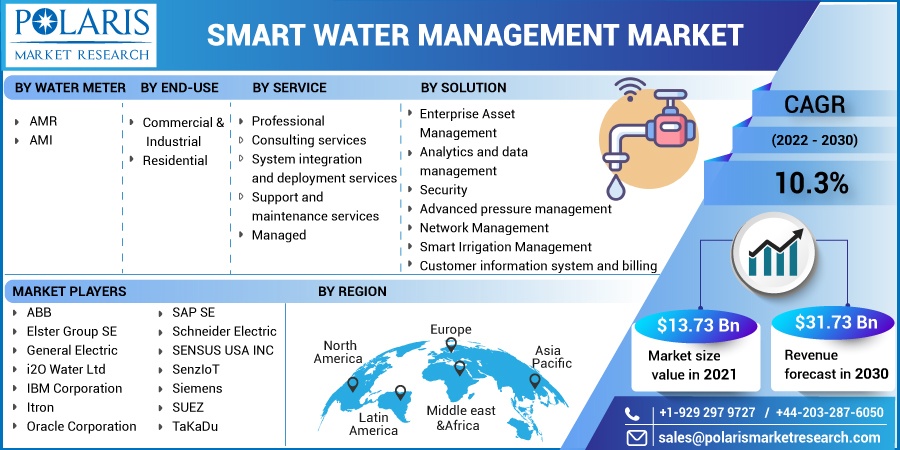

Smart Water Management Market Share, Size, Trends, Industry Analysis Report, By Water Meter (AMR, AMI); By Solution; By Service (Professional, Managed); By End-Use (Commercial & Industrial, Residential); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 114

- Format: PDF

- Report ID: PM2256

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

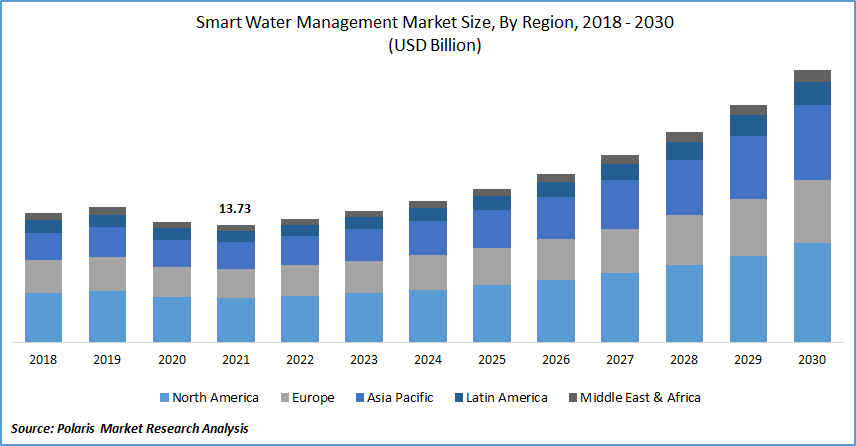

The global smart water management market was valued at USD 13.73 billion in 2021 and is expected to grow at a CAGR of 10.3% during the forecast period. The global challenge of coping with the increased demand for (renewable) H2O resources has arisen due to population expansion, economic development, continuous urbanization, and the growth in per-capita food consumption. Over 2 billion people live in H2O -stressed areas, according to the UN World Water Development Report 2021. Approximately 3.4 billion people, or 45% of the global population, lack access to clean sanitation facilities.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Furthermore, in March 2021, SUEZ and Schneider Electric launched a joint venture to strengthen their leadership in creating new smart digital solutions. By providing a unique collection of innovative software solutions for liquid treatment infrastructure planning, maintenance, operation, and optimization, this new business will enable municipal operators and industrial players to expedite their digital transformations. Thus, the collaborations among the major market players for a smart software solution are boosting the smart water management market growth during the forecast period.

However, H2O utilities are predicted to face a shortfall of 221,000 workers over the next ten years, according to the Workforce Renewal and Skills Strategy published by Energy & Utility Skills in 2017. The aging workforce, a tight job market, and a lack of technical skills within the workforce are all contributing to the gap. During the COVID-19 outbreak, however, utility businesses must connect with their most vulnerable customers, anticipate their requirements, and give proactive help, such as payment options for cash users and those in financial trouble.

This outbreak has put the utilities sector's resilience measures to the ultimate test, opening the way for more flexible, responsive working methods that entirely use contemporary technologies. The scarcity of digitally skilled workers in the H2O utility industry is one of the biggest bottlenecks in this era of technology. Another reason is millennials' lack of understanding of the growing importance of the H2O utility sector as a career option. These factors impede smart water management market expansion even further.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Major market players' initiatives include partnerships, product launches, mergers and acquisitions, and geographical expansion. For instance, in October 2021, ABB teamed up with DHI Group, a Danish H2O environment specialist. ABB and DHI Group planned to collaborate on digital solutions for smart H2O and wastewater utilities that would allow faster and more accurate decision-making. In June 2021, Itron inked a contract with United Utilities in England to optimize operations. Temetra, Itron's cloud-based meter data gathering and management technology, should help with distribution and administration. Thus, significant players' acquisitions and product advancements in the software boost the smart liquid administration market growth during the forecast period.

Furthermore, due to its real-time visualization, detection of leaks, and machine-to-machine interactions, demand for the IoT-based metering infrastructure. For example, Esri announced a relationship with Open Systems International (OSI) in January 2020. The geographic information system (GIS) and OSI's monarch operational technology (OT) offering are sufficient for these facilities. Furthermore, Industry 4.0 has seen the convergence of IoT with H2O management.

Report Segmentation

The market is primarily segmented based on water meter, solution, service, end-use, and region.

|

By Water Meter |

By Solution |

By Service |

By End-Use |

By Region |

|

· |

|

|

|

Know more about this report: Request for sample pages

Insight by End-Use

Based on the end-user segment, the commercial and industrial segment is expected to be the most significant revenue contributor in the global smart water management market in 2021 and is expected to retain its dominance in the foreseen period. In developing and developed countries, municipal authorities are in charge of H2O supply and distribution, directly handled by the government sector. The lack of privatization in the H2O sector causes H2O supply system efficiency problems. The lack of constant public sector supervision of smart H2O delivery networks worldwide has resulted in a high frequency of leakage and H2O loss occurrences.

Enterprises confront issues maintaining good H2O quality and pressure, securely disposing of industrial waste H2O in line with laws, and limiting downtime, such as pumping wastewater or pumps delivering cooling H2O. Due to these challenges, commercial and industrial end-users are expected to employ smart solutions to maximize H2O use, reduce billing blunders, implement cost-effective solutions, and minimize H2O expenditures. Many emerging nations' wastewater disposal systems are inefficient, and activities like forcing industrial waste into natural H2O bodies are common, making wastewater treatment a significant burden for local governments.

Geographic Overview

In terms of geography, North America had the highest share in 2021. North America dominates the smart water management market due to increased demand for sustainable energy solutions and stringent government regulations in various economies. When providing prediction analysis of national data, the existence and availability of the famous brands and the restraints followed by the local and established brands.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market over the forecast period. A rise in the use of smart grid solutions, an increase in urbanization leading to an increase in H2O needs, agricultural production, technological incorporation in the utility sector, and an exponential rise in population all contribute to the rapid market expansion. These variables result in large-scale smart technology deployment in the western areas, favorable government laws, increased awareness of clean and safe H2O supply, and increased industrial activity in the region. The demand for H2O efficiency and re-usability is strong in Asia-Pacific, which is projected to boost smart water management market expansion.

Competitive Insight

Some of the major market players operating in the global smart water management market include ABB, Elster Group SE, General Electric, Global Water Management, i2O Water Ltd, IBM Corporation, Itron, Neptune Technology Group, Oracle Corporation, Radius Synergies International Pvt Ltd, SAP SE, Schneider Electric, SENSUS USA INC, SenzIoT, Siemens, SUEZ, TaKaDu, and Trimble Water.

Smart Water Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 13.73 Billion |

|

Revenue forecast in 2030 |

USD 31.73 Billion |

|

CAGR |

10.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Water Meter, By Solution, By Service, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, Elster Group SE, General Electric, Global Water Management, i2O Water Ltd, IBM Corporation, Itron, Neptune Technology Group, Oracle Corporation, Radius Synergies International Pvt Ltd, SAP SE, Schneider Electric, SENSUS USA INC, SenzIoT, Siemens, SUEZ, TaKaDu, and Trimble Water. |