Sterile Injectable Contract Manufacturing Market Size, Share, Trends, Industry Analysis Report

: By Molecule Type (Small Molecules and Large Molecules), Therapeutic Application, Route of Administration, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 127

- Format: PDF

- Report ID: PM5151

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

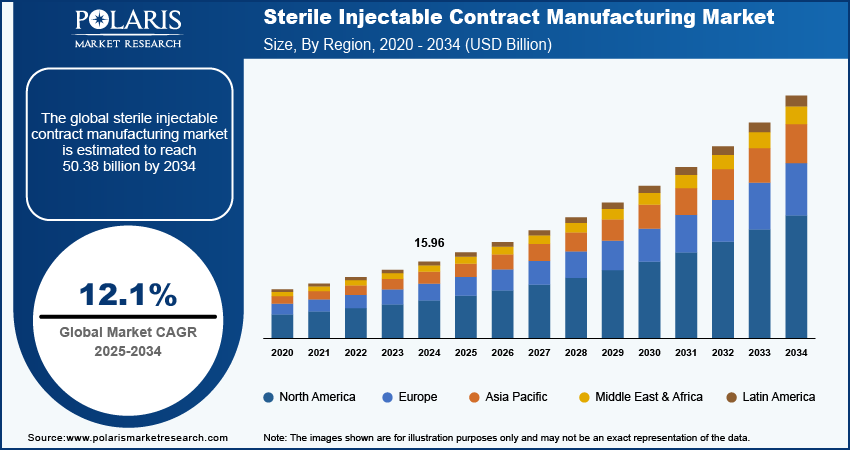

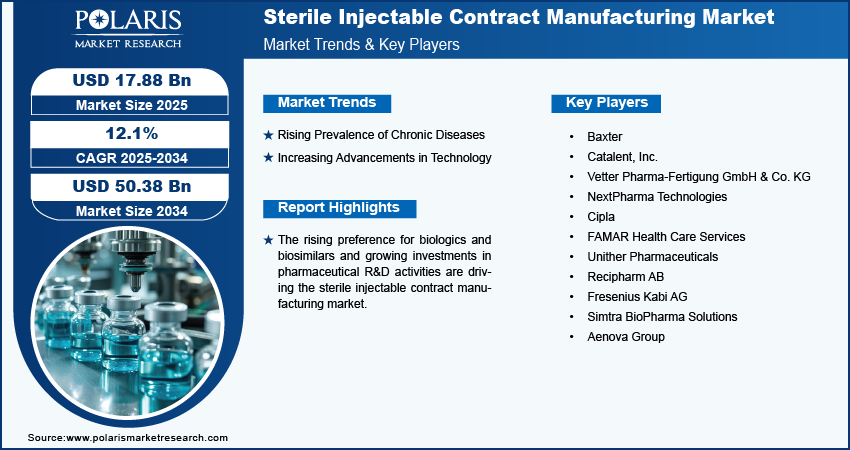

The sterile injectable contract manufacturing market size was valued at USD 15.96 billion in 2024. The market is projected to grow from USD 17.88 billion in 2025 to USD 50.38 billion by 2034, exhibiting a CAGR of 12.1% during 2025–2034.

Sterile injectable contract manufacturing is a segment within the pharmaceutical industry focusing on the outsourcing of sterile injectable drug production to specialized third-party manufacturers. This model allows pharmaceutical companies to leverage the expertise and facilities of contract manufacturing organizations (CMOs), which are equipped to handle the stringent regulatory requirements associated with producing sterile products.

The rising preference for biologics and biosimilars is driving the sterile injectable contract manufacturing market. Biologics, a sterile injectable drugs that are derived from living cells, require complex manufacturing processes that demand specialized facilities and expertise. Contract manufacturers provide the necessary infrastructure and knowledge to produce these products safely and efficiently. Therefore, as the preference for biologics and biosimilars increases, the demand for sterile injectable contract manufacturing also spurs.

To Understand More About this Research: Request a Free Sample Report

The sterile injectable contract manufacturing market is driven by the growing investments in pharmaceutical R&D activities. Companies are more focused on rapidly prototyping and testing new therapies with increased R&D funding. Outsourcing sterile manufacturing expedites this process, allowing quicker production of clinical trial materials. For instance, Hoffmann La Roche (Roche), a pharmaceutical company that develops, manufactures, and markets healthcare products and services, increased its research and development (R&D) spending to USD 14.72 billion in 2023 from USD 13.88 billion in 2022.

Market Driver Analysis

Rising Prevalence of Chronic Diseases

The prevalence of chronic illnesses is rising across the world. As per a report published by the National Library of Medicine, ∼1 in 3 of all adults suffer from multiple chronic conditions (MCCs) globally. Chronic illnesses often require long-term treatment options, leading to a growing need for medications, many of which are administered via sterile injectables. Thus, the rising requirement for sterile injectables due to the increasing prevalence of chronic conditions drives demand for contract manufacturing services that produce these complex formulations.

Increasing Advancements in Technology

Advanced manufacturing technologies such as automation and continuous processing improve the efficiency and scalability of sterile injectable production. Contract manufacturers leverage these technologies to optimize production cycles, reduce costs, and increase output. Moreover, the integration of advanced technologies, such as blockchain technology and advanced logistics systems, in supply chain management enhances transparency and efficiency. This helps ensure the timely delivery of raw materials and finished products, supporting the smooth operation of sterile injectable manufacturing. Therefore, the increasing advancements in technology fuel the global sterile injectable contract manufacturing market growth.

Segment Insights

Sterile Injectable Contract Manufacturing Market Breakdown, By Molecule Type

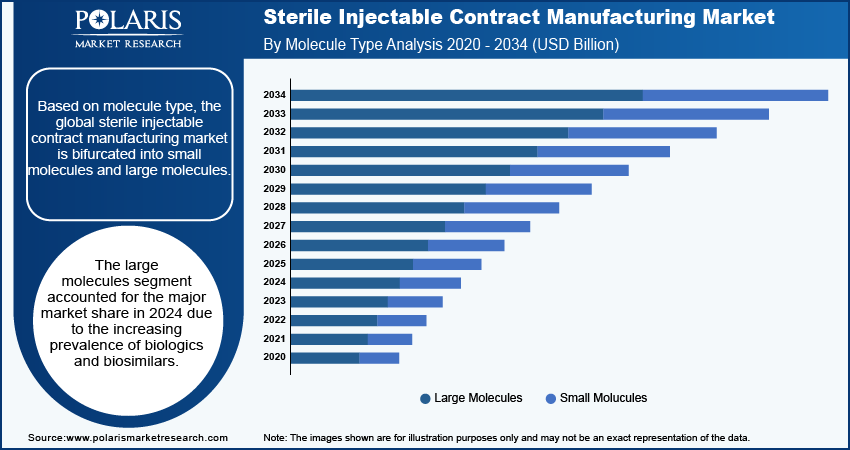

Based on molecule type, the global sterile injectable contract manufacturing market is bifurcated into small molecules and large molecules. The large molecules segment accounted for the major market share in 2024 due to the increasing prevalence of biologics and biosimilars. Biologics, which include complex proteins, monoclonal antibodies, and other therapeutic agents derived from living organisms, have become essential in treating chronic diseases such as cancer, diabetes, and autoimmune disorders. The significant efficacy and targeted action of these therapies have fueled their demand, prompting pharmaceutical companies to invest heavily in their development. Additionally, advancements in biomanufacturing technologies have enhanced the efficiency and scalability of producing these large molecules, further driving the segment.

The small molecules segment is expected to grow at a robust pace in the coming years, owing to the ongoing research and development activities focused on new therapies. The increasing prevalence of conditions such as infectious diseases and mental health disorders has led to heightened demand for small-molecule drugs. Furthermore, pharmaceutical companies are innovating formulations to improve the delivery and efficacy of these compounds, which will likely enhance their appeal in the coming years.

Sterile Injectable Contract Manufacturing Market Breakdown, By Therapeutic Application

In terms of therapeutic application, the global sterile injectable contract manufacturing market is segmented into cancer, diabetes, cardiovascular diseases, central nervous systems diseases, infectious disorders, musculoskeletal, anti-viral, and others. The cancer segment dominated the market in 2024 due to the rising prevalence of cancer worldwide and the increasing demand for innovative treatments. Advances in immunotherapy, targeted therapies, and biologics have significantly improved treatment outcomes for patients, creating a surge in the development of injectable therapies designed specifically for oncology. Pharmaceutical companies are heavily investing in research to discover new compounds and optimize existing ones, resulting in a growing pipeline of sterile injectables tailored for cancer treatment. The urgency for effective cancer therapies, combined with supportive regulatory frameworks and increasing healthcare expenditures, has contributed to this segment's dominant position.

The central nervous system diseases segment is projected to grow at a rapid pace during the forecast period owing to the growing prevalence of neurological disorders, such as Alzheimer's disease and Parkinson's disease. This drives demand for novel therapies that address the unique challenges posed by CNS disorders, including the need for effective delivery methods that cross the blood-brain barrier. Pharmaceutical companies are increasingly focusing their R&D efforts on developing innovative small and large molecules for CNS applications, leading to advanced injectable products.

Regional Insights:

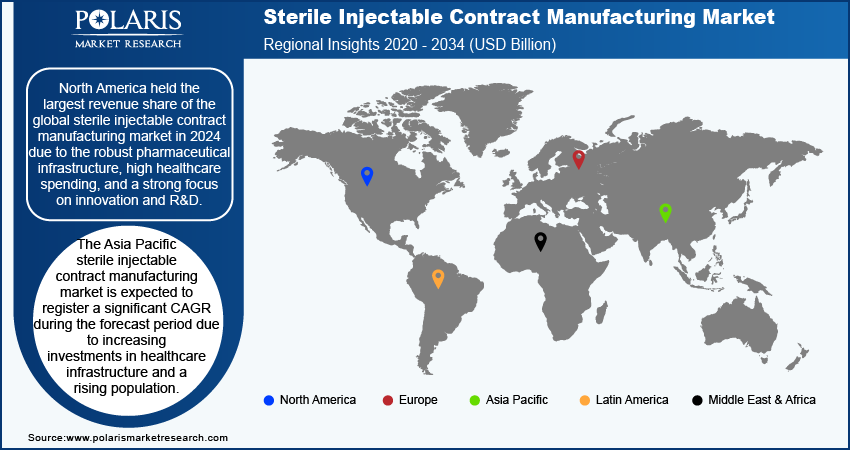

By region, the study provides the sterile injectable contract manufacturing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest revenue share in the global sterile injectable contract manufacturing market in 2024 due to the robust pharmaceutical infrastructure, high healthcare spending, and a strong focus on innovation and R&D. The US comprises a significant number of leading pharmaceutical companies and research institutions, driving advancements in drug development, particularly for sterile injectables and complex formulations. Additionally, the favorable regulatory environment and increased collaboration between industry and academia foster rapid development and commercialization of new therapies, further fueling the growth of the market in the region.

The Asia Pacific sterile injectable contract manufacturing market is expected to register a significant CAGR during the forecast period due to increasing investments in healthcare infrastructure and a rising population. Countries such as China and India are experiencing significant improvements in their pharmaceutical sectors, with a focus on manufacturing capabilities and R&D. The expansion of their domestic markets, combined with a growing demand for affordable and effective treatments, positions Asia Pacific as a critical region in the global market. Additionally, the growing prevalence of chronic diseases in the region is propelling the global sterile injectable contract manufacturing market as sterile injectables are used in the treatment of chronic illness. According to the National Health Commission of the People's Republic of China, more than 300 million patients have been diagnosed with chronic diseases.

Key Players and Competitive Insights

Major market players are investing heavily in research and development to expand their offerings, which will boost the sterile injectable contract manufacturing market growth during the forecast period. Market participants are also undertaking a variety of strategic activities, including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations, to expand their global footprint. To expand and survive in a more competitive and rising market environment, the market players must offer innovative solutions.

The sterile injectable contract manufacturing market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Baxter; Catalent, Inc.; Vetter Pharma-Fertigung GmbH & Co. KG; NextPharma Technologies; Cipla; FAMAR Health Care Services; Unither Pharmaceuticals; Recipharm AB; Fresenius Kabi AG; Simtra BioPharma Solutions; and Aenova Group.

Cipla Limited, founded in 1935 by Dr. K.A. Hamied in Mumbai, has evolved into a prominent global pharmaceutical company. The company specializes in various therapeutic areas, including respiratory diseases, cardiovascular conditions, and infectious diseases. It has established itself as a major producer of sterile injectables. Cipla's sterile injectable contract manufacturing division focuses on the production of high-quality injectable formulations that adhere to stringent regulatory standards. In January 2024, Cipla (EU) Limited, UK, a wholly owned subsidiary of Cipla Limited, announced a strategic collaboration with Kemwell Biopharma Private Limited and Manipal Education & Medical Group to incorporate a joint venture in the US. The primary objective of this joint venture is to develop and commercialize novel cell therapy products for major unmet medical needs in the US, Japan, and EU countries.

Baxter, founded in 1931, is a global healthcare company that has established itself as a prominent player in the sterile injectable contract manufacturing sector through its specialized division, Baxter BioPharma Solutions (BPS). BPS is dedicated to providing comprehensive contract manufacturing services for parenteral drug products, including vaccines, biologics, and cytotoxic compounds. In November 2021, Baxter announced a ∼USD 100 million expansion of its sterile fill/finish manufacturing facility located in Halle/Westfalen, Germany.

Key Companies in Sterile Injectable Contract Manufacturing Market

- Baxter

- Catalent, Inc.

- Vetter Pharma-Fertigung GmbH & Co. KG

- NextPharma Technologies

- Cipla

- FAMAR Health Care Services

- Unither Pharmaceuticals

- Recipharm AB

- Fresenius Kabi AG

- Simtra BioPharma Solutions

- Aenova Group

Industry Developments

February 2024: Simtra BioPharma Solutions, a contract development and manufacturing organization that specializes in sterile injectables for the biopharma and pharmaceutical industries, announced that it is investing more than USD 250 million to expand its sterile fill/finish manufacturing campus in Bloomington.

April 2023: Bridgewest Group announced the launch of a new contract development and manufacturing organization (CDMO), NovaCina, to focus on sterile injectable drug products.

November 2020: Baxter International Inc., a global producer of sterile medication, announced a USD 50 million expansion of its sterile fill/finish manufacturing facilities located in Bloomington, Ind.

Market Segmentation

By Molecule Type Outlook (Revenue, USD Billion, 2020–2034)

- Small Molecules

- Large Molecules

By Therapeutic Application Outlook (Revenue, USD Billion, 2020–2034)

- Cancer

- Diabetes

- Cardiovascular Diseases

- Central Nervous Systems Diseases

- Infectious Disorders

- Musculoskeletal

- Anti-Viral

- Others

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Subcutaneous (SC)

- Intravenous (IV)

- Intramuscular (IM)

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.96 billion |

|

Market Size Value in 2025 |

USD 17.88 billion |

|

Revenue Forecast by 2034 |

USD 50.38 billion |

|

CAGR |

12.1 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sterile injectable contract manufacturing market size was valued at USD 15.96 billion in 2024 and is projected to grow to USD 50.38 billion by 2034.

The global market is projected to record a CAGR of 12.1 % during 2025-2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Baxter; Catalent, Inc.; Vetter Pharma-Fertigung GmbH & Co. KG; NextPharma Technologies; Cipla; FAMAR Health Care Services; Unither Pharmaceuticals; Recipharm AB; Fresenius Kabi AG; Simtra BioPharma Solutions; and Aenova Group.

The large molecules segment is projected for significant growth in the global market during the forecast period.

The cancer segment dominated the sterile injectable contract manufacturing market in 2024.