Sterilization Container Systems Market Share, Size, Trends, Industry Analysis Report, By Material (Stainless Steel, Aluminum, Others); By Type (Perforated, Non-Perforated); By Product; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 108

- Format: PDF

- Report ID: PM1952

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

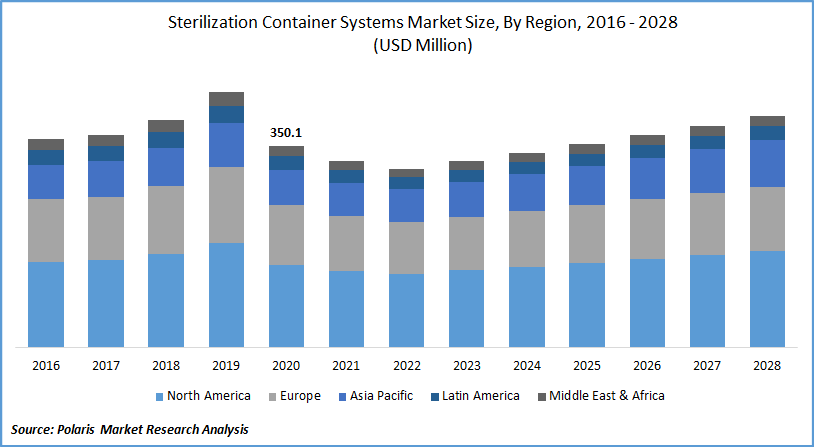

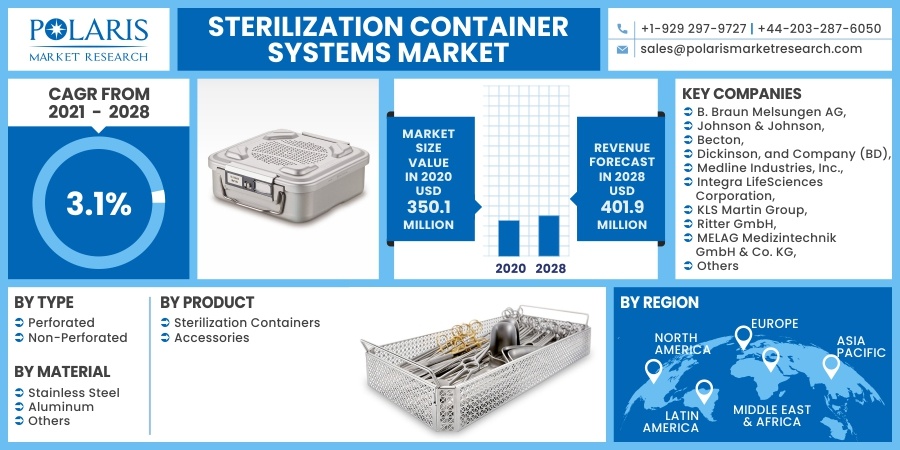

The global sterilization container systems market was valued at USD 350.1 million in 2020 and is expected to grow at a CAGR of 3.1% during the forecast period. Key primary factors responsible for the systems market growth include an increase in the prevalence of hospital-acquired infections, a recent surge in infectious diseases, and rising necessity among the medical community for the sterile environment for medical products.

Sterilized containers are reusable, customized container systems for storing, packaging, and transporting medical equipment and other medical necessities. Moreover, such containers also provide an alternative to wrap and package materials and instruments and offer substantial economic benefits with increased safety and environmental issues.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Pathogen infections are a major problem in healthcare management and are primarily responsible for mortality and morbidity among a huge population. The most common bacteria related to HAIs comprise C. difficile, methicillin-resistant Staphylococcus aureus (MRSA), Klebsiella, E. coli, Pseudomonas, and Enterococcus. The increasing prevalence of HAIs is the major growth driver for the global market for sterilization container systems.

Equipment sterilization plays an essential role in preventing the spread of COVID-19 in healthcare settings. During the outburst, patient-to-patient pathogen transmission through medical devices can be entirely prevented by appropriately sterilizing medical devices.

Moreover, the use of reprocessed and the sterilized medical instruments has increased in the current pandemic, and inappropriate contamination of such surgical and respiratory devices could increase the threat of transmission of such infectious diseases. This has resulted in extensive use of sterilization containers to safeguard the sterile environment in medical devices.

Know more about this report: request for sample pages

Sterilization Container Systems Market Report Scope

The market is primarily segmented on the basis of type, product, material, and region.

|

By Type |

By Product |

By Material |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on the type, the market for sterilization container systems is classified into perforated and non-perforated. Among these, the perforated segment is anticipated to hold the largest share and is expected to register the highest growth rate over the study period. This is primarily due to the advantages these perforated storages offer for the frequent rapid sterilization processes, as it takes less time for sterilization than other methods.

Insight by Product

Depending on the product, the systems market is categorized into sterilization containers and accessories. Among these, the sterilization containers segment is expected to hold the largest share over the study period. Such a high share is attributed to its high usage in providing a sterile environment against pathogens and its strong ability to contain deadly infectious diseases. The factors mentioned above are likely to drive the segment’s growth prospects.

Insight by Material

The aluminum container systems market segment held maximum revenue share in the global market and is also anticipated to register the highest CAGR over the system study period. This large share is attributed to the associated benefits of the anodized aluminum, such as its long-lasting nature, durability, and excellent drying properties.

Geographic Overview

Geographically, North America is the most significant revenue contributor in the global systems market, owing to the massive growth of the pandemic in the region. The rise in the geriatric population and a high proportion of people suffering from such chronic diseases, high prevalence of HAIs, and the presence of sophisticated healthcare facilities both in the U.S. and Canada are the most important regional factors impacting its market growth.

Moreover, favorable government policies and strict regulations also favoring the region’s growth. For instance, the Patient Protection and Affordable Care Act had also mandated sterilization equipment in dedicated healthcare facilities, which has also supplemented the growth in the region over the systems study period. In addition, Europe is expected to hold a substantial share in the overall sterilization container systems market. Approximately 60 percent of the hospitals in the concerned region use customized storage, and the rest 40% use blue wraps.

Furthermore, the region is also anticipated to hold the majority share in the global systems market during the prediction period due to increased environmental awareness and stringent policies for the ecological imbalance. Additionally, Asia Pacific is anticipated to witness substantial growth in the global market during the forecast period. The COVID-19 outbreak escalated from China as a result, to which the demand for supply of sterilization container systems has also augmented.

Competitive Insight

Some of the major players operating the sterilization container systems market include B. Braun Melsungen AG, Johnson & Johnson, Becton, Dickinson, and Company (BD), Medline Industries, Inc., Integra LifeSciences Corporation, KLS Martin Group, Ritter GmbH, MELAG Medizintechnik GmbH & Co. KG, Hu-Friedy Mfg. Co., LLC, Summit Medical LLC., Case Medical, GPC Medical Ltd., AYGÜN Co., Inc., C.B.M. S.r.l. Medical Equipment, and EMED.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 350.1 million |

|

Revenue forecast in 2028 |

USD 401.9 million |

|

CAGR |

3.1% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Product, By Material, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

B. Braun Melsungen AG, Johnson & Johnson, Becton, Dickinson, and Company (BD), Medline Industries, Inc., Integra LifeSciences Corporation, KLS Martin Group, Ritter GmbH, MELAG Medizintechnik GmbH & Co. KG, Hu-Friedy Mfg. Co., LLC, Summit Medical LLC., Case Medical, GPC Medical Ltd., AYGÜN Co., Inc., C.B.M. S.r.l. Medical Equipment, and EMED. |