Solar Panel Recycling Market Size, Share, Trends, Industry Analysis Report

: By Type, Process, Shelf Life (Normal Loss and Early Loss), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM3069

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

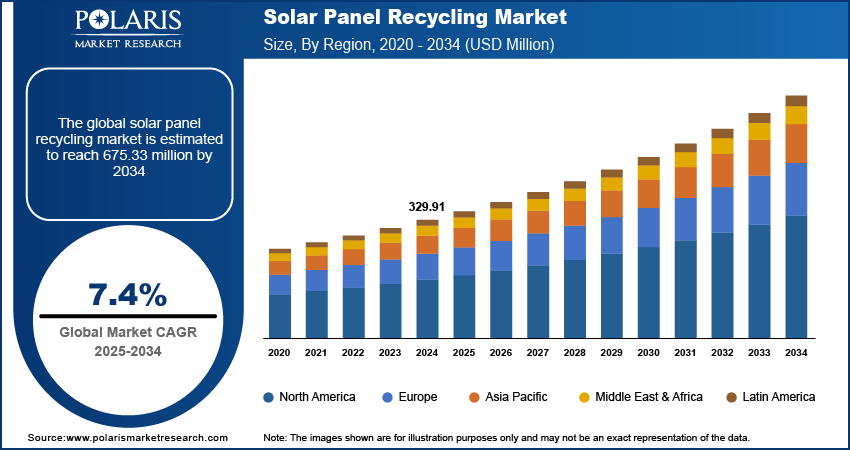

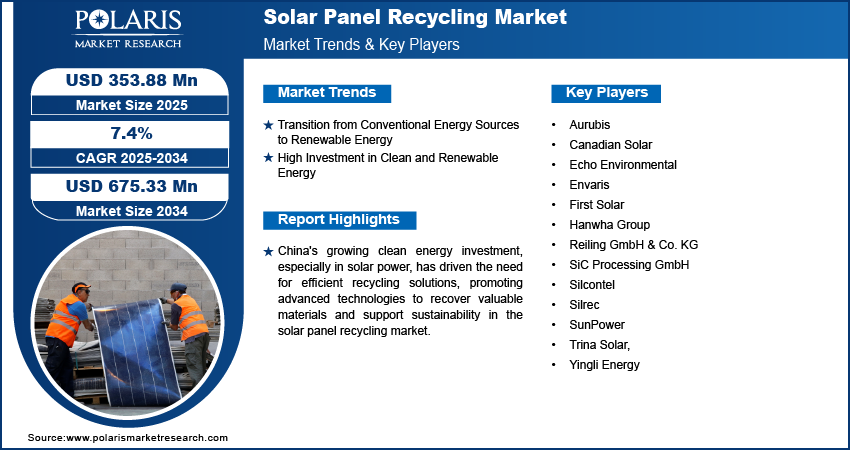

The global solar panel recycling market size was valued at USD 329.91 million in 2024, growing at a CAGR of 7.4% during 2025–2034. The market growth is primarily driven by the introduction of government initiatives and regulations encouraging the responsible disposal of solar panels.

Key Insights

- The silicon segment is anticipated to register the fastest growth during the projection period. This is primarily because crystalline silicon is present in most solar panels.

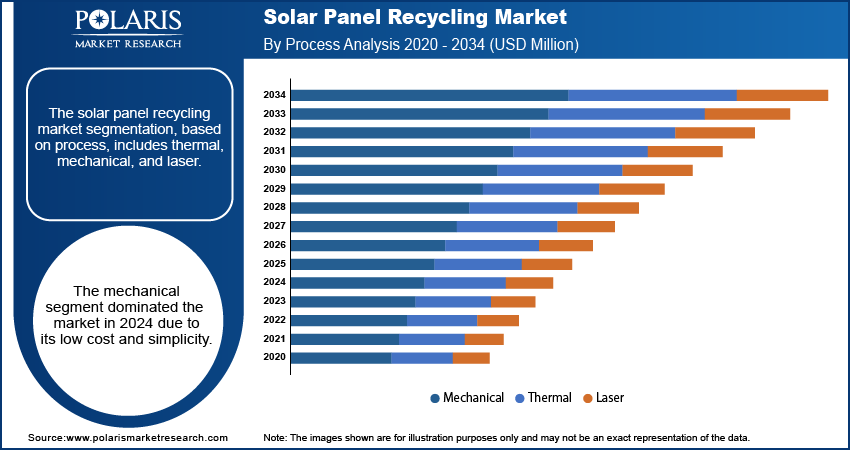

- The mechanical segment accounted for the largest market share in 2024. The simplicity, low cost, and ability to recover a high percentage of valuable materials contribute to the segment’s leading market position.

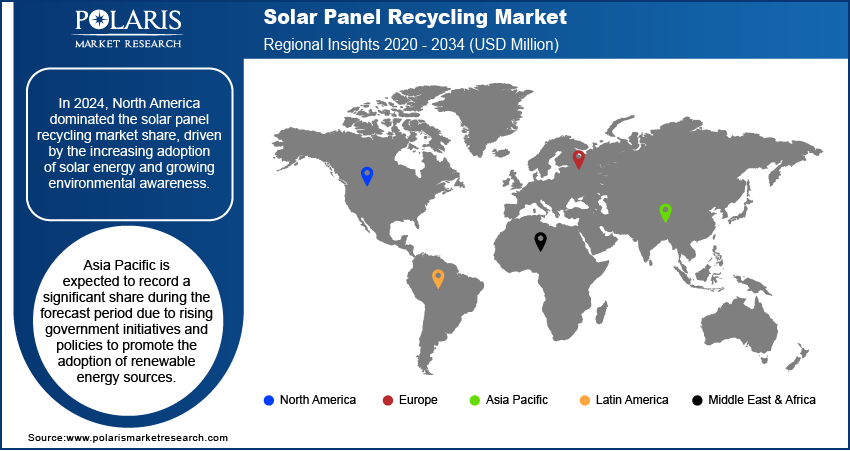

- North America led the global market in 2024. The regional market dominance is primarily attributed to growing environmental awareness and rising adoption of solar energy.

- Asia Pacific is anticipated to register a significant market share during the projection period. This is due to the launch of initiatives and policies by governments across the Asia Pacific for promoting the adoption of renewable energy sources.

Industry Dynamics

- The shift from conventional energy to renewable energy sources like solar has created an increased demand for recycling solutions for end-of-life solar panels.

- Rising investments by individuals, businesses, and governments globally in solar power to promote sustainability and reduce carbon emissions drive market growth.

- Technological advancements in recycling technologies are expected to create several market opportunities in the coming years.

- The high initial cost associated with solar panel recycling may hinder market growth.

Market Statistics

2024 Market Size: USD 329.91 million

2034 Projected Market Size: USD 675.33 million

CAGR (2025-2034): 7.4%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Solar panel recycling involves the process of reclaiming valuable materials from used or damaged solar panels, such as silicon, metals, and glass, to be reused in the production of new panels or other products. This helps reduce waste, conserve natural resources, and lower the environmental impact of solar energy systems.

Government policies and regulations promote the use of renewable energy sources and encourage the responsible disposal of solar panels. On May 19, 2022, Solar PV cells and modules (panels) were incorporated by MoEFCC (Ministry of Environment, Forest and Climate Change) into its amended draft E-waste management guidelines via Gazette; by doing so, it has established a niche reputation and joined an exclusive group of nations that address environmental issues related to solar energy. These government initiatives and regulations are driving the solar panel recycling market development.

The solar panel recycling market demand is expected to rise during the forecast period due to the continued high value of the renewable energy industry and rising investments in solar power generation. The development of solar technology is predicted to attract investments and offer new chances for industry participants to grow. Due to the quick pace of PV installation, the number of retired PV panels has also surged. This is expected to accelerate the solar panel recycling market expansion. According to the International Energy Agency, by 2050, the value of clean resources may exceed USD 15 million, sufficient to power 630 GW with 2 million solar panels. In the upcoming 10–20 years, lifespan of solar panels is anticipated to drive demand for recycling process globally.

Market Dynamics

Transition from Conventional Energy Sources to Renewable Energy

The rising adoption of solar power leads to an increase in the number of installed solar panels, creating a higher demand for recycling solutions when these panels stop working. According to Invest India, in India alone, the installation of solar capacity increased from 21,651 MW in 2018 to 70,096 MW in 2023. Recycling helps recover valuable materials such as silicon and metals, reducing waste and minimizing environmental impact. This adoption supports the transition to a more sustainable energy system, ensuring that resources are reused and extending the lifecycle of solar panels. The rising transition from conventional energy sources to renewable energy is driving the solar panel recycling market growth.

High Investments in Clean and Renewable Energy

Governments, businesses, and individuals are investing in solar power to reduce carbon emissions and promote sustainability, leading to a rise in the number of solar panels installed globally. According to the International Energy Agency, in 2022, USD 1.6 trillion was invested in clean energy, showcasing a large amount as an investment in the energy. This growing use of solar panels creates a need for effective recycling solutions once the panels reach the end of their life. Hence, the high investments in clean and renewable energy are driving the solar panel recycling market development.

Segment Analysis

Assessment by Type Outlook

The solar panel recycling market segmentation, based on type, includes silicon, monocrystalline, polycrystalline, and thin-film. The silicon segment is expected to witness the fastest growth during the forecast period, as over 95% of solar panels sold are made of crystalline silicon. Solar cells in this kind of panel have a silicon crystal structure. These solar panels frequently have trace amounts of precious metals such as silver and copper incorporated within them. Solar panels made of crystalline silicon are effective, affordable, and have lengthy lifespans; modules are anticipated to last for at least 25 years. These benefits fuel the market growth for the segment.

Evaluation by Process Outlook

The solar panel recycling market segmentation, based on process, includes thermal, mechanical, and laser. The mechanical segment dominated the solar panel recycling market share in 2024. Mechanical recycling involves physically breaking down the solar panels into smaller components, such as glass, aluminum, and silicon, which are easily recovered and reused. This method is widely used due to its low cost and simplicity, as well as its ability to recover a high percentage of valuable materials from the solar panels. The laser and thermal segments are also expected to witness significant growth during the forecast period, driven by the increasing demand for high-purity silicon and the need for sustainable and responsible recycling solutions for decommissioned solar panels.

Regional Analysis

By region, the study provides the solar panel recycling market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the solar panel recycling market revenue share, driven by the increasing adoption of solar energy and growing environmental awareness. The US and Canada are investing heavily in renewable energy, leading to a rise in the number of solar panels being installed. According to the International Energy Agency, in 2024, the US accounted for 15% of global clean energy investment. Approximately 40% of new electric generation capacity in the US was generated by solar panels in 2020, up from just 4% in 2010. In the country as a whole, solar technology was used to generate 3.3% of the electricity in 2020. Once these panels reach the end of their lifespan, there is a growing need for recycling solutions to manage waste and recover valuable materials, including silicon and metals. Additionally, stringent environmental regulations and government incentives are encouraging the development of sustainable recycling technologies, further boosting the North America solar panel recycling market expansion.

Asia Pacific is expected to record a significant solar panel recycling market share during the forecast period. Several governments of Asia Pacific are launching initiatives and policies to promote the adoption of renewable energy sources, the demand for the solar panel recycling is growing as more people adopt renewable energy with government support, thereby driving the growth of the solar panel recycling market expansion in Asia Pacific.

China’s growing investments in clean energy are fueling the solar panel recycling market expansion in the country. According to the China Briefing, in 2023, China invested USD 863 million in clean energy, which showcases growing investments in clean energy. The country’s focus on renewable energy, particularly solar power, has led to a rapid increase in the installation of solar panels. This growth creates a need for efficient recycling solutions once panels reach the end of their life. Investments in advanced recycling technologies are enabling the recovery of various valuable materials such as silicon and metals, reducing waste, supporting sustainability, and driving the solar panel recycling market growth in the country.

Key Players & Competitive Analysis Report

The solar panel recycling market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the solar panel recycling industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the solar panel recycling market include First Solar, Echo Environmental, Silcontel, Canadian Solar, Silrec, SunPower, Reiling GmbH & Co. KG, Trina Solar, Aurubis, Envaris, SiC Processing GmbH, Yingli Energy, and Hanwha Group.

Canadian Solar Inc., established in 2001 and based in Guelph, Ontario, Canada, is a prominent player in the solar energy sector. The company focuses on manufacturing solar photovoltaic (PV) odules and battery energy storage systems (BESS). It also provides integrated energy solutions, which include inverters and engineering, procurement, and construction (EPC) services. Canadian Solar has developed advanced PV modules utilizing N-type TOPCon solar cells, which are known for their efficiency and reliability. The company has shipped over 6.5 GWh of battery products globally through its subsidiary e-STORAGE. Additionally, it has engaged in utility-scale solar and energy storage project development, having developed more than 10 GWp of solar projects and 3.3 GWh of energy storage projects since 2010. The company operates in various regions worldwide, including North America, South America, Europe, Africa, the Middle East, Australia, and Asia. Its manufacturing facilities are primarily located in China, Southeast Asia, and the US, with over 26 facilities globally. Canadian Solar also maintains subsidiaries in 23 countries to support its operations across different markets. Canadian solar with partnership with SOLARCYCLE offers comprehensive, eco-friendly solar panel recycling, extracting up to 95% of valuable materials like silver, silicon, and aluminum for repurposing. Their technology minimizes waste and supports a circular economy for solar energy. Canadian Solar partners with SOLARCYCLE to provide end-of-life recycling services for their solar solutions.

SunPower Corporation is an American solar energy company headquartered in San Jose, California. Founded in 1985 by Richard Swanson, the company has developed a reputation for providing photovoltaic solar energy systems and battery storage solutions, primarily for residential customers. SunPower became publicly traded in 2005 and has undergone various ownership changes, including a significant acquisition by TotalEnergies in 2011, which later reduced its stake to 32.5%. The company operates through three main segments—residential, commercial, and power plants. The residential segment focuses on high-efficiency solar solutions for homeowners, while the commercial segment serves businesses seeking to reduce energy costs and improve sustainability. The power plant segment provides large-scale solar solutions to utility companies. Key products include solar panels known for their efficiency, inverters that optimize energy conversion, and energy storage systems such as the SunVault, which integrates solar technology with energy management. SunPower primarily operates in North America, with a strong presence in the US and Canada. The company has also expanded into international markets, including Europe and Asia, through strategic acquisitions. In August 2024, SunPower filed for Chapter 11 bankruptcy protection due to financial challenges. Despite this setback, the company continues to focus on residential installations and the development of solar technologies.

List of Key Companies

- Aurubis

- Canadian Solar

- Echo Environmental

- Envaris

- First Solar

- Hanwha Group.

- Reiling GmbH & Co. KG

- SiC Processing GmbH

- Silcontel

- Silrec

- SunPower

- Trina Solar

- Yingli Energy

Solar Panel Recycling Industry Developments

In January 2023, First Solar finished the sale of Luz del Norte, a utility-scale solar power facility in Copiapó, Chile, with a 141 MW AC capacity, to the Toesca, a private asset manager with its headquarters in Chile.

In January 2023, CSI Solar signed an investment agreement with the municipal body of the Jiangsu Province, China, according to a statement from Canadian Solar.

Solar Panel Recycling Market Segmentation

By Type Outlook (Revenue USD Million, 2020–2034)

- Silicon

- Monocrystalline

- Polycrystalline

- Thin-Film

By Process Outlook (Revenue USD Million, 2020–2034)

- Thermal

- Mechanical

- Laser

By Shelf-Life Outlook (Revenue USD Million, 2020–2034)

- Normal Loss

- Early Loss

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Solar Panel Recycling Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 329.91 million |

|

Market Size Value in 2025 |

USD 353.88 million |

|

Revenue Forecast by 2034 |

USD 675.33 million |

|

CAGR |

7.4% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The solar panel recycling market size was valued at USD 329.91 million in 2024 and is projected to grow to USD 675.33 million by 2034.

The global market is projected to register a CAGR of 7.4% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are First Solar, Echo Environmental, Silcontel, Canadian Solar, Silrec, SunPower, Reiling GmbH & Co. KG, Trina Solar, Aurubis, Envaris, SiC Processing GmbH, Yingli Energy, and Hanwha Group.

The mechanical process segment dominated the market in 2024 due to its low cost and simplicity.

The silicon segment is expected to witness the fastest growth during the forecast period, as solar panels with crystalline silicon make up most of the market.