Smart Sports Equipment Market Size, Share, Trends, Industry Analysis Report: By Product (Balls, Golf Stick, Hockey Stick, Rackets & Bats, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 119

- Format: PDF

- Report ID: PM5531

- Base Year: 2024

- Historical Data: 2020-2023

Smart Sports Equipment Market Overview

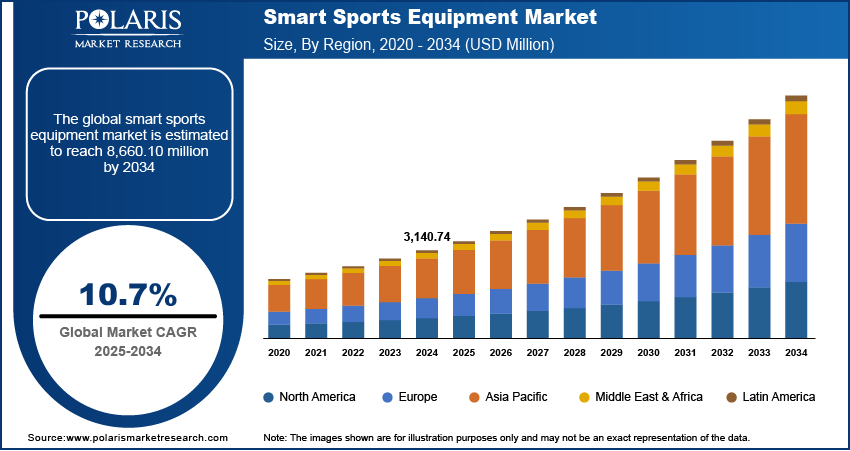

The smart sports equipment market size was valued at USD 3,140.74 million in 2024. The market is projected to grow from USD 3,468.94 million in 2025 to USD 8,660.10 million by 2034, exhibiting a CAGR of 10.7% during 2025–2034.

The smart sports equipment market insight encompasses technologically advanced sports gear integrated with sensors, connectivity features, and analytics capabilities. These products, including smart rackets, balls, wearables, and fitness equipment, provide real-time performance tracking, data analysis, and personalized insights to enhance athletic performance and training efficiency. The increasing adoption of Internet of Things (IoT) technology and artificial intelligence (AI) in sports equipment has driven market growth, enabling athletes and fitness enthusiasts to monitor and improve their skills effectively. Furthermore, the growing emphasis on health and fitness, coupled with rising consumer demand for smart wearable technology, is contributing to smart sports equipment market growth.

Key drivers of the smart sports equipment market demand include the rising integration of IoT and AI, growing consumer preference for connected fitness devices, and advancements in sports analytics technology. The increasing popularity of smart sports gear among professional athletes, coaches, and recreational users is fueling demand, as these devices offer enhanced training insights and injury prevention features. Additionally, the expansion of e-commerce platforms and the proliferation of smartphone applications that complement smart sports equipment are further propelling market growth. However, high costs associated with smart sports products and concerns related to data security and privacy may pose challenges to widespread adoption.

To Understand More About this Research: Request a Free Sample Report

Smart Sports Equipment Market Dynamics

Increased Funding for Modernizing Sports Equipment

Increasing funding aimed at modernizing sports equipment has significantly contributed to the smart sports equipment market development. In October 2022, the Sports Authority of India (SAI) approved a special grant of USD 2,917,834 to upgrade equipment for grassroots-level athletes across all SAI Training Centres. This investment reflects a strategic move to integrate advanced technology into sports training and development. Such financial commitments from government bodies underscore the importance of modern equipment in nurturing athletic talent and promoting technological advancements in sports.

Integration of Sports Programs in Educational Institutions

The incorporation of sports programs within educational institutions has emerged as a significant driver for the smart sports equipment market growth. Such activities promote physical activity among students and boost equipment procurement for both indoor and outdoor games. By equipping schools with modern sports tools, this initiative fosters early adoption of smart sports equipment, encouraging a culture of technological integration in sports from a young age.

Smart Sports Equipment Market Segment Insights

Smart Sports Equipment Market Assessment – by Product

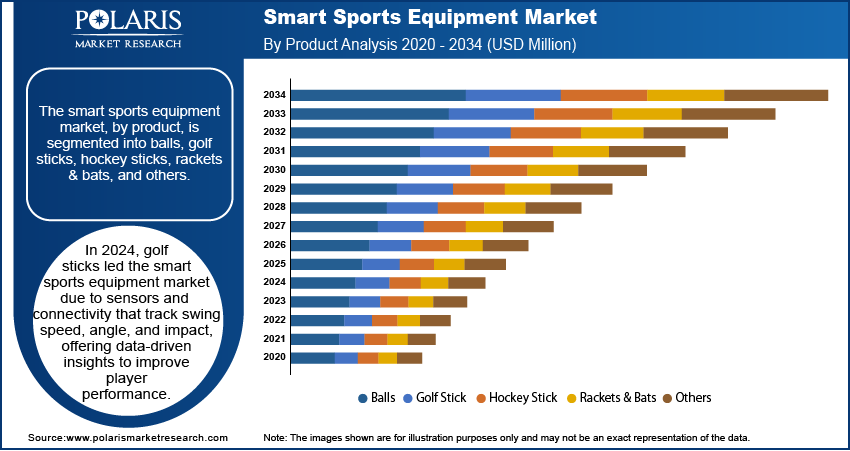

The smart sports equipment market, by product, is segmented into balls, golf sticks, hockey sticks, rackets & bats, and others. The golf sticks segment is dominating the smart sports equipment market share. Smart golf sticks, equipped with advanced sensors and connectivity features, enable players to monitor metrics such as swing speed, angle, and impact location, providing valuable data to enhance performance. These innovations have found applications across various levels of play, from recreational golfers to competitive professionals, seeking real-time feedback and analytics. The increasing adoption of data-driven training methodologies and the golf community's openness to technological advancements have further propelled the demand for smart golf sticks, positioning this segment as a key player in the market's expansion.

The balls segment is anticipated to dominate the smart sports equipment market revenue share during the forecast period, driven by the integration of technology to enhance training and gameplay analysis. These balls are embedded with sensors that measure speed, spin, and trajectory, offering athletes detailed analytics to refine their skills. The ability to track progress over time through connected applications has made smart balls increasingly popular across multiple sports, including soccer, basketball, and football. The rising consumer interest in performance optimization and the growing emphasis on technology-driven sports training would contribute to the segment's growth in the coming years.

Smart Sports Equipment Market Evaluation– by Distribution Channel

The smart sports equipment market, by distribution channel, is segmented into franchise stores, specialty stores, and online. The franchise stores segment has established a dominant position, reflecting their extensive reach and strong consumer trust. These outlets offer customers the opportunity to assess products physically, receive personalized assistance, and access comprehensive after-sales support, enhancing the overall purchasing experience, thereby driving the segmental growth.

The specialty stores segment is expected to witness significant growth, driven by a focus on niche, high-tech products tailored to specific athletic requirements. These stores provide expert advice and support, enhancing the shopping experience for consumers seeking personalized fitness solutions. The growing demand for advanced sports gear, particularly among younger consumers, further boosts the popularity of specialty stores. This segment is poised for rapid growth due to its adaptability to new technologies and consumer preferences.

Smart Sports Equipment Market Regional Insights

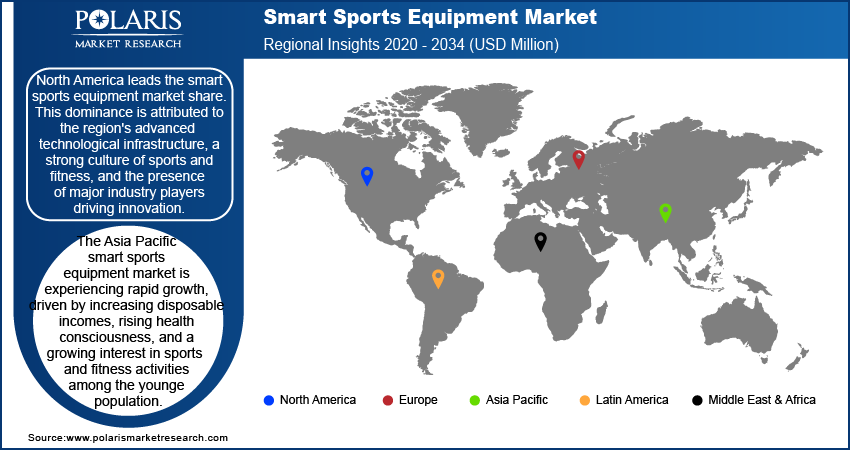

By region, the study provides smart sports equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is leading in market share. This dominance is attributed to the region's advanced technological infrastructure, a strong culture of sports and fitness, and the presence of major industry players driving innovation. High consumer awareness and demand for innovative fitness solutions further bolster North America's leadership position.

The Asia Pacific smart sports equipment market is experiencing rapid growth, driven by increasing disposable incomes, rising health consciousness, and a growing interest in sports and fitness activities among the younger population. Technological advancements and the presence of numerous manufacturers in countries such as China and India contribute to the development and adoption of smart sports equipment in the region.

Smart Sports Equipment Market – Key Players and Competitive Insights

The smart sports equipment market ecosystem features several active companies driving innovation and growth. A few notable players include Technogym; Anta Sports; Nike, Inc.; Adidas AG; Under Armour, Inc.; Puma SE; ASICS Corporation; New Balance Athletics, Inc.; Wilson Sporting Goods Co.; Callaway Golf Company; Mizuno Corporation; Reebok International Limited; Garmin Ltd.; Fitbit, Inc.; and Suunto Oy. These companies are actively engaged in developing and marketing smart sports equipment, integrating advanced technologies to enhance athletic performance and user experience.

Technogym has established itself as a leader in the fitness equipment industry, offering a range of smart products that integrate digital technologies to provide personalized training experiences. The company's commitment to innovation is evident in its continuous development of connected equipment and wellness solutions. Similarly, Anta Sports has made significant strides in the market, particularly through its subsidiary Amer Sports, which manages brands such as Wilson and Salomon, known for their smart sports equipment offerings. This strategic expansion has enabled Anta Sports to diversify its product portfolio and strengthen its global presence.

In the wearable technology segment, companies such as Garmin Ltd.; Fitbit, Inc.; and Suunto Oy have been instrumental in advancing smart sports equipment. Their products, including smartwatches and fitness trackers, offer features such as real-time performance monitoring, GPS tracking, and health metrics analysis, catering to both amateur and professional athletes. These companies' focus on integrating advanced technology with user-friendly designs has contributed to the growing adoption of smart sports equipment worldwide.

Nike, Inc. is a global leader in the design, development, and marketing of athletic footwear, apparel, equipment, and accessories. The company is renowned for its innovative products and strong brand presence across various sports disciplines. Over the years, Nike has expanded its portfolio to include smart sports equipment, integrating advanced technologies into their products to enhance athletic performance and user experience.

Adidas AG is a prominent multinational corporation specializing in the production of sportswear, footwear, and accessories. With a rich history and a strong emphasis on innovation, Adidas has developed a range of smart sports equipment that combines advance technology with functional design. The company's commitment to sustainability and performance has solidified its position as a key player in the global sports equipment market.

List of Key Companies in Smart Sports Equipment Market

- Adidas AG

- Anta Sports Products Limited

- ASICS Corporation

- Callaway Golf Company

- Fitbit, Inc.

- Garmin Ltd.

- Mizuno Corporation

- New Balance Athletics, Inc.

- Nike, Inc.

- Puma SE

- Reebok International Limited

- Suunto Oy

- Technogym S.p.A.

- Under Armour, Inc.

- Wilson Sporting Goods Co.

Smart Sports Equipment Industry Developments

- January 2025: Adidas introduced the Predator 25, a modern iteration of its iconic football boot. This version features an enhanced STRIKESKIN upper for improved grip and HYBRIDTOUCH 2.0 for a better fit.

- July 2024: FIFA-certified Playmaker technology was launched in India for Indian football teams by triQUIP Sports through a strategic partnership. The AI wearable tech aims to revolutionize player performance and game strategy with detailed performance analytics.

- January 2024: The SmartGolf stick was launched at CES 2024, eliminating the need to fork out hundreds on the likes of TopGolf and Trackman, developed in South Korea and priced at USD 299. It was designed to simplify golf practice, rivaling costly systems such as Bushnell Launch Pro.

Smart Sports Equipment Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Balls

- Golf Stick

- Hockey Stick

- Rackets & Bats

- Others

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Franchise Stores

- Specialty Stores

- Online

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Smart Sports Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,140.74 million |

|

Market Size Value in 2025 |

USD 3,468.94 million |

|

Revenue Forecast by 2034 |

USD 8,660.10 million |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The smart sports equipment market has been segmented into detailed segments of product and distribution channels. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The smart sports equipment market growth and marketing strategy focuses on product innovation, digital integration, and strategic partnerships. Companies are enhancing their offerings by incorporating advanced sensors, AI-driven analytics, and IoT connectivity to improve user experience. Expanding e-commerce channels and direct-to-consumer sales are key strategies to reach a broader audience. Collaborations with professional athletes, sports teams, and fitness influencers help drive brand visibility and consumer trust. Additionally, companies are leveraging data-driven insights and personalized marketing to engage tech-savvy consumers and increase product adoption.

FAQ's

The smart sports equipment market size was valued at USD 3,140.74 million in 2024 and is projected to grow to USD 8,660.10 million by 2034.

The market is projected to register a CAGR of 10.7% during the forecast period.

North America held the largest share of the market in 2024.

A few notable players include Technogym; Anta Sports; Nike, Inc.; Adidas AG; Under Armour, Inc.; Puma SE; ASICS Corporation; New Balance Athletics, Inc.; Wilson Sporting Goods Co.; Callaway Golf Company; Mizuno Corporation; Reebok International Limited; Garmin Ltd.; Fitbit, Inc.; and Suunto Oy.

The golf stick segment accounted for the larger share of the market in 2024.

The franchise store segment accounted for the largest share of the market in 2024.