Smart Railways Market Share, Size, Trends, Industry Analysis Report, By Offering Solutions (Passenger Information System, Freight Management System, Security and Safety Solutions, Rail Communication and Networking System, Smart Ticketing System, Rail Analytics System, Rail Asset Management and Maintenance Solutions, Rail Operation and Control Solutions), Services, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 114

- Format: PDF

- Report ID: PM219

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

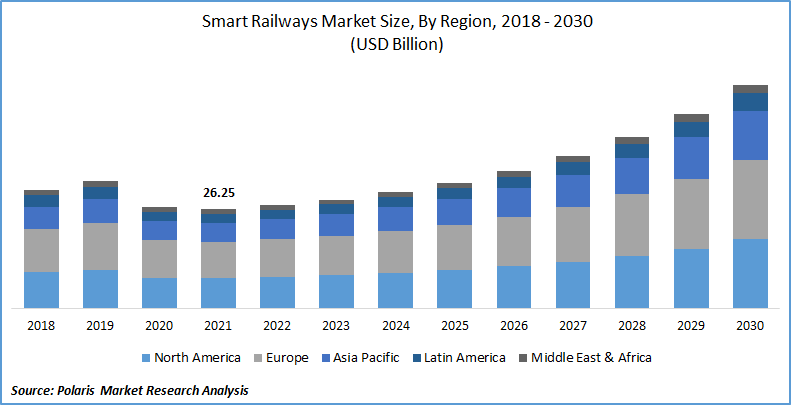

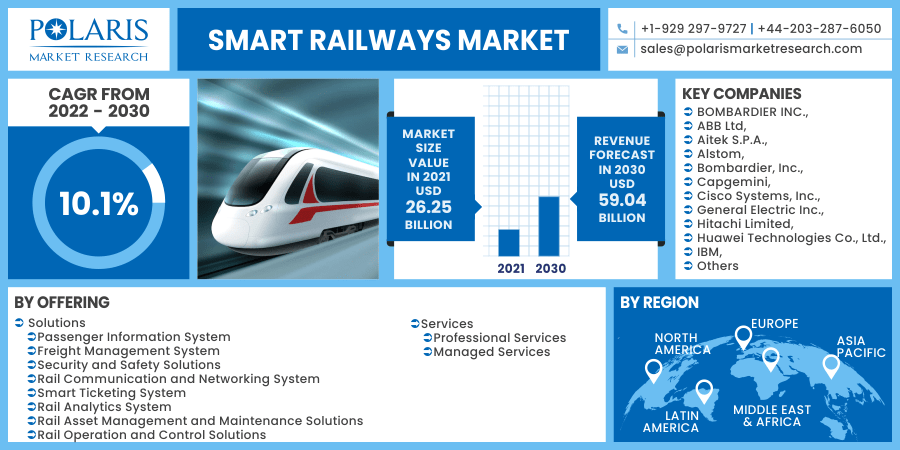

The global smart railways market was valued at USD 26.25 billion in 2021 and is expected to grow at a CAGR of 10.1% during the forecast period. The prime factors for the market development include increasing demand for freight along with passenger capacity. Moreover, digitalization is also expected to support the industry growth as it gains tremendous traction among the innovative railway technology. Thereby, the deployment of this technology is anticipated to be accepted by a large number of railway transportation service vendors around the world.

Know more about this report: request for sample pages

The onset of COVID-19 has a significant impact on the smart rail market and a considerable impact on the global economy because of the imposition of lockdowns in various regions for evading the spread of coronavirus. From March 2020, public transport in a large number of cities has been partially or entirely shut down for the short term.

However, the restrictions on public transport have been raised moderately after as well as many cities were experiencing a 70–90% decrease in the public transit ridership. Thus, after the gradual opening of lockdown, the world is considerably reshaping and tracking back with new permanent societal changes. Hence, the COVID-19 outbreak has shown a significant downfall in the global smart railways market.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Efficient rail operation requires accurate scheduling, observing, and maintenance of rail-based assets. These schedules shrink the asset productivity and decrease downtime. This downtime is further protracted due to manual diagnostics with a low success rate.

Rail authorities greatly emphasize condition-based and predictive maintenance solutions to improve efficiency and cut time consumption. Condition-based and predictive maintenance mainly work on real-time analytics, thus, reducing the dependence on manual diagnostics. The data from rail assets can be utilized to improve rail asset utilization. Also, it enables the listed maintenance of assets and resource intensities and costs.

Report Segmentation

The market is primarily segmented on the basis of offering and region.

|

By Offering |

By Region |

|

|

Know more about this report: request for sample pages

Insight by Offering

The rail communication and networking system segment accounted for the largest revenue in the global smart railways market. The adoption of smart communication solutions across diverse applications of railways management help to take timely decision-making for issues, including asset deployment, maintenance, and utilization. Efficient railways operations depend on precise, on-time communication among stations, control, dispatch centers, and rolling stock to ensure safety, security, and uninterrupted services. This will become a key factor for smart railway providers and vendors across the globe.

Moreover, the rail communication and networking system segment is also expected to demonstrate the highest growth over the forecast period. The robust growth of the strategic partnership between rail operators and smart solutions service providers, along with the constant technological developments in railway infrastructure across emerging nations, are accelerating the segment growth over the upcoming years.

The managed services segment is recorded with the largest shares in 2021 and is expected to lead the industry in the forecasting years. Factors such as the growing demand to outsource the maintenance of smart railways are projected to drive the demand for managed services in the market. Organizations need to improve resource utilization, which is one of the major factors projected to fuel the growth of the smart railways market.

Geographic Overview

Geographically, Europe accounted for the highest shares in the global smart railways market in 2021 and is likely to dominate the market over the upcoming scenario. The European countries, especially Western Europe, such as the UK, Germany, and France, have well-recognized railways infrastructure and several railways operators in the region. These nations are increasingly utilizing some of the most progressive smart railways solutions. Social and trade agreements across the EU countries have promoted large-scale passenger traffic and cross-border trade in Europe.

Moreover, Asia Pacific is expected to contribute a significant share in the global market during the forthcoming years. The advancements in smart railways have generated business opportunities in railways and paved the way for business models, innovation, and new services. Factors such as rising R&D activities in the railway's digitalization, coupled with the robust demand for IT-based solutions and services to protect the critical railway's infrastructure, are driving the market growth in the region.

Competitive Insight

Some of the major players operating in the global market include BOMBARDIER INC., ABB Ltd, Aitek S.P.A., Alstom, Bombardier, Inc., Capgemini, Cisco Systems, Inc., General Electric Inc., Hitachi Limited, Huawei Technologies Co., Ltd., IBM, Indra Sistemas, S.A., Tata Consultancy Services Limited, Telangana State Technology Services, Teleste, Thales Group, and ZTE Corporation.

Smart Railways Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 26.25 billion |

|

Revenue forecast in 2030 |

USD 59.04 billion |

|

CAGR |

10.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Offering, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BOMBARDIER INC., ABB Ltd, Aitek S.P.A., Alstom, Bombardier, Inc., Capgemini, Cisco Systems, Inc., General Electric Inc., Hitachi Limited, Huawei Technologies Co., Ltd., IBM, Indra Sistemas, S.A., Tata Consultancy Services Limited, Telangana State Technology Services, Teleste, Thales Group, and ZTE Corporation. |