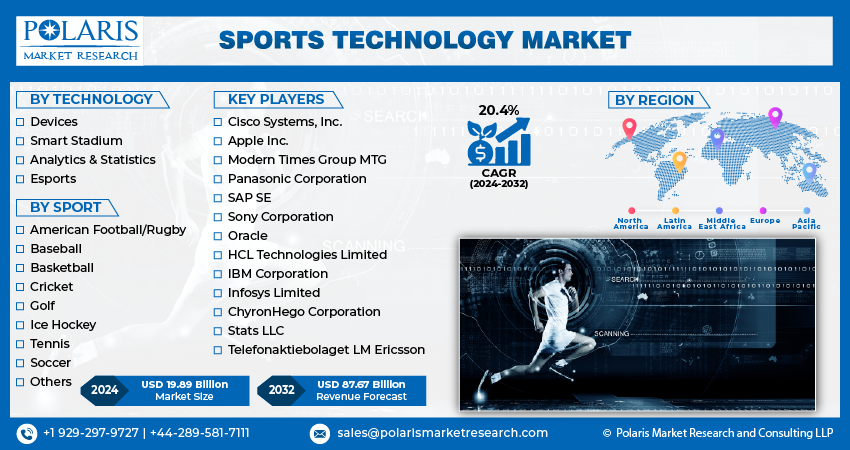

Sports Technology Market Share, Size, Trends, Industry Analysis Report, By Technology (Devices, Smart Stadiums, Analytic & Statistics, Esports); By Sport (American Football/Rugby, Baseball, Basketball, Cricket, Golf, Ice Hockey, Tennis, Soccer, Others); By Regions; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM1921

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

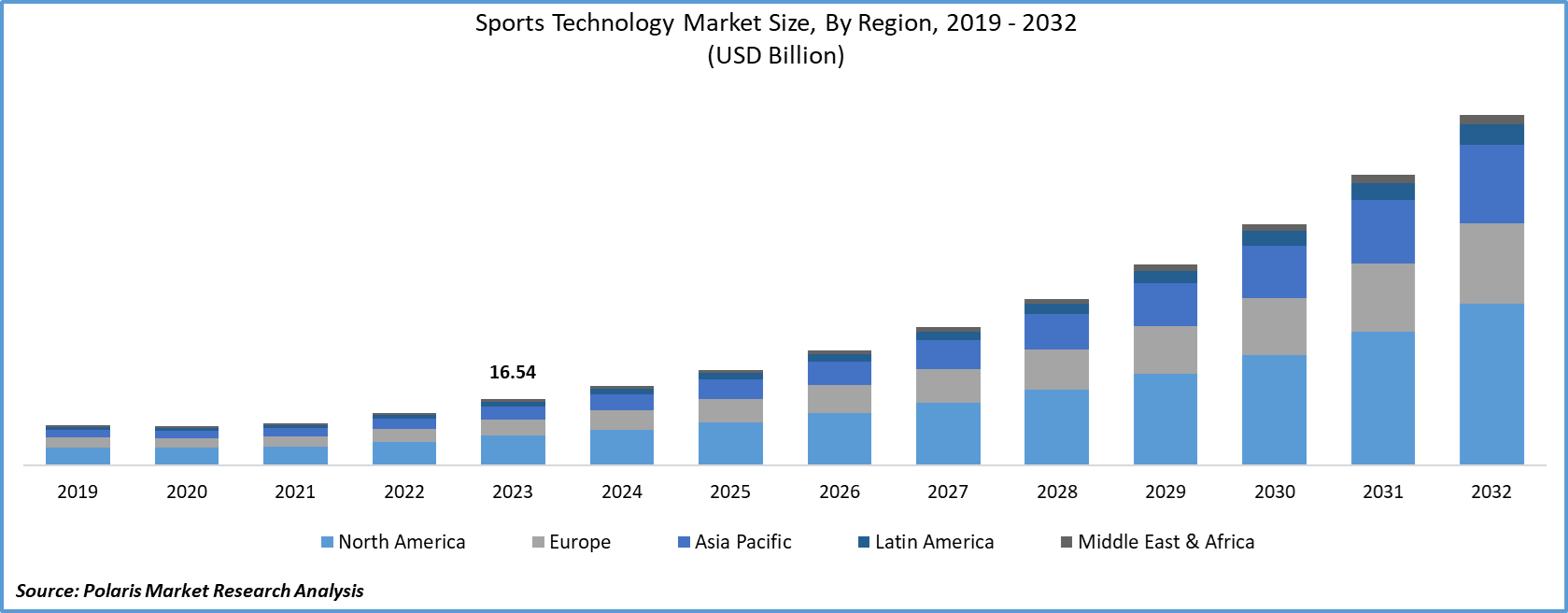

The global sports technology market size was valued at USD 16.54 billion in 2023. The market is anticipated to grow from USD 19.89 billion in 2024 to USD 87.67 billion by 2032, exhibiting the CAGR of 20.4% during the forecast period.

The increasing adoption of data analytics and advanced technology among various sports is expected to drive the market over the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Entertainment activities are incorporated with digital platforms for audience engagement and better connectivity, which is anticipated to boost the market growth. The industry is witnessing a significant shift due to growing investment by several organizations in developing new technology for engaging more fans along with players' performance monitoring.

Industry Dynamics

Growth Drivers

Key market players in the sports technology industry are focusing on gaining more revenue by investing in sales, operations, and marketing which is projected to grow the market over the coming years. The increasing number of sports associations across the globe is driving the need for new technology and infrastructural development accounting for new opportunities for market development over the forecast period.

Increasing adoption of innovative and high-tech gadgets such as digital signage, wearables, and smart stadium aids in better performance evaluation of the players and thus gaining market demand for sports technology from several sports.

The emerging franchise model for various sports segments is the new market trend as it provides profitability to the players, investors, and organizers. It helps in revenue sharing using merchandise, events, and games thus becoming a key driver for the growing demand for technology advancement in the sports industry.

Sports Technology Market Report Scope

The market is primarily segmented on the basis of technology, sport, and region.

|

By Technology |

By Sport |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Technology

The smart stadium segment accounted for the highest revenue share in the year 2020. It aids in strengthening stadium security, increasing profitability, and improve the audience experience. It enables the organizer in maintaining services in the stadium such as live tracking of parking tickets, food concessions, and ticket lines. An amalgamation of IoT devices enables in designing of wireless connection and interactive seats which propelled the market growth for sports technology.

The software sector reported the highest market growth in the year 2020 accounted for the rising demand for creating automation software for a secured and energy-efficient stadium. The significant need for asset management, ecological monitoring, and sanitation inside the stadium is driving the market growth for software technology.

Esports is expected to grow over the coming years considering the increasing viewership for the platform. The audience for the segment grew nearly by half a billion in the year owing to the significant shift in audience from live shows to virtual tournaments such as PUBG Mobile World League 2020, due to the lockdown. Esports have shown a capability to an engaged a larger audience on virtual ground, creating lucrative future opportunities.

The segment for Esports is bifurcated into sponsorship & advertisement, tickets & merchandise, and others. With a surge in marketing campaign focusing on digital platforms, the sponsorship & advertisement is expected to grow at a higher pace over the forecast period.

Insight by Sport

Soccer dominated the market in the year 2020, owing to the growing implementation of smart technology in the sport for better monitoring and accurate results on athletes’ performance. The sector had a slow start after approval in the year 2015 by the International Football Association Board. FIFA permitted sharing the Crucial data about players' statistics during the game with coaches in real-time using smart devices after the year 2018, which fueled the market growth.

Basketball is anticipated to show significant growth from the year 2021 to 2028 owing to the rapid adoption of technology such as mobile apps, data analytics, heart rate sensors, and wearable devices. In the year 2020, an analytics department was created for all the NBA teams to enhance the game-day performance by optimizing effective training sessions.

The segment for Esports is bifurcated into sponsorship & advertisement, tickets & merchandise, and others. With a surge in marketing campaign focusing on digital platforms, the sponsorship & advertisement is expected to grow at a higher pace over the forecast period.

Rugby has shown market growth in the past few years and has potential to attract the market with ascending use of IoT sensors. It enables the players to measure collision impact of the opponent during the game and assists in smart decision making for improving strategy.

Geographic Overview

Europe dominated the sports technology market in the year 2020, with over 30% revenue share of the global industry and is expected to continue its dominance over the forecast period. Major driver in the European region includes several football leagues belong to Europe and most of them have integrated smart devices with advantages in the management of players, leagues, and audiences.

The government of Europe has strengthened the public safety norms for viewers which is expected to enforce major stadiums to adopt new technologies for hosting games with ease, further contributing to the development of the market.

Asia Pacific sports technology industry is projected to witness fastest growth over the coming years on account of the growing sports industries in the nations such as India, Japan, and China. Several leagues are gaining popularity among the youth in various sports in India with regional tournaments massively contributing to the industry expansion.

Competitive Insight

The prominent players operating in the sports technology market are Cisco Systems, Inc., Apple Inc., Modern Times Group MTG, Panasonic Corporation, SAP SE, Sony Corporation, Oracle, HCL Technologies Limited, IBM Corporation, Infosys Limited, ChyronHego Corporation, Stats LLC, Telefonaktiebolaget LM Ericsson.

The industry offers better future opportunities triggering the entry of new players in the market to seize the profitability. Companies are working towards collaboration and strategic partnership to gain a competitive edge. In the year 2019, the Eredivisie football league in the Netherland and Modern Times Group enter into a strategic partnership to expand FIFA 2020 e-league.