Space Electronics Market Share, Size, Trends, Industry Analysis Report

By Product Type (Radiation-Hardened and Radiation-Tolerant); By Platform; By Component; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2870

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

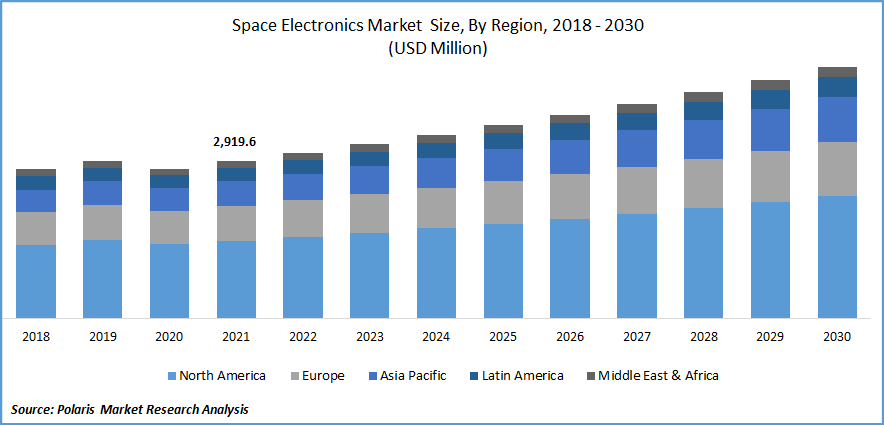

The global space electronics market was valued at USD 2,919.6 million in 2021 and is expected to grow at a CAGR of 5.3% during the forecast period.

Rapid growth in the investment in space ventures, rise in launch activities, and establishment of communication satellite constellation in LEO are major factors expected to augment the growth of the global market over the course of the projected period. Moreover, an extensive rise in the application of satellites for a wide range of activities including surveillance, real-time imaging, navigation, weather forecasting, broadband & connectivity, communication, and integration of IoTs for several commercials, government, and civil-military sectors are expected to propel the growth of the global market.

Know more about this report: Request for sample pages

The outbreak of the COVID-19 pandemic has significantly impacted market growth. The emergence of the deadly virus has impacted almost every industry including space electronics. High disruptions in the supply chain and imposed lockdowns in many countries across the globe have halted the manufacturing processes during the pandemic. The industrial manufacturing sector was already facing a high shortage of semiconductor chips, which worsened the market due to the global trade restrictions and the crisis of COVID-19.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

High mechanical advancements in microprocessors, heavily investing in the satellite manufacturing sector, and the rising prevalence of space operations around the world are key factors projected to drive the growth of the global market over the forecast period. In addition, the arrival of many new materials for the better fabrication of space electronics coupled with the growing demand for reconfigurable satellite payloads is likely to create lucrative growth opportunities for the market over the coming years.

Furthermore, rising demand for wide bandgap materials like silicon carbide and gallium nitride for the manufacturing of space cables to provide significant enhancements and improvements in performance are likely to be another major factor driving the growth of the market in the coming years. Several benefits offered by wide bandgap materials such as operating at much higher temperatures, the ability to handle 10X more voltage as compared to silicon materials, and quick switching frequency has resulted in the rising popularity of these materials worldwide and are expected to augment the market growth.

Report Segmentation

The market is primarily segmented based on product type, platform, component, and region.

|

By Product Type |

By Platform |

By Component |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Radiation-tolerant segment is expected to witness the fastest growth

The radiation-tolerant segment is witnessing the fastest growth rate during the projected period. Growing demand for smaller-size satellites, rising prevalence of COTS (Commercial off the Shelf), and reduction in satellite launch costs from various commercial space companies globally are key factors fueling the growth of the segment market. Increasing numbers of product launches by key market companies to cater the growing demand from various industries. For instance, in April 2022, Microchip Technology Inc. announced its new commercial off-the-staff TR SuperFlash devices which have applications related to aerospace and defense applications.

Furthermore, the radiation-hardened segment holds a significant market revenue share in 2021 and is likely to maintain its position throughout the forecast period on account of the increasing need for intensification in broader and throughput variations. These devices allow the users of satellites to modify their scope accordingly while in orbit, which helps to reduce the reconfiguration cost. In addition, major market companies operating in the market are implementing the development activities of innovative software-defined, radiation-hardened components, which are expected to foster the adoption and growth of the market significantly over the coming years.

Satellite segment held the largest market revenue share in 2021

In 2021, the satellite segment dominated the global market and is projected to grow significantly during the forecast period. The growth of the segment market is mainly driven by the increasing adoption of satellites in modern communication technologies and the high development of miniature hardware systems. In the last few years, there has been an extensive rise in the number of activities related to small satellites, due to technology breakthroughs, rising private investments, and growing industry commercialization, which helps small satellites to achieve orbit control and attitude, end-of-life deorbiting, and orbital transfers. Moreover, significant growth in the NewSpace industry has resulted in higher use of various modular components such as miniaturized rad-hard MOSFETs, DC-DC converters, gate drivers, and SS relays are likely to be key factors driving the industry at a considerable growth rate over the anticipated period.

Integrated circuits segment accounted for the highest market share

The integrated circuits accounted for a significant global market share owing to the growing demand for electronic components which are smaller in size and more-lighter in weight and consume low energy as compared to others. Integrated circuits are mainly used for battery-operated devices that have small power capacity. Since the integration of various types of functions into a single chip enables to use of space and system power more efficiently. Several functions frequently integrated into PMICs include voltage converters, regulators, LED drivers, real-time clocks, power sequencers, battery chargers, and power control, which is fueling the adoption of integrated circuits across the globe.

In addition, the discrete semiconductors segment is projected to gain a high growth rate throughout the anticipated period. The growth of the segment can be attributed to the rising prevalence of MOSFETs and IGBTs in electronics and the high demand for wireless and portable electronic components coupled with the rising efforts on development activities by public and private companies worldwide. For instance, in November 2021, Texas Instruments announced its plan to start the construction of its 300-millimeter semiconductor wafer fabrication plant in Sherman. Production from the latest new fab is estimated as soon as 2025.

North America region dominated the global market in 2021

The North American region dominated the market and is expected to retain its position over the forecast period due to high investment by the United States government in advanced space electronics for the enhancement of quality and effectiveness of deep space exploration and satellite communication. In addition, the modernization of current existing communications in military platforms, law enforcement agencies, and critical infrastructure are other key factors anticipated to drive the growth of the space electronics market in the region.

Furthermore, Asia Pacific region is expected to contribute significantly to the market growth over the study period. High adoption of advanced technologies, rising number of companies dealing with space electronics components, and rising government efforts to enhance aerospace and defense sectors, especially in countries like India, China, and Russia are major key factors expected to boost the growth and adoption of the space electronics market in the region extensively in the coming years.

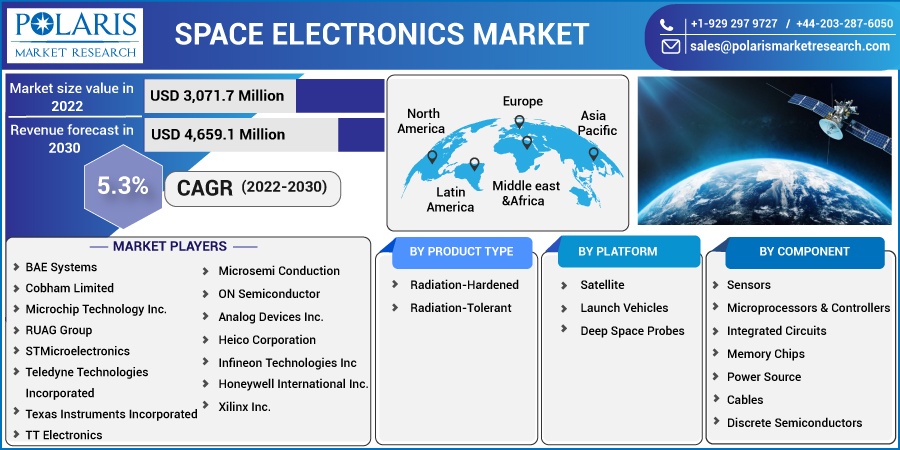

Competitive Insight

Key players include BAE Systems, Cobham Limited, Microchip Technology, RUAG Group, STMicroelectronics, Teledyne Technologies, Texas Instruments, TT Electronics, Xilinx Inc., Honeywell International, Microsemi Conduction, ON Semiconductor, Analog Devices, Renesas Electronics, Heico Corporation, and Infineon Technologies.

Recent Developments

In December 2021, Microchip Technology announced the expansion of its Gallium Nitride Radio Frequency device portfolio with the latest and innovative MMICs and discrete transistors with a frequency power of up to 20 gigahertz. The new device is capable to combine high linearity and efficiency in a wide range of applications including 5G, electronic warfare, test equipment, and satellite communications.

Furthermore, in August 2021, STMicroelectronics announced that it has entered a collaboration with Xilinx. With this collaboration, the company builds a power solution for “Xilinx Kintex UltraScale” FPGA.

Space Electronics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3,071.7 million |

|

Revenue forecast in 2030 |

USD 4,659.1 million |

|

CAGR |

5.3% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product Type, By Platform, By Component, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

BAE Systems, Cobham Limited, Microchip Technology Inc., RUAG Group, STMicroelectronics, Teledyne Technologies Incorporated, Texas Instruments Incorporated, TT Electronics, Xilinx Inc., Honeywell International Inc., Microsemi Conduction, ON Semiconductor, Analog Devices Inc., Renesas Electronics Corporation, Heico Corporation, and Infineon Technologies Inc |