Space Camera Market Size, Share, Trends, Industry Analysis Report: By Type (Satellite Cameras, CubeSat Cameras, Onboard Spacecraft Cameras, and Others), Technology, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5530

- Base Year: 2024

- Historical Data: 2020-2023

Space Camera Market Overview

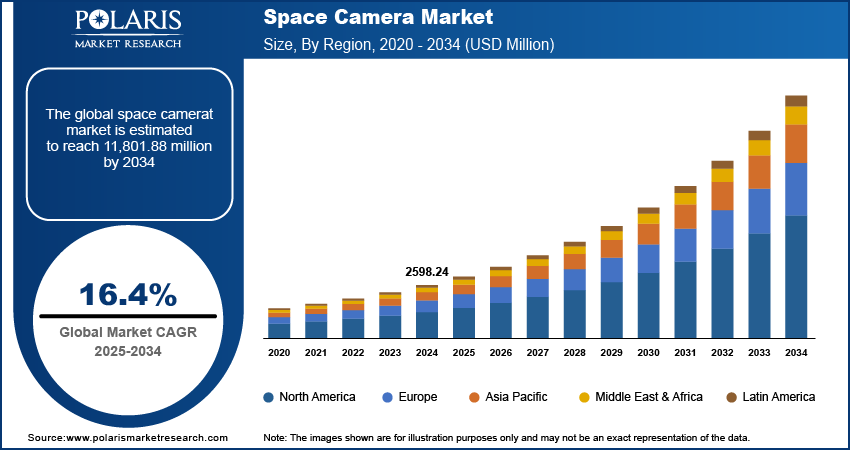

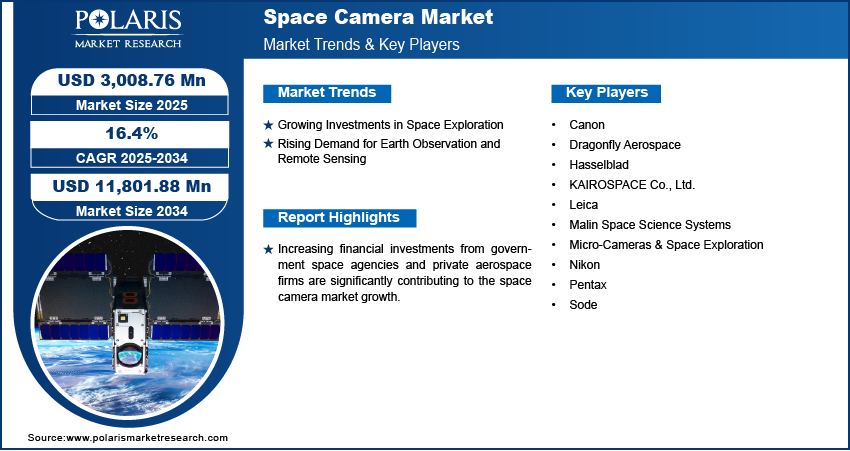

The global space camera market size was valued at USD 2,598.24 million in 2024 and is expected to reach USD 3,008.76 million by 2025 and USD 11,801.88 million by 2034, exhibiting a CAGR of 16.4% during 2025–2034.

The space camera market refers to the industry focused on the development, manufacturing, and deployment of high-resolution imaging systems for space applications, including Earth observation, deep-space exploration, satellite navigation, and astrophotography. These advanced cameras are integrated into satellites, space probes, and crewed missions to capture detailed images for scientific research, defense, climate monitoring, and commercial applications. Continuous innovations in multispectral, hyperspectral, and infrared imaging sensors are enabling superior data collection and enhanced imaging capabilities, fueling the space camera market growth.

To Understand More About this Research: Request a Free Sample Report

The rise of private sector initiatives, such as satellite-based analytics, space tourism, and space-based internet services, is accelerating space camera market demand with increasing adoption of advanced imaging solutions. Additionally, the adoption of AI-driven image processing, real-time data analytics, and automated anomaly detection improves image accuracy and operational efficiency, which boosts the market growth.

Space Camera Market Dynamics

Growing Investments in Space Exploration

Increasing financial investments from government space agencies and private aerospace firms are significantly contributing to space camera market development. Funding for interplanetary missions, lunar exploration, and Mars expeditions is accelerating demand for high-resolution imaging technologies. In March 2025, Minister Jones disclosed a significant multimillion-pound investment aimed at supporting Bristol's aerospace capabilities, facilitated by the prominent German space company OHB. This strategic investment is expected to enhance regional innovation and industrial growth within the space sector, leveraging advanced technologies and fostering collaboration among local enterprises and research institutions. Advanced space cameras play a crucial role in capturing detailed planetary images, mapping extraterrestrial terrain, and enabling scientific discoveries. The emergence of commercial space programs and deep-space telescopes is further enhancing market dynamics; as high-precision imaging becomes integral to mission success. Investments in miniaturized, radiation-resistant, and AI-powered cameras are also driving space camera market expansion. The growing focus on sustainable space exploration is fostering demand for reusable and long-lifespan imaging solutions.

Rising Demand for Earth Observation and Remote Sensing

Expanding applications of satellite imagery in climate change analysis, disaster management, and precision agriculture are leading to lucrative space camera market opportunities. Governments and commercial enterprises increasingly rely on high-resolution cameras for monitoring environmental changes, tracking natural disasters, and optimizing resource management. The integration of multispectral and hyperspectral imaging is enhancing market value, providing detailed insights into deforestation, urbanization, and oceanic patterns. Advanced sensor technologies and real-time data transmission are improving response times for emergency management and strategic planning. As satellite networks grow, increasing investments in high-accuracy remote sensing systems are contributing to market expansion, driving innovations in lightweight and AI-powered imaging solutions.

Space Camera Market Segment Insights

Space Camera Market Assessment by Type Outlook

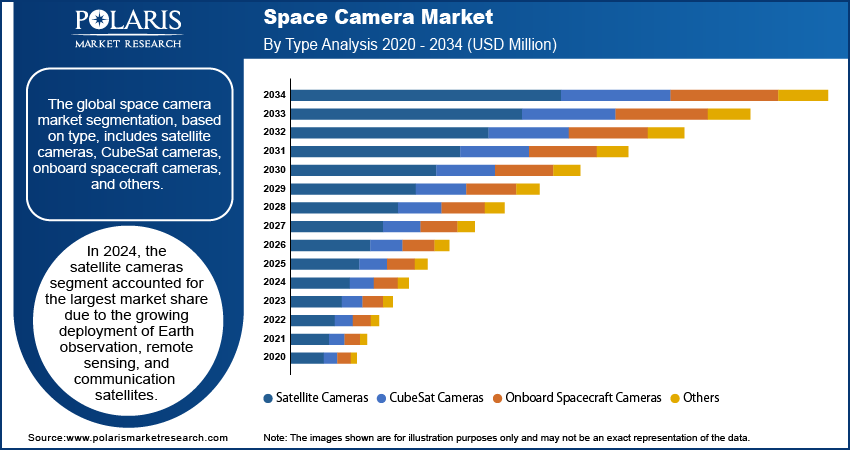

The global space camera market segmentation, based on type, includes satellite cameras, CubeSat cameras, onboard spacecraft cameras, and others. In 2024, the satellite cameras segment accounted for the largest market share due to the growing deployment of Earth observation, remote sensing, and communication satellites. The increasing demand for high-resolution imaging for environmental monitoring, disaster response, and defense applications is strengthening market dynamics. Technological advancements, including AI-driven image processing and multispectral cameras, are enhancing the performance of satellite cameras, increasing their adoption. The shift toward small satellite constellations for real-time data collection is further boosting market size. Government investments and commercial satellite programs are reinforcing market value, as satellite-based cameras remain critical for scientific exploration, strategic surveillance, and global connectivity initiatives.

The CubeSat cameras segment is expected to register the highest CAGR during the forecast period due to its increasing affordability and accessibility. They are compact and high-performance imaging systems. Miniaturization of optical sensors and advancements in lightweight camera modules are supporting the rapid adoption of CubeSat cameras for Earth observation, IoT-based satellite networks, and deep-space exploration. Rising private sector investments and academic research initiatives are accelerating market growth and enhancing data collection capabilities across various industries. The integration of AI-powered onboard image analysis and real-time data transmission is optimizing CubeSat performance, contributing to market dynamics. The demand for cost-effective and scalable satellite solutions is supporting market expansion for the CubeSat cameras segment.

Space Camera Market Evaluation by End Use Outlook

The global space camera market segmentation, based on end use, includes government and military, commercial enterprises, space agencies, and research institutions. In 2024, the government and military segment accounted for the largest market share due to growing defense and national security initiatives. The increasing reliance on satellite-based reconnaissance, intelligence gathering, and border surveillance is creating market demand for high-resolution cameras with infrared and hyperspectral imaging capabilities. Space-based defense programs and strategic collaborations between governments and private space firms are strengthening market value, enhancing security infrastructure. The need for advanced surveillance technologies to monitor geopolitical developments and track potential threats is fostering market dynamics, reinforcing continued investments in high-precision imaging solutions for defense applications.

The commercial enterprises segment is expected to register the highest CAGR during the forecast period due to expanding private space ventures and commercial satellite programs. Increasing participation of tech companies in satellite imaging, telecommunications, and Earth observation services is driving market demand for high-resolution, cost-efficient space cameras. The adoption of AI-enhanced imaging solutions for applications such as precision agriculture, maritime surveillance, and urban planning is contributing to market growth. Advancements in reusable launch technologies and declining satellite deployment costs are enhancing market value, enabling businesses to leverage space-based imaging for data-driven decision-making, infrastructure development, and environmental monitoring.

Space Camera Market Regional Analysis

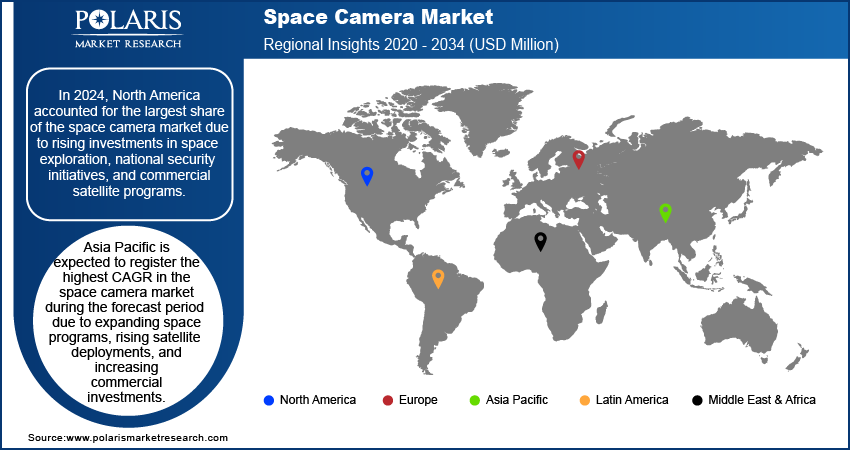

By region, the study provides space camera market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share due to rising investments in space exploration, national security initiatives, and commercial satellite programs. Space officials have placed key investment areas to maintain the US competitive advantage in space. The fiscal year 2025 budget proposal allocated USD 33.7 billion for essential space initiatives. The presence of leading space agencies, such as NASA, and major private players, including SpaceX and Blue Origin, is accelerating the space camera market expansion. Increasing government funding for deep-space missions, Earth observation, and military surveillance is driving market demand for high-resolution imaging technologies. Furthermore, rapid advancements in AI-powered image processing, hyperspectral imaging, and radiation-hardened camera systems are enhancing market value. The strong aerospace infrastructure, coupled with regulatory support and technological innovation, is positioning North America as a dominant force in the market.

Asia Pacific is expected to register the highest CAGR during the forecast period due to expanding space programs, rising satellite deployments, and increasing commercial investments. For instance, Asia experienced a 70% increase in satellite launches between 2018 and 2023. Growing government initiatives, particularly in China, India, and Japan, are driving market growth, with significant investments in lunar missions, satellite constellations, and deep-space exploration. The emergence of private aerospace startups, coupled with cost-effective satellite manufacturing, is accelerating demand for compact and high-performance imaging systems. Advancements in miniaturized CubeSat cameras, AI-powered data analytics, and multispectral imaging technologies are enhancing market value. Increasing collaboration between space agencies and commercial enterprises is positioning Asia Pacific as the fastest-growing region in the space camera market.

Space Camera Market – Key Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for space camera market share through innovation, strategic partnerships, and regional expansion. Global players leverage advanced R&D capabilities, AI-driven automation, and precision imaging technologies to deliver high-performance solutions, addressing the rising market demand for high-resolution imaging, multispectral sensors, and radiation-hardened optics. Space camera market trends indicate a surge in AI-powered image processing, lightweight miniaturized cameras, and deep-space exploration initiatives, driven by increasing commercial satellite deployments, governmental space programs, and advancements in autonomous spacecraft navigation. Strategic investments, mergers and acquisitions, and joint ventures remain pivotal for market expansion, allowing firms to enhance their technological capabilities and broaden their market footprint. Post-merger integration and cross-industry collaborations are key strategies to improve competitive positioning and accelerate market growth.

Competitive benchmarking involves entry strategies, regulatory compliance, and partnerships with space agencies, defense organizations, and commercial satellite operators to align with the evolving market dynamics. The space camera market is witnessing rapid technological innovations such as hyperspectral imaging, real-time cloud-based analytics, and AI-enhanced anomaly detection, reshaping market value and operational efficiencies. Companies are investing in radiation-resistant materials, precision optics, and scalable imaging solutions to meet growing market demand, industry trends, and evolving mission requirements. Pricing insights, revenue growth analysis, and strategic intelligence remain critical for identifying long-term profitability and scalability opportunities in the space camera market. Major players emphasize technological leadership, market penetration strategies, and geopolitical adaptability, ensuring sustained market expansion in a highly competitive global ecosystem.

Canon Inc. is engaged in the manufacturing of optical and imaging products, including cameras, printers, and medical equipment. The company specializes in developing advanced imaging technologies. Canon's product portfolio includes digital cameras, camcorders, lenses, laser printers, and medical imaging devices. The company also provides services such as document management solutions and professional printing systems. Canon operates globally with a strong presence in regions like North America, Europe, and Asia. In the space camera sector, Canon has developed compact cameras for satellites, such as the CE-SAT series, which capture high-resolution Earth images for applications like climate monitoring and mapping.

Nikon Corporation is engaged in the production of optical instruments and imaging equipment. Nikon specializes in cameras, lenses, microscopes, and semiconductor manufacturing equipment. Its product portfolio includes DSLR cameras, mirrorless cameras, binoculars, and precision instruments for industrial applications. Nikon serves markets worldwide with a strong presence across Asia, Europe, and the Americas. In the space camera domain, Nikon has supplied advanced imaging equipment for space exploration missions, contributing to capturing high-quality images of celestial bodies and Earth from orbit.

List of Key Companies in Space Camera Market

- Canon

- Dragonfly Aerospace

- Hasselblad

- KAIROSPACE Co., Ltd.

- Leica

- Malin Space Science Systems

- Micro-Cameras & Space Exploration

- Nikon

- Pentax

- Sode

Space Camera Industry Developments

In March 2024, Canon Electronics launched its CE-SAT-IE satellite into orbit, marking a significant achievement in its foray into space technology.

In March 2024, Nikon signed a Space Act agreement with NASA to support the Artemis mission using the Nikon Z 9 camera. This partnership will utilize the camera’s advanced imaging technology to capture high-resolution data crucial to the program's objectives.

Space Camera Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Satellite Cameras

- CubeSat Cameras

- Onboard Spacecraft Cameras

- Others

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Electro-Optical (EO) Cameras

- Infrared (IR) Cameras

- Multispectral Cameras

- Hyperspectral Cameras

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Space Exploration

- Earth Observation and Remote Sensing

- Astronomy and Cosmic Studies

- Space Tourism and Entertainment

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Government and Military

- Commercial Enterprises

- Space Agencies

- Research Institutions

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Space Camera Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,598.24 million |

|

Market Size Value in 2025 |

USD 3,008.76 million |

|

Revenue Forecast in 2034 |

USD 11,801.88 million |

|

CAGR |

16.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global space camera market size was valued at USD 2,598.24 million in 2024 and is projected to grow to USD 11,801.88 million by 2034.

The global market is projected to register a CAGR of 16.4% during the forecast period.

In 2024, North America accounted for the largest share due to rising investments in space exploration, national security initiatives, and commercial satellite programs.

A few of the key players in the market are Canon; Hasselblad; Leica; Nikon; Micro-Cameras & Space Exploration; Malin Space Science Systems; Dragonfly Aerospace; Sode; Pentax; and KAIROSPACE Co., Ltd.

In 2024, the satellite cameras segment accounted for the largest market share due to the growing deployment of Earth observation, remote sensing, and communication satellites.

In 2024, the government and military segment accounted for the largest market share due to growing defense and national security initiatives.