Specialty Oleochemicals Market Size, Share, Trends, Industry Analysis Report: By Application Type, Product Type, Market Source Type (Microbial-Based, Animal-Based, and Plant-Based), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1524

- Base Year: 2024

- Historical Data: 2020-2023

Specialty Oleochemicals Market

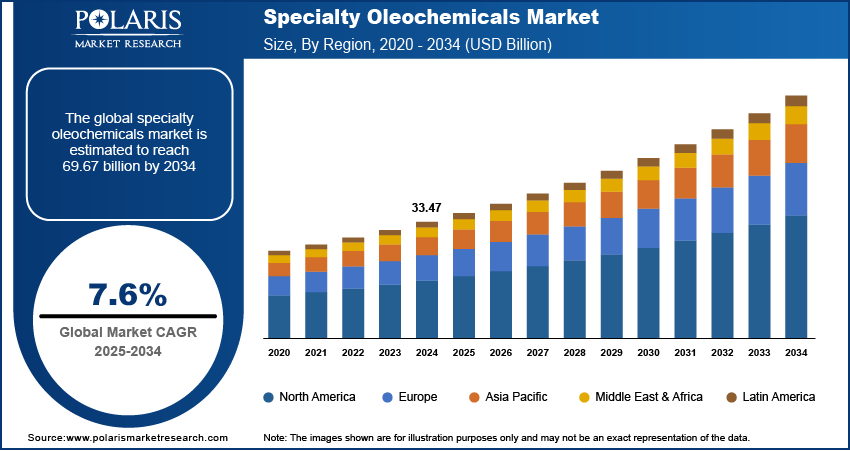

The global specialty oleochemicals market size was valued at USD 33.47 billion in 2024. The market is projected to grow from USD 35.98 billion in 2025 to USD 69.67 billion by 2034, at a CAGR of 7.6 % from 2025 to 2034.

Specialty oleochemicals are eco-friendly compounds derived from various natural sources, providing a sustainable alternative to products made from petroleum. The compounds have unique properties, including emulsifying capabilities and surface activity, making them valuable in a wide range of industries such as personal care, food production, textiles, lubricants, and even bio-based polymers. A few examples of specialty oleochemicals are specialty esters, fatty acid methyl esters, glycerol esters, and alkoxylates. Plant-based feedstocks such as soybean oil, palm oil, rapeseed oil, and sunflower oil are also used to create specialty oleochemicals.

To Understand More About this Research: Request a Free Sample Report

The specialty oleochemicals market demand is driven by factors such as the rising use of sustainable and renewable feedstocks, developments in genetic engineering and biotechnology, and the incorporation of advanced manufacturing and processing methods. The market for specialty oleochemicals is anticipated to benefit from rising demand for biopolymers. Manufacturers in the market are focusing on creating bio-based alternatives due to growing concerns regarding the biodegradability of polymers and plastic. Specialty oleochemical use has surged due to rapidly increasing consumer demand for biosurfactants, biodegradable polymers, and lubricants. The specialty oleochemicals market development is mostly dependent on government encouragement for the use of more environmentally friendly products and strict regulations for petroleum-based products.

Emerging opportunities in the food & beverage sector, the development of bio-based products, and the entry of key players into emerging markets are all potential possibilities for innovation. Specialty oleochemicals are also used in a variety of food products, including margarine and baked goods, and the food and beverage industry has seen growth in many nations. Additionally, specialty oleochemical use has also increased in the food processing, paint, ink, health and pharmaceutical, polymer, and plastic additive industries. Specialty chemicals are widely employed in the manufacturing of bio-based lubricants due to their ability to enhance desirable qualities, create customized formulations, and have limited property variation.

Specialty Oleochemicals Market Dynamics

Reduced Expenses and Incorporation of Eco-friendly Raw Materials

Vegetable and animal feedstock are used to make specialty oleochemicals. Vegetable waste oil is a sustainable, inexpensive, renewable, and nontoxic source of raw materials for manufacturing. They are a great alternative to chemicals derived from petroleum. These substances, which are produced by trans-esterifying, epoxidizing, and sulfonating leftover vegetable oils, are used to create surface active agents, or biosurfactants, which have numerous uses in the petroleum industry. Furthermore, as live feedstocks are more productive and efficient than petroleum feedstocks, these raw resources offer outstanding advantages. Hence, reduced expenses and the incorporation of eco-friendly raw materials play a crucial role in boosting specialty oleochemical market revenue growth.

Extensive Applications in Cosmetics & Personal Care Products

The natural origin, biodegradability, and adaptability of specialty oleochemicals make them popular in the personal care & cosmetics industry. They provide desired qualities, including skin moisturization, cleaning, and hair conditioning, by acting as emollients, thickeners, and surfactants. Oleochemicals-based emulsifiers also stabilize the oil and water mixture in lotions, creams, and cosmetics. Specialty oleochemicals from sustainable sources are becoming more and more popular as a result of the growing demand for natural and organic personal care products. Furthermore, the demand for specialty oleochemicals in the personal care and cosmetics sector is being further supported by the rising popularity of antiaging and skin care products.

Specialty Oleochemicals Market Segment Insights

Specialty Oleochemicals Market Outlook by Application Type

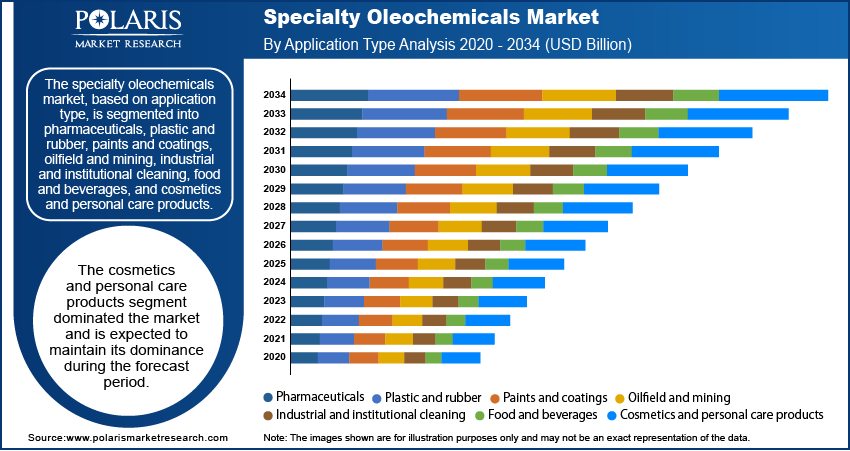

The specialty oleochemicals market, based on application type, is segmented into pharmaceuticals, plastic and rubber, paints and coatings, oilfield and mining, industrial and institutional cleaning, food and beverages, and cosmetics and personal care products. The cosmetics and personal care products segment dominated the specialty oleochemicals market share in 2024 and is expected to maintain its dominance during the forecast period. The food and beverages segment is anticipated to register the highest CAGR during the forecast period. In the food industry, the growing use of bio-based stabilizers, thickeners, and other food additives is anticipated to propel the specialty oleochemical market expansion in the coming years. The growing awareness of the environmental benefits of oleochemicals over conventional petroleum-based chemicals is also projected to aid in the market growth.

Specialty Oleochemicals Market Assessment by Product Type

The specialty oleochemicals market, based on product type, is segmented into bio-based solvents, ionic surfactants, non-ionic surfactants, amides, esters, glycerin & derivatives, fatty acids & derivatives, and others. The fatty acids & derivatives segment dominated the specialty oleochemicals market revenue share in 2024. The main reason behind this dominance is a growing demand for fatty acids and their derivatives in industries such as food products, personal care products, and excipients in the pharmaceutical industry. The highest growth rate for the glycerin & derivatives segment is attributed to its growing need for detergents, cosmetics, soaps, and personal care products, which are major end users of glycerin.

Specialty Oleochemicals Market Outlook by Regional Insights

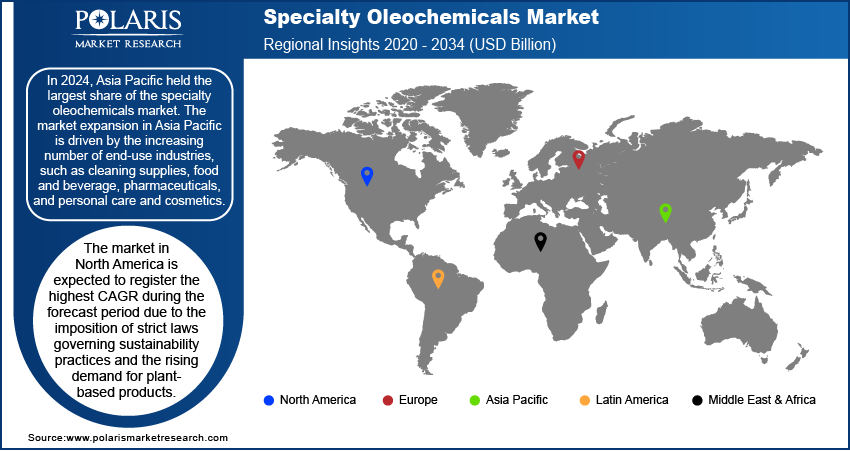

By region, the report provides specialty oleochemicals market insights into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. In 2024, Asia Pacific held the largest specialty oleochemicals market share. The Philippines, Malaysia, Thailand, and Indonesia are producing more palm oil and palm kernel oil, which is driving the region's market dynamics. A significant amount of the raw materials used in the production of oleochemicals come from these nations. The growth of the Asia Pacific market is also attributed to the expansion in a number of end-use industries, such as cleaning supplies, food & beverages, pharmaceuticals, and personal care and cosmetics.

The specialty oleochemicals market in North America is expected to register the highest CAGR during the forecast period. The regional market growth is driven by the imposition of strict laws governing sustainability practices and the rising demand for plant-based goods. Furthermore, the US market is anticipated to be driven by the expanding chemical industry in the nation. Over the last decade, European nations such as Germany, Italy, France, and the UK have been implementing sustainability practices as a result of consumers' increased awareness of pollution, climate change, and other environmental issues. A key driver of the regional market is the growing focus on the effective use of bio-based resources, such as waste and products derived from agriculture and animals.

Specialty Oleochemicals Market – Key Players and Competitive Insights

Leading market players in the specialty oleochemicals market are embracing eco-friendly procedures and integrating renewable raw materials into their manufacturing processes as part of a trend toward sustainability. The fierce rivalry between long-standing firms and the rise of new competitors defines the competitive landscape of the market. Market players constantly strive to develop new products for end-use markets and new applications through research and development. This maintains a high level of competition among the players. To expand their market share and obtain a competitive advantage, a number of significant players engage in a variety of strategic alliances to market their brands and sales.

Oleon NV, Kao Corporation, Evonik Industries, IOI Group, Wilmar International, Emery Oleochemicals, Godrej Industries, Ecogreen Oleochemicals, and Vantage Specialty Chemicals are among the key players influencing the specialty oleochemicals market dynamics.

List of Key Players in Specialty Oleochemicals Market

- Oleon

- Kao Corporation

- Evonik Industries

- IOI Group

- Wilmar International

- Emery Oleochemicals

- Godrej Industries

- Ecogreen Oleochemicals

- Vantage Specialty Chemicals

- BASF

- LG Chem

- Croda International

Specialty Oleochemicals Industry Developments

In March 2024, Arkema's Oleris C7 and C11 oleochemicals were awarded the USDA BioPreferred product label. The United States Department of Agriculture (USDA) has approved Arkema's range of innovative biomaterials made from renewable castor seeds to use the BioPreferred label.

In February 2024, Emery Oleochemicals, a company based in Düsseldorf, Germany, announced that it had won the EcoVadis Silver Medal in its most recent grading, which was completed in January 2024. This achievement has placed Emery Oleochemicals LLC in the top 15% of companies evaluated globally.

Specialty Oleochemicals Market Segmentation

By Application Type Outlook

- Pharmaceuticals

- Plastic and Rubber

- Paints and Coatings

- Oilfield and Mining

- Industrial and Institutional Cleaning

- Food and Beverages

- Cosmetics and Personal Care Products

By Product Type Outlook

- Bio-Based Solvents

- Ionic Surfactants

- Non-Ionic Surfactants

- Amides

- Esters

- Glycerin & Derivatives

- Fatty acids & Derivatives

- Others

By Market Source Type Outlook

- Microbial-Based

- Animal-Based

- Plant-Based

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Oleochemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 33.47 Billion |

|

Market Size Value in 2025 |

USD 35.98 Billion |

|

Revenue Forecast by 2034 |

USD 69.67 Billion |

|

CAGR |

7.6 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The specialized oleochemicals market is valued at USD 33.47 billion in 2024 and is projected to grow to USD 69.67 billion by 2034.

The market is expected to register a CAGR of 7.6% during the forecast period.

Asia Pacific held the largest market share in 2024.

Oleon, Kao Corporation, Evonik Industries, IOI Group, Wilmar International, Emery Oleochemicals, Godrej Industries, Ecogreen Oleochemicals, and Vantage Specialty Chemicals are among the key players in the market.

The fatty acids & derivatives segment dominated the specialized oleochemicals market revenue in 2024.

The cosmetics and personal care segment held the largest share of the market in 2024.