Sodium Hydroxide Market Size, Share, Trends, Industry Analysis Report: By Grade (Solid, 50% Aqueous Solution, and Others), Production Process, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM3492

- Base Year: 2024

- Historical Data: 2020-2023

Sodium Hydroxide Market Overview

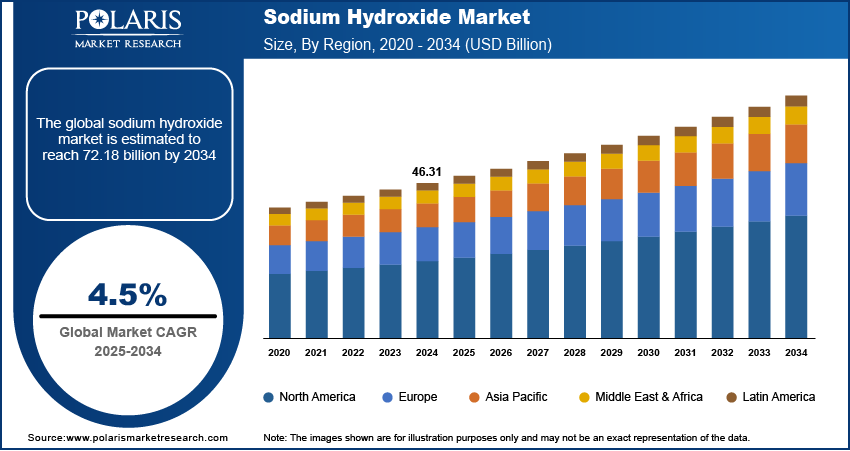

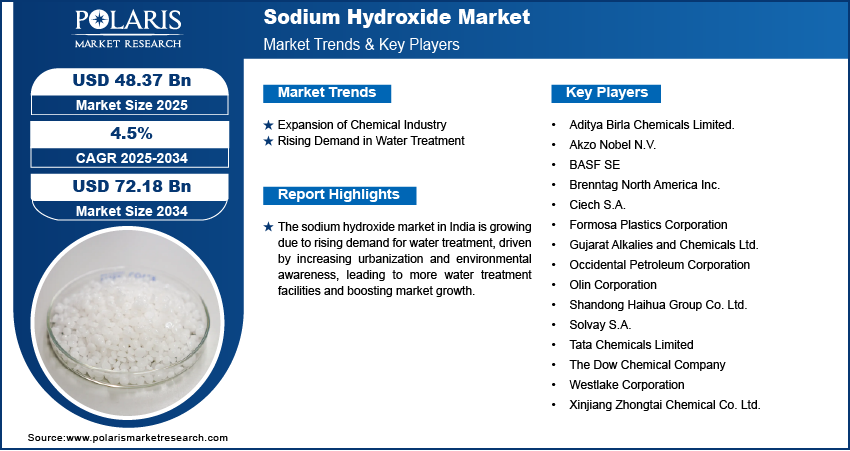

Sodium hydroxide market size was valued at USD 46.31 billion in 2024. The market is projected to grow from USD 48.37 billion in 2025 to USD 72.18 billion by 2034, exhibiting a CAGR of 4.5% during the forecast period.

Sodium hydroxide, commonly known as caustic soda, is a strong alkaline compound used in a variety of industrial processes, including soap-making, water treatment, and chemical production.

Growing demand for sodium hydroxide in various industrial applications is driving the sodium hydroxide market. Sodium hydroxide is widely used in a variety of industrial applications, including the production of soap, laundry detergents, and other cleaning products. It is also critical in industries and application such as molded pulp packaging, textiles, and petroleum refining. The expansion of these industries and increased production of consumer goods directly contribute to the growing demand for sodium hydroxide. Its essential role in chemical manufacturing processes, such as neutralizing acids and controlling pH levels, further boosts the need for this compound.

To Understand More About this Research: Request a Free Sample Report

Governments worldwide are implementing stricter environmental regulations, prompting industries to seek more sustainable and eco-friendly solutions for their production processes. Sodium hydroxide plays a key role in this shift, being involved in processes that reduce harmful emissions, purify wastewater, and manage waste. Its use in environmentally friendly products, such as organic liquid soap and sustainable manufacturing processes, supports the movement toward greener production. Additionally, sustainability is becoming a central focus across various sectors, due to which the demand for sodium hydroxide is further rising, thereby driving the sodium hydroxide market expansion.

Sodium Hydroxide Market Dynamics

Expansion of Chemical Industry

The global chemical industry is growing rapidly, and sodium hydroxide is a critical raw material in many chemical manufacturing processes. For instance, according to the India Brand Equity Foundation, in 2023, in India alone, chemical manufacturing accounted for 7% of total GDP. The growth of the chemical industry is driving the demand for sodium hydroxide. Additionally, sodium hydroxide is essential in producing other chemicals, such as sodium carbonate and sodium hypochlorite, further creating demand for sodium hydroxide, thereby driving the sodium hydroxide market growth.

Rising Demand in Water Treatment

Urbanization and growing environmental concerns are driving the demand for the need for clean water, which in turn is driving the demand for sodium hydroxide. For instance, according to the World Bank, 57% of the total world population lives in urban areas, showcasing growth in urbanization. Sodium hydroxide plays an important role in water treatment processes. It is commonly used to neutralize acidic water, balance pH levels, and remove impurities, making water safer for human consumption and industrial use. Sodium hydroxide is also employed in wastewater treatment to break down organic materials and manage pollution levels.

Sodium Hydroxide Market Segment Analysis

Sodium Hydroxide Market Assessment by Grade Outlook

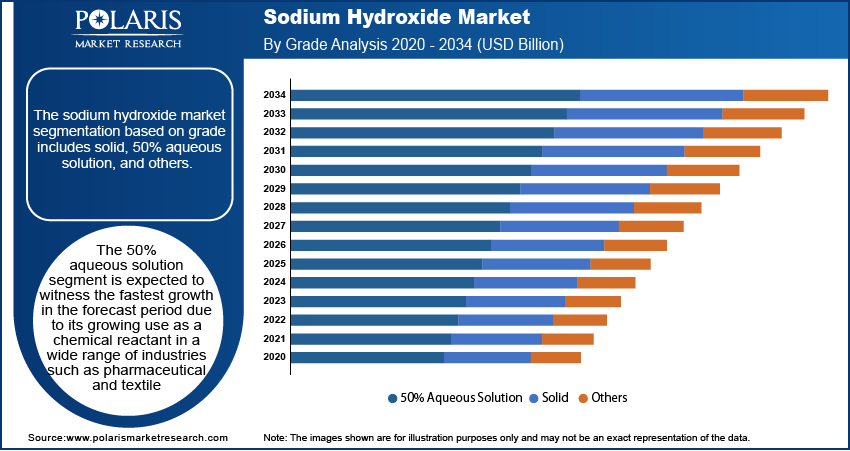

The sodium hydroxide market segmentation, based on grade, includes solid, 50% aqueous solution, and others. The 50% aqueous solution segment is expected to witness the fastest market growth during the forecast period. This growth is driven by its growing use as a chemical reactant in a wide range of industries. The 50% solution is highly effective in various chemical reactions, making it valuable in industries such as chemicals, pharmaceuticals, textiles coating, and water treatment. Its versatility and efficiency in different industrial processes make it a preferred choice for many applications, such as PH adjustment, thereby driving the segmental growth in the market.

Sodium Hydroxide Market Evaluation by Application Outlook

The sodium hydroxide market segmentation, based on application, includes biodiesel, alumina, inorganic chemicals, organic chemicals, food, pulp & paper, soap & detergent, textiles, water treatment, and others. The organic chemical segment dominated the sodium hydroxide market in 2024 due to its increasing use in the production of various types of plastics, such as polyvinyl chloride (PVC) and polycarbonate. Sodium hydroxide is essential in the manufacturing processes of these plastics, which are widely used in industries such as construction, packaging, and automotive. The rising global demand for plastics, driven by growth in infrastructure, consumer goods, and automotive sectors, has significantly boosted the need for sodium hydroxide.

Sodium Hydroxide Market Regional Insights

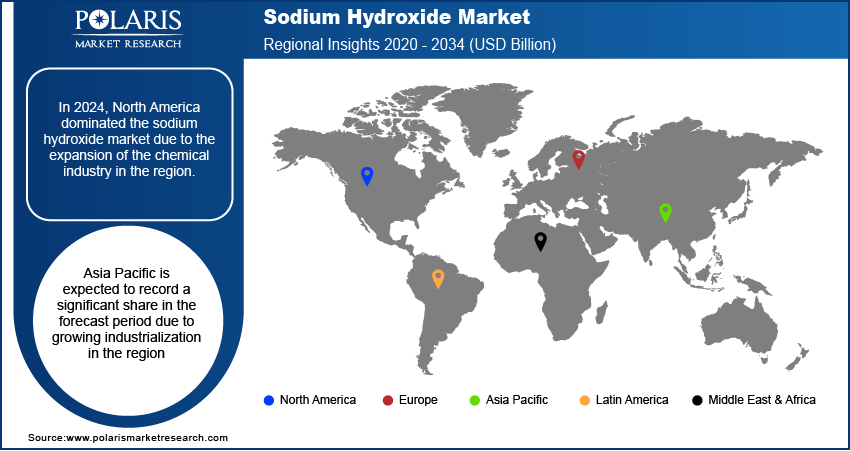

By region, the study provides the sodium hydroxide market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to the expansion of the chemical industry in the region. The increasing demand for various chemicals has made sodium hydroxide a key ingredient in manufacturing processes such as plastic, textile, and laundry detergent production. Growth in the chemical industry is driven by industrial advancements, technological innovation, and a rising demand for consumer goods. North America’s strong focus on sustainability and cleaner production methods has also contributed to the rising demand for efficient and eco-friendly chemical solutions, further boosting the sodium hydroxide market in North America.

Asia Pacific is expected to record a significant sodium hydroxide market share during the forecast period, due to increasing industrialization. Countries such as China and Japan are expanding their manufacturing sectors, leading to a higher demand for sodium hydroxide. Additionally, the establishment of more production plants has further boosted the need for sodium hydroxide across various applications, thereby driving the market growth in Asia Pacific.

The sodium hydroxide market in India is experiencing substantial growth due to the rising demand for water treatment, driven by increasing urbanization. The need for clean and safe water is becoming more critical as more people are moving to cities. For instance, according to the World Bank Group, as of 2023, 36.36% of the total Indian population lives in urban areas. Rapid urban expansion and growing awareness of environmental concerns are encouraging the development of more water treatment facilities, further boosting the demand for sodium hydroxide.

Sodium Hydroxide Market Key Players & Competitive Analysis Report

The sodium hydroxide market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Major global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the sodium hydroxide industry include Tata Chemicals Limited, Olin Corporation, Occidental Petroleum Corporation, Solvay S.A., BASF SE, Akzo Nobel N.V., Brenntag North America Inc., Xinjiang Zhongtai Chemical Co. Ltd., Westlake Corporation, The Dow Chemical Company, Shandong Haihua Group Co. Ltd., Formosa Plastics Corporation, Ciech S.A., Gujarat Alkalies and Chemicals Ltd., and Aditya Birla Chemicals Limited.

BASF SE, based in Ludwigshafen, Germany, is a chemical producer operating in over 80 countries. Established in 1865, the company has developed a diverse portfolio organized into six main segments, which include chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. The chemicals segment includes products such as solvents, amines, resins, and industrial gases. The materials segment focuses on high-performance plastics and biodegradable materials. Industrial solutions provide essential ingredients for coatings and adhesives, while surface technologies offer catalysts and coatings for automotive and chemical applications. Nutrition & care addresses the need for personal care and nutrition, and agricultural solutions supply crop protection products. BASF's sodium hydroxide 50% LowPCF is a certified sustainable variant with a product carbon footprint (PCF) reduced by one-third. It leverages renewable energy and membrane cell technology to minimize emissions, aiding customers in reducing upstream Scope 3 emissions while enhancing brand sustainability. TÜV Rheinland-certified per ISO 14067:2018 standard. The company operates across various regions, including Europe, North America, Asia Pacific, South America, Africa, and the Middle East.

Tata Chemicals Limited, a player in the global chemicals sector, operates as a subsidiary of the Tata Group. Established in 1939 and headquartered in Mumbai, the company has become one of the largest producers of soda ash and sodium bicarbonate worldwide. It is recognized for its extensive product portfolio, which is divided into two primary segments which include basic chemistry products and specialty products. The basic chemistry products segment includes soda ash, sodium bicarbonate, sodium hydroxide (caustic soda), industrial salt, and chlorine. In contrast, the specialty products segment focuses on nutritional sciences, material sciences, and agro sciences, offering products such as prebiotics and crop protection chemicals. Tata Chemicals produces sodium hydroxide using membrane cell technology at its Mithapur Complex in Gujarat, which has a capacity of 73,000 tons per annum. Additionally, it operates a facility in Northwich, UK, as part of its European operations. The company has a diverse global footprint with manufacturing bases located in India, North America, Europe, and Africa. Key facilities include those in Mithapur (Gujarat), Cuddalore (Tamil Nadu), Green River (Wyoming), Northwich (UK), and Magadi (Kenya). Tata Chemicals also has several subsidiaries that enhance its operational capabilities, such as Tata Chemicals North America and Rallis India, which specializes in agrochemicals.

Key Companies in Sodium Hydroxide Market

- Aditya Birla Chemicals Limited.

- Akzo Nobel N.V.

- BASF SE

- Brenntag North America Inc.

- Ciech S.A.

- Formosa Plastics Corporation

- Gujarat Alkalies and Chemicals Ltd.

- Occidental Petroleum Corporation

- Olin Corporation

- Shandong Haihua Group Co. Ltd.

- Solvay S.A.

- Tata Chemicals Limited

- The Dow Chemical Company

- Westlake Corporation

- Xinjiang Zhongtai Chemical Co. Ltd.

Sodium Hydroxide Market Development

December 2023: Dow introduced a range of reduced-carbon caustic soda or sodium hydroxide products, Caustic DEC and TRACELIGHT DEC. These products are powered by renewable energy and can achieve up to 90% lower carbon emissions in production.

Sodium Hydroxide Market Segmentation

By Grade Outlook (Revenue USD Billion, 2020–2034)

- Solid

- 50% Aqueous Solution

- Others

By Production Process Outlook (Revenue USD Billion, 2020–2034)

- Membrane Cell

- Diaphragm Cell

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Biodiesel

- Alumina

- Inorganic Chemicals

- Organic Chemicals

- Food

- Pulp & Paper

- Soap & Detergent

- Textiles

- Water Treatment

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sodium Hydroxide Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 46.31 billion |

|

Market Size Value in 2025 |

USD 48.37 billion |

|

Revenue Forecast in 2034 |

USD 72.18 billion |

|

CAGR |

4.5% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The sodium hydroxide market size was valued at USD 46.31 billion in 2024 and is projected to grow to USD 72.18 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Tata Chemicals Limited, Olin Corporation, Occidental Petroleum Corporation, Solvay S.A., BASF SE, Akzo Nobel N.V., Brenntag North America Inc., Xinjiang Zhongtai Chemical Co. Ltd., Westlake Corporation, The Dow Chemical Company, Shandong Haihua Group Co. Ltd., Formosa Plastics Corporation, Ciech S.A., Gujarat Alkalies and Chemicals Ltd., and Aditya Birla Chemicals Limited.

The organic chemical segment dominated the sodium hydroxide market in 2024 due to its increasing use in the production of various types of plastics, such as polyvinyl chloride (PVC) and polycarbonate.

The 50% aqueous solution segment is expected to witness the fastest growth in the forecast period due to its growing use as a chemical reactant in a wide range of industries such as pharmaceutical and textile.