Space Situational Awareness Market Share, Size, Trends, Industry Analysis Report, By Solution (Services, Payload Systems, Software), By Orbital Range (Near-Earth, Deep Space) By End-Use; By Object; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2021

- Pages: 115

- Format: PDF

- Report ID: PM2168

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

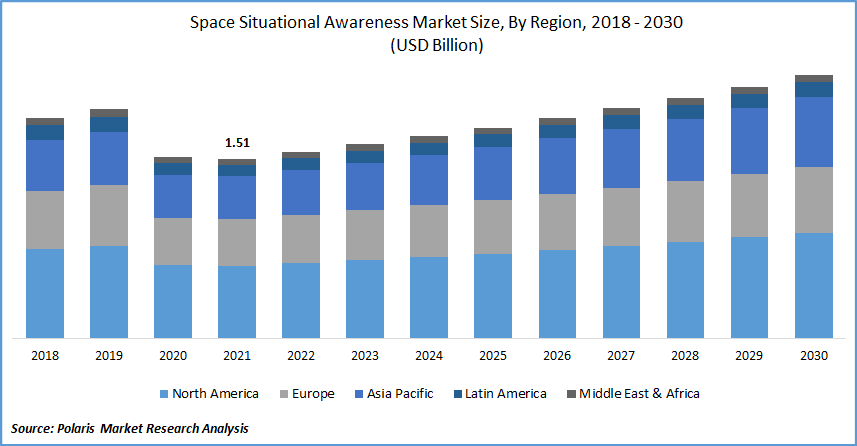

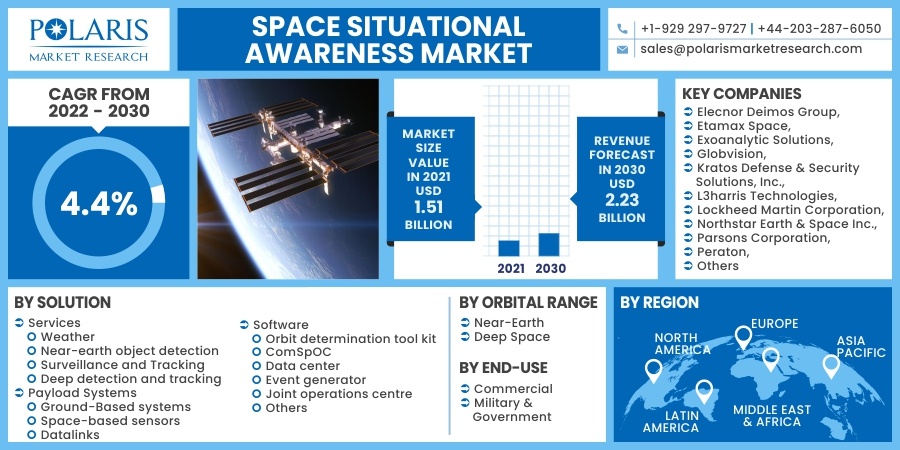

The global space situational awareness market was valued at USD 1.51 billion in 2021 and is expected to grow at a CAGR of 4.4% during the forecast period. The key factors, such as the rising demand for earth observation imaginary and analytics, increasing engagement of various countries in the use of space for various activities, and the rising need for lower earth orbit services, are boosting the market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The increased demand for LEO-based services such as the internet, services for acquiring photographs of the planet, situational awareness services, and on-orbit services is expected to fuel the expansion of the global space situational awareness market. Small satellites are becoming more popular because of their low cost, large capacity, and improved ability to provide low-latency broadband services.

In addition, as little satellite technologies progress, the number of small satellite constellations deployed in LEO is projected to rise in the future years. Due to technological developments, small satellites are predicted to perform LEO-based activities on pace with giant satellites.

Further, agriculture, insurance firms, financial traders, hedge funds, energy businesses, urban planning, retail, resource management, maritime, and media are likely to fuel expansion in the small satellite imaging industry, enhancing the market for situational awareness. Also, the expansion of the space situational awareness market will be fueled by the increasing engagement of multiple countries in the use of space for science, national security, and safety.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The presence of hazardous debris and the continuous addition of newly built space systems result in a complicated and congested environment. Due to increased congestion, satellite operators and government agencies will need to improve their situational awareness capabilities to adapt to these operations' changing nature effectively. According to ESA, over 6050 launches have resulted in 56450 monitored objects in orbit, of which about 28160 remain in earth orbit and are regularly monitored and preserved in the US Surveillance Network's catalog, which covers items larger than about 5-10 cm in low-Earth orbit and 30 cm-1 m at geostationary altitudes.

Only roughly 4000 of the satellites are still intact and working today. This massive amount of hardware weighs in at around 9300 tons. As a result, the market will likely develop as congestion increases. Further, the government and commercial sectors are expected to increase their requirement for market-based sensing activities, including such radio frequency mapping, weather monitoring, GPS based radio occultation (GPS-RO), and automated broadcast to be used in the storage, maritime activities, and aeronautics areas to accumulate situational awareness.

Small satellites are excellent for situational awareness applications due to their lower operating costs. Airlines employ these satellites to track planes in accordance with recently updated International Civil Aviation Organization (ICAO) requirements, which require tracking every 15 minutes. They are also used to track ships and keep an eye on suspicious activity around the coast. As a result of the growing usage of various sensing activities to check the progress of satellites and their payloads and acquire situational awareness, the space situational awareness market is forecast to increase.

Report Segmentation

The market is primarily segmented based on solution, orbital range, end-use, object, and region.

|

By Solution |

By Orbital Range |

By End-Use |

By Object |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Solution

Based on the solution segment, the services segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. This is due to the growing requirement for improved capabilities in weather services networks, the development of SSA tools and the necessity for surveillance and tracking to ensure satellites perform properly.

Geographic Overview

In terms of geography, North America had the largest share in 2021. Due to the increased dependency on assets and a need to maintain safe operations, the space situational awareness industry is being driven by the presence of important organizations such as NASA and the Department of Defense. The US took several steps to help this situational awareness business flourish. For instance, the US government's situational awareness programs concentrate on intelligence, reconnaissance, environmental monitoring, surveillance, and command and control.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. The establishment of the Asia Pacific Optical Satellite Observation System (APOSOS) in China is expected to drive growth in the Asia Pacific. Increased collaboration between the countries would boost growth in the region.

Competitive Insight

Some of the major players operating in the global market include Elecnor Deimos Group, Etamax Space, Exoanalytic Solutions, Globvision, Kratos Defense & Security Solutions, Inc., L3harris Technologies, Lockheed Martin Corporation, Northstar Earth & Space Inc., Parsons Corporation, Peraton, Schafer Corporation, Spacenav, and Telespazio.

Space Situational Awareness Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.51 billion |

|

Revenue forecast in 2030 |

USD 2.23 billion |

|

CAGR |

4.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Solution, By Orbital Range, By End-Use, By Object, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Elecnor Deimos Group, Etamax Space, Exoanalytic Solutions, Globvision, Kratos Defense & Security Solutions, Inc., L3harris Technologies, Lockheed Martin Corporation, Northstar Earth & Space Inc., Parsons Corporation, Peraton, Schafer Corporation, Spacenav, and Telespazio. |