Smokeless Tobacco Products Market Size, Share, Trends, Industry Analysis Report: By Products (Chewing Tobacco, Dipping Tobacco, Dissolvable Tobacco, Snuff, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 123

- Format: PDF

- Report ID: PM5195

- Base Year: 2024

- Historical Data: 2020-2023

Smokeless Tobacco Products Market Overview

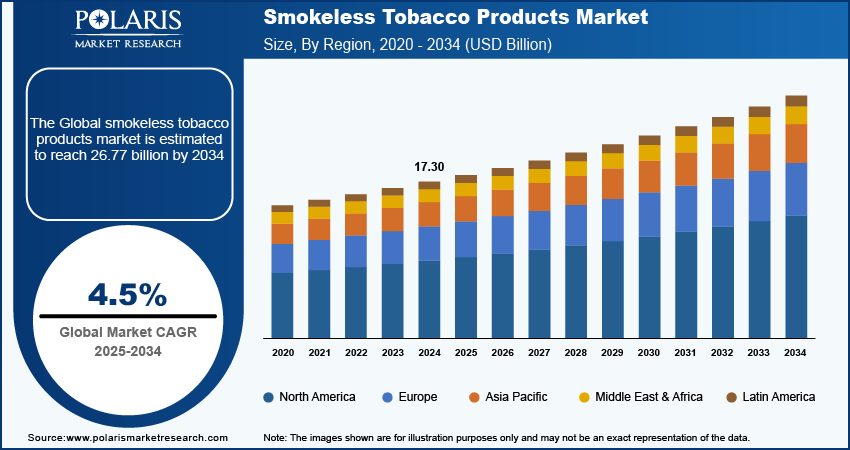

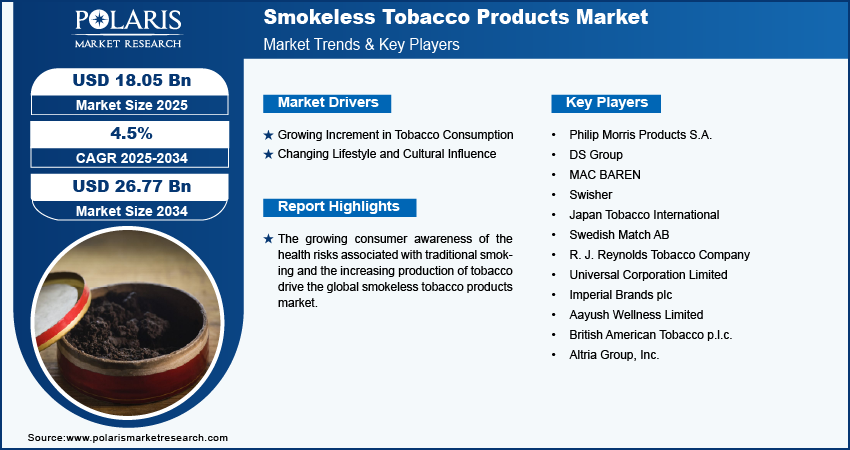

The smokeless tobacco products market size was valued at USD 17.30 billion in 2024. The market is projected to grow from USD 18.05 billion in 2025 to USD 26.77 billion by 2034, exhibiting a CAGR of 4.5% during 2025–2034.

Smokeless tobacco products (SLT) are tobacco forms that do not require combustion and are used through various methods such as chewing, snuffing, or placing between the gum and cheek. These products are prevalent in many regions, particularly in South Asia, where they account for a significant portion of global consumption.

The growing consumer awareness of the health risks associated with traditional smoking is driving the global smokeless tobacco products market. The rising awareness related to the adverse impact of smoking on organs, such as lung cancer and respiratory issues, leads several consumers to purchase smokeless tobacco since they view smokeless tobacco as a less harmful alternative to cigarettes.

The convenience and appealing flavors associated with smokeless tobacco products are estimated to fuel the global smokeless tobacco products market growth. Smokeless tobacco products are often more convenient than traditional cigarettes. They are used discreetly and don’t require special settings for smoking, making them appealing to people who want to use tobacco in various environments without attracting attention. Furthermore, the introduction of diverse and appealing flavors such as mint, fruit, and other sweet options attracts consumers who don’t enjoy the taste of traditional tobacco. This flavor variety makes the products more appealing, especially to younger users, thereby boosting their demand.

To Understand More About this Research: Request a Free Sample Report

Lower costs of smokeless tobacco products compared to traditional cigarettes fuel the smokeless tobacco products market growth. Smokeless products often have a lower price point, making them more accessible for budget-conscious consumers, especially in regions where cigarette taxes are high. This affordability attracts individuals looking for cost-effective alternatives to smoking.

Smokeless Tobacco Products Market Driver Analysis

Growing Increment in Tobacco Consumption

There is an increasing interest among consumers in exploring various forms of tobacco products, including smokeless tobacco. Rising tobacco consumption leads to increased sales of smokeless tobacco products. For instance, according to a data published by the pubmed, smokeless tobacco (ST) is consumed by more than 300 million people worldwide. Therefore, the growing increment in tobacco consumption is driving the market for smokeless tobacco products.

Changing Lifestyle and Cultural Influence

Modern lifestyles prioritize convenience and discretion. Smokeless tobacco allows for consumption without the need for designated smoking areas, appealing to those with busy, on-the-go routines. Additionally, cultural influences, including social media and celebrity endorsements, popularize smokeless tobacco among younger demographics, leading to increased interest, trial, and demand. Thus, the changing lifestyle and cultural influence boost the global smokeless tobacco products market.

Smokeless Tobacco Products Market Segment Analysis

Smokeless Tobacco Products Market Breakdown By Product

Based on product, the global smokeless tobacco products market is segmented into chewing tobacco, dipping tobacco, dissolvable tobacco, snuff, and others. The snuff segment accounted for a major share of the market in 2024 due to its popularity among consumers seeking a discreet and flavorful option. Snuff offers a variety of flavors and fine textures that appeal to a broad audience, including long-time users and newcomers. Additionally, the increasing awareness of reduced health risks associated with snuff compared to traditional smoking boosts its appeal. The segment benefits from targeted marketing strategies that emphasize its modern image and lifestyle compatibility, further driving its dominance in the market.

The chewing tobacco segment is estimated to grow at a robust pace in the coming years, owing to the revival of traditional tobacco practices among younger demographics who are increasingly interested in nostalgic and authentic experiences. Chewing tobacco also benefits from its social acceptance in certain cultural contexts, where it is seen as a traditional form of tobacco consumption. The introduction of flavored variants attracts new users and encourages existing consumers to experiment with different tastes. Moreover, the increasing availability of products in retail outlets makes chewing tobacco more accessible, further enhancing its market presence.

Smokeless Tobacco Products Market Breakdown By Distribution Channel

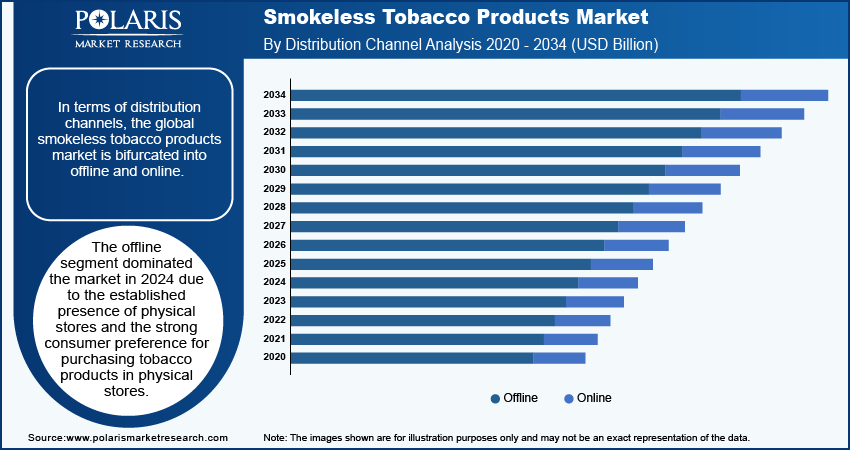

In terms of distribution channels, the global smokeless tobacco products market is bifurcated into offline and online. The offline segment dominated the market in 2024 due to the established presence of physical stores and the strong consumer preference for purchasing tobacco products in physical locations. Convenience stores, gas stations, and dedicated tobacco shops provide immediate access, allowing consumers to browse a wide variety of options and make informed choices. Additionally, the social aspect of shopping in-store plays a role, as many users enjoy discussing products with staff or fellow consumers. The presence of promotional displays and in-store advertising further enhances visibility and encourages impulse purchases, contributing to the dominance of the offline segment.

The online segment is expected to register a significant CAGR during the forecast period owing to the increasing comfort of consumers with e-commerce platforms and the convenience of home delivery offered by online channels. Online retailers often provide a broader selection of products, including niche and specialty items that may not be available in local stores, which attracts younger consumers. Additionally, online shopping allows for discreet purchasing. This appeals to users who prefer privacy.

Smokeless Tobacco Products Market Regional Insights

By region, the study provides the smokeless tobacco products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest revenue share of the global market in 2024 due to the increasing popularity of traditional products such as chewing tobacco and snus, particularly in countries such as India and China. India's cultural affinity for these products significantly contributes to its market dominance in the region, as a substantial portion of the population regularly uses smokeless tobacco for social and traditional purposes. According to the Global Adult Tobacco Survey (GATS), 21.38% of adults in India use smokeless tobacco. This included 29.6% of men and 12.8% of women. The rising awareness about alternatives to smoking, along with the growing acceptance of smokeless options among younger demographics, further fuels the smokeless tobacco products market growth. Additionally, government regulations in certain countries in the region have not restricted these products as heavily as cigarettes, allowing for broader market access and consumption.

The North America smokeless tobacco products market is expected to register a significant CAGR during the forecast period due to the shift in consumer preferences toward less harmful tobacco alternatives. Factors such as increasing health consciousness, stringent regulations on smoking, and aggressive marketing strategies by manufacturers are reshaping the market landscape in the region, especially in the US. Additionally, the rise of convenience and discreet use among younger consumers propels the demand for smokeless tobacco products in North America.

Smokeless Tobacco Products Market – Key Players and Competitive Insights

Prominent smokeless tobacco products market players are investing heavily in research and development to expand their offerings, which will boost the market growth during the forecast period. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the smokeless tobacco products industry players must offer innovative solutions.

The smokeless tobacco products market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Philip Morris Products S.A.; DS Group; MAC BAREN; Swisher; Japan Tobacco International; Swedish Match AB; R. J. Reynolds Tobacco Company; Universal Corporation Limited; Imperial Brands plc; Aayush Wellness Limited; British American Tobacco p.l.c. ; and Altria Group, Inc.

Swedish Match AB is a major Swedish tobacco company headquartered in Stockholm. The company is known for its commitment to producing smokeless tobacco products. It has undergone significant transformation over the years, moving away from traditional cigarette manufacturing to focus on smoke-free alternatives. Swedish Match holds a strong market position in Scandinavia and the US. It is the largest producer of snus in Scandinavia and ranks third in the moist snuff category in the US. In November 2022, the company became a subsidiary of Philip Morris International, further aligning its strategies with the growing demand for reduced-risk products in the tobacco industry.

DS Group (Dharampal Satyapal Group) is a prominent Indian conglomerate with a strong presence in domestic and international markets. The company was founded in 1929 and is diversified into various sectors, including mouth fresheners, food & beverages, confectionery, hospitality, agri-business, and luxury retail. DS Group's product portfolio includes well-known brands such as Rajnigandha, Catch, Pulse, FRU, Ksheer, Pass Pass, BABA, and Tulsi. The group is particularly known for its presence in the smokeless tobacco segment, with the launch of its inaugural tobacco brand 'BABA' in India in 1958.

Major Companies in Smokeless Tobacco Products Industry Outlook

- Philip Morris Products S.A.

- DS Group

- MAC BAREN

- Swisher

- Japan Tobacco International

- Swedish Match AB

- R. J. Reynolds Tobacco Company

- Universal Corporation Limited

- Imperial Brands plc

- Aayush Wellness Limited

- British American Tobacco p.l.c.

- Altria Group, Inc.

Smokeless Tobacco Products Industry Developments

June 2024, Aayush Wellness Limited, an India-based health and wellness company, announced the launch of Aayush Tobaccofree Herbal Pan Masala & Gutka, a product designed to revolutionize the chewing habits of India’s Gutka and Pan Masala consumers.

March 2023: The US Food and Drug Administration authorized the Copenhagen Classic Snuff, a loose, moist snuff smokeless tobacco product, to be marketed as a modified risk tobacco product (MRTP).

October 2022: Altria, the cigarette maker behind the Marlboro brand in the US, announced a strategic partnership with JT Group to sell smoke-free products. The partnership will give Altria a fresh chance to gain a foothold in the US 28 billion smokeless tobacco market after several unsuccessful attempts. It will also give the company the opportunity to grow outside the US.

Smokeless Tobacco Products Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Chewing Tobacco

- Dipping Tobacco

- Dissolvable Tobacco

- Snuff

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smokeless Tobacco Products Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.30 Billion |

|

Market Size Value in 2025 |

USD 18.05 Billion |

|

Revenue Forecast by 2034 |

USD 26.77 Billion |

|

CAGR |

4.5 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global smokeless tobacco products market size was valued at USD 17.30 billion in 2024 and is projected to grow to USD 26.77 billion by 2034.

The global market is projected to register a CAGR of 4.5 % during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Philip Morris Products S.A.; DS Group; MAC BAREN; Swisher; Japan Tobacco International; Swedish Match AB; R. J. Reynolds Tobacco Company; Universal Corporation Limited; Imperial Brands plc; Aayush Wellness Limited; British American Tobacco p.l.c. ; and Altria Group, Inc.

The chewing tobacco segment is projected for significant growth in the global market during the forecast period.

The offline segment dominated the market in 2024.