Solar Inverters/PV Inverters Market Size, Share, Trends, Industry Analysis Report: By Type (Central Inverters, String Inverters, and Microinverters), Deployment, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM1351

- Base Year: 2024

- Historical Data: 2020-2023

Solar Inverters/PV Inverters Market Overview

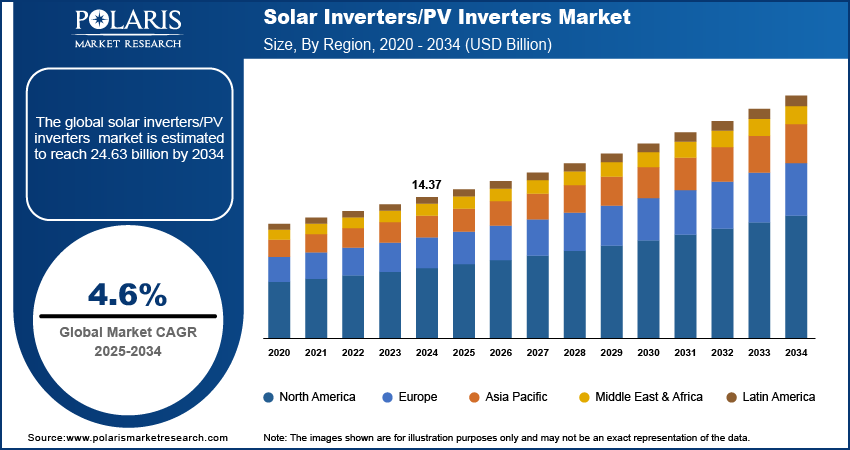

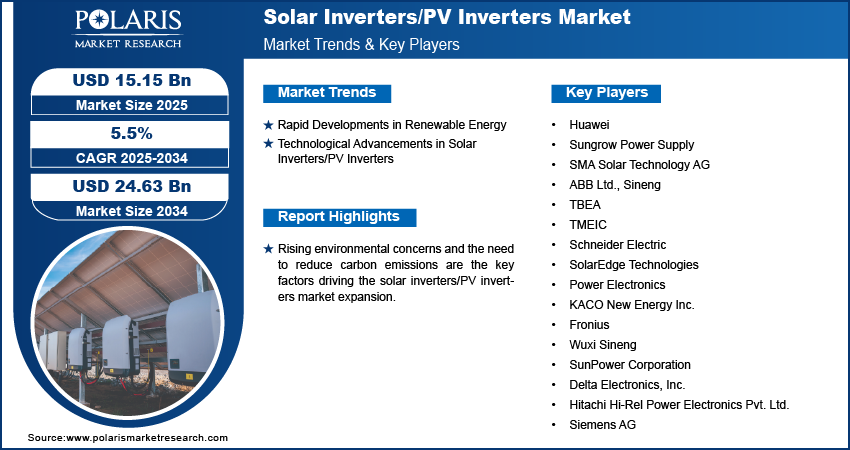

The global solar inverters/PV inverters market size was valued at USD 14.37 billion in 2024. The market is projected to grow from USD 15.15 billion in 2025 to USD 24.63 billion by 2034, exhibiting a CAGR of 5.5% from 2025 to 2034.

Solar inverters/PV inverters are devices that transform the direct current (DC) electricity generated by solar panels into alternating current (AC) electricity. The AC electricity can then be used to operate appliances, fed into the electrical grid, or supplied to an off-grid AC network. Solar inverters/PV inverters are available in different types such as microinverters, string inverters, and hybrid inverters.

The rising solar inverters/PV inverters market development is driven by increasing environmental concerns and the need to reduce carbon emissions. This is fueling the demand for clean energy alternatives and optimized solar power systems. According to the International Energy Agency (IEA), solar photovoltaic (PV) power generation increased by 270 terawatt-hours in 2022, accounting for 4.5% of total global electricity generation.

To Understand More About this Research: Request a Free Sample Report

Governments are supporting the solar inverters/PV inverters market expansion by offering incentives for renewable energy technologies. These include funding for solar projects and initiatives aimed at bringing electricity to rural areas. In addition, government efforts to reduce carbon emissions by installing solar power plants are creating a strong demand for efficient solar inverters, which are essential for converting solar energy into usable electricity. For instance, in September 2022, the Ministry of New & Renewable Energy’s Grid Solar Power Division allocated USD 1.66 billion (INR 14,007 crore) for the development of high-efficiency solar PV modules under the Production Linked Incentive Scheme.

Rising awareness about solar inverters and their increasing integration with other renewable technologies are the key solar inverters/PV inverters market trends anticipated to drive the adoption of solar inverters in the upcoming years. In addition, a greater focus on technological advancements to optimize the efficiency and flexibility of solar inverters is projected to create lucrative solar inverters/PV inverters market opportunities during the forecast period.

Solar Inverters/PV Inverters Market Dynamics

Rapid Developments in Renewable Energy

Solar inverters have become easier to install, contributing to their widespread adoption across various solar power systems. In addition, the growing focus on renewable energy sources, owing to their various benefits such as environmental protection, sustainable development, and more resilient electrical grid, has driven the demand for efficient solar inverters, which are crucial for converting solar energy into usable electricity. As renewable energy becomes more common, the demand for solar inverters increases, further speeding up the transition to clean energy solutions. Thus, the rapid developments in renewable energy propel the solar inverters/PV inverters market revenue.

Technological Advancements in Solar Inverters/PV Inverters

Enhanced efficiency, reliability, and grid interfacing capabilities are making solar PV systems more attractive. Advancements in power electronics, high-performance inverters, and maximum power point tracking (MPPT) optimization are key drivers of this shift. In addition, the integration of smart grids and energy storage boosts the value proposition. These innovations reduce costs and improve performance, paving the way for wider adoption of solar energy. Thus, rising advancements in solar inverter technology are driving the solar inverters/PV inverters market growth.

Solar Inverters/PV Inverters Market Segment Insights

Solar Inverters/PV Inverters Market Outlook by Type Insights

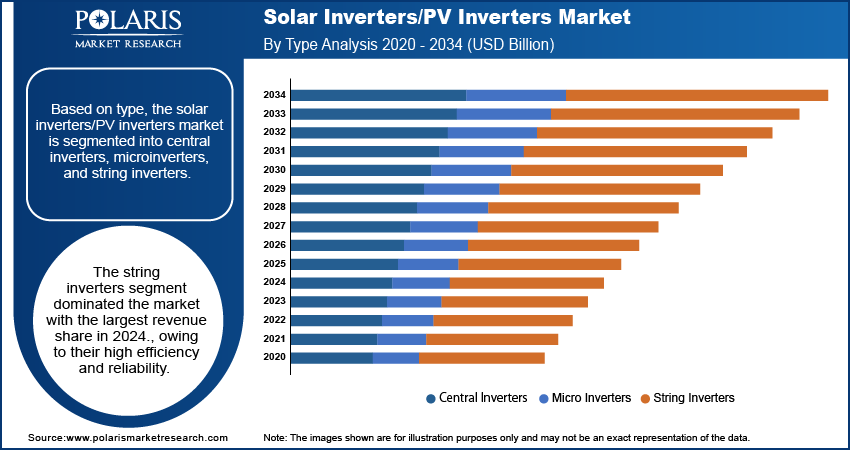

The solar inverters/PV inverters market, based on type, is segmented into central inverters, string inverters, and microinverters. The string inverters segment dominated the market with the largest revenue share of 49.10% in 2024. String inverters are connected to a string of solar inverters called the string array. These inverters are known for their efficiency and reliability. They can handle high voltages and output and provide reliable performance in extreme temperatures. Also, string inverters have comparatively fewer connections, making them easier to troubleshoot. Thus, the various benefits of string inverters contribute to their dominance in the market.

Solar Inverters/PV Inverters Market Outlook by End Users Insights

The solar inverters/PV inverters market, based on end users, is segmented into utilities, commercial, and industrial. The utilities segment accounted for the largest market share of 46.33% in 2024. String inverters and central inverters are the two most commonly used types of solar inverters in the utility sector. Rising renewable energy demand, reduced solar devices and equipment cost, and increasing government funding are among the key factors driving the utility sector growth. The presence of several market participants offering advanced utility-scale solutions to reduce balance-of-system costs and achieve higher efficiency further contributes to the growth of the segment.

Solar Inverters/PV Inverters Market Regional Analysis

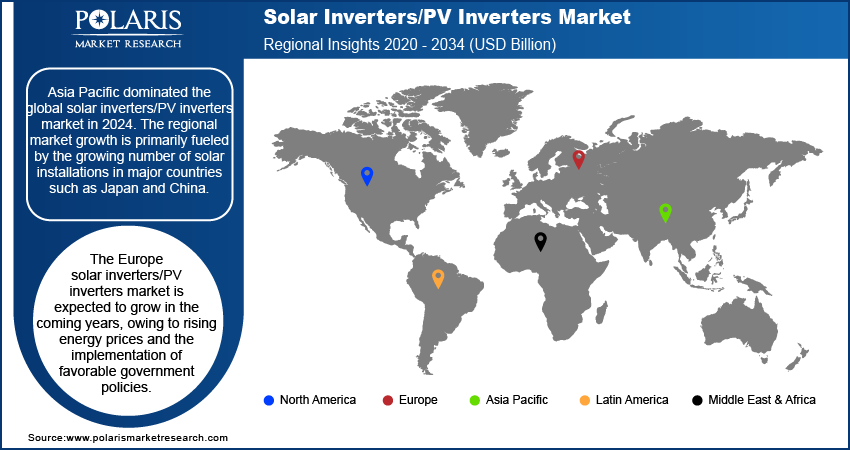

By region, the solar inverters/PV inverters market research report offers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market with a revenue share of 46.10% in 2024. The regional market growth is primarily fueled by the growing number of solar installations in countries such as Japan and China. In addition, a positive outlook for product demand in India presents potential factor for regional market growth.

North America accounted for a significant share of the global solar inverters/PV inverters market in 2024, with the US being a key contributor to the regional market demand. The US is a major market for various solar inverters types. A few recent inverter trends in the US are the increasing adoption of 1.5 MW capacity central inverters and 60 kW capacity string inverters. Though North America experienced robust demand for string inverters, central PV inverters are anticipated to continue their dominance due to their scalability and efficiency in large-scale solar installations.

The Europe solar inverters/PV inverters market is expected to grow during the forecast period, owing to rising energy prices and the implementation of favorable government policies. The rise in electric vehicle (EV) charging infrastructure in the region further supports the solar inverters/PV inverters market development. In Europe, Germany held the largest market share and is expected to witness the fastest growth, as the country is known for its strong renewable energy policies and substantial investments in solar power.

Solar Inverters/PV Inverters Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the solar inverters/PV inverters market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, market participants must offer innovative solutions.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the solar inverters/PV inverters market to benefit clients and increase their market share. The report offers a market assessment of all the key market players, including Huawei; Sungrow Power Supply; SMA Solar Technology AG; ABB Ltd.; Sineng; TBEA; TMEIC; Schneider Electric; SolarEdge Technologies; Power Electronics; KACO New Energy Inc.; Fronius; Wuxi Sineng; SunPower Corporation; Delta Electronics, Inc.; Hitachi Hi-Rel Power Electronics Pvt. Ltd.; and Siemens AG.

Huawei is a gloabal player focusing on innovating string inverters, energy storage, digital upgrades, system security, and smart grid connections. The company caters to the solar energy market by offering a diverse array of solar products and solutions, including smart module collectors, smart string ESS, smart chargers, smart chargers, EMMA, and accessories. In May 2023, Huawei announced the launch of its new FusionSolar strategy and Smart PV+Energy Storage System (ESS) solutions. The company stated the introduction of these solutions supports its shift toward renewable energy.

Sungrow is a global leader in PV inverters and energy storage. With a massive installed base and a dedicated R&D team, they offer solutions for various solar applications. Their commitment to innovation is evident in innovative technologies such as the introduction of the world's first 35kV solid-state transformer PV inverter. Sungrow's extensive global presence solidifies its position as a key player in the solar and clean energy sectors. In February 2024, Sungrow introduced its new string inverter series, the SG iNext. According to the company, the latest series boasts significant efficiency improvements and enhanced grid support features, underscoring its commitment to advancing solar technology and enhancing power system performance.

List of Key Companies in Solar Inverters/PV Inverters Market

- Huawei

- Sungrow Power Supply

- SMA Solar Technology AG

- ABB Ltd.

- Sineng

- TBEA

- TMEIC

- Schneider Electric

- SolarEdge Technologies

- Power Electronics

- KACO New Energy Inc.

- Fronius

- Wuxi Sineng

- SunPower Corporation

- Delta Electronics, Inc.

- Hitachi Hi-Rel Power Electronics Pvt. Ltd.

- Siemens AG

Solar Inverters/PV Inverters Industry Developments

June 2024: SMA Solar Technology AG, a German inverter manufacturer, received the Smarter E Award 2024 for its innovative Sunny Central FLEX platform solution for PV, battery, and hydrogen applications at Europe's largest solar trade fair in Munich.

February 2024: SMA Solar Technology AG announced its strategic partnership with ENGIE, an energy company. The company stated that the partnership aims to accelerate the development and deployment of distributed solar and storage solutions across Europe.

April 2022: SMA Solar Technology AG unveiled a new series of four inverters with power capacities of 12kW, 15kW, 20kW, and 25kW. These inverters are specifically designed for rooftop photovoltaic systems with maximum capacities of up to 135kW.

January 2023: Schneider Electric SE announced the acquisition of IGE+X AO, a Russian company specializing in energy storage solutions. The company stated that the move is aimed at improving its presence in the distributed energy sector.

Solar Inverters/PV Inverters Market Segmentation

By Type Outlook

- Central Inverters

- Microinverters

- String Inverters

By Deployment Outlook

- On-Grid

- Off-Grid

By End Users Outlook

- Utilities

- Commercial

- Industrial

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Solar Inverters/PV Inverters Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.37 billion |

|

Market size value in 2025 |

USD 15.15 billion |

|

Revenue Forecast by 2034 |

USD 24.63 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The solar inverters/PV inverters market size was valued at USD 14.37 billion in 2024 and is projected to grow to USD 24.63 billion by 2034.

The market is projected to register a CAGR of 5.5% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

The solar inverters/PV inverters market report comprises a competitive analysis of key players such as Huawei; Sungrow Power Supply; SMA Solar Technology AG; ABB Ltd.; Sineng; TBEA; TMEIC; Schneider Electric; SolarEdge Technologies; Power Electronics; KACO New Energy Inc.; Fronius; Wuxi Sineng; SunPower Corporation; Delta Electronics, Inc.; Hitachi Hi-Rel Power Electronics Pvt. Ltd.; and Siemens AG.

The string inverters segment dominated the solar inverters/PV inverters market share in 2024.

The utilities segment accounted for the largest market share in 2024.