South East Asia Polyurethane Adhesives Market Size, Share, Trends, Industry Analysis Report: By Industry Vertical (Footwear, Automotive, Construction, Packaging, and Others) and Country (Indonesia, Thailand, Malaysia, Singapore, and Rest of South East Asia) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5436

- Base Year: 2024

- Historical Data: 2020-2023

South East Asia Polyurethane Adhesives Market Overview

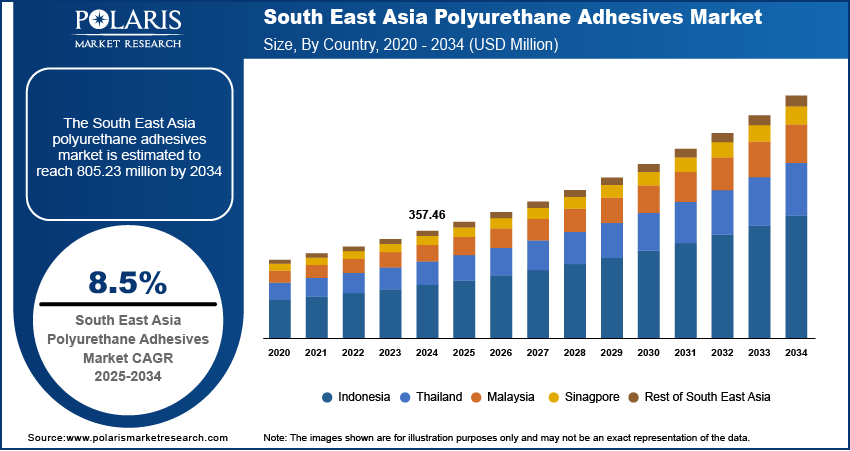

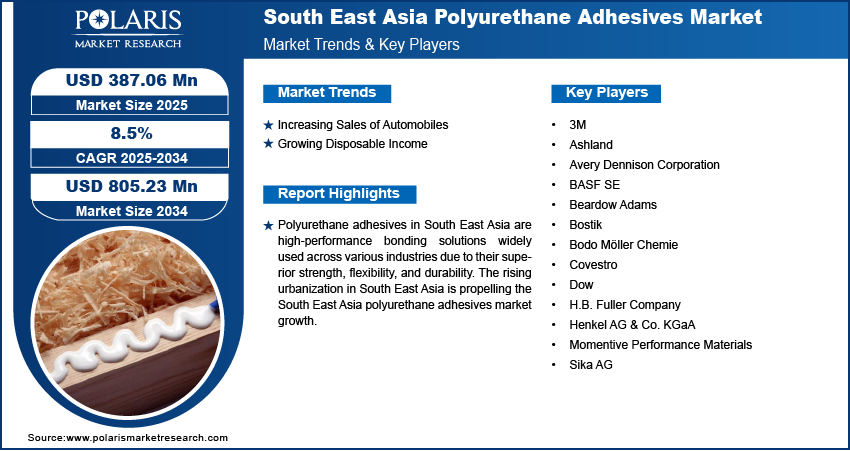

The South East Asia polyurethane adhesives market size was valued at USD 357.46 million in 2024. The market is projected to grow from USD 387.06 million in 2025 to USD 805.23 million by 2034, exhibiting a CAGR of 8.5% during 2025–2034.

Polyurethane adhesives are high-performance bonding solutions widely used across various industries due to their superior strength, flexibility, and durability. These adhesives are formulated from polyurethane polymers and are available in both one-component and two-components, offering excellent adhesion to a wide range of materials, including metals, plastics, wood, glass, and composites. The versatility, resistance to moisture and temperature fluctuations, and ability to bond dissimilar materials of polyurethane adhesives make them a preferred choice in multiple industries across South East Asia.

The rising urbanization in South East Asia is propelling the South East Asia polyurethane adhesives market growth. Governments and private developers in South East Asia are investing heavily in residential, commercial, and industrial construction to accommodate the growing urban population. This surge in construction projects has increased the demand for high-performance materials, including polyurethane adhesives. Builders and contractors prefer polyurethane adhesives as they provide strong bonding, flexibility, and resistance to environmental factors. These adhesives play a crucial role in flooring, panel bonding, insulation, and waterproofing applications, making them essential for modern construction projects. As the urban population is increasing in South East Asia, governments are prioritizing large-scale infrastructure projects such as bridges, airports, railways, and roads, leading to the high adoption of polyurethane adhesives. According to data published by the United Nations Economic and Social Commission for Asia and the Pacific in February 2024, half of South East Asia's population resides in urban areas, and an estimated additional 70 million people will inhabit South East Asian cities by the end of 2025.

To Understand More About this Research: Request a Free Sample Report

The South East Asia polyurethane adhesives market demand is driven by the growing e-commerce sector in the region. Increased e-commerce activities have led to a surge in demand for packaging materials that ensure product safety during transit. Businesses in the e-commerce supply chain rely on high-quality adhesives for secure packaging, and polyurethane adhesives have become a preferred choice. These adhesives provide strong bonding, flexibility, and resistance to moisture, making them essential for sealing cartons, assembling packaging materials, and ensuring product integrity.

The rise of online shopping has driven the growth of the logistics and warehousing industry. Companies are building large-scale fulfillment centers and automated warehouses to handle the increasing volume of orders. These facilities require durable construction materials, including flooring solutions, insulation panels, and conveyor belt systems, all of which depend on polyurethane adhesives. Hence, with the growing e-commerce sector in South East Asia, the demand for polyurethane adhesives is increasing in the region.

South East Asia Polyurethane Adhesives Market Dynamics

Increasing Sales of Automobiles

Automakers in South East Asia are expanding production facilities in key regions such as Thailand, Indonesia, and Vietnam to meet this rising vehicle demand. This propels the demand for polyurethane adhesives as they are essential materials in the automotive sector. Automobile manufacturers use polyurethane adhesives in various automotive applications, including windshield bonding, structural bonding, and interior assembly. These adhesives provide strong and durable bonds while reducing the overall weight of the vehicle. The growing popularity and adoption of electric vehicles (EVs) in South East Asia has further fueled the need for polyurethane adhesives. Automakers use these adhesives in battery assembly, thermal management systems, and electrical insulation to enhance the performance and safety of EVs. For instance, according to Nikkei ASEAN, automobile sales in the Philippines grew by 5% in Q3 of 2024, while Vietnam recorded a 25% surge in automobile sales in Q3 of 2024. Therefore, the demand for polyurethane adhesives is increasing in South East Asia with the rising sales of automobiles.

Growing Disposable Income

Increased income encourages consumers to invest more in housing, automobiles, electronics, and consumer goods, all of which require polyurethane adhesives in product development, manufacturing, and assembly. The electronics industry in the region is witnessing rapid growth due to higher consumer spending on smartphones, laptops, and home appliances. Manufacturers of these devices use polyurethane adhesives to assemble and protect electronic components, ensuring durability and resistance to heat and moisture. Furthermore, the footwear and packaging industries have also seen higher demand with the rising disposable income. People are buying more branded and high-quality shoes, leading to increased production and the use of polyurethane adhesives in shoe assembly. In e-commerce and retail, businesses require strong, flexible adhesives such as polyurethane adhesive for secure packaging solutions. Hence, rising consumer spending across various sectors in the region, due to increasing disposable income, propels the South East Asia polyurethane adhesives market development.

South East Asia Polyurethane Adhesives Market Assessment by Segment

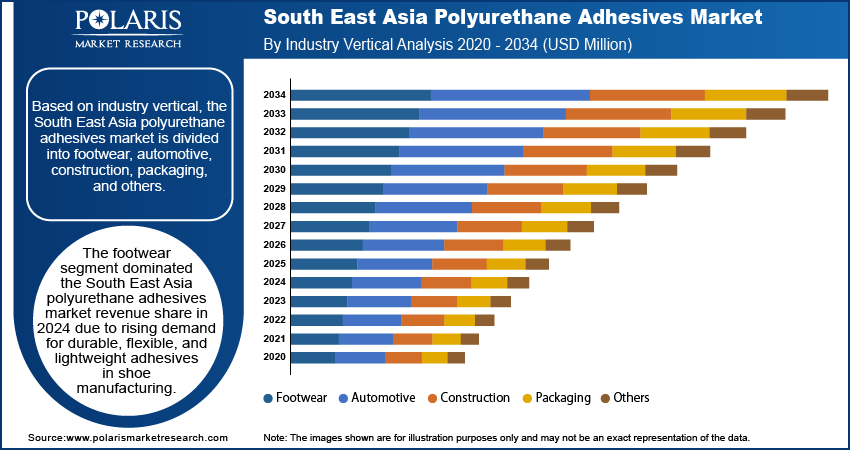

South East Asia Polyurethane Adhesives Market Evaluation by Industry Vertical

Based on industry vertical, the South East Asia polyurethane adhesives market is divided into footwear, automotive, construction, packaging, and others. The footwear segment dominated the South East Asia polyurethane adhesives market share in 2024 due to rising demand for durable, flexible, and lightweight adhesives in shoe manufacturing. The increasing preference for sports and casual footwear, driven by a growing middle-class population and higher disposable incomes, significantly contributed to the expansion of the segment. Polyurethane adhesives offer superior bonding strength, resistance to moisture and chemicals, and excellent flexibility, making them the preferred choice for assembling various shoe parts. The presence of major footwear manufacturing hubs in countries such as Vietnam, Indonesia, and Thailand further fueled demand. Additionally, the shift toward sustainable and solvent-free adhesives pushed manufacturers to adopt polyurethane-based solutions that align with environmental regulations and consumer preferences for eco-friendly products.

The automotive segment is expected to grow at a rapid pace in the coming years owing to the increasing production of electric vehicles (EVs) and the rising demand for lightweight materials to enhance fuel efficiency and reduce emissions. These adhesives play a critical role in vehicle assembly, providing strong adhesion, vibration resistance, and durability. Governments across South East Asia are actively promoting domestic automotive manufacturing, particularly in EV production, through incentives and infrastructure development. This trend, combined with the expansion of global automotive players in the region, is estimated to propel the demand for high-performance polyurethane adhesives in structural bonding, interior trims, and electronic component assembly.

South East Asia Polyurethane Adhesives Market Country Analysis

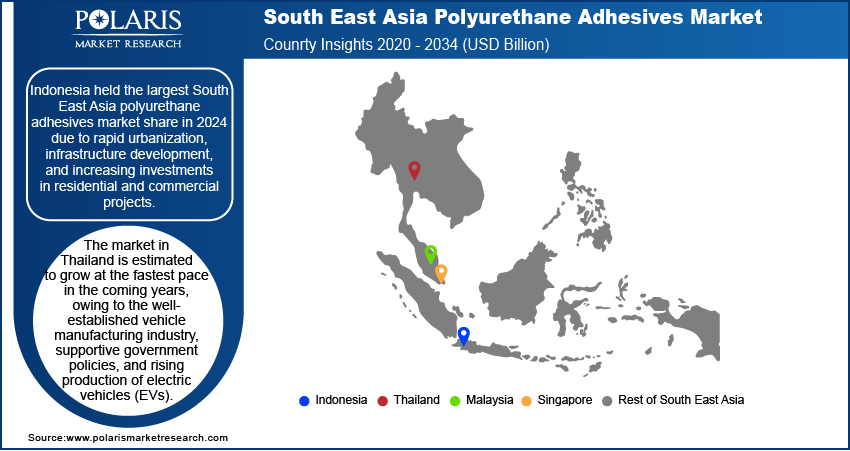

By country, the report provides South East Asia polyurethane adhesives market insight into Indonesia, Thailand, Malaysia, Singapore, and the Rest of South East Asia. Indonesia held the largest South East Asia polyurethane adhesives market revenue share in 2024 due to rapid urbanization, infrastructure development, and increasing investments in residential and commercial projects. The government in Indonesia is focusing on the development of infrastructure projects, such as the development of new airports, highways, and mass transit systems, which fueled the demand for high-performance polyurethane adhesives. Additionally, the growing middle-class population and rising disposable incomes in Indonesia spurred the construction of housing complexes and commercial spaces, further contributing to the South East Asia polyurethane adhesives market expansion.

The polyurethane adhesives market in Thailand is estimated to grow at the fastest pace in the coming years, owing to the well-established vehicle manufacturing industry, supportive government policies, and rising production of electric vehicles (EVs). The shift toward lightweight and energy-efficient vehicles is estimated to increase the adoption of polyurethane adhesives in car assembly, particularly in bonding applications for structural components and interior parts. Major automotive manufacturers are expanding their production capacities in Thailand, further strengthening the demand for advanced adhesive solutions, including polyurethane adhesives.

South East Asia Polyurethane Adhesives Market Players & Competitive Analysis Report

Major players in the South East Asia polyurethane adhesives market are intensifying their focus on research and development to enhance product performance and meet evolving industry demands. To strengthen their market presence, these companies are adopting strategic initiatives, including innovative product launches, global partnerships, increased investments in production capabilities, and mergers and acquisitions. By leveraging these strategies, businesses are expanding their geographical reach and driving technological advancements, boosting industry growth and maintaining a competitive edge in the global market.

The South East Asia polyurethane adhesives market is fragmented, with the presence of various regional market players. A few major companies in the market are 3M, Ashland, Avery Dennison Corporation, BASF SE, Beardow Adams, Bostik, Bodo Möller Chemie, Covestro, Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Momentive Performance Materials, and Sika AG.

Dow Inc. is a major global materials science company renowned for its innovative solutions across various sectors, including mobility, packaging, infrastructure, and consumer applications. In the field of polyurethane adhesives, Dow has been expanding its capabilities, particularly in South East Asia, with significant investments in high-performance thermally conductive adhesives and gap fillers. These adhesives are crucial for the automotive industry, especially in electric vehicle (EV) battery assembly, where they enhance mechanical properties and thermal management, contributing to vehicle safety, range, and reliability.

H.B. Fuller Company is a prominent global adhesives manufacturing firm headquartered in St. Paul, Minnesota. Founded in 1887 by Harvey Benjamin Fuller, the company has evolved into a major provider of adhesives, sealants, and specialty chemical products. With a diverse portfolio of over 20,000 products, H.B. Fuller serves a wide range of industries, including construction, electronics, hygiene products, and food packaging. The company's extensive global network and ability to provide customized adhesives solutions make it a strong contender in the South East Asia polyurethane adhesives market.

List of Key Companies in South East Asia Polyurethane Adhesives Market

- 3M

- Ashland

- Avery Dennison Corporation

- BASF SE

- Beardow Adams

- Bostik

- Bodo Möller Chemie

- Covestro

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Momentive Performance Materials

- Sika AG

South East Asia Polyurethane Adhesives Industry Developments

September 2024: Covestro, a Germany-based company producing polyurethane and polycarbonate raw materials, introduced a new adhesive solution for the automotive and footwear industries.

May 2024: Bodo Möller Chemie, an expert in adhesive solutions, expanded its presence in South East Asia through the opening of new branches in Thailand and Vietnam.

July 2023: Dow, the leading global materials science company, launched the new polyurethane flooring adhesive technology DIAMONDLOCK in Thailand. The product is versatile for use with various flooring substrates and is easy to cure and handle.

South East Asia Polyurethane Adhesives Market Segmentation

By Industry Vertical Outlook (Volume in Kilotons, Revenue, USD Million, 2020–2034)

- Footwear

- Automotive

- Construction

- Packaging

- Others

By Country Outlook (Volume in Kilotons, Revenue, USD Million, 2020–2034)

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of South East Asia

South East Asia Polyurethane Adhesives Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 357.46 Million |

|

Revenue Forecast in 2025 |

USD 387.06 Million |

|

Revenue Forecast in 2034 |

USD 805.23 Million |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The South East Asia polyurethane adhesives market size was valued at USD 357.46 million in 2024 and is projected to grow to USD 805.23 million by 2034.

The market is projected to record a CAGR of 8.5% during the forecast period.

Indonesia held the largest share of the market in 2024.

A few of the key players in the market are 3M, Ashland, Avery Dennison Corporation, BASF SE, Beardow Adams, Bostik, Bodo Möller Chemie, Covestro, Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Momentive Performance Materials, and Sika AG.

The footwear segment dominated the market in 2024.