Special Mission Aircraft Market Share, Size, Trends, Industry Analysis Report, By Platform (Military Aviation, Commercial Aviation, and Unmanned Aerial Vehicle); By Application; By End-Use; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 119

- Format: PDF

- Report ID: PM2882

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

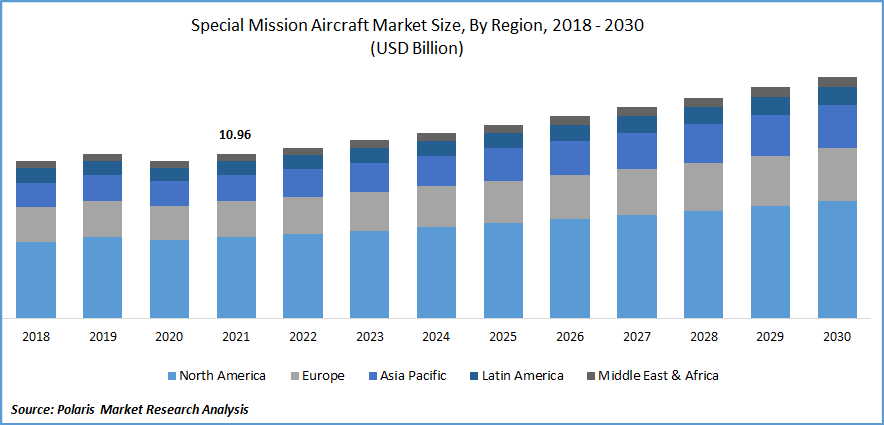

The global special mission aircraft market was valued at USD 10.96 billion in 2021 and is expected to grow at a CAGR of 4.4% during the forecast period.

The global rise in geopolitical issues, increased military expenditure by many countries, and high development in sensor technology coupled with the growing need for low-cost aircraft, especially in emerging economies like India and China are key factors expected to drive the growth of the global market during the forecast period. High usage of UAVs in combat activities along with the rising prevalence of air-to-air refueling systems to enable foreign deployment is also likely to boost the growth and demand of the global market over the coming years. In September 2021, the Ministry of Defense, India, announced a deal with Airbus Defense and Space SA, of the value of USD 2.8 Bn for replacing India’s outdated 56 Avro aircraft from the 56 C-295MW carrier aircraft.

Know more about this report: Request for sample pages

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the special mission aircraft market. As governments from several global nations send money to fight COVID-19, it is anticipated that less money had flowed into the defense industry. However, during the forecast period, demand for and production of special mission aircraft are likely to return to normal as conditions improve.

Industry Dynamics

Growth Drivers

The extensive rise in military spending by emerging economies is being driven due to growing geopolitical tensions and cross-border problems across the world. Special purpose aircraft assist in several types of duties such as maritime patrol, electronic warfare, search & rescue, & medevac, by serving as the low-cost multi-role alternatives. This is projected to boost the demand over the study period.

Another major factor driving the expansion of maritime patrol aircraft across various ocean borders is the desire for maritime security. To undertake ISR missions and protect the security of maritime boundaries, numerous naval forces are purchasing maritime surveillance aircraft in large quantities. For instance, in March 2022, an order for “King Air 350 Special Mission Maritime Patrol Aircraft” was placed with Bird AeroSystems. This aircraft comes with its advanced ASIO solution & offers the capability of maritime & coastal surveillance, & better monitoring capabilities.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on platform, application, end-user, and region.

|

By Platform |

By Application |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Military aviation segment is expected to witness the fastest growth

During the forecast period, the military aviation segment is anticipated to have rapid growth owing to the high usage of these systems in various non-combat defense purposes including opponent tracking, supply deliveries, rescue missions, intelligence data collection, and rescue missions across the globe. In addition, an extensive rise in geopolitical issues is expected to create high-growth opportunities for the adoption of military aviation by several developing countries like India, China, and Indonesia.

Furthermore, the rising number of modernization programs coupled with the increasing procurement by several militaries across the world for enhancing their security and safety with the help of advanced and highly innovated defense systems are some other factors projected to fuel the demand and growth of the segment in the coming years. For instance, in March 2022, Germany announced that they will replace some of their aging Tornado bomber jets with highly innovative Lockheed Martin F-35A Lighting II aircraft having capabilities of carrying nuclear weapons into it.

Intelligence, surveillance, and reconnaissance segment accounted for the largest market share in 2021

The growth of the segment is majorly driven by an increasing number of surveillance aircraft acquisitions across the world due to the high tensions associated with land and sea borders in many countries and many other factors also such as high-seas piracy and drug trafficking. The high capability of these special mission aircraft to handle and operate surreptitiously and quietly has paved the way for higher adoption of these aircraft in surveillance, classification, detection, and identification of a maritime target, which is likely to impact the segment market positively over the coming years. Moreover, the increasing number of government initiatives by various government authorities to enhance the ISR and the increasing importance of aircraft in providing real-time data in many sensitive and crucial situations are propelling the segment growth at a significant growth rate.

Defense segment held the highest revenue share in 2021

The defense segment dominated the market in 2021 and is projected to maintain its dominance throughout the forecast period. Special mission aircraft are used in almost every defense branch with a variety of applications including maritime patrol, rocket launches, supply deliveries, and surveillance operations for performing several types of defense needs smoothly to ensure the safety and security of a nation are major key factors driving the growth of the market extensively over the coming years.

Additionally, various types of national law enforcement and intelligence agencies around the world are further expected to fuel the demand for special mission aircraft during the forecast period. However, the space segment is witnessing strong growth over the forecast period owing to a high number of space activities performed by many large private and government companies mainly in developed countries such as the United States, France, and Japan.

The demand in North America is projected to witness significant growth

Increasing military spending and an extensive rise in the demand for advanced and specialized aircraft are key factors expected to drive the growth of the special mission aircraft market in the region over the forecast period. In addition, aerospace is one of the largest and major industries in the terms of exports in the region with a large number of value chain partners across Europe, Asia, and South America coupled with the intensive research and development activities undertaken in the aviation industry.

Furthermore, the Asia Pacific region is projected to grow rapidly throughout the forecast period owing to an increasing number of geopolitical issues and rising border tensions, especially in countries like India and China. In addition, undertaking several types of development activities and increasing focus on fleet modernization for enhancing aerial capabilities such as situational awareness and combat readiness are likely to propel the growth of the special mission aircraft market in the region over the coming years.

Competitive Insight

Key players include The Boeing Company, Lockheed Martin, Dassault Aviation SA, Textron Aviation Inc., Northrop Grumman Corporation, General Dynamics Corporation, Butler National Corporation, General Atomics Aeronautical Systems Inc., Israel Aerospace Industries Ltd., L Harris Technologies Inc., Ruag International Holding AG, Gulfstream Aerospace Corporation, Elbit Systems Ltd., Bombardier Inc., BAE Systems, and Pilatus Aircraft Ltd.

Recent Developments

In November 2021, Norwegian Defense Material Agency announced the acceptance of its first 5 Boeing P 8A Poseidon patrolling aircraft “Vingtor”, manufactured & designed by the Boeing Company, to be operated by the Royal Norwegian Air Force.

In August 2021, Lockheed Martin was awarded USD 328.8 Mn, for the 5-year contract from the Indian Airforce, to provide comprehensive & dedicated support for IAF’s fleet of the 12 C 130J 30 Hercules Aircraft.

Special Mission Aircraft Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 11.42 billion |

|

Revenue forecast in 2030 |

USD 16.14 billion |

|

CAGR |

4.4% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Platform, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

The Boeing Company, Lockheed Martin, Dassault Aviation SA, Textron Aviation Inc., Northrop Grumman Corporation, General Dynamics Corporation, Butler National Corporation, General Atomics Aeronautical Systems Inc., Israel Aerospace Industries Ltd., L Harris Technologies Inc., Ruag International Holding AG, Gulfstream Aerospace Corporation, Elbit Systems Ltd., Bombardier Inc., BAE Systems, and Pilatus Aircraft Ltd. |