Sports Medicine Market Size, Share, Trends, Industry Analysis Report: By Product Type (Body Reconstruction & Repair, Body Support & Recovery, Body Monitoring & Evaluation, and Accessories), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2025–2034)

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5196

- Base Year: 2024

- Historical Data: 2020-2023

Sports Medicine Market Overview

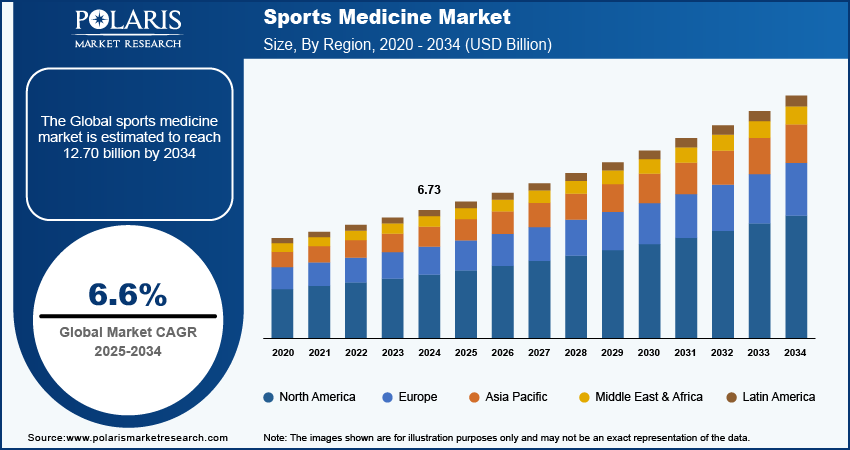

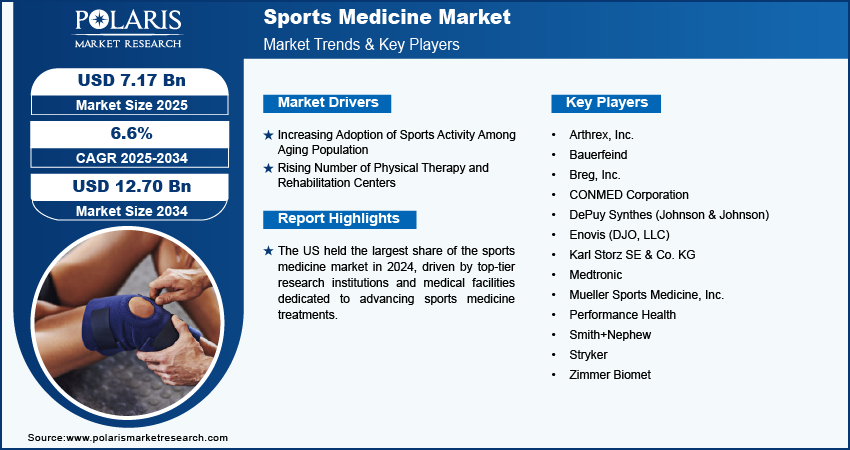

The global sports medicine market size was valued at USD 6.73 billion in 2024. The market is projected to grow from USD 7.17 billion in 2025 to USD 12.70 billion by 2034, exhibiting a CAGR of 6.6% during 2025–2034.

The sports medicine market focuses on the prevention, diagnosis, treatment, and rehabilitation of injuries and conditions related to sports, physical fitness, and exercise.

The sports medicine includes a wide range of products and services, such as injury prevention devices, surgical equipment, rehabilitation products, and therapies designed to help athletes and active individuals recover from injuries and optimize performance.

Increasing involvement in sports and physical activities has led to a higher incidence of sports-related injuries, which is driving the demand for sports medicine. Additionally, the global emphasis on physical fitness and maintaining an active lifestyle has contributed to the rise in sports injury cases, fueling the sports medicine market growth.

To Understand More About this Research: Request a Free Sample Report

Innovations in diagnostic tools, minimally invasive surgical techniques, and rehabilitation devices have enhanced treatment options, improving recovery times and boosting the market. Moreover, increased government support for sports activities and injury prevention programs has positively impacted market expansion, especially in emerging economies.

Sports Medicine Market Trends

Increasing Adoption of Active Lifestyle Among Aging Population

The rising number of elderly individuals adopting more active lifestyles has led to an increased need for sports medicine interventions to manage age-related musculoskeletal conditions, including joint degeneration, muscle strains, and tendon injuries. This demographic trend fosters the development of advanced treatment protocols and preventive strategies tailored to older individuals seeking to maintain physical activity. Additionally, government initiatives and expanded healthcare spending on veterans have further encouraged sports participation among this group, leading to a rise in sports-related injuries. For instance, according to USAFacts, in the fiscal year 2020, a total of USD 249.4 billion was allocated by governments to support veterans, averaging ∼USD 752 per person. Consequently, the need for specialized medical interventions to manage and treat these injuries is expected to drive the expansion of the sports medicine market during the forecast period.

Rising Number of Physical Therapy and Rehabilitation Centers

The growing number of physical therapy and rehabilitation centers specializing in treating sports-related injuries is estimated to significantly contribute to the expansion of the sports medicine market in the coming years. These centers are becoming hubs for injury prevention, treatment, and recovery, driving more athletes, whether professional, amateur, or recreational, to seek specialized care. Therefore, as these centers expand, the demand for sports medicine also spurs.

Sports Medicine Market Segment Analysis

Sports Medicine Market Breakdown by Product Type Insights

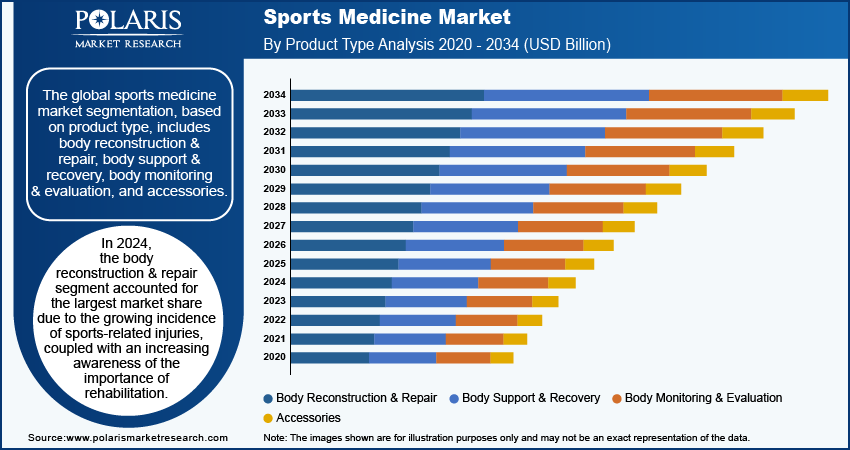

The global sports medicine market segmentation, based on product type, includes body reconstruction & repair, body support & recovery, body monitoring & evaluation, and accessories. In 2024, the body reconstruction & repair segment accounted for the largest market share due to the growing incidence of sports-related injuries. Furthermore, increasing awareness regarding the importance of rehabilitation has significantly contributed to the demand for advanced reconstruction and repair solutions. Athletes and active individuals are increasingly seeking innovative procedures and technologies that enhance recovery times and improve overall performance. Additionally, advancements in surgical techniques and materials, such as biologics and minimally invasive procedures, have made body reconstruction more effective and accessible, positioning the segment's dominant share.

Sports Medicine Market Breakdown by End Use Insights

The global sports medicine market, based on end use, is segmented into hospitals, orthopedic specialty clinics, fitness and training centers, ambulatory surgical centers, and others. The hospital segment is expected to register the highest CAGR during the forecast period due to rising demand for specialized treatment and rehabilitation services being offered by hospitals. The hospitals are increasingly investing in new technology and equipment to provide comprehensive care, including advanced imaging techniques, surgical interventions, and postoperative rehabilitation programs. Moreover, hospitals are forming partnerships with sports teams and organizations to establish dedicated sports medicine departments, enhancing their capabilities to attract patients seeking specialized care. For instance, in August 2024, Harris Regional Hospital renewed its partnership with Western Carolina University Athletics, to provide orthopedic and sports medicine care for WCU's student-athletes. Thus, the growing emphasis on personalized medicine and patient-centered approaches within hospital settings is driving the hospital segment growth.

Sports Medicine Market Regional Insights

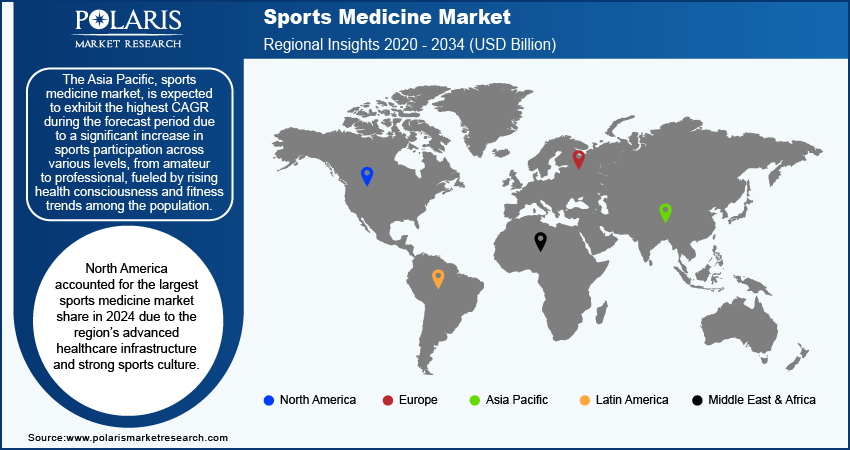

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest sports medicine market share in 2024 due to the region’s advanced healthcare infrastructure and strong sports culture. The increasing participation in sports and fitness activities has led to a higher incidence of sports-related injuries, driving demand for specialized medical treatments and rehabilitation services. In the 2024 Paris Olympics, the USA and Canada together had over 900 participants. With numerous professional sports leagues, North America boosts the importance of sports medicine, driving advancements and financial backing in this sector.

In North America, the US accounted for the largest sports medicine market share in 2024, driven by the presence of top-tier research institutions and medical facilities dedicated to advancing sports medicine treatments. Furthermore, increasing public awareness about the importance of injury prevention, rehabilitation, and overall athlete well-being has encouraged athletes and recreational sports enthusiasts to seek specialized care, thereby contributing to market growth.

The Asia Pacific sports medicine market is expected to record the highest CAGR during the forecast period due to a significant increase in sports participation across various levels, from amateur to professional, fueled by rising health consciousness and fitness trends among the population. This growing interest in sports and physical activities has led to a higher incidence of sports-related injuries, thereby driving demand for specialized medical treatments and rehabilitation services. Moreover, the region is witnessing improvements in healthcare infrastructure, with rising investments in advanced medical technologies and facilities dedicated to sports medicine. Governments and private organizations are increasingly promoting sports and physical fitness, leading to initiatives aimed at enhancing athlete health and performance. Additionally, the rising number of sports events, both at the national and international levels, has spurred the demand for effective sports medicine solutions to manage and prevent injuries.

The China sports medicine market is expected to exhibit the highest CAGR during the forecast period as the Chinese government is actively promoting sports as part of its national agenda, evidenced by initiatives aimed at boosting physical fitness and hosting major sporting events. This emphasis on sports has fostered a supportive environment for the development of sports medicine, leading to increased investments in specialized healthcare facilities and training for medical professionals.

Sports Medicine Market – Key Players and Competitive Insights

The competitive landscape of the sports medicine market is characterized by a diverse array of players, including multinational corporations, regional companies, and specialized firms. Key participants in this market include medical device manufacturers, pharmaceutical companies, and healthcare providers that focus on sports-related injuries and rehabilitation solutions. Major multinational companies, such as Johnson & Johnson, Stryker Corporation, and Medtronic, dominate the market by offering a wide range of products, including orthopedic implants, surgical instruments, and rehabilitation equipment. These companies leverage their extensive research and development capabilities to innovate and introduce advanced technologies, enhancing treatment options for athletes and active individuals. In addition to these large players, there is a growing presence of specialized firms that focus exclusively on sports medicine products and services. Major companies differentiate themselves by developing niche offerings tailored to specific sports injuries, such as regenerative medicine techniques, sports bracing, and rehabilitation programs. Moreover, the competitive landscape is influenced by strategic collaborations, mergers, and acquisitions as companies seek to expand their market reach and enhance their product portfolios. Partnerships between sports organizations, healthcare providers, and technology firms are also on the rise, facilitating the development of comprehensive sports medicine solutions that encompass prevention, treatment, and rehabilitation. Arthrex, Inc.; Bauerfeind; Breg, Inc.; CONMED Corporation; DePuy Synthes (Johnson & Johnson); Enovis (DJO, LLC); Karl Storz SE & Co. KG; Medtronic; Mueller Sports Medicine, Inc.; Performance Health; Smith+Nephew; Stryker; and Zimmer Biomet.

Smith and Nephew PLC, a medical equipment manufacturing company, specializes in healthcare, orthopedic reconstruction, knee replacement, medical devices, extremities, negative pressure wound therapy, ENT, ligament repair, wound care, hip replacement, trauma, sports medicine, robotics, medical supplies, and exudate management. The company offers Smith + Nephew Academy, products, procedures, indications, and therapies. Under Smith + Nephew Academy, the company offers courses in ENT (ear, nose, and throat), orthopedics, and wound. The company’s product portfolio includes categories of wound management, ENT, orthopedics, and sports medicine. In October 2023, Smith+Nephew launched its REGENETEN Bioinductive Implant allowing its access in Japan. Over 100,000 procedures were completed globally after its introduction in the US and Europe.

Johnson & Johnson Services, Inc. is a multinational corporation based in New Brunswick, New Jersey, USA. The company operates through pharmaceuticals, medical devices, and consumer health products operations. The company also has a medical devices division, which develops and markets a wide range of products, including surgical instruments, orthopedic implants, and diabetes care products. It also has a consumer health division, which develops and markets over-the-counter products such as Band-Aids, Tylenol, and Listerine.

The DePuy Synthes is an orthopedic company acquired by Johnson & Johnson Services, Inc. in 1998. In February 2022, DePuy Synthes acquired CrossRoads Extremity Systems, a Tennessee-based company that provides a range of sterile-packed implants and instrumentation systems cleared for lower extremity indications.

Key Companies in the Sports Medicine Market

- Arthrex, Inc.

- Bauerfeind

- Breg, Inc.

- CONMED Corporation

- DePuy Synthes (Johnson & Johnson)

- Enovis (DJO, LLC)

- Karl Storz SE & Co. KG

- Medtronic

- Mueller Sports Medicine, Inc.

- Performance Health

- Smith+Nephew

- Stryker

- Zimmer Biomet

Sports Medicine Industry Developments

In January 2024, Arthrex launched TheNanoExperience.com to educate patients on Nano arthroscopy benefits, connecting them with trained surgeons for minimally invasive orthopedic procedures.

In August 2023, Smith & Nephew introduced the OR3O Dual Mobility System for hip arthroplasty in India. The system includes double mobility implants with a smaller femoral head and a larger polyethylene insert, which reduces the risk of dislocation, improves range of motion, and enhances stability.

In July 2023, Stryker launched the Ortho Q Guidance system, an advanced solution for developed surgery planning and recommendations in knee and hip procedures. The system provides surgeons with easy control from the sterile field.

Sports Medicine Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Body Reconstruction & Repair

- Body Support & Recovery

- Body Monitoring & Evaluation

- Accessories

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Knees

- Shoulders

- Ankle & Foot

- Back & Spine

- Elbow & Wrist

- Hips

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Orthopedic Specialty Clinics

- Fitness and Training Centers

- Ambulatory Surgical Centers (ASCs)

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sports Medicine Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.73 billion |

|

Market Size Value in 2025 |

USD 7.17 billion |

|

Revenue Forecast by 2034 |

USD 12.70 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sports medicine market size was valued at USD 6.73 billion in 2024 and is projected to grow to USD 12.70 billion by 2034.

The global market is projected to register a CAGR of 6.6% during the forecast period

North America accounted for the largest market share in 2024 due to the region’s advanced healthcare infrastructure and a strong sports culture.

A few key players in the market are Arthrex, Inc.; Bauerfeind; Breg, Inc.; CONMED Corporation; DePuy Synthes (Johnson & Johnson); Enovis (DJO, LLC); Karl Storz SE & Co. KG; Medtronic; Mueller Sports Medicine, Inc.; Performance Health; Smith+Nephew; Stryker; and Zimmer Biomet.

The body reconstruction & repair segment dominated the market in 2024 due to the growing incidence of sports-related injuries.

The hospitals segment is expected to record the highest CAGR during the forecast period due to the increasing incidence of sports-related injuries among professional and amateur athletes.