Specialty Polyamides Market Size, Share, Trends, Industry Analysis Report: By Product (High Temperature Specialty Polyamides, Long Chain Specialty Polyamides, and MXD6/PARA), End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 118

- Format: PDF

- Report ID: PM1502

- Base Year: 2024

- Historical Data: 2020-2023

Specialty Polyamides Market Overview

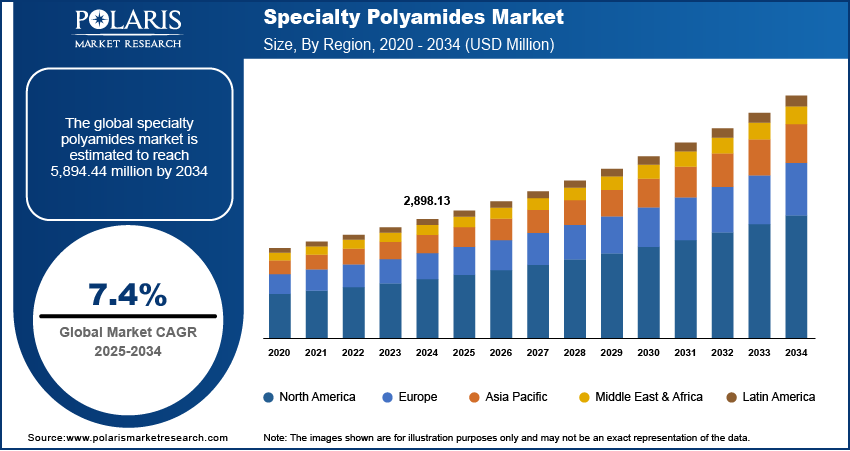

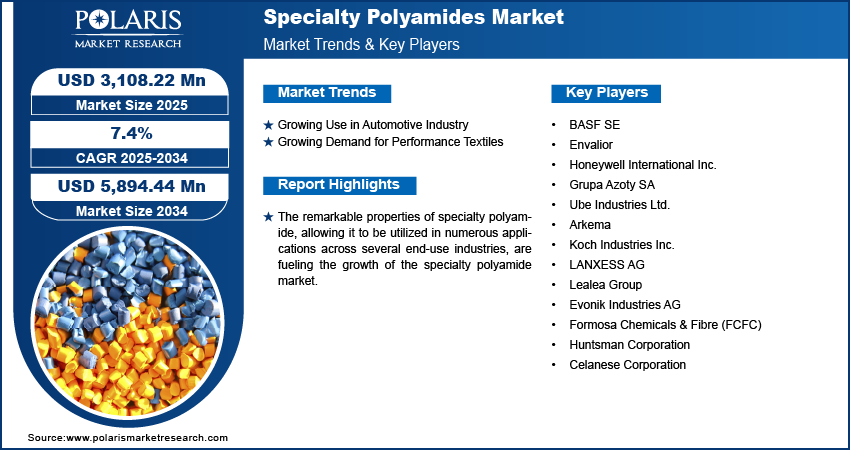

The global specialty polyamides market size was valued at USD 2,898.13 million in 2024. The market is projected to grow from USD 3,108.22 million in 2025 to USD 5,894.44 million by 2034, at a CAGR of 7.4% from 2025 to 2034.

Specialty polyamides are synthetic materials used to produce monofilaments for applications that require high chemical resistance and dimensional stability. These polyamides are made by linking two monomer molecules together with an amide function. They are classified into three types based on their main chain composition: aliphatic polyamides, semi-aromatic polyamides, and aromatic polyamides. Specialty Polyamides are utilized across various industries, including automotive, energy, consumer goods, industrial coatings, and electronics.

The exceptional qualities of specialty polyamide, which enable its use across a wide range of applications in various industries, are driving the specialty polyamide market growth. Polyamide is vital to the automotive industry, where it is used in manufacturing numerous components components. Additionally, other transportation sectors, such as aerospace and defense, have adopted specialty polyamide due to its excellent strength-to-weight ratio. In addition, due to their desirable characteristics, including high tensile strength and lightweight nature, sports goods manufacturers are increasingly using specialty polyamide fibers as a primary material for their finished products.

To Understand More About this Research:Request a Free Sample Report

The specialty polyamide market is expected to grow in the coming years due to increased demand for sustainable options such as bio-based polymers and durable coating materials. Increasing investments in research & development, alongside government initiatives to strengthen the energy industry, are creating opportunities in the specialty polyamides market landscape.

Specialty Polyamides Market Dynamics

Growing Use in Automotive Industry

The rising emphasis on reducing vehicle weight to improve fuel efficiency, enhance performance, and comply with environmental regulations is driving the increased use of specialty polyamides in the automotive industry. Polyamides offer an optimal balance of durability, strength, and lightweight properties, making them an ideal alternative to traditional metals like aluminum and steel. As the automotive industry moves towards more fuel-efficient and eco-friendly vehicles, the specialty polyamides market demand is expected to rise.

Growing Demand for Performance Textiles

The growing demand for performance textiles is significantly increasing the specialty polyamides market demand, particularly in applications where high strength, durability, moisture management, and quick-drying properties are crucial. This includes sportswear, athletic apparel, military gear, and technical textiles. Specialty polyamides can be engineered with specific properties like high tensile strength, abrasion resistance, excellent moisture-wicking capabilities, and temperature regulation, making them ideal for such demanding activities. Different types of polyamides can be blended or modified to achieve desired characteristics, allowing manufacturers to tailor fabrics for specific applications like compression garments, swimwear, or protective gear.

Specialty Polyamides Market Segment Insights

Specialty Polyamides Market Evaluation by Product Insights

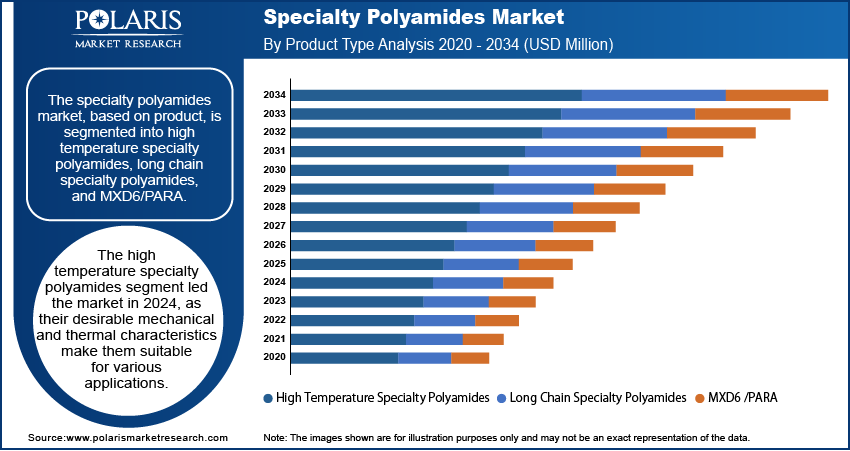

The specialty polyamides market, based on product type, is segmented into high temperature specialty polyamides, long chain specialty polyamides, and MXD6/PARA. The high temperature specialty polyamides segment led the market with a 49.6% revenue share in 2024. In contrast to other specialist polyamides such as PA 6/10, PA 6/12, PA 12, and PA 11, high temperature polyamides are highly crystalline polyamides due to their mechanical and thermal properties. These polyamides are strong, long-lasting, and simple-to-process materials that offer excellent performance at a comparatively low price. Manufacturers of various end-use products prefer high temperature specialty polyamides when the focus is on increased strength, reduced weight, and simplified processing.

The chain specialty polyamides segment is expected to grow at the fastest rate during the projected period. PA12, PA11, PA612, PA610, PA1010, PA410, and PA1012 are types of long chain specialty polyamides. These specialty polyamides are usually used to make monofilaments, which are further used in various that require high chemical resistance and exceptional dimensional stability.

Specialty Polyamides Market Assessment by End-Use Insights

Based on end-use, the market for specialty polyamides is segmented into automotive & transportation, consumer goods & retail, industrial coatings, electrical & electronics, energy, and others. The automotive & transportation segment accounted for the largest market share in 2024. Specialty polyamides are frequently used in the automobile industry due to their ability to meet the thermal management requirements of vehicle components. They retain exceptional strength and durability even in the presence of heated automotive fluids. Their unique combination of toughness, mechanical strength, oil resistance, design flexibility, and thermal stability makes them ideal for applications such as engine components, transmission systems, cooling systems, and battery compartments in electric vehicles.

The electrical & electronics segment is projected to register a high CAGR during the projection period. This growth can be attributed to increasing semiconductor demand with advancements in AI, machine learning, and cloud computing. Specialty polyamide with conductive fillers provides resistance to electrostatic discharge, electromagnetic interferences, and radiofrequency interference shielding, making it ideal for electronic equipment, conveyor systems, and semiconductor manufacturing trays.

Specialty Polyamides Market Regional Analysis

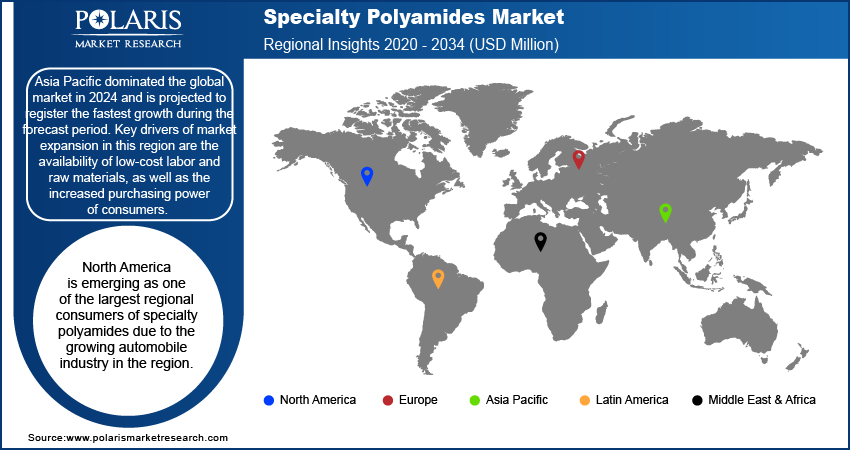

By region, the report provides the specialty polyamides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific accounted for the largest market share of 45.6% in 2024 and is anticipated to grow at the fastest rate during the forecast period. Global specialty polyamide manufacturers are increasingly drawn to establish production and distribution facilities in this region due to its significant untapped market potential and favorable government regulations. In addition, the availability of cost-effective labor and raw materials, along with rising purchasing power among consumers, contributes to the region’s dominance in the global market.

North America is emerging as one of the largest regional consumers of specialty polyamides due to the growing demand for these materials. Automakers are increasingly using lightweight materials to reduce vehicle curb weight and minimize emissions. The surge in demand from the electronics and automotive sectors has significantly contributed to the market expansion in the region. Additionally, the rising adoption of electric vehicles (EVs) to reduce emissions is fueling this growth.

Specialty Polyamides Market – Key Players and Competitive Insights

The global specialty polyamides market is highly competitive, with numerous companies competing for market dominance. Businesses in the market are continuously innovating and expanding their product lines to stay ahead. Leading players in the market include well-established and financially robust polyamide producers who have been operating for many years.

The top market participants offer a diverse range of products and have robust international sales and marketing networks. Among the leading players in this market are Evonik Industries AG, Formosa Chemicals & Fibre (FCFC), Huntsman Corporation, Celanese Corporation, BASF SE, Envalior, Lealea Group, Honeywell International Inc., Koch Industries Inc., Grupa Azoty SA, LANXESS AG, Ube Industries Ltd., and Arkema.

List of Specialty Polyamides Market Key Players

- Arkema

- BASF SE

- Celanese Corporation

- Envalior

- Evonik Industries AG

- Formosa Chemicals & Fibre (FCFC)

- Grupa Azoty SA

- Honeywell International Inc.

- Huntsman Corporation

- Koch Industries Inc.

- LANXESS AG

- Lealea Group

- Ube Industries Ltd.

Specialty Polyamides Industry Developments

- In March 2024, Toray Advanced Composites expanded its product lineup with the addition of Toray Cetex TC915 PA+, an advanced, high-performance thermoplastic material. This reinforced polyamide thermoplastic offers enhanced strength, stiffness, temperature stability, and reduced moisture absorption.

- In April 2024, BASF launched Ultramid Ccycled, a unique polyamide designed for textile applications. The material is certified as Recycled Claim Standard (RCS) and is produced through the chemical recycling of plastic waste.

Specialty Polyamides Market Segmentation

By Product Outlook

- High Temperature Specialty Polyamides

- Long Chain Specialty Polyamides

- MXD6 /PARA

By End-User Industry Outlook

- Automotive & Transportation

- Consumer Goods & Retail

- Industrial Coatings

- Electrical & Electronics

- Energy

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Polyamides Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,898.13 million |

|

Market Size Value in 2025 |

USD 3,108.22 million |

|

Revenue Forecast by 2034 |

USD 5,894.44 million |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The specialty polyamides market was valued at USD 2,898.13 million in 2024 and is projected to grow to USD 5,894.44 million by 2034.

The market is projected to register a CAGR of 7.4% during 2025–2034.

Asia Pacific held the largest market share in 2024.

Envalior Honeywell International Inc., Grupa Azoty SA, Ube Industries Ltd., Arkema, Koch Industries Inc., LANXESS AG, Lealea Group, Evonik Industries AG, Formosa Chemicals & Fibre, Huntsman Corporation, and Celanese Corporation are a few of the key players in the market.

The high temperature specialty polyamides segment led the market in 2024.

The automotive & transportation segment held the largest market in 2024.