Steel Fiber Market Size, Share, Trends, Industry Analysis Report: By Steel Type (Carbon Steel Fibers and Stainless Steel Fibers), Product Type, Manufacturing Process, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5093

- Base Year: 2023

- Historical Data: 2019-2022

Steel Fiber Market Overview

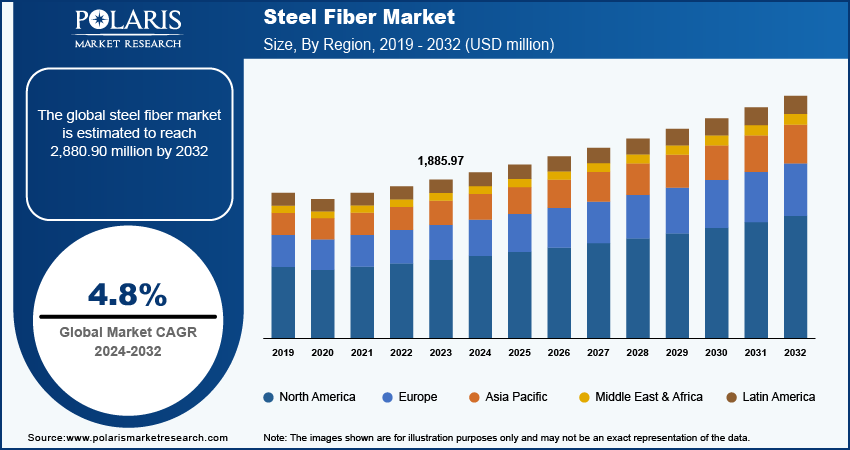

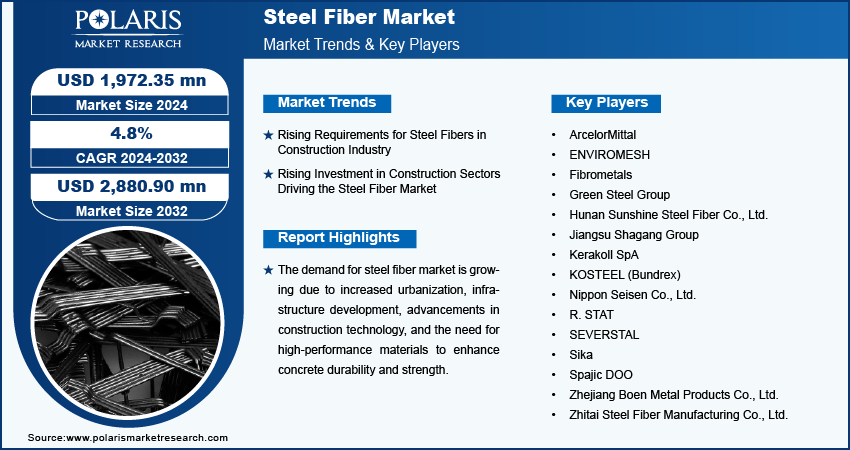

Global steel fiber market size was valued at USD 1,885.97 million in 2023. The market is projected to grow from USD 1,972.35 million in 2024 to USD 2,880.90 million by 2032, exhibiting a CAGR of 4.8% during the forecast period.

Steel fibers are short, discontinuous filaments of steel that are typically added to concrete, refractory materials, or composite materials to enhance their mechanical properties. These fibers are generally manufactured from high-strength stainless steel or carbon steel and are available in various shapes, sizes, and configurations depending on their intended application.

The global demand for steel fibers is driven by extensive infrastructure development projects worldwide, which require materials that withstand heavy loads, environmental conditions, and prolonged service life. Furthermore, the need to reduce maintenance costs and the rising demand for durable, eco-friendly building materials are driving this trend.

To Understand More About this Research: Request a Free Sample Report

The adoption of advanced construction techniques, such as 3D printing and prefabrication, increases the demand for steel fibers. These techniques often require specialized concrete mixtures that benefit from the reinforcing properties of steel fibers. Thus, companies capitalize on the growing global demand for steel fibers by expanding their market reach into emerging economies where infrastructure development is thriving.

Steel Fiber Market Trends

Rising Requirements for Steel Fibers in Construction Industry

Steel fibers are increasingly used in concrete to improve its mechanical properties. They enhance tensile strength, impact resistance, and flexibility. This makes concrete more robust and less prone to cracking, which is crucial for constructing high-performance structures. The growing demand for such high-quality and durable structures is a major driver for the steel fiber industry.

Many countries are investing heavily in infrastructure development, including roads, bridges, and tunnels. These projects require concrete that can withstand harsh conditions and high loads. Steel fibers help meet these requirements by reinforcing concrete, which increases its durability and lifespan. As infrastructure projects expand globally, the demand for steel fibers to enhance concrete performance grows accordingly. Thus, companies are engaged in the production of steel fibers and get environmental declarations, which are used in construction to enhance the performance and durability of concrete.

For instance, in October 2021, Bekaert secured an Environmental Product Declaration (EPD) for its Dramix steel fibers produced for concrete reinforcement at its Petrovice facility in the Czech Republic. This certification highlights the sustainability of Dramix, enabling architects, developers, and other construction professionals to compare it with traditional concrete reinforcement options. Such innovation plays a crucial role in advancing the use of steel fibers in construction, helping to meet the growing demands of the steel fiber market.

Rising Investment in Construction Sectors Driving the Steel Fiber Market

The rising investment in the construction sector is a significant driver of growth in the steel fiber market. Rapid urbanization and population growth are driving significant investments in residential and commercial real estate. New buildings, high-rise apartments, commercial spaces, and industrial facilities all require robust concrete solutions. Steel fibers are used to reinforce concrete in these construction projects, providing the strength and durability needed for modern buildings.

Governments and private entities around the globe are ramping up investments in construction projects, particularly in residential housing, to address several pressing needs. Additionally, they help improve infrastructure, support sustainable urban development, and promote affordable housing solutions, ensuring that more people have access to quality homes.

For instance, in June 2024, the India Government decided to extend the Pradhan Mantri Awas Yojana-Urban (PMAY-U) by assisting an additional three crore households following the successful sanction of 4.21 crore houses. The scheme has already sanctioned 1.18 crore houses, with 1.14 crore under construction and 83.67 lakh completed, totaling an expenditure of Rs 1,51,246 crore. Notably, 16 lakhs of these houses are utilizing new technologies, highlighting the program’s commitment to modern and sustainable construction. This substantial investment in the construction sector is driving the steel fiber market revenue.

Steel Fiber Market Segment Insights

Steel Fiber Product Breakdown by Product Type Insights

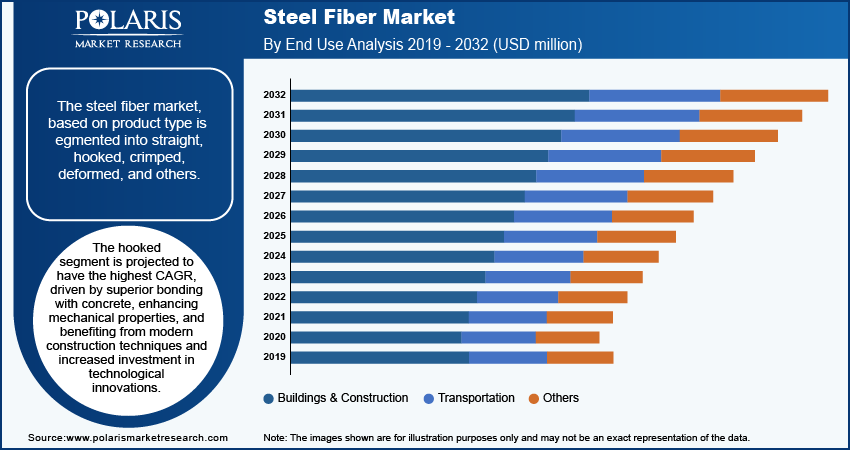

The global steel fiber market segmentation, based on product type, includes straight, hooked, crimped, deformed, and others. The hooked segment is expected to witness the highest CAGR during the forecast period due to their superior bonding characteristics with concrete. The hooked shape creates a mechanical interlock with the surrounding concrete, leading to improved reinforcement and resistance to crack propagation.

Modern construction techniques and innovations, such as high-performance concrete and advanced structural designs, benefit significantly from the use of hooked-end fibers. Their ability to improve the mechanical properties of concrete makes them ideal for these advanced applications, contributing to their growing popularity. The steel fiber market is seeing increased technological innovation and expansion. Companies are investing in improving the production and performance of hooked-end fibers, which supports their growing adoption and market share.

For instance, Tengzhou Star Smith Metal Products Co., Ltd. offers SDS Loose Hooked End Steel Fiber and SDS Glued Hooked End Steel Fiber, known for their exceptional tensile strength, excellent toughness, and cost-effectiveness. These versatile fibers are ideal for a wide range of applications, including roads, highways, curbs, factory floors, and airport runways.

Steel Fiber Market Breakdown by End Use Insights

The global steel fiber market segmentation, based on end use, includes buildings & construction, transportation, and others. The buildings & construction accounted for the largest market share and are anticipated to witness significant growth during the forecast period.

The ongoing trend of urbanization and large-scale infrastructure development worldwide fuels the need for advanced construction materials. As cities expand and new infrastructure projects are initiated, the demand for high-performance concrete reinforced with steel fibers increases significantly. This growth in construction activity directly impacts the steel fiber market.

Key players often collaborate to expand their geographical reach and market presence. By working with local distributors, construction firms, and international partners, companies penetrate new markets and increase their supply capabilities.

For instance, in April 2023, ArcelorMittal joined forces with BP2, the manufacturer of complete solutions for residential construction, to supply XCarb steel fiber for BP2’s integrated photovoltaic roof system. This strategic expansion helps address regional demands and enhances the steel fibers market demand.

Steel Fiber Market Breakdown by Regional Insights

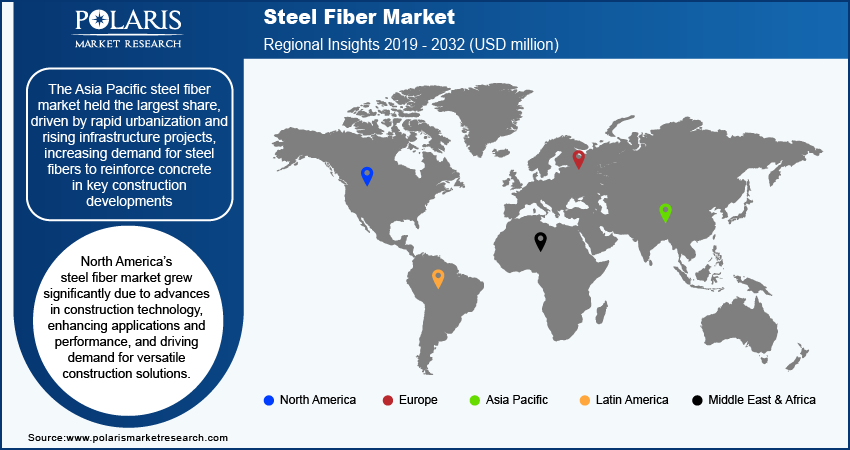

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific steel fiber market accounted for the largest share in 2023 due to rapid urbanization, with cities expanding and new infrastructure projects being launched. This growth drives the need for high-performance construction materials, including steel fibers, to reinforce concrete in roads, bridges, high-rise buildings, and other infrastructure projects.

The presence of major companies such as Nippon Seisen Co., Ltd.; Zhejiang Boen Metal Products Co., Ltd.; Zhitai Steel Fiber Manufacturing Co., Ltd.; and KOSTEEL (Bundrex); offering their products further strengthens the market landscape in APAC.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and to serve better offerings in APAC, further driving the market during the forecast period.

Japan's steel fiber market held the largest share in 2023, with its advanced construction techniques and innovation. The integration of steel fibers in various construction applications, including high-rise buildings and complex structures, is driven by technological advancements and the pursuit of superior performance. The major players in this market have strategically acquired the stake of steelmakers to enhance their productivity, thereby driving the steel fiber market.

For instance, in January 2022, Japan's Nippon Steel announced buying two electric arc furnace steelmakers in Thailand for up to $763 million, which indicated the rising development in the steel fiber market.

India's steel fiber market held a substantial share in 2023 due to the country's significant urbanization and infrastructure development. Steel fibers significantly enhance the durability and performance of concrete, making them essential in large-scale construction projects. The increased demand has led leading suppliers to cater to the evolving needs of the construction sector, contributing to the market's robust growth and importance in India's development landscape.

For instance, Kasturi Metal Composite Ltd., manufactures, imports, and supplies a comprehensive range of steel fibers. Their offerings include flat steel fibers for industrial flooring, docks, and pavements; loose and glued hooked-end steel fibers for dams, tunnel and mine shotcreting, roadways, highways, shipping dockyards, and precast elements; and stainless-steel fibers for refractory shotcrete and castables.

In 2023, the steel fiber market in North America held a significant share due to advances in construction technology and innovations in steel fiber production. These innovations have expanded the range of applications and improved the performance of steel fibers, driving market growth by providing more effective and versatile solutions for various construction needs, thereby boosting demand across the region.

The US steel fiber market is expected to witness significant growth during the forecast period, driven by manufacturers and suppliers who are expanding their operations in the country, introducing new steel fiber product lines, and significantly supporting the growth of the steel fiber market.

For instance, Helix Steel introduced two new products tailored for the Ultra High-Performance Concrete (UHPC) market, including Twisted Steel Micro Rebar technology and Helix's unique twisted, screw-like steel fibers. These innovations offer significant advantages over traditional smooth steel fibers, enhancing concrete performance. Such advancements are expected to boost the steel fiber market demand. On the other hand, the Canadian steel fiber market held notable growth in 2023 due to robust activity in both residential and commercial projects. As developers and builders sought high-performance concrete solutions to meet modern standards, the adoption of steel fibers became more prevalent.

Steel Fiber Key Market Players & Competitive Insights

Leading market players are pivotal in shaping market trends and influencing demand through their market developments, including diverse product offerings, strategic initiatives, and the ability to address evolving industry needs. Manufacturer innovations such as enhanced fiber shapes, improved bonding properties, and eco-friendly materials capture a significant steel fiber market share and meet the diverse needs of the construction sector.

Opportunities exist for market growth through technological advancements, expansion into emerging markets, and adherence to regulatory standards. By leveraging these opportunities, key players strengthen their steel fiber market position and meet the evolving demands of the various industries.

Major players in the steel fiber market, including ArcelorMittal; ENVIROMESH; Fibrometals; Green Steel Group; Hunan Sunshine Steel Fiber Co., Ltd; Jiangsu Shagang Group; Kerakoll SpA; KOSTEEL (Bundrex); Nippon Seisen Co., Ltd.; R. STAT; SEVERSTAL; Sika; Spajic DOO; Zhejiang Boen Metal Products Co., Ltd.; and Zhitai Steel Fiber Manufacturing Co., Ltd.

KOSTEEL (Bundrex) offers its steel fiber brand, BUNDREX, a major solution for concrete reinforcement. For the past 18 years, Bundrex has been manufacturing steel fibers in Korea using innovative developments and specialized techniques. The company is dedicated to developing new solutions and aims to become a significant player in the global steel fiber market. In September 2021, Bundrex-reinforced steel fibers were supplied for the Tesalia Tunnel project in Colombia.

Sika is a specialty chemicals company with a global presence, specializing in the production and development of systems and products for sealing, bonding, damping, protecting and reinforcing in the building and automotive industries. With subsidiaries in 103 countries and over 400 factories worldwide, Sika delivers innovative technologies to its global customer base. In March 2021, Sika introduced new free software to calculate the amount of SikaFiber needed for ground-bearing concrete slabs. This tool helps identify potential cost savings through optimized steel fiber specifications.

List of Key Companies in Steel Fiber Market

- ArcelorMittal

- ENVIROMESH

- Fibrometals

- Green Steel Group

- Hunan Sunshine Steel Fiber Co., Ltd.

- Jiangsu Shagang Group

- Kerakoll SpA

- KOSTEEL (Bundrex)

- Nippon Seisen Co., Ltd.

- R. STAT

- SEVERSTAL

- Sika

- Spajic DOO

- Zhejiang Boen Metal Products Co., Ltd.

- Zhitai Steel Fiber Manufacturing Co., Ltd.

Steel Fiber Industry Developments

April 2024: Sika is launching an advanced facility in Lima, Peru, to manufacture synthetic macro fibers, further expanding its product range with high growth potential in Latin America. This new technology reinforces Sika’s position as a major supplier to the mining industry and a key partner for infrastructure projects.

July 2022: ArcelorMittal signed an agreement to acquire CSP, a state-of-the-art steel facility in northeast Brazil. This acquisition enhances ArcelorMittal’s footprint in the rapidly growing Brazilian steel market.

Steel Fiber Market Segmentation

By Steel Type Outlook

- Carbon Steel Fibers

- Stainless Steel Fibers

By Product Type Outlook

- Straight

- Hooked

- Crimped

- Deformed

- Others

By Manufacturing Process Outlook

- Slit Sheet

- Melt Extract

- Cut Wire

- Cold Drawn

- Others

By Application Outlook

- Concrete

- Refractories

- Composites

- Others

By End Use Outlook

- Buildings & Construction

- Transportation

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Steel Fiber Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,885.97 million |

|

Market Size Value in 2024 |

USD 1,972.35 million |

|

Revenue Forecast in 2032 |

USD 2,880.90 million |

|

CAGR |

4.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global steel fiber market size was valued at USD 1,885.97 million in 2023 and expected to grow at 2,880.90 million in 2032

The global market registers a CAGR of 4.8% during the forecast period, 2023-2032.

Asia Pacific region had the largest share of the global market

The key players in the market are ArcelorMittal; ENVIROMESH; Fibrometals; Green Steel Group; Hunan Sunshine Steel Fiber Co., Ltd; Jiangsu Shagang Group; Kerakoll SpA; KOSTEEL (Bundrex); Nippon Seisen Co., Ltd.; R. STAT; SEVERSTAL; Sika, Spajic DOO; Zhejiang Boen Metal Products Co., Ltd.; and Zhitai Steel Fiber Manufacturing Co., Ltd.

The hooked segment is expected to witness the highest CAGR during the forecast period.

The buildings & construction accounted for the largest market share and are anticipated to witness significant growth during the forecast period.