Solder Materials Market Size, Share & Trends Analysis Report

By Product (Wire, Paste, Bar, Flux), By Process (Screen-printing, Robotic, Laser, Wave/Reflow), By Region; And Segment Forecasts, 2023 - 2032

- Published Date:May-2023

- Pages: 119

- Format: PDF

- Report ID: PM3249

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

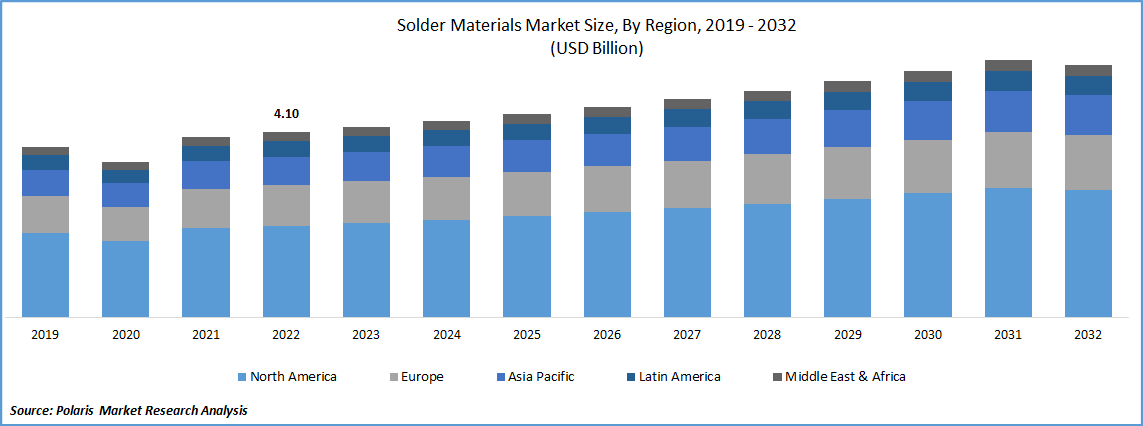

The size of the worldwide market for solder materials, which was estimated at USD 4.10 billion in 2022, is anticipated to grow at a CAGR of 3.19% from 2023 to 2032. The market is anticipated to be driven primarily by rising demand for smart devices and the development of energy-efficient electronics. Traditional micrometre solder pastes have a number of drawbacks, including high melting temperatures, which could cause unwanted tension during the reflow processing, limited uses, and joint defects. As a result, numerous nanoparticle- and sub-microscopic-sized solder compounds have been developed.

Know more about this report: Request for sample pages

The expansion of the electronics repair sector is anticipated to be the main driver of the solder materials market in the United States. The demand for these materials is also anticipated to increase over the forecast period as a result of increasing electronic device production in the area and the existence of an important electronics aftermarket industry. Thermal excursion during electronic assembly has been decreased thanks to intensive R&D efforts on the part of leading businesses to produce advanced solder materials like Sn-Bi-Ag alloy.

In turn, this has made it unnecessary to use the traditional wave soldering method, improving reliability and lowering energy costs. The replacement of lead solders has received significant attention from numerous governments around the globe due to their toxic nature. However, a low lead-based solder is an environmentally friendly substitute that can be used up until the regulatory bodies implement a complete ban. It is anticipated that increased use of these low-lead products will support market expansion.

Over the course of the forecast period, process automation advancements in soldering techniques are also anticipated to support market development. Automation has reduced the need for human involvement during the soldering process, increasing productivity. As a result, the market is anticipated to expand significantly in the years to come.

Global markets have been significantly impacted by the coronavirus' quick spread because major economies around the world are currently on full lockdown as a result of the pandemic. As many of the electronics manufacturing facilities stayed shut down, the demand for solder materials decreased. For instance, it is anticipated that the semiconductor business in India will decline by 0.9% in 2022. As a result, the demand for solder materials will decline due to the decline in the semiconductor sector.

An emerging tendency in the industry is the adoption of automated soldering solutions. The use of automation in the soldering process has grown considerably as a result of increased vendor knowledge of growing automation and vendor efforts to use automation to gain a competitive advantage. Vendors previously used small-scale automation for soldering, but as robotics technology has advanced, robots are now used in soldering operations. Robotic soldering boosts productivity, quality, productivity, and scrap reduction while also enhancing the efficiency of soldering processes.

The price fluctuation of raw materials is a significant barrier to market expansion. The supply and price changes of the raw materials used in the production of solder materials affect the manufacturers of solder materials (primarily steel, brass, copper, silver, and aluminium alloys). The availability and costs of energy costs, raw materials, such as steel and non-ferrous metals and materials, are prone to volatility and are influenced by factors such as the state of the global economy, the balance between global supply and demand, the amount of inventory on hand, the accessibility of substitute materials, the value of the local currency, any impending or perceived shortages, and governmental trade policies.

For Specific Research Requirements, Speak With a Research Analyst

Industry Dynamics

Growth Drivers

The proliferation of electrical parts in automobiles is a significant factor in market expansion. Due to the increasing use of electronic components in automobiles, such as the introduction of advanced driver-assistance systems (ADAS) and infotainment systems in mass-produced mid-segment cars, the demand for automotive PCBs (printed circuit boards) is anticipated to rise.

The demand for advanced PCBs supporting numerous electronic components integrated into them will increase as in-vehicle electronics are used more frequently in cars. In order to keep the electrical flow, soldering is necessary during the integration of many electronic components. This will increase the demand for solder materials, which will fuel the market's expansion over the course of the projection period.

Report Segmentation

The market is primarily segmented based on component, product type, process, and region.

|

By Product |

By Process |

By Region |

|

|

|

Know more about this report: Request for sample pages

The wire segment is expected to dominate the market during forthcoming years

Widespread use of wires in PCB soldering and better output are major market drivers. For instance, people should be conscious that certain wires should only be used in certain situations, such as acid core solder wire, which is okay for plumbing but not for electronics because it contains acid.

The market is expanding as a result of the introduction of advanced solder wires with specialized flux leads and improved characteristics like mechanical strength and electrical contacts. In addition, greater use in the electronics sector is anticipated to drive up demand for wires.

The transaction monitoring segment will account for a higher share of the market during forecast period

The largest process segment, wave/reflow, dominated the market as it prevents damage from overheating, it is one of the methods for soldering that is most frequently used in the electronics business. The segment will grow because the method can also be applied to mass production.

The fastest-growing industry is robotic process because it offers a fully automated answer. Recent years have seen many technological breakthroughs in the fields of robotic and laser soldering. The segment is also anticipated to expand as advanced robotic solutions are introduced.

The demand in North America is expected to witness significant growth during forecast period

Due to the quickly growing electronics and semiconductor industries, North America is the second-largest regional market after Asia Pacific. This was attributed to the country's expanding refurbishing sector. The growth is anticipated to increase during the forecast period due to increased output of sophisticated semiconductor devices.

Competitive Insight

Fusion, Inc., Indium Corporation, Kester, Koki Company ltd, Lucas Milhaupt, Inc., Nihon Genma, Qualitek International, Inc., Senju Metal Industry Co., Ltd., Stannol GmbH Co. KG, Tamura Corporation, and The Dow Chemical Company are major market participants in the solder materials market.

Recent Developments

- Technology advancements are a key trend in the solder materials market. Companies operating in the solder materials market are developing various technological advancements for soldering metal alloys to gain a competitive edge in the market.

- For instance, in June 2022, SAFI-Tech Inc., a US-based manufacturer of lead-free soldering alloys, developed a new super-cooled soldering technique based on SAC305 to address the incompatibility with high temperatures. The micro-encapsulation process develops a new form factor that stabilizes the supercooled liquid phase of SAC305 inside a nanofilm shell. It extends the usefulness of this liquid phase to temperatures well below the alloy's typical solidification point, enabling it to be applied throughout the entire extended liquid range at temperatures suitable for each product design. This method prevents thermal damage to components and materials while mitigating quality difficulties caused by a coefficient of thermal expansion mismatch.

Solder Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.22 billion |

|

Revenue forecast in 2032 |

USD 5.60 billion |

|

CAGR |

3.19% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Process, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Fusion, Inc., Indium Corporation, Kester, Koki Company ltd, Lucas Milhaupt, Inc., Nihon Genma, Qualitek International, Inc., Senju Metal Industry Co., Ltd., Stannol GmbH Co. KG, Tamura Corporation |

FAQ's

key companies in solder materials market are Fusion, Inc., Indium Corporation, Kester, Koki Company ltd, Lucas Milhaupt, Inc., Nihon Genma, Qualitek International, Inc., Senju Metal Industry Co., Ltd.

The solder materials market anticipated to grow at a CAGR of 3.19% from 2023 to 2032.

The solder materials market report covering key segments are product, process, and region.

key driving factors in solder materials market are increasing use of electronic components in automobiles.

The global solder materials market size is expected to reach USD 5.60 billion by 2032.