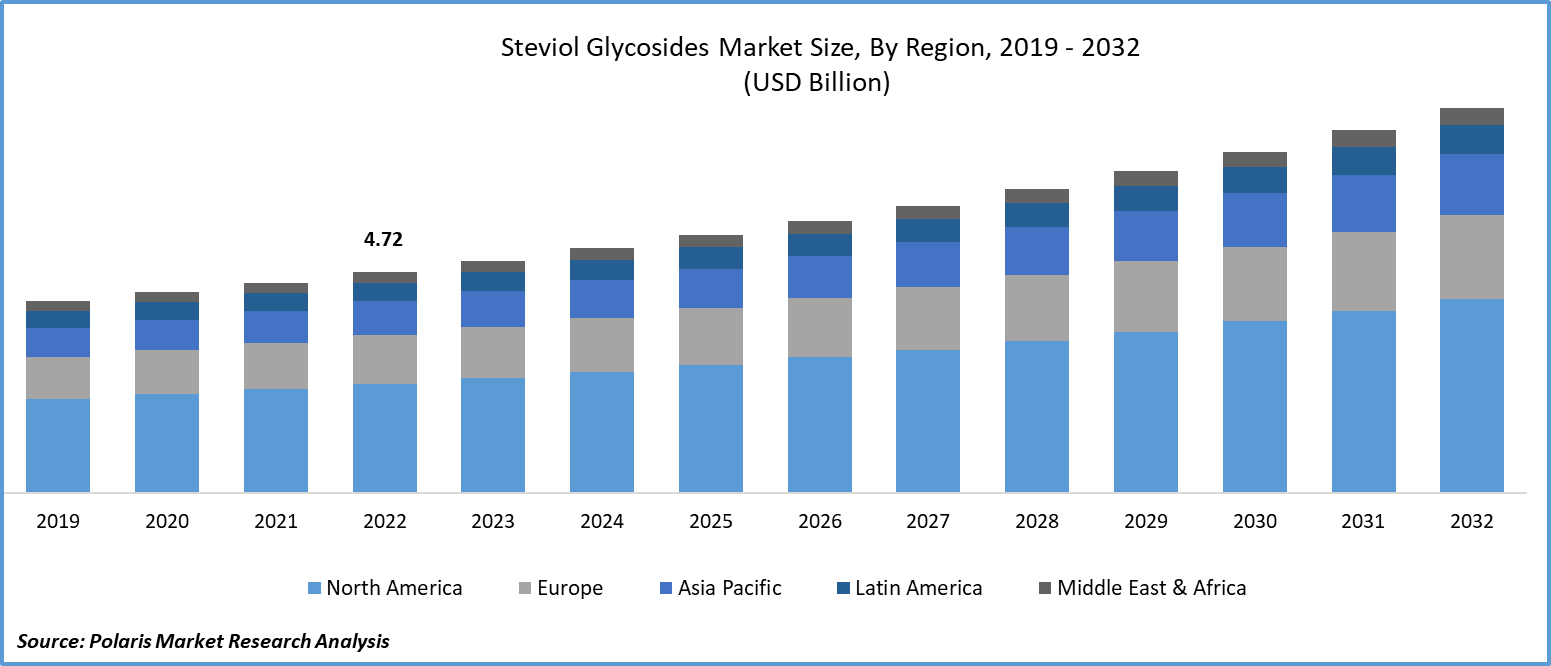

The global steviol glycosides market was valued at USD 4.72 billion in 2022 and is expected to grow at a CAGR of 5.8% during the forecast period.

The product is highly considered safe for consumption by various leading regulatory agencies, including the US Food & Drug Administration and the European Food Safety Authority, among others. It is gaining traction to be used in a variety of products such as bakery products, tabletop sweeteners, dairy products, and food & beverages, which are the major factors driving the global market growth. In addition, rising focus on exploring its potential health benefits beyond its use as a type of sugar substitute and rising investments in research & development activities to develop products with more improved characteristics and properties are likely to foster the growth of the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2023, Icon Foods unveiled its new SteviaSweet RM95, which is a 95% Reb M stevia extract and is formulated to have a clean flavor profile. The newly launched zero-calorie and high-intensity sweetener offers a natural sweet taste and also works well with several other high-intensity sweeteners for increasing sweetness or modulating flavor.

Moreover, with the increasing number of consumers worldwide seeking clean-label and natural ingredients, there has been a significant push to develop steviol glycoside-based sweeteners with minimal processing and additives that cater to the demand of consumers looking for simpler and more natural food and beverage options.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the steviol glycosides market. The emergence of the deadly virus and pandemic has negatively impacted the global supply chains and various manufacturing facilities across industries. Also, it affected the availability of raw materials and workforce required for the production of steviol glycosides. However, the pandemic accelerated the demand and consumption of low-calorie and sugar-free products to maintain a healthy lifestyle, which fueled the demand for sales of products like steviol glycosides.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

Shift Towards the Natural & Clean Label Food Ingredients Driving the Global Market

The global Steviol Glycosides Market is experiencing a significant boost due to the shifting consumer preference towards natural and clean-label food ingredients. As health-conscious consumers become increasingly aware of the impact of their dietary choices on overall well-being, there is a growing demand for naturally derived sweeteners like steviol glycosides. This trend aligns with the desire for cleaner, more transparent ingredient lists, and steviol glycosides, extracted from the leaves of the Stevia plant, offer a natural and plant-based sweetening solution that resonates with health-conscious individuals.

Moreover, the adoption of steviol glycosides is driven by the increasing scrutiny of added sugars and artificial sweeteners in the food and beverage industry. With a rising emphasis on reducing sugar content in products and promoting healthier alternatives, steviol glycosides have emerged as a versatile, zero-calorie, and high-intensity sweetening option. Their use in a wide range of food and beverage applications, including soft drinks, dairy products, and snacks, is contributing to the growth of the market. As the clean label movement continues to gain momentum, the Steviol Glycosides Market is well-positioned to expand further as a pivotal player in the natural sweetener industry.

Report Segmentation

The market is primarily segmented based on type, processing method, end-use, and region.

|

By Type |

By Processing Method |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Stevioside Segment Accounted for the Largest Market Share in 2022

The stevioside segment accounted for the largest market share. The segment market has experienced significant growth due to its widespread adoption as a sugar substitute in weight-loss diets. This is due to its low-calorie content, as well as other health benefits. Besides this, several major governments across the world have imposed several favorable initiatives and programs on sugary beverages and implemented regulations to reduce sugar content in various types of food products that have encouraged manufacturers to explore alternative sweeteners like steviol glycosides, including stevioside.

By Processing Method Analysis

The Fermentation-Based Production Segment is Expected to Hold a Substantial Share

The fermentation-based production segment is expected to hold a substantial market share throughout the study period, which is majorly driven by its ability to offer a more controlled and sustainable method that helps reduce the pressure on agricultural land and water resources along with the growing advances in fermentation technology, that makes it more efficient and cost-effective method to produce steviol glycosides over others. Additionally, it has a lower environmental footprint in terms of land use, pesticide use, and consumption, which aligns with emerging consumer demand for eco-friendly and sustainable products.

The farming-based production segment held the largest market share in terms of revenue in 2022 on account of a surge in the number of innovations in agricultural practices, including improved cultivation methods and crop breeding, which have led to higher yields and better-quality steviol glycosides that contribute to the growth of the farming-based production segment at an exponential rate.

By End-Use Analysis

The Medicines Segment Is Expected to Witness the Highest Growth

The medicines segment is projected to grow at the highest growth rate over the next coming years, mainly due to the surging popularity and prevalence of the product as an attractive option for formulating medications and supplements mainly for individuals with diabetes or people looking to reduce their sugar intake along with the widespread use of steviol glycosides to mask unwanted flavors and improve the overall palatability of medications, that makes them more appealing to patients and help them maintain their health more efficiently.

The food & beverages segment led the industry market with a notable share in 2022, which is largely accelerated by the growing consumption of low-calorie and sugar-free products incorporated with natural ingredients and catering to increasing global clean label trends all over the world.

Regional Insights

North America Region Dominated the Global Market in 2022

The North American region dominated the global market, owing to the rapid emergence of the fitness trend and a growing number of health-conscious consumers opting for products with healthier ingredients like steviol glycosides coupled with the rising FDA approval for the product used in different sectors, including pharmaceuticals, chemicals, and food & beverage. Also, significant production of beverages in the region and focus on leading beverage producers for incorporating these kinds of sweeteners into their product offerings to improve their taste and properties are likely to foster the region’s market growth.

The Asia Pacific region is anticipated to emerge as the fastest-growing region with a healthy CAGR over the forecast period, which is mainly driven by changes in consumer preferences for food & beverages and a surge in the prevalence and proliferation of incorporating products into various traditional food products to reduce the sugar content and enhancing its properties.

Key Market Players & Competitive Insights

The steviol glycosides market is highly fragmented, with the robust presence of several large market players worldwide. The top players in the market are constantly investing in research & development initiatives to develop innovative and new steviol glycoside products with enhanced taste profiles, stability, and solubility, and also adopting some major business development strategies like partnerships, collaborations, and acquisitions to expand their geographical presence and customer base.

Some of the major players operating in the global market include:

- Cargill Incorporated

- Evolva

- GLG Life Tech Corporation

- Ingredion Incorporated

- Kerry Inc.

- Koninklijke DSM N.V.

- Layn Corporation

- Morita Kagaku Kogyo Co. Ltd.

- Stevia Extraction Technology

- Sunrise Nutrachem Group

- Sunwin Stevia International Inc.

- Tate & Lyle

- Zhucheng HaoTian Pharma Co. Ltd.

Recent Developments

- In January 2022, Codex Alimentarius approved new production technologies for steviol glycosides, encompassing four different technologies for producing steviol glycosides. These technologies include steviol glycosides from bioconversion, steviol glycosides from fermentation, glycosylated steviol glycosides, and stevia leaf extracts.

- In November 2022, PureCircle announced the expansion of its stevia reach across the European region with the latest approval of ingredients using bioconversion technology. The latest approval will cover the production of three different types of steviol glycosides, including Reb M, Rem AM, and Reb D, with the help of bioconversion.

Steviol Glycosides Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.96 billion |

|

Revenue Forecast in 2032 |

USD 8.21 billion |

|

CAGR |

5.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Processing Method, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |