Steel Rebar Market Size, Share, Trends, Industry Analysis Report: By Type (Deformed and Mild), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 125

- Format: PDF

- Report ID: PM5373

- Base Year: 2024

- Historical Data: 2020-2023

Steel Rebar Market Overview

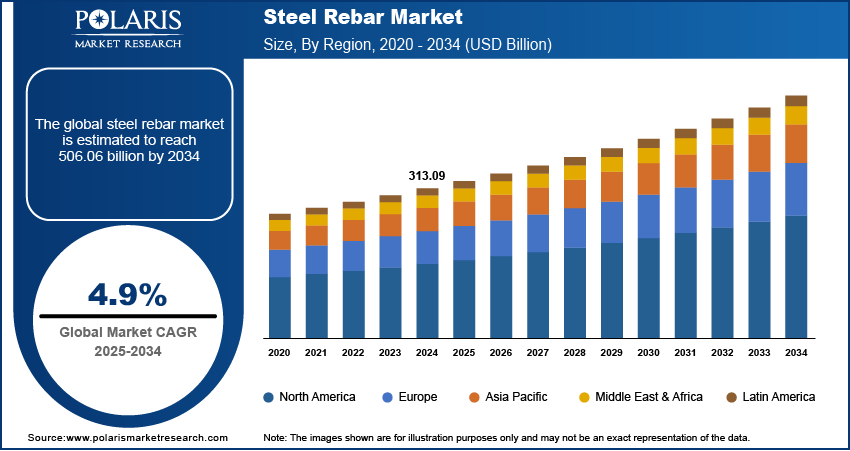

The global steel rebar market size was valued at USD 313.09 billion in 2024. The market is projected to grow from USD 328.16 billion in 2025 to USD 506.06 billion by 2034, exhibiting a CAGR of 4.9% from 2025 to 2034.

Steel rebar is a type of steel bar used to reinforce concrete and improve its strength and durability. It is commonly used in construction projects such as buildings, bridges, and roads to prevent cracking and improve structural integrity.

The steel rebar market is growing due to rising government initiatives for the development of roads and highways. Governments worldwide are aiming to develop better connectivity between key domestic economies for seamless transportation activity. For instance, A report by the Ministry of Information & Broadcasting in February 2025 stated that under the Bharatmala Pariyojana scheme India's National Highway (NH) network expanded from 91,287 km in 2014 to 1,46,145 km in 2024. These government backed initiatives are significantly boosting the demand for steel rebar, thereby driving market growth.

To Understand More About this Research: Request a Free Sample Report

The increase in disposable income is driving the steel rebar market expansion, as people now have greater purchasing power to invest in better housing and infrastructure. For instance, according to the US Bureau of Economic Analysis, personal disposable income in the US rose by 0.1% from August to September 2024. Rising income levels have led to increased demand for residential buildings, which in turn boosts the need for steel rebar to reinforce concrete structures. Additionally, with more money to spend, both governments and private developers are investing in larger and more advanced construction projects, further boosting market demand.

Steel Rebar Market Dynamics

Surging Construction Activity

With more residential, commercial, and infrastructure projects being undertaken globally, the need for reinforcement materials like steel rebar has increased. For instance, according to the Indian Department of Economics Affairs, in 2024, India recorded USD 818.67 billion worth of new infrastructure projects by public-private partnerships, highlighting the growth in construction activity. Additionally, population growth and urbanization are fueling construction projects in both urban and rural areas, creating a strong demand for steel rebar. Thus, the surge in construction activity is boosting the steel rebar market demand.

Rising Investment in Infrastructure

The steel rebar market is growing rapidly due to increased investment in infrastructure development. Governments and private sectors are spending heavily on building roads, bridges, airports, and other large-scale projects, driving the rising demand for steel rebar. For instance, according to the US Department of Treasury, the US allocated USD 1.2 trillion for infrastructure development under the Bipartisan Infrastructure Law. This surge in infrastructure spending is fueled by the need for modernization and better connectivity. Additional funds are being directed toward urban development, transport networks, and industrial projects, further boosting the steel rebar market revenue.

Steel Rebar Market Segment Insights

Steel Rebar Market Assessment by Type Outlook

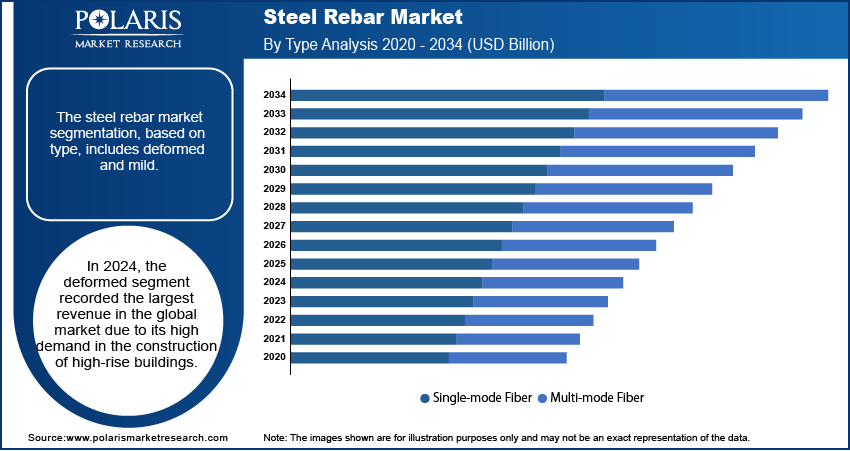

The steel rebar market assessment, based on type, includes mild and deformed. In 2024, the deformed segment recorded the largest revenue share due to its high demand in the construction of high-rise buildings. Deformed rebars are preferred for their superior grip on concrete, providing better strength and resistance to tension and bending. These properties make them ideal for tall structures that require durability and stability. Additionally, the ongoing growth of urbanization and the rise in skyscraper construction have fueled the demand for deformed steel rebars in the global market.

Steel Rebar Market Evaluation by Application Outlook

The steel rebar market evaluation, based on application, includes construction & infrastructure and industrial. The construction & infrastructure segment dominated the market in 2024 due to the increasing number of construction and infrastructure projects worldwide. This growth is fueled by rising demand for housing, transportation systems, and essential services. Additionally, advancements in construction technology, materials, and project management have made large-scale projects more feasible and cost-effective, further accelerating global infrastructure development and boosting demand for steel rebar.

Steel Rebar Market Regional Analysis

By region, the study provides the steel rebar market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific had the largest revenue share of the global market due to its rapid industrialization, urbanization, and significant infrastructure development. Countries such as China, India, and Japan are investing heavily in large-scale construction projects, including roads and high-rise buildings. The region's growing population and increasing demand for residential and commercial properties further boost the need for steel rebar. Additionally, the availability of low-cost raw materials and established manufacturing facilities in Asia Pacific contribute to its market dominance.

The North America steel rebar market is experiencing significant growth in the global market due to increased investment in infrastructure. Governments and private sectors are allocating substantial funds to upgrade transportation networks, construct new roads, bridges, and airports, and enhance residential and commercial buildings. These projects require large amounts of steel rebar for reinforcement. The focus on infrastructure renewal and development in both the US and Canada is further fueling the demand for durable, high-strength materials like steel rebar, thereby supporting regional market growth.

The steel rebar market in Canada is experiencing substantial growth due to the country’s ongoing industrial development. The expansion of Canada’s manufacturing, mining, and energy sectors has increased the demand for strong and durable infrastructure. For instance, according to the Canada Renewable Energy Association, in 2024 the energy industry expanded its generation capacity by 2.3 GW. Large industrial projects, including factories, pipelines, and energy plants, require steel rebar for structural reinforcement. The growing need for robust construction materials in these sectors is pushing up the demand for steel rebar, thereby propelling market growth in Canada.

Steel Rebar Market – Key Players and Competitive Insights

The steel rebar market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the steel rebar market include ArcelorMittal, SAIL, NLMK, Tata Steel, JSW, NIPPON STEEL CORPORATION, Nucor, Gerdau S/A, Mechal, and Steel Dynamics Inc.

Tata Steel, established in 1907 in Jamshedpur, India, is a steel producer and a flagship company of the Tata Group. With an annual crude steel capacity of approximately 35 million tons per annum (MnTPA), it ranks among the world's leading steel manufacturers. The company operates across five continents, with facilities in India, Europe, and Southeast Asia. Tata Steel offers a diverse product portfolio for various sectors. Its key segments include automotive and special products, providing high-strength steels for the automotive industry; industrial products, serving construction and engineering needs; branded products and retail offerings, such as galvanized sheets; and services, including design and automation solutions. In India, Tata Steel’s major plants are located in Jamshedpur and Kalinga Nagar, with ongoing capacity expansions. In Europe, the company has significant operations in the Netherlands and the UK. Additionally, its presence in Southeast Asia is strengthened through acquisitions like Millennium Steel in Thailand.

Nippon Steel Corporation, headquartered in Chiyoda-ku, Tokyo, was formed through the merger of Nippon Steel and Sumitomo Metal Industries in 2012. Nippon Steels has an annual production capacity of approximately 37 million tons of crude steel, making it the third-largest steel producer worldwide. Nippon Steel operates across four primary business segments which include steelmaking and steel fabrication, engineering, chemicals, and system solutions. The steelmaking segment is the core of its operations, producing a diverse range of products, including flat products, structural steel, bars and wire rods, pipes and tubes, and specialty steels tailored for automotive applications. In addition to its manufacturing prowess, Nippon Steel provides engineering services that support its operations and infrastructure projects. The chemicals segment develops products that complement its steel manufacturing processes, while the system solutions segment focuses on delivering integrated solutions. Nippon Steel's global footprint extends across several regions, with major operations in Asia Pacific, particularly Japan and Southeast Asia. The company has also established partnerships and manufacturing sites in North America to cater to growing market demands. In Europe, Nippon Steel engages in joint ventures to strengthen its presence.

List of Key Companies in Steel Rebar Market

- ArcelorMittal

- Gerdau S/A

- JSW

- Mechal

- NIPPON STEEL CORPORATION

- NLMK

- Nucor

- SAIL

- Steel Dynamics Inc.

- Tata Steel

Steel Rebar Market Industry Developments

October 2024: Shyam Metalics launched stainless steel rebar production, focusing on coastal regions and aligning with India's infrastructure vision and 'Make in India' initiative, supported by Minister Gadkari.

October 2021: Tata Steel launched Tata Tiscon 550SD, India’s first GreenPro Certified rebar. Designed for strength, safety, and sustainability, this product was introduced to help home builders reduce costs while ensuring superior performance and structural integrity.

Steel Rebar Market Segmentation

By Type Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Mild

- Deformed

By Application Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Construction & Infrastructure

- Industrial

By Regional Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Steel Rebar Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 313.09 billion |

|

Market size value in 2025 |

USD 328.16 billion |

|

Revenue Forecast by 2034 |

USD 506.06 billion |

|

CAGR |

4.9% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in kilotons, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The steel rebar market size was valued at USD 313.09 billion in 2024 and is projected to grow to USD 506.06 billion by 2034.

• The global market is projected to register a CAGR of 4.9% from 2025 to 2034.

• Asia Pacific had the largest revenue share of the global market in 2024.

• A few of the key players in the market are ArcelorMittal, SAIL, NLMK, Tata Steel, JSW, NIPPON STEEL CORPORATION, Nucor, Gerdau S/A, Mechal, and Steel Dynamics Inc.

• The deformed segment recorded the largest revenue share in the global market in 2024 due to its high demand in the construction of high-rise buildings.

• The construction & infrastructure segment dominated the market in 2024 due to the increase in number of construction and infrastructure projects worldwide.