Stablecoins & CBDCs Market Size, Share, Trends, Industry Analysis Report: By Type (Stablecoins and CBDC), Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5442

- Base Year: 2024

- Historical Data: 2020-2023

Stablecoins & CBDCs Market Overview

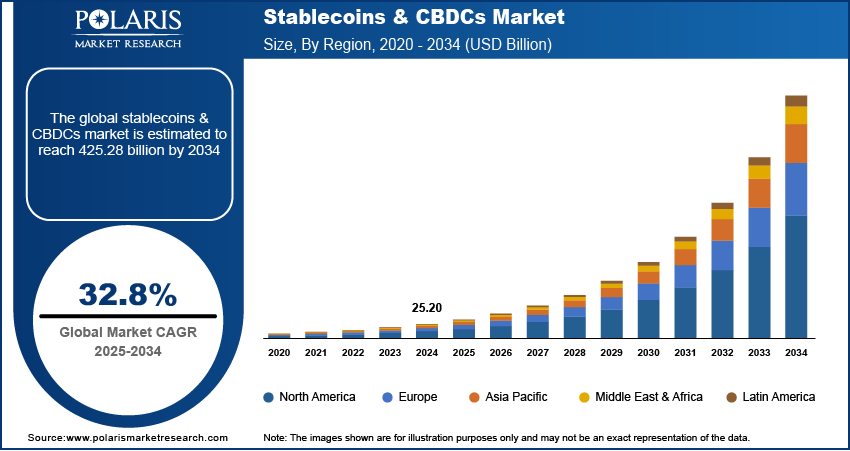

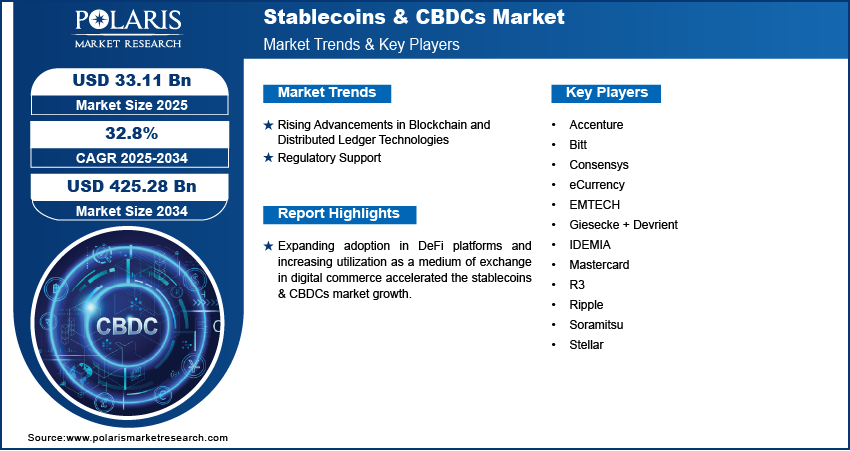

The global stablecoins & CBDCs market size was valued at USD 25.20 billion in 2024 and is expected to reach USD 33.11 billion by 2025 and USD 425.28 billion by 2034, exhibiting a CAGR of 32.8% during 2025–2034.

Stablecoins are digital assets designed to maintain a stable value by pegging their price to a reserve asset, such as a fiat currency or commodity. Central Bank Digital Currencies (CBDCs) are digital forms of a country's sovereign currency, issued and regulated by the nation's central bank.

Expanding adoption in DeFi platforms and increasing utilization as a medium of exchange in digital commerce accelerated the stablecoins & CBDCs market growth. Enhanced transaction efficiency, liquidity, and decentralized financial applications contributed to market demand, encouragement of long-term growth, and broader financial integration.

To Understand More About this Research: Request a Free Sample Report

CBDCs enhanced financial inclusion by offering unbanked populations access to digital financial services, boosting economic participation. Secure, low-cost transactions and government-backed stability contributed to stablecoins & CBDCs market expansion, increasing adoption and driving digital payment accessibility in underserved regions. Furthermore, stablecoins and CBDCs offer faster and more cost-effective transaction solutions, which propels the market growth.

Stablecoins & CBDCs Market Dynamics

Rising Advancements in Blockchain and Distributed Ledger Technologies

Developments in blockchain and distributed ledger technologies enhanced security, scalability, and transaction efficiency, contributing to stablecoins & CBDCs market expansion. Advanced cryptographic protocols and consensus mechanisms improved data integrity and reduced the risk of cyber threats, strengthening market demand across financial institutions and enterprises. Scalability improvements facilitated faster and cost-effective transactions. Smart contract integration optimized automation in financial settlements, reducing reliance on intermediaries and enhancing transparency. Ongoing research in quantum-resistant cryptography and interoperability solutions further increased market value, enabling seamless integration across diverse financial ecosystems.

Regulatory Developments and Market Growth of Stablecoins and CBDCs

Governments and financial institutions increasingly explored and authorized digital currencies, driving stablecoins & CBDCs market demand. Regulatory frameworks established by central banks ensured compliance, mitigating risks related to money laundering and financial fraud. For instance, in January 2025, the US President signed an Executive Order aimed at creating a comprehensive regulatory framework for digital assets. This order sets the stage for structured oversight of cryptocurrencies and blockchain technologies, addressing various aspects such as consumer protection, financial stability, and innovation. Strategic initiatives such as central bank pilot programs and regulatory sandboxes contributed to the market growth by fostering innovation while ensuring legal stability. Clearer guidelines on taxation, asset backing, and issuance models improved market value, encouraging institutional adoption. Collaborative efforts between regulatory bodies and fintech companies facilitated the integration of digital currencies into mainstream financial systems. Heightened regulatory clarity promoted confidence among investors, reinforcing the long-term viability of stablecoins and CBDCs.

Stablecoins & CBDCs Market Segment Insights

Stablecoins & CBDCs Market Assessment by Type Outlook

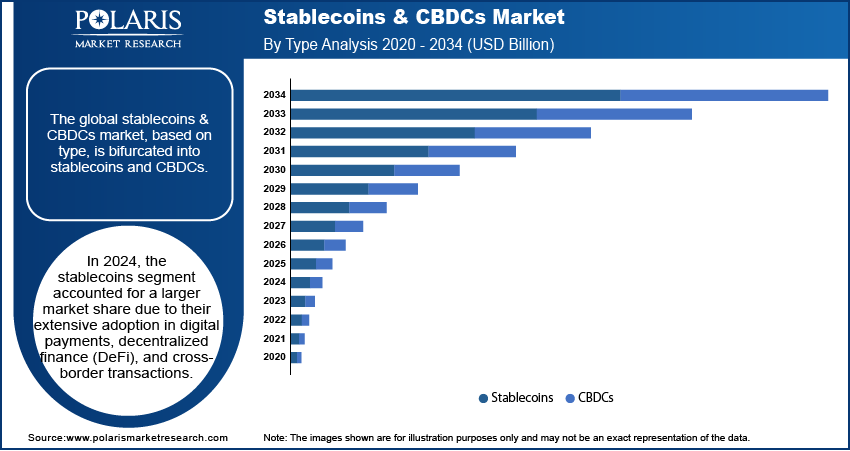

The global stablecoins & CBDCs market segmentation, based on type, includes stablecoins and CBDCs. In 2024, the stablecoins segment accounted for the largest market share due to its extensive adoption in digital payments, decentralized finance (DeFi), and cross-border transactions. Their ability to provide price stability, backed by fiat reserves or algorithmic mechanisms, positioned them as a preferred choice for institutional and retail investors. Increased integration with payment processors and crypto exchanges further solidified stablecoins’ role in enhancing liquidity within digital asset ecosystems. The rise of tokenized assets and institutional-grade stablecoin solutions, backed by regulatory clarity in key markets, contributed to stablecoins & CBDCs market expansion, reinforcing their dominance across global financial applications.

The CBDCs segment is expected to register a higher CAGR over the forecast period due to central banks' increasing initiatives to develop sovereign digital currencies. The adoption of CBDCs aims to enhance financial inclusion, reduce transaction costs, and improve monetary policy efficiency, contributing to stablecoins & CBDCs market demand. Governments across emerging and developed economies are accelerating pilot programs, leading to the integration of CBDCs into mainstream banking systems. Advancements in distributed ledger technology (DLT) and interoperability frameworks are further improving scalability, security, and real-time transaction processing, positioning CBDCs as a transformative force within global financial markets.

Stablecoins & CBDCs Market Evaluation by Application Outlook

The global stablecoins & CBDCs market segmentation, based on application, includes payments and settlements, remittances, decentralized finance (DeFi), forex, and others. In 2024, the payments and settlements segment accounted for the largest market share due to the increasing demand for instant, cost-effective transactions. The ability to settle transactions in real time use of stablecoins and CBDCs without intermediaries enhanced financial efficiency, supporting stablecoins & CBDCs market expansion. Leading financial institutions and fintech companies adopted stablecoins for cross-border payments, reducing currency exchange complexities. The integration of blockchain-powered payment networks strengthened market value by streamlining remittances, corporate payments, and interbank transactions. Regulatory developments and compliance frameworks reinforced institutional adoption, establishing payments and settlements as pivotal applications within digital currency ecosystems.

The remittances segment is expected to register the highest CAGR during the forecast period due to the increasing demand for low-cost, efficient cross-border fund transfers. Stablecoins and CBDCs reduce transaction fees and processing times compared to traditional remittance services, contributing to market growth for the segment. Emerging markets, particularly in regions with high remittance inflows, are accelerating adoption as digital currencies offer financial access to unbanked populations. Strategic partnerships between blockchain payment providers and global remittance platforms further enhance market penetration, making digital currencies a critical solution for cross-border financial transactions.

Stablecoins & CBDCs Market Regional Analysis

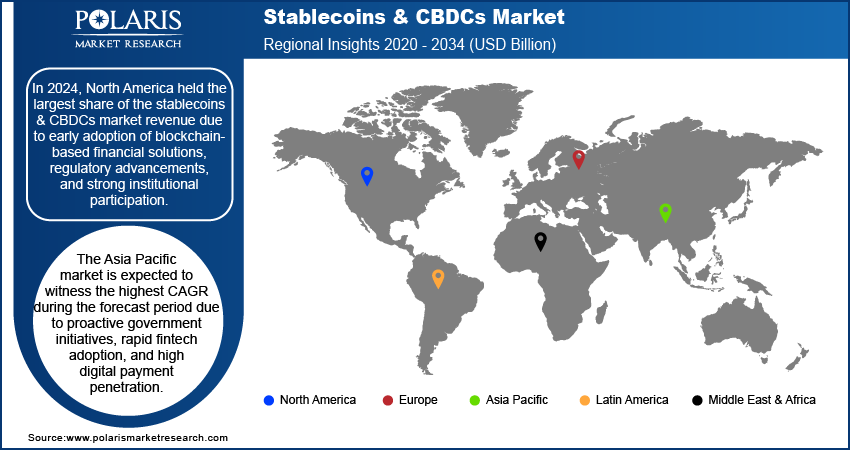

By region, the study provides stablecoins & CBDCs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the early adoption of blockchain-based financial solutions, regulatory advancements, and strong institutional participation. Major financial institutions and technology firms actively integrated stablecoins for payments, trading, and settlement purposes. The US Federal Reserve and regulatory agencies explored CBDCs to enhance financial infrastructure, while established crypto payment providers expanded their stablecoin offerings. Increased venture capital investments and collaborations between traditional banking entities and digital asset firms further solidified North America’s dominance in the global stablecoins & CBDCs market revenue share. In February 2025, Metallicus partnered with Payfinia, a US Credit Union Service Organization, to create a framework for embedded instant payment solutions integrated with cryptocurrency services for credit union members nationwide.

The Asia Pacific stablecoins & CBDCs market is expected to register the highest CAGR during the forecast period due to proactive government initiatives, rapid fintech adoption, and high digital payment penetration. For instance, approximately 58% of consumers in Southeast Asia have successfully adopted a fully digital payment system on a weekly basis, marking a 10% increase since 2020. This shift indicates a significant trend toward digital transactions in the region. China’s digital yuan (e-CNY) rollout, along with similar CBDC projects in Japan, India, and Southeast Asia, is driving the market growth. The region’s thriving e-commerce and cross-border trade activities are accelerating stablecoin adoption for payments and remittances. Favorable regulatory developments and collaborations between central banks and private financial institutions are fueling the Asia Pacific stablecoins & CBDCs market expansion.

Stablecoins & CBDCs Market Players & Competitive Analysis Report

The competitive landscape of the stablecoins & CBDCs market is characterized by strategic partnerships, mergers and acquisitions, and collaborations among financial institutions, technology providers, and regulatory bodies. Leading stablecoin issuers are forming alliances with payment processors and fintech firms to enhance adoption and expand global reach. Major financial institutions are acquiring blockchain startups to strengthen their digital currency capabilities, while central banks are collaborating with private sector entities to develop and test CBDCs. Market participants are launching innovative solutions, including algorithmic stablecoins and interoperable CBDC platforms, to gain a competitive edge. Increasing regulatory clarity is driving strategic investments and market consolidation as firms seek to position themselves as key players in the evolving digital currency ecosystem.

Accenture, a global professional services company, provides consulting, technology, and outsourcing services to various industries worldwide. The company operates in segments such as media & technology, communications, financial services, health & public service, products, and resources. Artificial intelligence (AI) is one of the key focus areas for Accenture. The company offers various AI solutions to help clients optimize their operations, improve customer experiences, and drive business growth. These solutions include AI-powered automation, machine learning, natural language processing, and predictive analytics. Accenture has invested heavily in building a strong ecosystem of AI partners, including technology giants such as Google, Microsoft, and Amazon Web Services, as well as niche AI startups. The company's AI solutions are designed to integrate seamlessly with existing technology systems and processes, enabling clients to derive maximum value from their investments. Accenture is engaged in the stablecoins and CBDCs market through investments and partnerships, such as with EMTECH, and involvement in projects, including the Digital Dollar Project. The company provides consulting services to central banks on CBDC infrastructure and integration.

Mastercard is a technology company specializing in global transaction processing and a wide range of payment solutions. The company offers products and services for account holders, merchants, financial institutions, digital partners, businesses, and government entities, including deferred payment credits, fund access solutions, prepaid program services, and various payment products. Mastercard is involved in stablecoins and CBDCs by developing payment systems that support digital currencies. It collaborates with central banks and fintech companies to explore the integration of CBDCs into existing payment networks, enhancing cross-border transactions and financial inclusion.

List of Key Companies in Stablecoins & CBDCs Market

- Accenture

- Bitt

- Consensys

- eCurrency

- EMTECH

- Giesecke + Devrient

- IDEMIA

- Mastercard

- R3

- Ripple

- Soramitsu

- Stellar

Stablecoins & CBDCs Industry Developments

In September 2024, Accenture invested in EMTECH, a company specializing in CBDCs. This partnership is aimed at leveraging EMTECH's innovative technology to enhance the development and implementation of digital currency frameworks for central banks.

In September 2024, UDPN Integrated Hedera-Backed stablecoins and CBDCs for enhanced payment interoperability.

In May 2023, Ripple launched its CBDC platform, enabling central banks and financial institutions to seamlessly mint, manage, and transact CBDCs and stablecoins using XRP Ledger’s technology.

Stablecoins & CBDCs Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Stablecoins

- CBDCs

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Blockchain

- Consensus Mechanisms

- Interoperability & Cross-Chain Solutions

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Payments and Settlements

- Remittances

- Decentralized Finance (DeFi)

- Forex

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Stablecoins & CBDCs Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.20 billion |

|

Market Size Value in 2025 |

USD 33.11 billion |

|

Revenue Forecast in 2034 |

USD 425.28 billion |

|

CAGR |

32.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global stablecoins & CBDCs market size was valued at USD 25.20 billion in 2024 and is projected to grow to USD 425.28 billion by 2034.

The global market is projected to register a CAGR of 32.8% during the forecast period

In 2024, North America accounted for the largest market share due to the early adoption of blockchain-based financial solutions, regulatory advancements, and strong institutional participation.

The Asia Pacific stablecoins & CBDCs market is expected to witness the highest CAGR during the forecast period due to proactive government initiatives, rapid fintech adoption, and high digital payment penetration.

A few of the key players in the market are Accenture, Bitt, Consensys, eCurrency, EMTECH, Giesecke + Devrient, IDEMIA, Mastercard, R3, Ripple, Soramitsu, and Stellar.

• In 2024, the stablecoins segment accounted for a larger market share due to their extensive adoption in digital payments, decentralized finance (DeFi), and cross-border transactions.

In 2024, the payments and settlements segment accounted for the largest market share due to the increase in instant, cost-effective transactions.