Sports Composites Market Size, Share, Trends, Industry Analysis Report: By Reinforcement Material (Carbon Fiber, Glass Fiber, and Others), Resin Type, Process Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5309

- Base Year: 2024

- Historical Data: 2020-2023

Sports Composites Market Overview

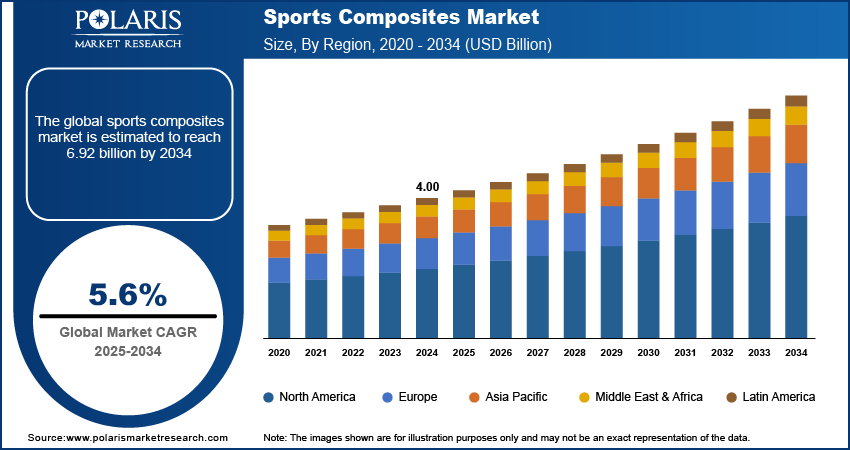

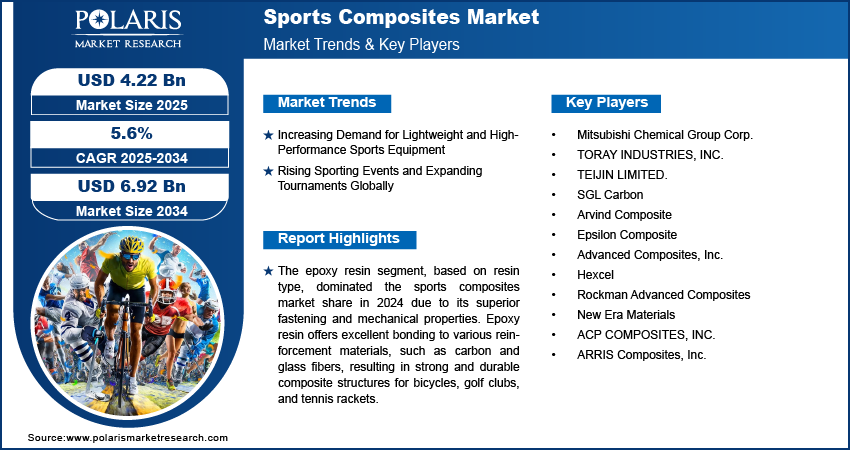

The global sports composites market size was valued at USD 4.00 billion in 2024. The market is projected to grow from USD 4.22 billion in 2025 to USD 6.92 billion by 2034, exhibiting a CAGR of 5.6% during 2025–2034.

Sports components refer to the individual parts or materials used in producing sports or fitness equipment and gear. Sports components play a critical role in improving the performance, durability, and safety of sports products, including bicycles, tennis rackets, golf clubs, helmets, skis, and protective gear. The production of sports components is increasingly leveraging high-performance materials, such as carbon fiber, fiberglass, Kevlar, and advanced polymers, in response to advancements in technology. Composite materials provide superior strength-to-weight ratios, enhanced durability, and increased flexibility, making them ideal for optimizing performance in various sports applications such as bicycle frames and tennis rackets. Additionally, the ongoing advancements in technology and the incorporation of advanced composites drive the design of sports equipment that demonstrates improved performance and improved efficiency. As a result, sports composite materials are used in the production of bicycles, tennis rackets, golf clubs, skis, and protective gear, providing improved durability, flexibility, and precision.

To Understand More About this Research: Request a Free Sample Report

Advancements in sports composites aim to improve energy efficiency and reduce fatigue, ultimately contributing to better athletic performance. Consequently, the sports composite market is experiencing strong growth due to the increasing demand for lightweight, durable, and high-performance equipment that supports active and healthy lifestyles.

In December 2021, Adidas collaborated with the organizers of the 2024 Paralympic Games in Tokyo to create advanced prosthetic sports gear such as carbon fiber running blades and personalized athletic apparel.

Sports Composites Market Drivers

Increasing Demand for Lightweight and High-Performance Sports Equipment

Athletes and fitness enthusiasts continually seek gear that enhances performance while minimizing tiredness. In June 2022, Lineat introduced the world’s first recycled carbon fiber tennis racket using its Aligned Formable Fibre Technology (AFFT). This innovation repurposes carbon fiber waste into high-performance materials, showcasing sustainable collaboration with manufacturers such as Wilson and SCOTT Sports. The demand for lightweight, strong, and durable equipment continues to drive innovations in sports composites, with athletes increasingly relying on advanced materials to boost performance and endurance across various sports. Therefore, the growing demand for lightweight, high-performance sports equipment is a key driver in the sports composites market growth.

Rising Sporting Events and Expanding Tournaments Globally

The rising popularity of global sporting events such as the Olympics, World Cups, and other international tournaments has increased the need for high-performance sports equipment. These events display the highest level of athletic accomplishment and generate a surge in interest among amateur and professional athletes looking to enhance their performance through advanced technology. Furthermore, the emergence of regional leagues and amateur sports, along with increasing interest in niche sports such as esports, rock climbing, and adventure racing, has increased the demand for specialized equipment. As a result, there have been more partnerships and sponsorships connecting brands with athletes and events, which has expanded the market reach. For instance, the PGA of America’s expansion into India in July 2023 has opened new avenues for promoting golf culture and increasing participation, thus driving demand for high-quality golf equipment. This expansion highlights the growing interest in golf and underscores the broader trend of sports organizations and brands capitalizing on emerging markets to foster athletic engagement and promote advanced sporting technologies.

Sports Composites Market Segment Insights

Sports Composites Market Assessment, by Reinforcement Material Outlook

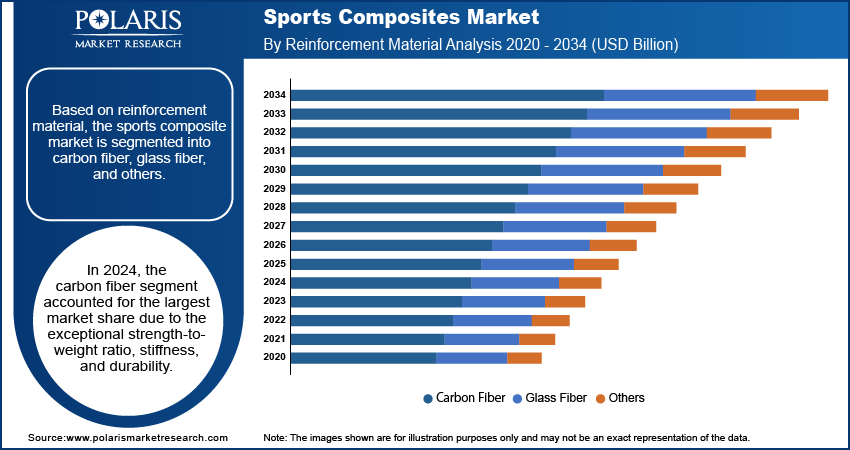

The global sports composites market segmentation, based on reinforcement material, includes carbon fiber, glass fiber, and others. In 2024, the carbon fiber segment accounted for the largest market share due to exceptional strength-to-weight ratio, stiffness, and durability. This material offers exceptional performance characteristics, making it perfect for high-end sports equipment such as bicycles, tennis rackets, golf clubs, and skis. The lightweight nature of carbon fiber enables athletes to achieve faster speed and agility, which is crucial in competitive sports such as tennis, cycling, and others. Additionally, carbon fiber composites are resistant to fatigue and environmental factors, ensuring longevity and reliable performance. Advances in manufacturing and processing techniques have further improved the development of innovative products to meet the growing demands of athletes.

The glass fiber segment held the second-largest market share in 2024. Glass fiber is more affordable and attractive for a broader range of products, especially in recreational sports equipment, offering good tensile strength and flexibility. Overall, carbon fiber's unmatched performance characteristics ensure its dominance in the sports composites market, driving demand for high-performance sports equipment across various disciplines.

Sports Composites Market Outlook, by Resin Type Insights

The global sports composites market segmentation, based on resin type, includes epoxy resin, polyamide, and others. The epoxy resin segment dominated the market share in 2024 due to its superior fastening and mechanical properties. It offers excellent bonding to various reinforcement materials, such as carbon and glass fibers, resulting in strong and durable composite structures for bicycles, golf clubs, and tennis rackets. Additionally, epoxy resins have high thermal stability, making them suitable for applications that experience temperature fluctuations and mechanical stress. Epoxy resin displays minimal shrinkage during the curing process, resulting in improved dimensional stability. This characteristic is crucial for the manufacturing of precision sports equipment, where maintaining exact specifications is crucial for performance and reliability.

The polyamide segment is expected to register a significant CAGR during the forecast period due to their excellent impact resistance and flexibility, making them suitable for applications such as sports footwear and protective gear. Polyamide is often less expensive than epoxy, making it attractive for manufacturers seeking to balance performance with cost. Thus, epoxy resin's unmatched mechanical properties and versatility ensure its dominance in the sports composites market, providing athletes with durable and reliable gear across various sports disciplines.

Sports Composites Market Assessment by Process Type Outlook

The global sports composites market segmentation, based on process type, includes prepreg layup, infusion, filament winding, wet layup, and others. In 2024, the prepreg layup segment dominated the market due to its ability to produce high-quality, consistent composite structures with superior mechanical properties. Prepreg layups are used to ensure uniform resin content and optimal fiber orientation, resulting in components with excellent performance characteristics. Additionally, this method also reduces labor time and enables efficient management of the curing process, leading to quicker production cycles for complex parts. The customization potential of prepregs allows manufacturers to tailor materials for specific applications, making it ideal for high-end sports equipment such as bicycles, tennis rackets, and golf clubs.

Sports Composites Market Evaluation by Application Outlook

The global sports composites market segmentation, based on application, includes bicycle parts, rackets & bats, golf equipment, hockey sticks, and others. In 2024, the golf equipment segment dominated the sports composites market share. Continuous technological advancements in composite materials, particularly carbon fiber and advanced epoxy resins, have significantly enhanced the performance characteristics of golf equipment, allowing for the creation of lighter, stronger, and more durable equipment that improves swing speed, accuracy, and distance. In January 2022, TaylorMade Golf launched its Stealth driver, which features a carbon fiber face designed to increase ball speed and distance. This driver utilizes a 60X Carbon Twist Face, allowing for a lighter and larger club head, which enhances performance while maintaining a high level of forgiveness on off-center hits. The introduction of this driver highlights the growing trend of using advanced composite materials to create high-performance golf equipment that caters to both amateur and professional players.

Sports Composites Market Share, by Region

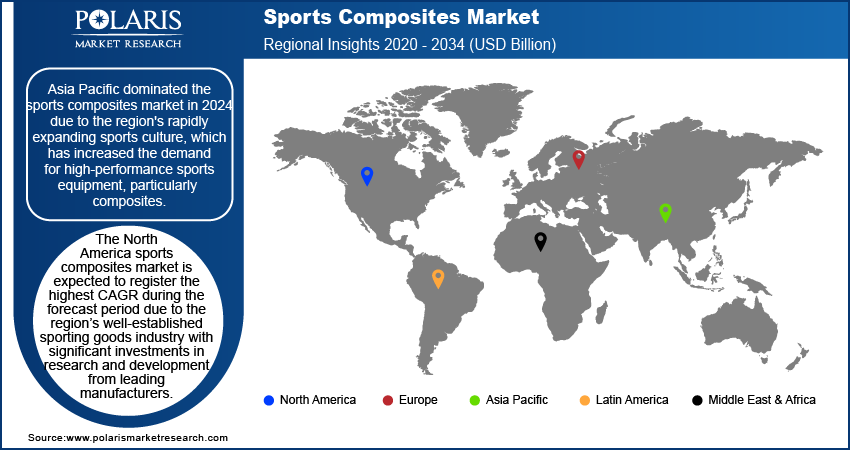

By region, the study provides sports composites market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the market due to the region's rapidly expanding sports culture and the increased demand for high-performance sports equipment, particularly composites. Additionally, rapid economic growth; higher sports participation rates; and improving living standards in countries such as China, India, Japan, and South Korea have significantly boosted the need for advanced sporting gear, propelling the sports composites market expansion in the region. In July 2023, Yonex, a leading Japanese sports equipment manufacturer, announced the expansion of its production capacity for carbon fiber composite tennis and badminton rackets. This move was in response to growing demand in countries such as China, India, and South Korea, where participation in racket sports has surged due to increasing interest and government support for sports initiatives. The use of high-performance composites such as carbon fiber enables Yonex to cater to amateur and professional athletes, reflecting the region's growing demand for advanced sports equipment.

The North America sports composites market is expected to register the highest CAGR during the forecast period due to the region’s well-established sporting goods industry with significant investments in research and development from leading manufacturers. Major companies such as TaylorMade, Callaway, and Wilson Sporting Goods are present in the region, driving innovation in composite materials, especially in high-performance equipment such as golf clubs and bicycles. Furthermore, North America's strong recreational and competitive sports culture, along with a growing emphasis on fitness and outdoor activities, continues to fuel the demand for advanced composite products.

Sports Composites Market – Key Players and Competitive Analysis Report

The competitive landscape of the sports composites market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the industry, such as TORAY INDUSTRIES INC, SGL Carbon, TEIJIN LIMITED and others leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced sports composites products. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of sports composite providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific composite needs or local market demands. Competitive strategies often include mergers and acquisitions, partnerships with institutions, and investments in emerging markets to expand reach and enhance market presence. A few major market players include Mitsubishi Chemical Group Corp.; TORAY INDUSTRIES, INC.; TEIJIN LIMITED; SGL Carbon; Arvind Composite; Epsilon Composite; Advanced Composites, Inc; Hexcel; Rockman Advanced Composites; New Era Materials; ACP COMPOSITES, INC; and ARRIS Composites, Inc.

Hexcel is an American public industrial materials company based in Stamford, Connecticut, US. It is a member of The Winter Sports Sustainability Network (WSN). The company announced the successful transition of its winter sports industry production to the new HexPly Nature bio-derived product range in September 2024. This includes the full conversion of HexPly M78.1-LT prepregs to the more sustainable HexPly Nature version, reflecting the company’s ongoing commitment to environmental sustainability and innovation.

Toray Industries, Inc., a multinational corporation headquartered in Japan, specializes in industrial products centered on technologies in organic synthetic chemistry, polymer chemistry, and biochemistry. In October 2023, Toray Industries announced the development of TORAYCA T1200 carbon fiber, which has the world's highest strength at 1,160 kilopounds per square inch (Ksi). The offering will help reduce environmental footprints by making carbon-fiber-reinforced plastic materials lighter. The fiber also opens up new possibilities for strength-driven applications and can be used in aero structures, defense, alternative energy, and sports products.

Key Companies in Sports Composites Market Outlook

- Mitsubishi Chemical Group Corp.

- TORAY INDUSTRIES, INC.

- TEIJIN LIMITED.

- SGL Carbon

- Arvind Composite

- Epsilon Composite

- Advanced Composites, Inc.

- Hexcel

- Rockman Advanced Composites

- New Era Materials

- ACP COMPOSITES, INC.

- ARRIS Composites, Inc.

Sports Composites Market Developments

In October 2024, ARRIS Composites, a California-based leader in advanced carbon fiber technology, launched its first direct-to-consumer brand, AURORRA by ARRIS (AXA), focusing on high-performance solutions for industries like aerospace and athletics.

In March 2023, SGL Carbon expanded its material portfolio with a new carbon fiber called SIGRAFIL C T50-4.9/235. This carbon fiber meets the high strength requirements for common pressure vessel designs and has a high elongation capacity. It also opens up opportunities for applications in market segments that demand high strength and elongation, such as construction, infrastructure, and sports.

In September 2022, Xenia Thermoplastic Specialties introduced XECARB ST, a super-tough carbon fiber-reinforced thermoplastic composite that combines advanced lightweight benefits with superior impact strength.

In February 2021, Teijin Limited introduced Tenax PW (power series) and Tenax BM (beam series) carbon fiber intermediate materials for sports and satellite applications. Tenax PW maximizes power and speed with exceptional durability, impact absorption, and compressive strength. Tenax BM offers flexibility, resistance to thermal expansion, and superior vibration damping. Both materials provide advanced qualities for sporting goods and satellite applications.

Sports Composites Market Segmentation

By Reinforcement Material Outlook (Revenue, USD Billion, Kilotons, 2020–2034)

- Carbon Fiber

- Glass Fiber

- Others

By Resin Type Outlook (Revenue, USD Billion, Kilotons, 2020–2034)

- Epoxy Resin

- Polyamide

- Others

By Process Type Outlook (Revenue, USD Billion, Kilotons, 2020–2034)

- Prepreg Layup

- Infusion

- Filament Winding

- Wet Layup

- Others

By Application Outlook (Revenue, USD Billion, Kilotons, 2020–2034)

- Skis & Snowboards

- Bicycle Parts

- Rackets & Bats

- Golf Equipment

- Hockey Sticks

- Others

By Regional Outlook (Revenue, USD Billion, Kilotons, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sports Composites Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.00 billion |

|

Market Size Value in 2025 |

USD 4.22 billion |

|

Revenue Forecast by 2034 |

USD 6.92 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, Volume in Kilotons, and CAGR from 2025 to 2035 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sports composites market size was valued at USD 4.00 billion in 2024 and is projected to grow to USD 6.92 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

Asia Pacific dominated the sports composites market share in 2024.

A few key players in the market are Mitsubishi Chemical Group Corp.; TORAY INDUSTRIES, INC.; TEIJIN LIMITED; SGL Carbon; Arvind Composite; Epsilon Composite; Advanced Composites, Inc; Hexcel; Rockman Advanced Composites; New Era Materials; ACP COMPOSITES, INC; and ARRIS Composites, Inc.

The epoxy resin segment dominated the sports composites market revenue share in 2024.

The carbon fiber segment accounted for the largest market share in 2024.