Specialty Enzymes Market Size, Share, Trends, Industry Analysis Report: By Source (Animal, Microorganisms, and Plant), Type, Form, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM5338

- Base Year: 2024

- Historical Data: 2020-2023

Specialty Enzymes Market Overview

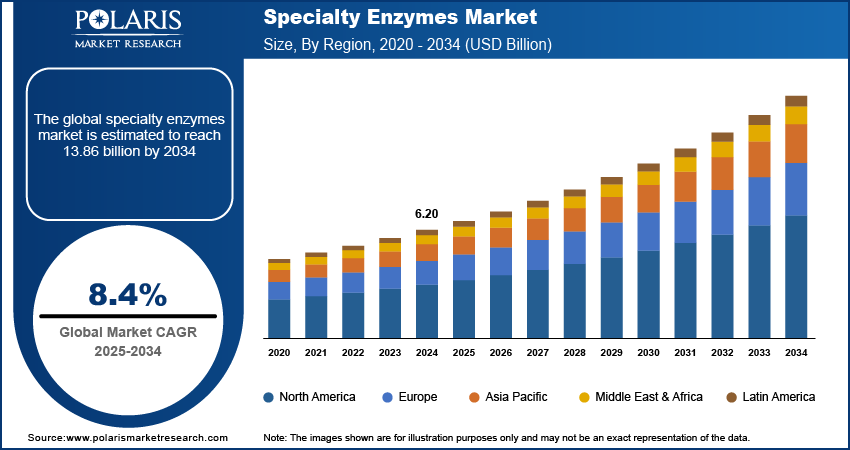

The specialty enzymes market size was valued at USD 6.20 billion in 2024. The market is projected to grow from USD 6.71 billion in 2025 to USD 13.86 billion by 2034, exhibiting a CAGR of 8.4% during 2025–2034.

Specialty enzymes are highly specific biological catalysts engineered to accelerate chemical reactions in various industrial and scientific applications. The specialty enzymes market growth is fueled by advancements in enzyme engineering, such as the use of artificial intelligence (AI) and machine learning (ML), to propel the development of designer enzymes. Several biotechnology companies are utilizing AI and ML to forecast optimal enzyme candidates for experimental screening, effectively mitigating the limitations associated with existing approaches. For instance, in December 2023, Neochromosome, Inc., a biotechnology company focused on genome-scale cell engineering, partnered with Dr. Giovanni Stracquadanio from the University of Edinburgh to harness the potential of AI and ML in the development of designer enzymes. Such technological adoptions enhance the development and optimization of enzymes by enabling rapid analysis and prediction of enzyme properties, structures, and functions. Therefore, the integration of AI and ML in enzyme engineering drives innovation and expands the specialty enzymes market across the globe.

To Understand More About this Research: Request a Free Sample Report

The global specialty enzymes market expansion is driven by increased public funding and incentives for biotechnological research. For instance, in the EU, the Horizon Europe program allocated USD 100.9 billion for 2021–2027 to drive research and innovation, with a specific focus on biotechnology. This funding supports projects focused on advancing biotechnological processes and products. Furthermore, in the US, the National Institutes of Health (NIH) allocated over USD 45.0 billion for biomedical research in 2022, with a portion dedicated to biotechnology research and the development of novel enzymes for medical and industrial applications. Such investments are accelerating the discovery of enzymes and enhancing their applications in biotechnology. Consequently, these funding initiatives by public and private biotechnology firms are driving the specialty enzymes market development.

Specialty Enzymes Market Trends

Innovative Product Launches

Biotechnology companies are introducing advanced, high-performance enzymes that meet the evolving needs of various industries. For instance, in November 2021, Enzyme Specialists Biocatalysts Ltd introduced Promod 324L, an innovative enzyme designed to broaden the spectrum of enzymes available for the pet food industry. This enzyme is tailored with a distinctive combination of endopeptidase activities to hydrolyze animal waste protein effectively. Such new enzymes offer enhanced efficiency, specificity, and environmental benefits, leading to increased adoption in sectors such as pharmaceuticals, agriculture, and food processing. Thus, the development of innovative enzymes with improved stability and activity at extreme conditions is enabling more effective and sustainable processes, thereby driving the specialty enzymes market growth.

Expanding Bioscience Industry

The bioscience industry is experiencing a rapid expansion across the globe. According to the Biotechnology Innovation Organization and the Council of State Bioscience Associations, in 2021, the industry had a significant economic impact on the US economy, contributing a total of USD 2.9 trillion. This growth is driving the demand for innovative and highly specialized enzymes used in a wide range of applications. The rise of genomics, proteomics, and synthetic biology within biosciences has led to the development of enzymes with enhanced precision and efficacy. Thus, the expansion is broadening the scope of enzyme applications and stimulating continuous technological advancements, driving the specialty enzymes market demand globally.

Specialty Enzymes Market Segment Analysis

Specialty Enzymes Market Evaluation by Type Outlook

The global specialty enzymes market segmentation, based on type, includes carbohydrases, lipases, polymerases & nucleases, proteases, and others. The proteases segment is projected to register a significant CAGR in the global market due to the essential role and versatility of these enzymes across multiple industries. Proteases, also known as proteolytic enzymes, are crucial for breaking down proteins into peptides and amino acids, making them invaluable in diverse applications. In pharmaceuticals, protease enzymes are used in drug formulation and protein-based therapies. Consequently, the increasing focus on drug discovery and development, advancements in biotechnology, and the rising trend of enzyme-based solutions in various industrial processes are expected to drive the robust growth of the proteases segment during the forecast period.

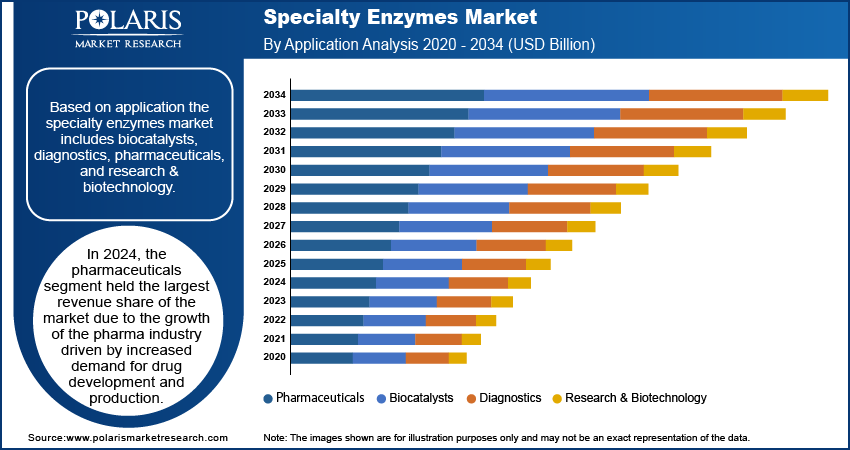

Specialty Enzymes Market Assessment by Application Outlook

The global specialty enzymes market segmentation, based on application, includes biocatalysts, diagnostics, pharmaceuticals, and research & biotechnology. In 2024, the pharmaceuticals segment held the largest revenue share of the market due to the growth of the pharma industry driven by increased demand for drug development and production. According to the IBEF, the Indian pharmaceutical industry held the third position globally in terms of pharmaceutical production by volume. It has shown significant growth at a CAGR of 9.43%. Such growth of the pharma industry worldwide is driving the demand for specialty enzymes that play a crucial role in various pharmaceutical processes, including drug synthesis, purification, and formulation. Thus, the adoption of specialty enzymes by the major pharma companies in drug development has contributed to the dominant revenue share of the pharmaceutical segment in the global specialty enzymes market.

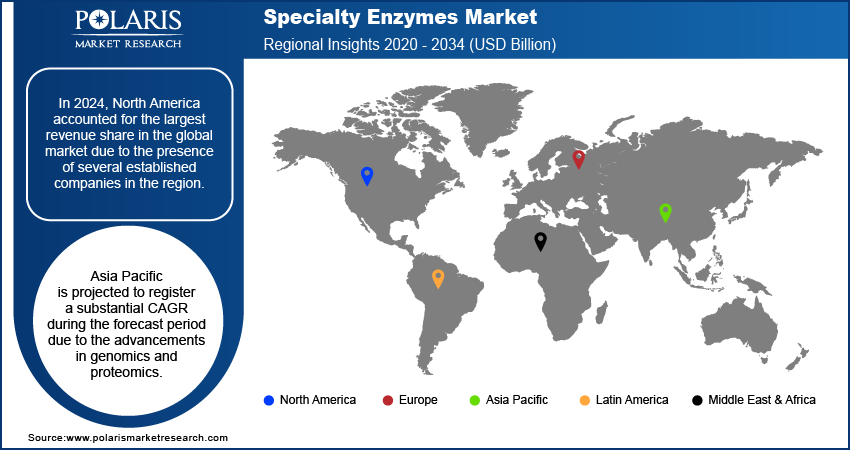

Specialty Enzymes Market Share by Region

By region, the study provides the specialty enzymes market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the global market due to the presence of several established companies in the region. Major multinational corporations and biotechnology firms headquartered in the region, such as Codexis, Inc.; Dyadic International Inc.; SEKISUI Diagnostics; and Thermo Fisher Scientific, are driving innovation through their advanced research and development capabilities. These companies invest heavily in enzyme technology, resulting in the commercialization of innovative products and solutions. Thus, the robust infrastructure, significant R&D investments, and strategic collaborations enhanced the region's pharma industry, thereby contributing to the dominance of North America in the global specialty enzymes market.

Asia Pacific is projected to register a substantial CAGR during the forecast period due to the advancements in genomics and proteomics. In May 2024, SOPHiA GENETICS, a cloud-native healthcare technology company, announced its collaboration with Microsoft and NVIDIA to utilize technological and genomic proficiency to introduce a streamlined and scalable solution for whole genome sequencing (WGS) analysis in healthcare institutions. Such technological breakthroughs are driving increased demand for sophisticated testing services to support research, drug development, and personalized medicine. Consequently, the rapid advancements in genomics and proteomics are fueling the market for specialty enzymes in Asia Pacific.

The specialty enzymes market in China is expected to have significant growth because of the regulatory support provided by the country for biotech innovations. The government of China has implemented a range of policies and initiatives, such as the 14th Five‐Year Plan, aimed at accelerating the development and application of biotechnological solutions, including specialty enzymes. These supportive regulations include streamlined approval processes, financial incentives, and investments in research and development infrastructure. Thus, China is encouraging innovation and commercialization of advanced enzyme technologies by creating a favorable environment for biotech companies and startups, which is anticipated to propel the specialty enzymes market expansion in China.

Specialty Enzymes Market – Key Players and Competitive Analysis

The specialty enzymes market is a dynamic and rapidly evolving environment with several players striving to innovate and differentiate from each other. Major global companies are dominating the market by leveraging extensive research and development capabilities, advanced manufacturing technologies, and broad distribution networks to maintain a competitive edge. The players are engaged in strategic activities such as mergers and acquisitions, partnerships, and collaborations to enhance their product portfolios and expand their market presence.

Startups are contributing to the specialty enzymes market development by introducing novel enzyme technologies and catering to niche applications. This competitive scenario is further intensified by ongoing advancements in biotechnology, increasing focus on sustainability, and the growing demand for customized enzyme solutions across various industries. Major players in the specialty enzymes market are 4basebio; Advanced Enzyme Technologies; Amano Enzyme Inc.; Aumgene Biosciences; BASF SE; BBI Solutions; Bioseutica; Codexis, Inc.; Dyadic International Inc; Enzyme Bioscience Private Limited; F. Hoffmann-La Roche Ltd; Merck KGaA; New England Biolabs; S.I. Biozyme; Sanofi; SEKISUI Diagnostics; and Thermo Fisher Scientific Inc.

Amano Enzyme Inc. is a manufacturer specializing in the production of high-quality enzymes for various industries, including food, medical, and green chemistry. Amano Enzyme leverages advanced technologies and extensive research and development capabilities with production facilities located in Japan, China, and the US to create tailored enzyme solutions that meet specific customer needs. In the food industry, Amano Enzyme offers a diverse range of products, including enzymes for enhancing plant-based foods, improving flavors, and optimizing protein modifications. The enzymes are designed to enhance the taste, texture, and nutritional profile of products such as plant-based meats, dairy alternatives, and beverages. In the medical sector, Amano provides enzymes that support health and nutrition, catering to everyday consumers and athletes. Amano Enzyme also contributes to green chemistry by developing enzymes that facilitate environment-friendly chemical processes, promoting sustainability. In July 2024, the company entered into a five-year Memorandum of Understanding (MOU) with Vietnam National University – Hanoi University of Science (VNU-HUS) to enhance collaboration in the areas of enzyme and protein technology. This partnership aims to facilitate joint scientific research, technology transfer, and student exchange programs.

SEKISUI Diagnostics specializes in the development, manufacturing, and supply of diagnostic tests, reagents, and systems for the healthcare industry. The company offers a wide range of products across various segments, including clinical chemistry, enzymes, and point-of-care testing. In clinical chemistry, SEKISUI Diagnostics provides a comprehensive portfolio of reagents for automated analyzers, covering a broad spectrum of assays for cardiovascular, diabetes, renal, liver, and therapeutic drug monitoring. Moreover, in the enzymes category, SEKISUI Diagnostics specializes in the production of high-quality enzymes for diagnostic and pharmaceutical manufacturers. The company also offers point-of-care testing solutions, providing rapid and accurate results at the point of patient care. In May 2019, SEKISUI Diagnostics Enzyme business completed the construction of a new BioProcess Innovation Centre in Maidstone, Kent, by investing USD 1.9 million in the project. This investment forms part of a comprehensive strategy aimed at expanding its presence in the Microbial Biopharma CDMO market, with a focus on enhancing cGMP manufacturing capabilities through future investments.

List of Key Companies in Specialty Enzymes Market

- 4basebio

- Advanced Enzyme Technologies

- Amano Enzyme Inc.

- Aumgene Biosciences

- BASF SE

- BBI Solutions

- Bioseutica

- Codexis, Inc.

- Dyadic International Inc

- Enzyme Bioscience Private Limited

- F. Hoffmann-La Roche Ltd

- Merck KGaA

- New England Biolabs

- S.I. Biozyme

- Sanofi

- SEKISUI Diagnostics

- Thermo Fisher Scientific Inc.

Specialty Enzymes Market Development

March 2024: Novus International Inc. acquired BioResource International Inc. (BRI), a US-based enzyme company. The acquisition aimed to enhance customer service and broaden the scope of innovation initiatives.

September 2023: Takara Bio Europe introduced new HQ (High Quality) grade mRNA production enzymes, "Pyrophosphatase (inorganic), HQ" and "T7 RNA polymerase, HQ." These enzymes are designed for pre-clinical and process development purposes in the manufacturing of mRNA vaccines and therapeutics.

December 2022: Ginkgo Bioworks introduced Ginkgo Enzyme Services, leveraging ultra-high throughput screening, machine learning-guided protein design, and optimized proprietary bacterial and fungal host strains for applications across pharmaceuticals, diagnostics, and food and agriculture.

Specialty Enzymes Market Segmentation

By Source Outlook (Revenue, USD Billion; 2020–2034)

- Animal

- Microorganisms

- Plant

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Carbohydrases

- Lipases

- Polymerases & Nucleases

- Proteases

- Others

By Form Outlook (Revenue, USD Billion; 2020–2034)

- Dry

- Liquid

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Biocatalysts

- Diagnostics

- Pharmaceuticals

- Research & Biotechnology

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Enzymes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.20 billion |

|

Market Size Value in 2025 |

USD 6.71 billion |

|

Revenue Forecast by 2034 |

USD 13.86 billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global specialty enzymes market size was valued at USD 6.20 billion in 2024 and is projected to grow to USD 13.86 billion by 2034.

The global market is projected to register a CAGR of 8.4% during 2025–2034.

North America had the largest share of the global market in 2024.

A few key players in the market are 4basebio; Advanced Enzyme Technologies; Amano Enzyme Inc.; Aumgene Biosciences; BASF SE; BBI Solutions; Bioseutica; Codexis, Inc.; Dyadic International Inc; Enzyme Bioscience Private Limited; F. Hoffmann-La Roche Ltd; Merck KGaA; New England Biolabs; S.I. Biozyme; Sanofi; SEKISUI Diagnostics; and Thermo Fisher Scientific Inc.

The proteases segment is anticipated to experience substantial growth with a significant CAGR in the global market. This growth is attributed to the indispensable role and adaptability of specialty enzymes in various industries.

The pharmaceuticals segment accounted for the largest revenue share of the market in 2024 due to the growth of the pharma industry driven by increased demand for drug development and production.