Solid State Transformers Market Size, Share, Trends, Industry Analysis Report: By Voltage Level (HV/MV and MV/LV), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: pdf

- Report ID: PM5345

- Base Year: 2024

- Historical Data: 2020-2023

Solid State Transformers Market Overview

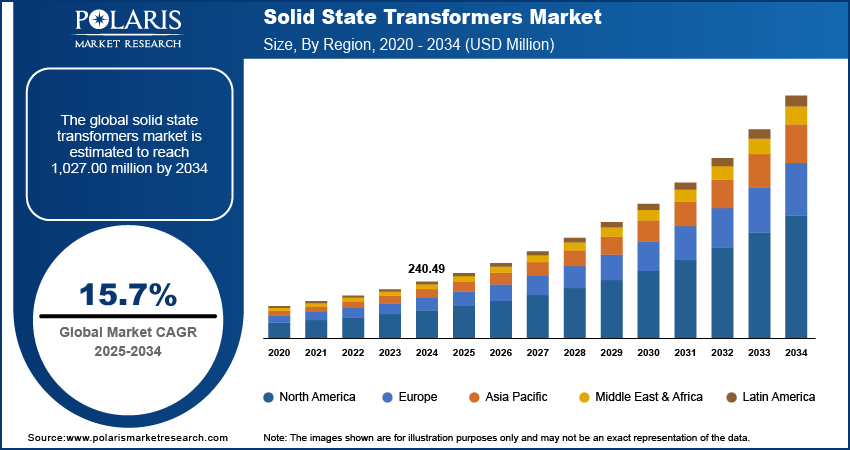

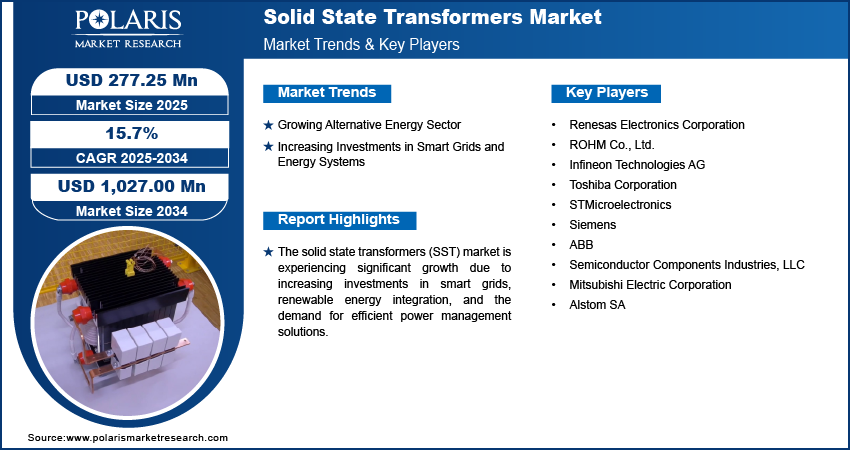

The solid state transformers market size was valued at USD 240.49 million in 2024. The market is projected to grow from USD 277.25 million in 2025 to USD 1,027.00 million by 2034, exhibiting a CAGR of 15.7% during the forecast period.

Solid state transformers (SSTs) are advanced power electronic devices that replace traditional transformers by using semiconductor components to manage and convert electrical power efficiently. They enable bidirectional power flow, grid integration of renewable energy, and improved energy management in modern electric power systems.

The market is rapidly evolving due to the increasing demand for efficient, reliable, and flexible power distribution units. The advanced transformers utilize power electronics to improve the integration of renewable energy sources, such as wind and solar, into the electrical grid. The solid state transformers market growth is driven by the global shift towards sustainable energy and the need for smarter, more resilient grids. SSTs offer advantages such as compact size, reduced losses, and the ability to manage bidirectional power flow, making them ideal for modernizing power systems. Additionally, their ability to efficiently convert and distribute power in renewable energy applications is fueling adoption. Several industries, such as utility, transportation, and industrial sectors, are recognizing the benefits of SSTs for grid modernization and electric vehicle charging infrastructure. The market is also poised for expansion with ongoing technological advancements and regulatory support for the need to reduce carbon footprints. For instance, in April 2024, the US Department of Energy (DOE) announced a USD 18 million funding initiative to support the development of Flexible Innovative Transformers Technologies (FITT).

To Understand More About this Research: Request a Free Sample Report

Solid State Transformers Market Dynamics

Growing Alternative Energy Sector

The expansion of the alternative energy sector, particularly solar and wind power, is driving the solid state transformers market demand. SSTs are well-suited for renewable energy systems as they enable efficient voltage regulation, grid integration, and bidirectional power flow, which are essential for managing intermittent energy sources. These transformers can seamlessly interface between renewable energy generators and the grid, enhancing energy efficiency and reducing losses.

The global push for clean energy and decarbonization is driving investments in advanced grid technologies, including SSTs, to support the transition toward sustainable power systems. For instance, in March 2023, the US Department of Energy (DOE) report highlighted advanced grid technologies such as energy storage and dynamic line rating as solutions to increase grid capacity and support peak demand growth. These measures aim to improve grid reliability and resilience, aligning with the goal of achieving a net-zero emissions economy by 2050. This trend is particularly evident in regions with significant renewable energy adoption, such as Europe and North America.

Increasing Investments in Smart Grids and Energy Systems

Increasing investments in smart grids and energy systems are driving the solid state transformers market revenue due to the advanced grid management and integration capabilities that benefit from the versatility of SSTs in handling the complexities of renewable energy sources, such as solar, wind, and electric vehicle charging. The shift toward decentralizing power generation and optimizing grid efficiency fuels the demand for SSTs that offer improved performance, efficiency, and faster response times compared to traditional transformers.

For instance, in October 2024, Schneider Electric introduced new smart grid solutions at Enlit Europe 2024 to improve grid resilience and flexibility and address the growing demand for net-zero energy goals. Additionally, governments and utilities are investing in these technologies to support the transition to more resilient, intelligent, and sustainable energy systems. This trend is aligned with the global move toward cleaner energy and decarbonization goals.

Solid State Transformers Market Segment Analysis

Solid State Transformers Market Assessment by Voltage Level Outlook

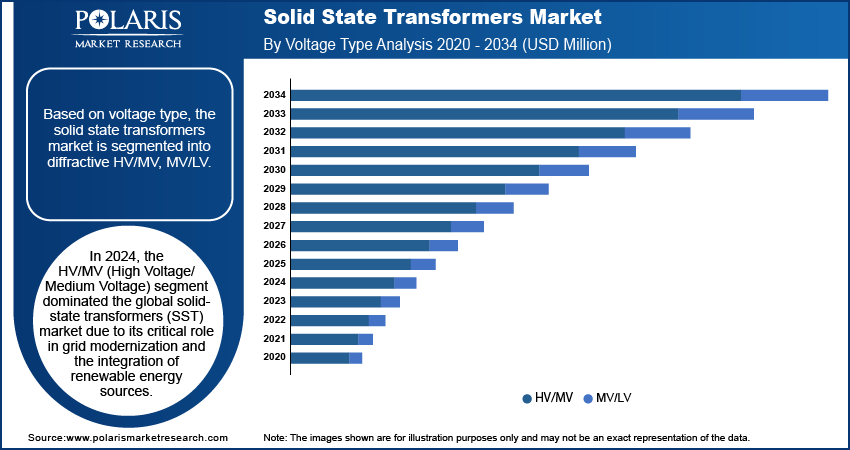

The global solid state transformers market segmentation, based on voltage level, includes HV/MV and MV/LV. In 2024, the HV/MV (High Voltage/Medium Voltage) segment dominated the global solid state transformers market share due to its critical role in grid modernization and the integration of renewable energy sources. HV/MV voltage levels are essential for improving the efficiency and reliability of power transmission, particularly in large-scale energy systems. HV/MV SSTs help optimize energy flow, support higher power capacities, and enhance grid resilience as energy grids become smarter and more decentralized. The adoption of these transformers is driven by the increasing demand for efficient, flexible solutions to manage renewable power integration and achieve grid stability, particularly as regions shift toward clean energy goals.

Solid State Transformers Market Evaluation by Application Outlook

The global solid state transformers market segmentation, based on application, includes renewable power generation, automotive, power grids, and traction locomotives. As per the solid state transformers market forecast, the automotive segment is anticipated to grow during 2025-2034 due to the increasing demand for electric vehicles (EVs) and advancements in automotive power electronics. SSTs are vital for EVs as they enable efficient power conversion, support charging infrastructure, and enhance the performance of in-vehicle electrical systems. The integration of SSTs allows for compact, high-performance solutions that can optimize power flow and reduce energy losses with the automotive industry's shift toward electrification and the need for more efficient energy management in vehicles. Moreover, the ongoing development of smart grids and vehicle-to-grid (V2G) technologies further boosts the adoption of SSTs in automotive applications.

Solid State Transformers Market Regional Insights

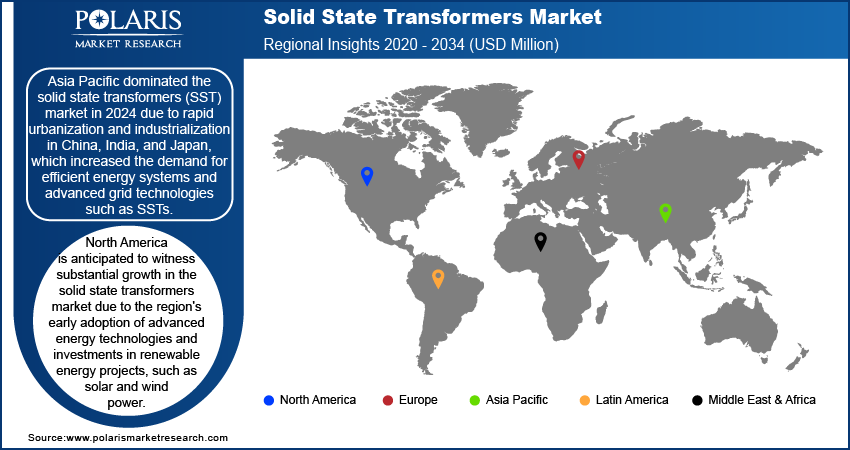

By region, the study provides solid state transformers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024 due to rapid urbanization and industrialization in China, India, and Japan, increasing the demand for efficient energy systems and advanced grid technologies, including SSTs. Additionally, the growing investments in renewable energy sources, such as solar and wind, require advanced transformers for efficient integration into power grids. The region's significant focus on smart grid development, along with strong government support for modernizing the energy infrastructure, further boosts solid state transformers market growth.

For instance, In September 2024, China commenced construction on its first hybrid power grid project in Jiangsu Province, combining both high-voltage alternating current (AC) and direct current (DC) systems. This initiative is a significant step in advancing the country's energy infrastructure, aiming to create a more efficient, safer, and environmentally friendly power grid. Moreover, Asia Pacific's role as a major manufacturing hub for electric vehicles (EVs) and the corresponding demand for efficient power electronics in EV charging stations contribute to the region's dominance. The adoption of SSTs is expected to increase in the coming years as energy efficiency and grid reliability continue to be priorities.

North America is anticipated to witness substantial growth in the market due to the early adoption of advanced energy technologies and investments in renewable energy projects, such as solar and wind power. The increasing focus on modernizing the power grid to improve efficiency and reliability, coupled with the integration of smart grids, is further driving solid state transformers market demand.

The presence of leading manufacturers and research institutions, alongside government initiatives promoting clean energy solutions, supports innovation and market growth. The rising adoption of electric vehicles (EVs) and associated charging infrastructure also fuels the demand for SSTs and plays a critical role in managing energy distribution effectively. For instance, in October 2022, Delta Electronics launched a 400 kW SST-based extremely fast EV charger developed in collaboration with US DOE (Department of Energy) partners. The innovation supports rapid EV charging and emphasizes the growing focus on efficient e-mobility infrastructure in North America, with a charging capacity of up to 500 Amps.

Solid State Transformers Market – Key Players and Competitive Analysis Report

The competitive landscape of the solid state transformers industry is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as STMicroelectronics, Siemens, ABB, and others in the market leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced solid state transformers solutions tailored for various applications, such as renewable energy integration, electric vehicle (EV) charging infrastructure, and smart grid technology. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions.

At the same time, smaller regional firms are entering the market with specialized SST solutions targeting local market demands, often focusing on customized and cost-effective applications. The competitive strategies in the solid state transformers market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence and cater to the growing demand for advanced grid solutions. A few key major players are Renesas Electronics Corporation; ROHM Co., Ltd.; Infineon Technologies AG; Toshiba Corporation; STMicroelectronics; Siemens; ABB; Semiconductor Components Industries, LLC; Mitsubishi Electric Corporation; Alstom SA

Toshiba manufactures and distributes electronic devices, energy systems, social infrastructure, and digital solutions. It operates in electronic devices and storage solutions, retail and printing solutions, battery business, energy and infrastructure systems and solutions, building solutions, and digital solutions. The energy systems and solutions division provides power generation systems for nuclear and thermal power plants and transmission, generation, and distribution systems for renewable energy. Additionally, they offer escalators, elevators, ventilation, and lighting solutions for buildings and facilities. The retail and printing solutions segment offers barcode printers, inkjet heads, peripherals, and retail solutions. The battery company specializes in creating rechargeable lithium-ion battery cells and industrial battery packs and modules. The electronic devices and storage solutions segment provides high-capacity HDDs for data centers, automotive and industrial semiconductors, equipment, and related materials and devices. Finally, the digital solutions segment focuses on AI, IoT, and quantum-related technologies. Toshiba manufactures various consumer and business products.

ABB operates as a technology company worldwide. The company operates through four segments that are electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgear under the distribution solution sub-segment. The motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation offer various energy and process industries and also offer measurement analytics, machine automation and robotics. Some of the prominent end-markets catered by the company are renewables, automotive, food & beverage, distribution, oil & gas, chemicals, mining & metals, buildings, etc. The company’s prominent channel partners include distributors followed by direct sales, engineering, procurement, and construction (EPCs), Original equipment manufacturers (OEMs), system integrators and panel builders. ABB was founded in 1988 and is headquartered in Zurich, Switzerland.

List of Key Companies in Solid State Transformers Market

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Infineon Technologies AG

- Toshiba Corporation

- STMicroelectronics

- Siemens

- ABB

- Semiconductor Components Industries, LLC

- Mitsubishi Electric Corporation

- Alstom SA

Solid State Transformers Market Developments

March 2021: Hitachi ABB Power Grids partnered with NTU Singapore to advance Solid State Transformer (SST) technology, supporting Singapore's Energy Grid 2.0 initiative for a more efficient, sustainable, and resilient energy system.

October 2024: Hitachi Energy manufactured its 1,000th WindSTAR transformers at its Vaasa, Finland facility. These transformers are designed to support offshore wind farms, contributing to the integration of renewable energy into power grids and advancing the transition toward carbon neutrality.

Solid State Transformers Market Segmentation

By Voltage Level Outlook (Revenue, USD Million, 2020–2034)

- HV/MV

- MV/LV

By Application Outlook (Revenue, USD Million, 2020–2034)

- Renewable Power Generation

- Wind Power

- Solar Power

- Tidal Power

- Automotive

- Power Grids

- Traction Locomotives

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Solid State Transformers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 240.49 million |

|

Market Size Value in 2025 |

USD 277.25 million |

|

Revenue Forecast by 2034 |

USD 1,027.00 million |

|

CAGR |

15.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global solid state transformers market size was valued at USD 240.49 million in 2024 and is projected to grow to USD 1,027.00 million by 2034.

The global market is projected to register a CAGR of 15.7% during the forecast period.

Asia Pacific dominated the solid state transformers (SST) market in 2024.

A few key players in the market are Renesas Electronics Corporation; ROHM Co., Ltd.; Infineon Technologies AG; Toshiba Corporation; STMicroelectronics; Siemens; ABB; Semiconductor Components Industries, LLC; Mitsubishi Electric Corporation; and Alstom SA

The HV/MV (High Voltage/Medium Voltage) segment dominated the global solid-state transformers (SST) market in 2024.

The automotive segment of the solid state transformers (SST) market is anticipated to grow during the forecast period.