Spatial Proteomics Market Size, Share, Trends, Industry Analysis Report: By Product (Instruments, Consumables, and Software), Technology, Workflow, Sample Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5128

- Base Year: 2023

- Historical Data: 2019-2022

Spatial Proteomics Market Overview

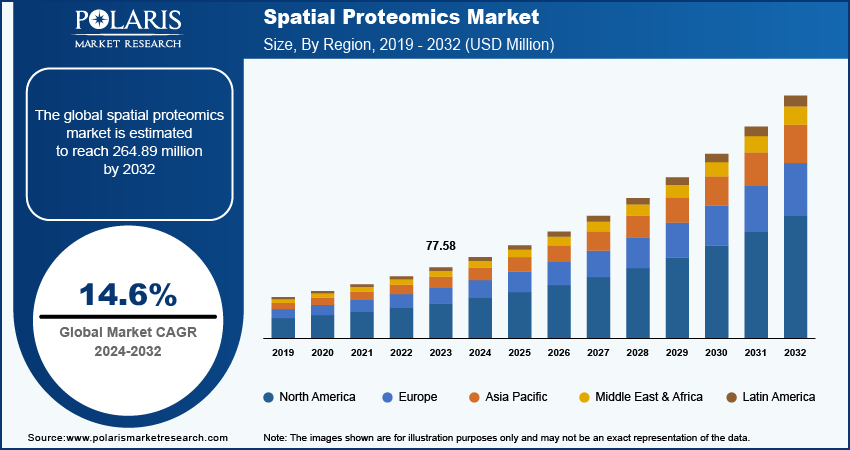

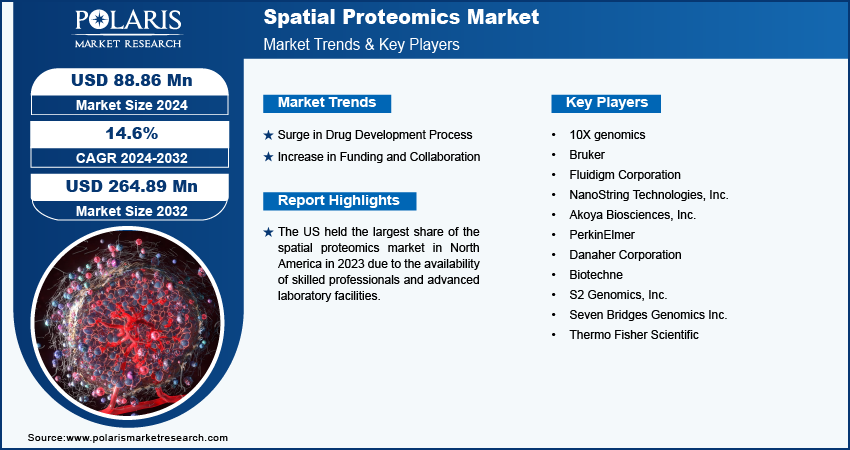

The global spatial proteomics market size was valued at USD 77.58 million in 2023. The market is projected to grow from USD 88.86 million in 2024 to USD 264.89 million by 2032, exhibiting a CAGR of 14.6% during 2024–2032.

Spatial proteomics is an advanced field in proteomics that focuses on analyzing the spatial distribution of proteins within cells and tissues. The shift toward personalized medicine emphasizes the need to understand the protein level profiles of patients. Spatial proteomics provides crucial insights into protein distribution and function, aiding in the development of tailored therapeutic approaches, thereby fueling the market growth. Additionally, the combination of spatial proteomics with genomics, transcriptomic, and metabolomics offers a holistic view of biological processes. This integrative approach is driving the adoption of spatial proteomics in various research fields, which fuels the spatial proteomics market growth.

To Understand More About this Research: Request a Free Sample Report

The rising prevalence of clinical research, especially in the fields of oncology and neurology, is propelling the need for the implementation of spatial proteomics.

Spatial Proteomics Market Trends

Surge in Drug Development Process

The rising efforts by pharmaceutical and biotechnology companies to discover and develop novel therapeutics boost the need for precise tools that clarify drug-target interactions and illuminate the biological mechanisms underlying efficacy and resistance. Spatial proteomics offers unique insights into the localization and dynamics of proteins within complex cellular environments, which are critical for understanding how drugs exert their effects and how resistance arises. Additionally, the increasing complexity of diseases, particularly of cancer, necessitates a more detailed understanding of molecular interactions within specific microenvironments. This demand for in-depth biological insights is propelling the adoption of spatial proteomics technologies, making them integral to the drug development pipeline. Consequently, the intersection of growing drug development initiatives and the capabilities of spatial proteomics fosters innovation and accelerates the delivery of effective therapies to patients. Thus, rising drug development processes are expected to emerge as key trends in the spatial proteomics market during the forecast period.

Increase in Funding and Collaboration

Government and private institutions are increasingly announcing funding for spatial proteomics research. For instance, in June 2021, the Chan Zuckerberg Initiative provided a grant of USD 28 million to support technology developments for next-generation electron microscopy, allowing researchers to observe cellular structures at near-atomic resolution. Moreover, growing collaborations between academic institutions, biotechnology companies, and pharmaceutical firms are fostering innovation and the application of spatial proteomics techniques. Therefore, the rising funding and collaboration strategies in spatial proteomics research are projected to boost the growth of the spatial proteomics market during 2024–2032.

Spatial Proteomics Market Segment Insights

Spatial Proteomics Market Breakdown by Product Insights

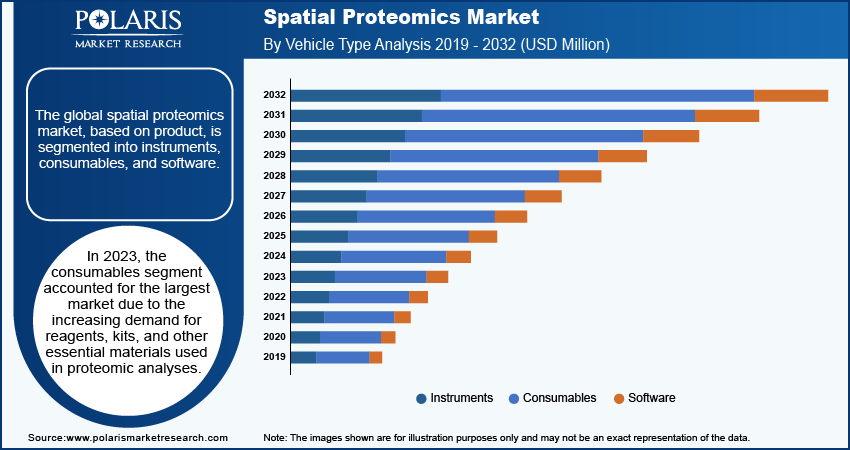

The global spatial proteomics market segmentation, based on product, includes instruments, consumables, and software. In 2023, the consumables segment accounted for the largest market share due to the increasing demand for reagents, kits, and other essential materials used in proteomic analyses. The increasing research in spatial proteomics is driving the demand for high-quality consumables due to advancements in technologies such as mass spectrometry and imaging techniques. Consumables such as antibodies, assay kits, and others are crucial for ensuring accurate and reproducible results, making them indispensable in academic and industrial laboratories. Furthermore, the growing emphasis on biomarker discovery and personalized medicine has spurred the development of specialized consumables tailored for specific applications, contributing to the segment's robust growth.

Spatial Proteomics Market Breakdown by Technology Insights

The global spatial proteomics market, based on technology, is segmented into imaging-based technologies, mass spectrometry-based technologies, sequencing-based technologies, and other technologies. The sequencing-based technologies segment is expected to register the highest CAGR during the forecast period due to their transformative impact on spatial proteomics and the increasing demand for high-throughput analyses. Sequencing-based technologies enable the simultaneous analysis of multiple proteins and their interactions, facilitating the identification of biomarkers and therapeutic targets with greater precision. For instance, in September 2024, MGI Tech Co., Ltd. announced the global rights to distribute and commercialize the new sequencing products CycloneSEQ-WY01 and CycloneSEQ-WT02. The CycloneSEQ technology integrates advanced protein engineering and a novel flow cell design to enable high accuracy and throughput in sequencing. Thus, the advancements in sequencing methodologies, including improved sensitivity and reduced costs, are driving widespread adoption across academic and clinical research settings.

Regional Insights

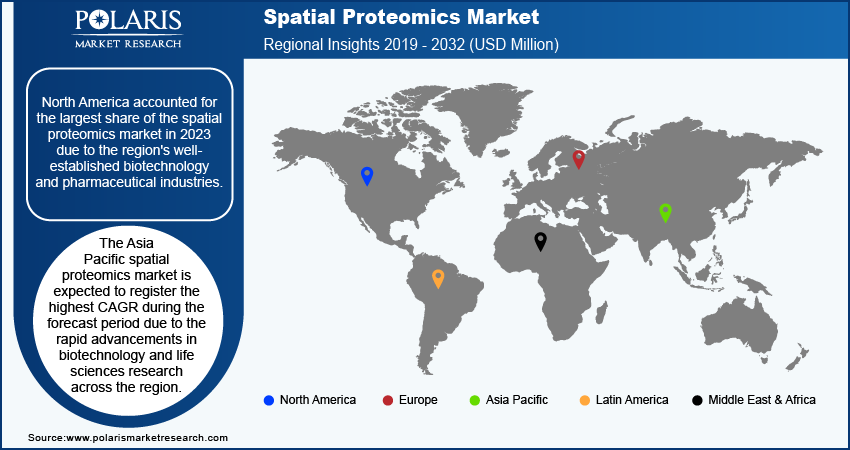

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the spatial proteomics market in 2023 due to the region's well-established biotechnology and pharmaceutical industries. Biotechnology and pharmaceutical companies in the region increasingly adopt spatial proteomics to advance drug discovery, biomarker identification, and personalized medicine. North America benefits from a strong infrastructure of academic and research institutions, which have been at the forefront of developing and applying advanced spatial proteomics technologies. Furthermore, substantial government funding and private investments in research initiatives have fostered innovation in this field. The growing focus on cancer research, neurodegenerative diseases, and precision medicine in the region has further fueled the demand for spatial proteomics techniques, as they offer high-resolution insights into protein interactions within tissues.

The US held the largest share of the North America spatial proteomics market in 2023 due to the availability of skilled professionals and advanced laboratory facilities.

The Asia Pacific spatial proteomics market is expected to record the highest CAGR during the forecast period due to the rapid advancements in biotechnology and life sciences research across the region, particularly in countries such as China, Japan, and South Korea. Furthermore, the expanding healthcare infrastructure and the rising prevalence of chronic diseases, including cancer, are contributing to the increased adoption of spatial proteomics. According to WCRF, in 2022, Australia recorded the highest cancer rate in men and women combined, at 462.5 people per 100,000. Thus, the growing importance of improving operational efficiency and accelerating time-to-market for applications fuels the demand for spatial proteomics in Asia Pacific.

The China spatial proteomics market is expected to register the highest CAGR during the forecast period due to the strong infrastructure for conducting large-scale clinical trials and research, along with its cost-competitive advantages that are attracting domestic and international companies to invest in spatial proteomics technologies.

Spatial Proteomics Market – Key Players and Competitive Insights

The competitive landscape of the spatial proteomics market is marked by a mix of established biotechnology companies, emerging startups, and academic collaborations, all striving to innovate and expand the capabilities of spatial proteomics technologies. Key players are focused on developing advanced platforms that combine proteomic analysis with high-resolution spatial mapping, driving innovation in areas such as mass spectrometry, imaging technologies, and single-cell proteomics. Large biotechnology companies and research tool providers, such as Thermo Fisher Scientific, Bruker Corporation, and Danaher Corporation, are investing heavily in product development and expanding their portfolios through acquisitions and partnerships. The companies benefit from well-established distribution networks and research expertise, allowing them to stay competitive by offering a comprehensive range of reagents, instruments, and software solutions for spatial proteomics applications. In addition, emerging players such as NanoString Technologies and Akoya Biosciences are pioneering novel spatial transcriptomics and proteomics platforms, which integrate molecular biology with advanced imaging systems. These smaller firms are increasingly forming strategic alliances with academic institutions and pharmaceutical companies to accelerate product development and adoption. A few major market players are 10X genomics; Bruker; Charles River Laboratories; Fluidigm Corporation; NanoString Technologies, Inc.; Akoya Biosciences, Inc.; PerkinElmer; Danaher; Biotechne; S2 Genomics Inc.; Seven Bridges Genomics Inc.; and Thermo Fisher Scientific.

Thermo Fisher Scientific Inc. provides services to the scientific community. The company focuses on improving patient health via diagnostics, promoting the study of life sciences, resolving complex analytical problems, increasing lab productivity, and creating and producing therapies that will change people's lives. Its brands, including Thermo Scientific, Invitrogen, Applied Biosystems, Unity Lab Services, Fisher Scientific, Patheon, and PPD, offer a mix of advanced technology, buying ease, and pharmaceutical services. In January 2024, Akoya Biosciences, Inc. and Thermo Fisher Scientific, Inc. partnered to offer a combined solution for detecting RNA and protein biomarkers in tissue samples. This solution includes Akoya’s PhenoImager systems and PhenoCode reagents, along with Thermo Fisher's ViewRNA in Situ Hybridization Assays.

Danaher Corporation is an American global conglomerate founded in 1984. Headquartered in Washington, D.C., Danaher specializes in designing, manufacturing, and marketing a diverse range of medical, industrial, and commercial products and services. The company operates through three main segments, including life sciences, diagnostics, and environmental & applied solutions, leveraging the Danaher Business System (DBS) to drive operational efficiency and continuous improvement across its operations. Danaher Corporation, with a strategy focused on strategic acquisitions, has evolved from its initial industrial roots into a leading innovator in science and technology. In July 2024, Danaher Corporation and Stanford University partnered to revolutionize cancer drug screening using "smart microscopy," combining spatial biology with AI.

Key Companies in Spatial Proteomics Market

- 10X genomics

- Bruker

- Fluidigm Corporation

- NanoString Technologies, Inc.

- Akoya Biosciences, Inc.

- PerkinElmer

- Danaher Corporation

- Biotechne

- S2 Genomics, Inc.

- Seven Bridges Genomics Inc.

- Thermo Fisher Scientific

Spatial Proteomics Industry Developments

In March 2024, Lunaphore and Nikon Instruments Inc. partnered to extend access to spatial biology services with the COMET platform for US-based academic, pharma, and biotech customers.

In September 2023, NanoString Technologies, Inc. launched GeoMx IO Proteome Atlas, a spatial proteomics assay for profiling over 500 immuno-oncology appropriate targets from FFPE tissue sections.

In July 2023, Cayman and Navinci partnered to broaden the availability of advanced tools for spatial proteomics.

Spatial Proteomics Market Segmentation

By Product Outlook (Revenue – USD Million, 2019–2032)

- Instruments

- Automated

- Semi-Automated & Manual

- Consumables

- Software

By Technology Outlook (Revenue – USD Million, 2019–2032)

- Imaging-Based Technologies

- Mass Spectrometry-Based Technologies

- Sequencing-Based Technologies

- Other Technologies

By Workflow Outlook (Revenue – USD million, 2019–2032)

- Sample Preparation

- Instrumental Analysis

- Data Analysis

By Sample Type Outlook (Revenue – USD million, 2019–2032)

- FFPE

- Fresh Frozen

By End Use Outlook (Revenue – USD million, 2019–2032)

- Academic & Translational Research Institutes

- Pharmaceutical and Biotechnology Companies

- Other End Use

By Regional Outlook (Revenue – USD million, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Spatial Proteomics Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 77.58 million |

|

Market Size Value in 2024 |

USD 88.86 million |

|

Revenue Forecast By 2032 |

USD 264.89 million |

|

CAGR |

14.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global spatial proteomics market size was valued at USD 77.58 million in 2023 and is projected to grow to USD 264.89 million by 2032.

The global market is projected to register a CAGR of 14.6% during the forecast period.

North America accounted for the largest share of the global market in 2023 due to the region's well-established biotechnology and pharmaceutical industries.

A few key players in the market are 10X genomics; Bruker; Charles River Laboratories; Fluidigm Corporation; NanoString Technologies, Inc.; Akoya Biosciences, Inc.; PerkinElmer; Danaher; Biotechne; S2 Genomics Inc.; Seven Bridges Genomics Inc.; and Thermo Fisher Scientific.

The consumables segment dominated the market in 2023 due to the increasing demand for reagents, kits, and other essential materials used in proteomic analyses.

The sequencing-based technologies segment is expected to record the highest CAGR during the forecast period due to their transformative impact on spatial proteomics and the increasing demand for high-throughput analyses