Smart Motors Market Share, Size, Trends, Industry Analysis Report, By Component (Variable Speed Drive, Intelligent Motor Control Center, Motor); By Product; By Application; By Regions; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 118

- Format: PDF

- Report ID: PM1993

- Base Year: 2020

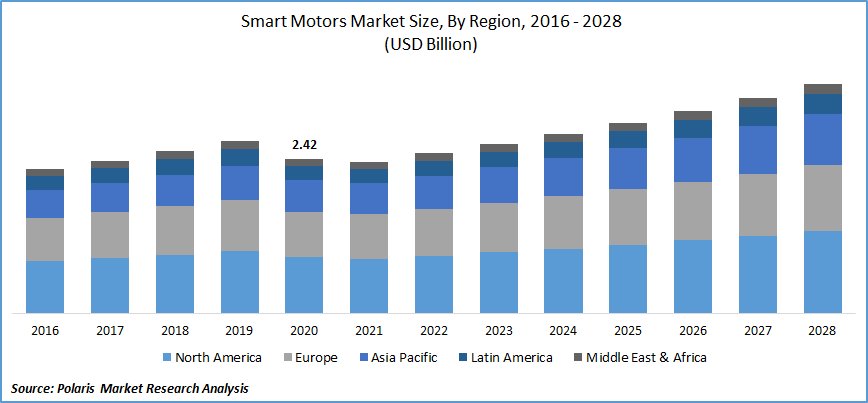

- Historical Data: 2016 - 2019

Report Outlook

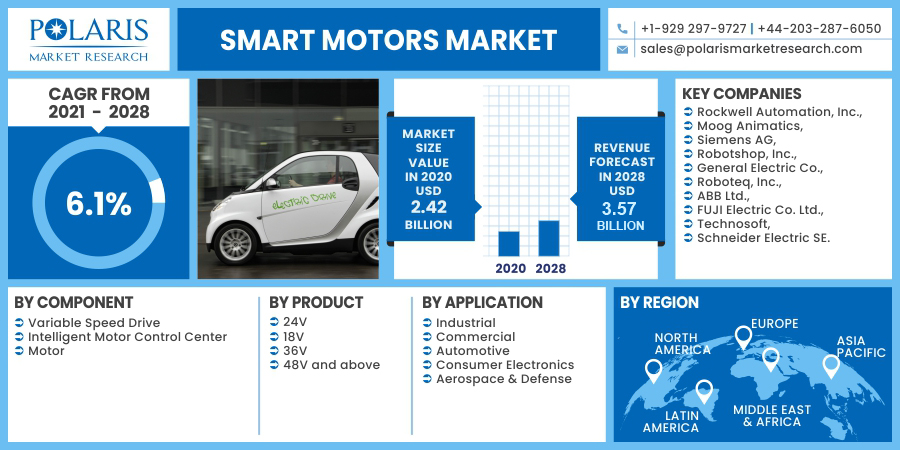

The global smart motors market was valued at USD 2.42 billion in 2020 and is expected to grow at a CAGR of 6.1% during the forecast period. Rising concern for saving energy costs by improving energy efficiency has resulted in a surge in the adoption of smart motors in various high energy-intensive industries such as automotive, industrial manufacturing, consumer electronics, aerospace & defense, oil & gas, mining, among others.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The variable speed drive (VSDs) in smart motor controls the frequency of electric power supplied to the smart motors, and thus, it adjusts the rotation speed to the required output, which, in turn, can save around 25-30% of energy, thus boosting the industry growth in the coming years.

Growing stringent regulations pertaining to carbon emissions by regulatory agencies such as the US Environmental Protection Agency (EPA) and the European Union is projected to fuel the market demand for smart motors significantly during the review period.

The COVID-19 outbreak had a negative impact on the smart motors market. Smart motors find widespread applications in automotive, industrial, aerospace & defense, consumer electronics, mining, and oil & gas, among others. The weakening market demand for smart motors from end-use industries has resulted in a decline in the use of smart motors in pumps, mills, and compressors.

Industry Dynamics

Growth Drivers

The rising cost of fossil fuels, mainly owing to intense competition, has necessitated the use of energy-efficient solutions. This has resulted in an augmented use of smart motors in the industrial sector in applications such as mixers, extruders, simple pumps, fans, compressors, vibrator motors, simple wire, and drawing machines to integrate smart motor controllers in an automation process helps to conserve energy. Additionally, intelligent motors control (IMC) monitors the load condition of the motors and adjusts the voltage input accordingly, thereby offering energy efficiency of up to 3-5%.

Furthermore, soaring carbon emissions and the growing need to reduce dependence on fossil fuels have led to a rising focus on implementing emission control standards and framing policies to encourage the adoption of electric vehicles across the globe which in turn propels the intelligent motors market development. Also, growing emphasis on the adoption of smart, flexible, and integrated solutions by the automobile players, particularly by electric vehicle manufacturers, is likely to drive the market demand for smart motors control systems in automobiles.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of component, product, application, and region.

|

By Component |

By Product |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The 24V segment held the largest share in the global market in 2020. Factors such as excellent power and reliability augment the segment growth. It operates very quietly and smoothly, even under heavy load, thus, it is suitable for heavy load in a compact size.

In addition, it provides sturdy and reliable performance and therefore can be used as an industrial-grade continuous use motor. Moreover, it offers high-torque, high-efficiency, industrial power tools, and robotic applications.

The 48V held a healthy CAGR during the forecast period. This is mainly ascribed to efficient operation without losses, variable speed control, precise operation, long life, high reliability, and low cost. Moreover, it offers extremely quiet operation and is well-suited for applications demanding low audible noise.

Insight by Application

The industrial application segment is expected to witness the highest market share by the end of the review period. Smart motors find usage in industries for their high energy efficiency and effectiveness. It finds widespread use in compressors, conveyor systems, automation processes, and material handling, among others.

Rising regulations pertaining to carbon emissions across the globe have resulted in an increased emphasis on adopting energy-efficient solutions across industries. This has led to the surging use of smart motors in the industrial sector to reduce energy usage which in turn will fuel the smart motors market.

Geographic Overview

Geographically, North America was the largest revenue contributor in the smart motor market. The U.S. was the leading contributor to the regional market growth due to the increasing adoption of advanced technologies and the strong presence of major end-use sectors such as industrial, automotive, aerospace & defense, and oil & gas, among others. Stringent environmental regulations pertaining to carbon emissions set by the US Environmental Protection Agency have resulted in an increased need for adopting energy-efficient solutions; this, in turn, is expected to fuel the market demand for smart in the region.

Asia Pacific is likely to register a healthy growth rate during the assessment period. This is mainly attributed to the strong industrial manufacturing sector in the developing economies of China and India. Moreover, recent technological developments and imposition of government policies such as Minimum Energy Performance Standards (MEPs) in several Asia-Pacific countries gave an impetus to energy-efficient smart motors systems, thereby increasing the regional market share in the smart motors.

Moreover, the industrial sector in the region is further anticipated to witness massive growth owing to favorable government initiatives, including “Make in India” and “Make in China 2025”, which is likely to promote the usage of smart motors in a diverse range of industries which will boost the market demand. Europe held the third-largest share in the global market. Germany had the largest market share in 2020, owing to the presence of established automotive and industrial sectors. Germany is the largest contributor to industrial manufacturing in Europe.

Also, the market growth in Europe is driven by the increasing adoption of energy-efficient solutions, particularly in the industrial and automotive sectors. According to European Investment Bank, in 2019, more than 40% of EU firms carried out measures to improve energy efficiency. In addition, growing emphasis on industrial automation is the key factor driving the region’s growth which contributes to the market growth.

Competitive Insight

Major players operating in the global market are Rockwell Automation, Inc., Moog Animatics, Siemens AG, Robotshop, Inc., General Electric Co., Roboteq, Inc., ABB Ltd., FUJI Electric Co. Ltd., Technosoft, and Schneider Electric SE.

Smart Motors Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 2.42 billion |

|

Revenue forecast in 2028 |

USD 3.57 billion |

|

CAGR |

6.1% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Component, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Rockwell Automation, Inc., Moog Animatics, Siemens AG, Robotshop, Inc., General Electric Co., Roboteq, Inc., ABB Ltd., FUJI Electric Co. Ltd., Technosoft, and Schneider Electric SE. |