Smart Water Meter Market Size, Share, Trends, Industry Analysis Report: By Technology, Application (Water Utilities and Industries), Meter Type, Component, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5533

- Base Year: 2024

- Historical Data: 2020-2023

Smart Water Meter Market Overview

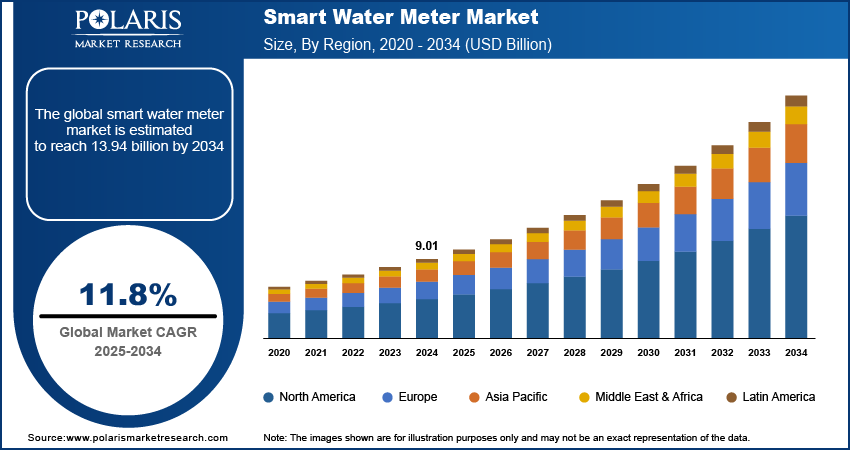

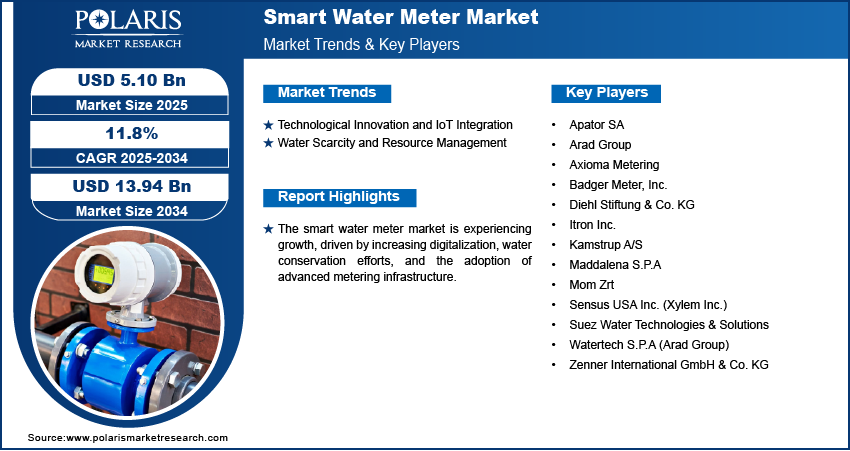

The global smart water meter market was valued at USD 4.57 billion in 2024. It is expected to grow from USD 5.10 billion in 2025 to USD 13.94 billion by 2034, at a CAGR of 11.8% during the forecast period.

A smart water meter is an advanced metering device that enables real-time monitoring and automated data collection for water consumption, improving efficiency and conservation efforts. The smart water meter market growth is driven primarily by population growth and urbanization. As the global population grows, especially in cities, the demand for better water management solutions is increasing. A United Nations report from November 2022 stated that the world’s population has reached 8 billion people. It took 12 years to grow from 7 billion to 8 billion, but the next increase to 9 billion is expected to take 15 years, reaching that number by 2037.

Rapid urbanization is putting pressure on existing water systems, making smart water meters essential for better resource management. These meters help reduce water waste, improve distribution, and ensure sustainability. To meet rising water needs, municipalities and utilities are investing in these smart systems, improving efficiency and making water management more effective in fast-growing urban areas.

To Understand More About this Research: Request a Free Sample Report

Another driver shaping the smart water meter market development is the regulatory compliance and sustainability goals. Governments and regulatory bodies worldwide are implementing strict water conservation policies, mandating the adoption of advanced metering solutions to monitor and control consumption effectively. For instance, The NHPC Water Conservation Policy, 2023, highlights sustainable water management across all projects and establishments. It focuses on regulatory compliance, reducing water footprints, rainwater harvesting, pollution prevention, and stakeholder awareness. The policy will be reviewed every five years to adapt to evolving needs. Smart water meters help utilities comply with regulatory standards by providing accurate, real-time usage data, reducing leaks, and supporting efficient billing systems. Additionally, sustainability initiatives aimed at reducing water wastage and optimizing resource management further accelerate the market demand. Therefore, as water scarcity concerns intensify, the push toward digitalization and intelligent water management continues to boost market growth.

Smart Water Meter Market Driver Dynamics

Technological Innovation and IoT Integration

The integration of IoT technology improves communication between water meters and utility providers, allowing for automated meter reading, predictive maintenance, and improved operational efficiency. For instance, in November 2022, Landis+Gyr launched ultrasonic smart water meters W270 and W370, featuring IoT technology for smart water networks. The meters provide data on volume, temperature, and alarms and are 100% recyclable. Smart meters equipped with AI-driven analytics provide actionable insights, helping utilities optimize water distribution and minimize losses, enabling advanced data analytics, remote monitoring, and real-time leak detection. Additionally, cloud-based platforms and wireless connectivity improve data accuracy and accessibility, reducing manual errors and operational costs. Therefore, as digital transformation accelerates across industries, the adoption of smart water meters continues to rise, driving expansion opportunities.

Water Scarcity and Resource Management

Utilities and governments are increasingly focusing on advanced metering solutions to monitor and regulate water usage, addressing the depletion of freshwater resources and rising consumption as efficient water management becomes a global priority. Smart water meters provide precise data on consumption patterns, enabling proactive leak detection and conservation efforts. These meters support sustainable water management practices by facilitating demand-based distribution and reducing non-revenue water losses. For instance, in May 2024, VivoAquatics introduced a facility-wide sub-metering platform for water usage and leak detection, integrating meters, sensors, and software to monitor water across key areas. This innovation enables leak identification, usage benchmarking, and conservation targets, helping reduce risks and operational costs. The need for intelligent water monitoring systems continues to grow as climate change and population growth exacerbate water scarcity concerns, reinforcing the smart water meter market growth trajectory.

Smart Water Meter Market Segment Assessment

Smart Water Meter Market Assessment by Application Outlook

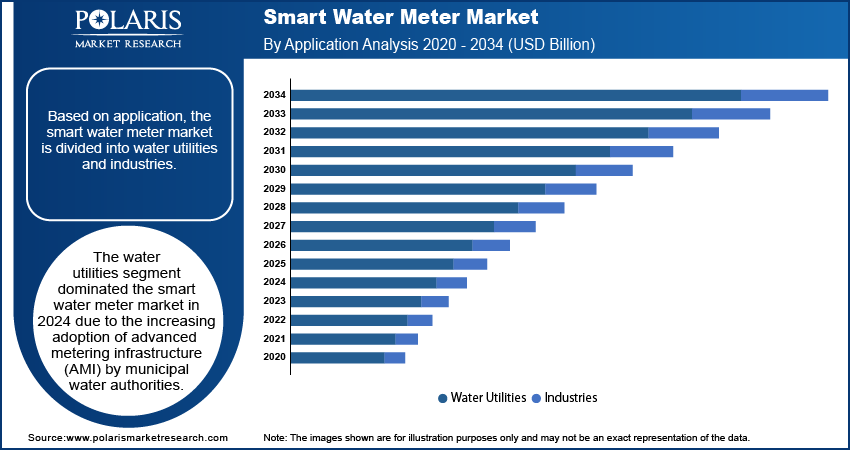

The global smart water meter market segmentation, based on application, includes water utilities and industries. The water utilities segment dominated the market in 2024 due to the increasing adoption of advanced metering infrastructure (AMI) by municipal water authorities. Utilities are prioritizing the deployment of smart water meters to enhance efficiency and reduce operational costs, with rising concerns over water conservation and non-revenue water losses. These meters provide real-time consumption data, enabling utilities to detect leaks, manage demand, and optimize distribution networks. Additionally, regulatory mandates and government initiatives promoting digital water management further drive adoption. Thus, as urban populations grow, the need for efficient water infrastructure continues to propel the dominance of this segment.

Smart Water Meter Market Evaluation by Meter Type Outlook

The global smart water meter market segmentation, based on meter type, includes electromagnetic, ultrasonic, and smart mechanical. The ultrasonic segment is expected to witness the fastest smart water meter market growth during the forecast period due to its superior accuracy, durability, and maintenance-free operation. Unlike traditional mechanical meters, ultrasonic smart meters leverage sound waves to measure flow rates with high precision, making them ideal for both residential and industrial applications. These meters are highly effective in detecting low water flows and leaks, contributing to efficient water resource management. Additionally, their ability to function without moving parts minimizes wear and tear, leading to a longer lifespan and lower maintenance costs. Therefore, as utilities and industries seek more reliable and cost-effective solutions, the demand for ultrasonic smart meters is projected to accelerate.

Smart Water Meter Market Regional Insights

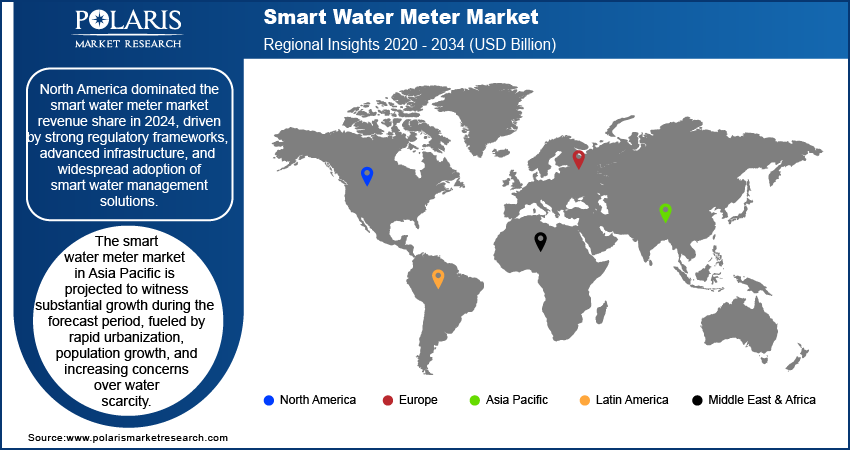

By region, the report provides the smart water meter market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the smart water meter market revenue share in 2024 driven by strong regulatory frameworks, advanced infrastructure, and widespread adoption of smart water management solutions. The region's utilities have been at the forefront of implementing digital metering technologies to improve operational efficiency and ensure regulatory compliance. Increasing investments in smart city initiatives, coupled with government policies aimed at water conservation, have further propelled market growth. For instance, in April 2023, Department of the Interior allocated USD 140 million for 84 water conservation projects across 15 western states. Funded by the Bipartisan Infrastructure Law, these initiatives aim to save 230,000 acre-feet of water, improving drought resilience and climate adaptation. Additionally, the presence of key industry players and technological advancements in IoT-enabled metering systems have accelerated deployment across residential, commercial, and industrial sectors, reinforcing North America's market leadership.

The smart water meter market in Asia Pacific is projected to witness substantial growth during the forecast period, fueled by rapid urbanization, population growth, and increasing concerns over water scarcity. Governments across the region are investing in smart water infrastructure to address rising demand and improve resource management. For instance, in November 2024, India and the Asian Development Bank signed a USD 200 million loan for the Uttarakhand Livability Improvement Project. It aims to improve urban services, climate resilience, and water supply in five cities, with co-financing from the European Investment Bank. The adoption of smart metering technology is further supported by initiatives aimed at reducing non-revenue water losses and improving utility efficiency. Additionally, advancements in IoT technology and cloud-based analytics are making smart water meters more accessible and cost-effective. Thus, as emerging economies continue to modernize their water distribution networks, the region is expected to experience substantial market expansion.

Smart Water Meter Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for smart water meter market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Smart water meter market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes.

Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with smart water meter market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the smart water meter industry's growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are Apator SA; Arad Group; Axioma Metering; Badger Meter, Inc.; Diehl Stiftung & Co. KG; Itron Inc.; Kamstrup A/S; Maddalena S.P.A; Mom Zrt; Sensus USA Inc. (Xylem Inc.); Suez Water Technologies & Solutions; Watertech S.P.A (Arad Group); Zenner International GmbH & Co. KG.

Axioma Metering is a European manufacturer of smart heat and water devices, specializing in ultrasonic technology for metering applications. Founded in 1990, the company has evolved over the years. Axioma's product portfolio includes ultrasonic heat and water meters, as well as data management devices designed for industrial, commercial, and residential use. These meters are highly accurate and reliable, with no moving parts, ensuring long-lasting performance of up to 16 years on a single set of batteries. The company's flagship product, the QALCOSONIC W1, exemplifies its advanced ultrasonic technology, offering customizable communication options and high precision in water flow measurement. Axioma's focus on IoT technologies, such as NB IoT and LoRa WAN, supports real-time data analytics and preventative maintenance, improving energy efficiency and resource management. Axioma Metering has established itself as a key player in the smart metering market with a strong emphasis on quality control and continuous improvement, contributing to environmental sustainability by helping clients manage consumption more effectively.

Diehl Stiftung & Co. KG is a globally active German technology enterprise. The company operates as a strategic management holding company, offering a diverse range of products across various industrial sectors. While Diehl Stiftung is primarily known for its contributions to defense, aerospace, and automotive industries, it also provides solutions relevant to the sanitation sector, including water management systems. Specifically, Diehl Metering, a division of the Diehl Group, is involved in the development and production of smart water meters. These meters are designed to improve efficiency in water distribution by providing accurate measurements and facilitating remote meter reading systems. This technology supports real-time monitoring and data-driven decision-making, which are crucial for effective water resource management. Diehl Metering plays a substantial role in addressing global water scarcity challenges by optimizing water usage and reducing waste by integrating advanced technologies into its metering solutions.

Key Companies in Smart Water Meter Market

- Apator SA

- Arad Group

- Axioma Metering

- Badger Meter, Inc.

- Diehl Stiftung & Co. KG

- Itron Inc.

- Kamstrup A/S

- Maddalena S.P.A

- Mom Zrt

- Sensus USA Inc. (Xylem Inc.)

- Suez Water Technologies & Solutions

- Watertech S.P.A (Arad Group)

- Zenner International GmbH & Co. KG

Smart Water Meter Market Developments

January 2025: United Utilities selected Arqiva to deploy over 1 million smart water meters in the North West by 2030. The 305 million USD project aims to reduce leakage, improve water management, and support customers through enhanced data insights and affordability measures.

January 2025: Affinity Water launched its first smart metering program, starting with a trial in Hertfordshire. The initiative will install 20,000 smart meters in households and 20 in non-household properties, aiming to improve water conservation and management practices.

April 2024: SUEZ and Vodafone collaborated to deploy over 2 million NB-IoT-enabled smart water meters globally by 2030. This collaboration aims to enhance remote meter reading, reduce water consumption by up to 15%, and improve leak detection and usage monitoring.

Smart water meter Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Automated Meter Reading

- Advanced Meter Reading

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Water Utilities

- Industries

By Meter Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Electromagnetic

- Ultrasonic

- Smart Mechanical

By Component Outlook (Revenue, USD Billion, 2020 - 2034)

- Meters & Accessories

- IT Solutions

- Communications

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Water Meter Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.57 billion |

|

Market Size Value in 2025 |

USD 5.10 billion |

|

Revenue Forecast in 2034 |

USD 13.94 billion |

|

CAGR |

11.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global smart water meter market size was valued at USD 4.57 billion in 2024 and is projected to grow to USD 13.94 billion by 2034.

The global market is projected to register a CAGR of 11.8% during the forecast period.

North America dominated the smart water meter market revenue share in 2024.

Some of the key players in the market are Apator SA; Arad Group; Axioma Metering; Badger Meter, Inc.; Diehl Stiftung & Co. KG; Itron Inc.; Kamstrup A/S; Maddalena S.P.A; Mom Zrt; Sensus USA Inc. (Xylem Inc.); Suez Water Technologies & Solutions; Watertech S.P.A (Arad Group); and Zenner International GmbH & Co. KG.

The water utilities segment dominated the smart water meter market in 2024.

The ultrasonic segment is expected to witness the fastest smart water meter market growth during the forecast period.