Smart Meter Market Share, Size, Trends, Industry Analysis Report, By Type (Smart Electric Meter, Smart Gas Meter, Smart Water Meter); By Technology; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3862

- Base Year: 2023

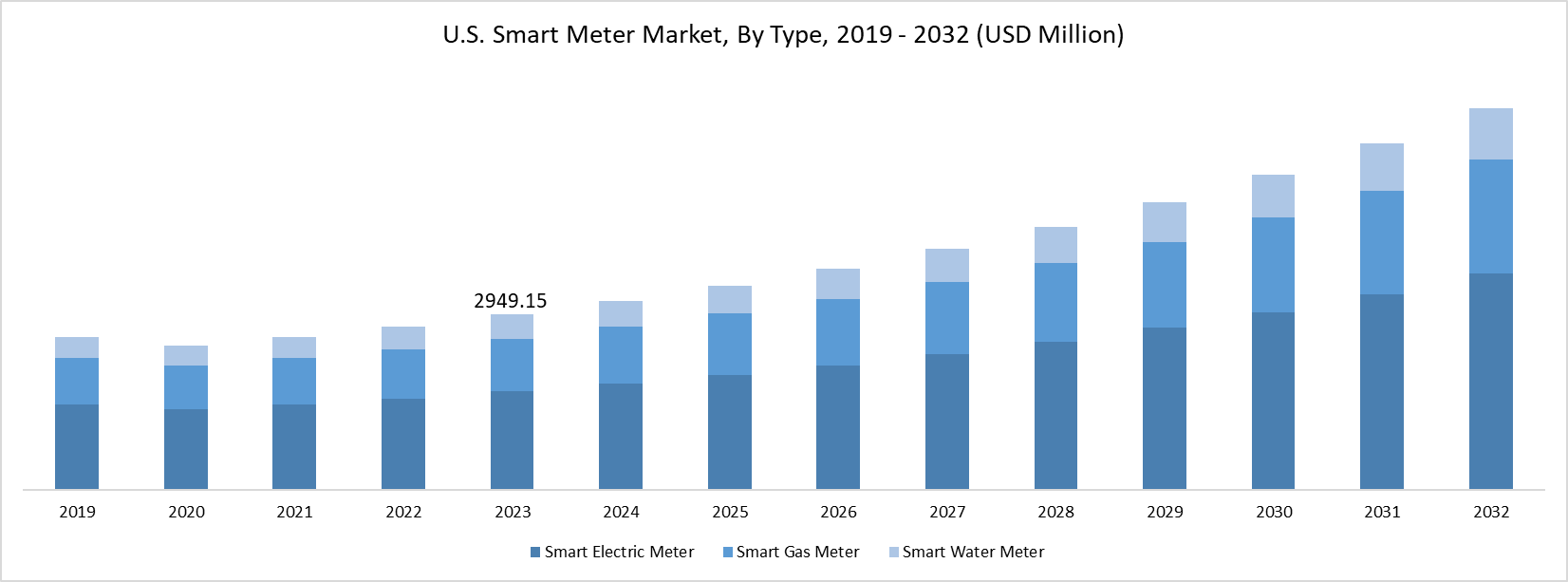

- Historical Data: 2019-2022

Report Outlook

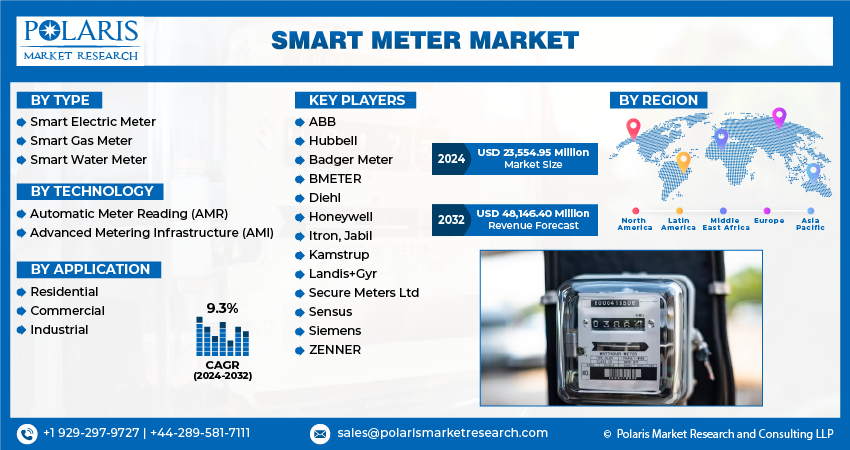

The global smart meter market was valued at USD 21,810.14 million in 2023 and is expected to grow at a CAGR of 9.3% during the forecast period. The global smart meter market has witnessed growth over the past few years, reshaping the landscape of the utility and energy sectors. Increasing consumer behavior towards more sustainable and efficient energy consumption models, the significance of smart meters has become rising significantly. These advanced devices, equipped with real-time data collection and communication capabilities, have emerged as a linchpin in the modernization of energy infrastructures worldwide.

To Understand More About this Research: Request a Free Sample Report

One of the primary drivers propelling the smart meter market's expansion is the imperative need for enhanced energy management and conservation. Traditional metering systems, characterized by manual reading and periodic billing, could be more robust in their ability to provide timely insights into consumption patterns. In contrast, smart meters empower both utilities and consumers with granular, real-time data, facilitating informed decision-making and fostering a culture of energy consciousness. This transition from reactive to proactive energy management is pivotal in optimizing resource allocation, minimizing wastage, and mitigating the environmental footprint.

Furthermore, the integration of smart meters within the broader smart grid ecosystem amplifies their utility manifold. By facilitating bidirectional communication between utilities and end-users, these devices enable dynamic demand response mechanisms, grid monitoring, and fault detection. Such functionalities not only bolster grid reliability and resilience but also pave the way for the seamless integration of renewable energy sources. As the global energy mix undergoes a paradigm shift towards sustainable alternatives, the role of smart meters in balancing supply-demand dynamics and ensuring grid stability becomes increasingly indispensable.

The proliferation of smart meters is mainly due to digital transformation and technological innovation. As utilities worldwide struggle with aging infrastructures, evolving regulatory mandates, and escalating consumer expectations, the adoption of smart metering solutions emerges as a strategic imperative rather than a mere operational upgrade. Consequently, the market landscape is witnessing a surge in investments, partnerships, and acquisitions aimed at harnessing the full potential of smart metering technologies. For instance, In Jan 2023, Badger Meter, Inc. acquired Syrinix, Ltd., a UK-based intelligent water monitoring solutions provider, for £15 million, enhancing its smart water capabilities with high-frequency pressure monitoring and leak detection technologies.

For Specific Research Requirements, Request for a Customized Research Report

Growth Drivers

Rising Government Support and Investments

Rising government support and strategic investments in modernizing the energy infrastructure drive the market during the forecast period. To overcome climate change, energy efficiency, and the pressing need for sustainable solutions, the deployment of smart meters has emerged as a pivotal strategy for efficient energy management.

Governments, recognizing the transformative potential of smart meter technology, have increasingly taken proactive measures to accelerate its adoption. Policymakers and regulatory bodies have been essential in shaping the market landscape by introducing favourable policies, incentives, and frameworks that incentivize utilities and consumers alike. These initiatives often encompass a range of measures, from regulatory mandates requiring utilities to deploy smart meters to financial incentives designed to mitigate the initial capital costs associated with large-scale deployments.

For instance, The Energy Efficiency Services Limited (EESL), which the Indian government owns, has installed about 10 lakh smart meters across the country as part of the Smart Meter National Programme. The program aims to install 25 crore smart meters over the next few years. To ensure that there is an adequate supply of meters and to prevent monopolies, it has been proposed to establish a manufacturing base for smart electricity meters in the country. This development is expected to be a major driver of the program. Such government support not only catalyzes investments but also instills confidence among stakeholders, paving the way for broader acceptance and integration of smart meter solutions.

Furthermore, the influx of investments from both public and private sectors has been instrumental in fueling the growth of the smart meter market. Venture capital firms, institutional investors, and industry stakeholders have shown a keen interest in backing innovative smart meter technologies and solutions. These investments are often directed toward research and development, infrastructure development, and market expansion initiatives, thereby fostering technological advancements and driving down costs.

Report Segmentation

The market is primarily segmented based on type, technology, application, and region.

|

By Type |

By Technology |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Smart Electricity Meters are Holding Largest Market Share in 2023 and Expected to Grow at High CAGR over the Forecast Period

Smart electricity meters offer electricity suppliers real-time statistics on a consumer's energy consumption every hour or even more frequently, eliminating the necessity for manual readings by electric companies. These meters empower consumers by providing accurate, real-time data on their energy usage, granting them greater control over electricity consumption. Additionally, smart electricity meters afford consumers the flexibility to select the most suitable tariff plan based on their specific energy consumption patterns.

Moreover, the installation of smart meters has been mandated by the majority of governments, considering them integral to national energy policies aimed at enhancing efficiency and reducing carbon emissions. Several governments have initiated the deployment of smart meters as part of efforts to expedite their adoption.

For instance, In June 2021, the Government of India unveiled its initiative to replace traditional electric meters with smart meters by 2025. The initial phase of the project involves replacing existing electric meters in 500 AMRUT cities, industrial and commercial centers, and union territories. The subsequent phase will prioritize the implementation of smart metering devices in rural areas.

By Technology Analysis

The Advanced Metering Infrastructure (Ami) Segment Acquired Highest Market Share in 2023

Automatic Meter Reading (AMR) is a technology employed to autonomously gather consumption, diagnostic, and status data from gas, electricity, or water metering devices. Subsequently, the AMR transmits this data to a centralized database for purposes such as billing, troubleshooting, and analysis. An automated meter reading device (AMR device) is an add-on that can be retrofitted onto an existing energy meter or water meter, transforming a conventional meter into a smart electricity meter or smart water meter by enabling the transmission of real-time data through a connected network.

The adoption of Automated Meter Reading (AMR) technology is increasing as more utilities recognize its potential to enhance efficiency and elevate customer service. For businesses, AMR technology provides them with control over consumption and billing. Utilities, businesses, and homeowners are discovering the benefits of AMR systems in streamlining operations. The recent advancements in AMR technology and data communication further contribute to its appeal.

Regional Insights

Asia Pacific Region Held the Largest Share of the Global Market in 2023

The smart meter market in the Asia Pacific region has achieved significant valuation and is poised to sustain its dominant position. This region is characterized by widespread implementations of smart electric meters, smart gas meters, and smart water meters, all aimed at fostering sustainable and efficient consumption of electricity, gas, and water respectively. The Asia Pacific region has witnessed a substantial increase in renewable energy production, leading to the establishment of new energy grids and the expansion of transmission and distribution networks. These advancements have propelled the installation of smart meters throughout the region. While natural gas and water meters currently hold a smaller presence compared to electricity meters, their market share is anticipated to grow with the rising adoption of IoT and mobile device management.

Key countries in the region, including China, Japan, and South Korea, have either implemented or are planning large-scale smart meter rollouts. Furthermore, the increasing uptake of renewable energy sources and the demand for more precise and real-time energy data are contributing to market expansion. However, challenges such as the need for more standardization and concerns about cybersecurity may impede market growth.

Key Market Players & Competitive Insights

The Smart Meter market is characterized by intense competition, with numerous manufacturers holding a significant portion of the market share. Key business strategies employed by market participants to sustain and expand their global presence include product launches, approvals, strategic acquisitions, and innovations.

Some of the major players operating in the global market include:

- ABB

- Hubbell

- Badger Meter

- BMETER

- Diehl

- Honeywell

- Itron, Jabil

- Kamstrup

- Landis+Gyr

- Secure Meters Ltd

- Sensus

- Siemens

- ZENNER

Recent Developments

- November 2023: Honeywell launched a hydrogen-capable gas meter, aligning with the European Green Deal, providing adaptability for hydrogen and natural gas, supporting energy transition, and operational sustainability.

- September 2023: Honeywell collaborated with Quantinuum to integrate quantum computing-hardened encryption keys into smart utility meters, enhancing cybersecurity and protecting critical infrastructure against evolving threats.

- January 2023: Badger Meter, Inc. has acquired Syrinix, Ltd., a UK-based intelligent water monitoring solutions provider, for £15 million, enhancing its smart water capabilities with high-frequency pressure monitoring and leak detection technologies.

Smart Meter Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 23,554.95 million |

|

Revenue forecast in 2032 |

USD 48,146.40 million |

|

CAGR |

9.3% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

We provide our clients the option to personalize the Smart Meter Market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

Browse Our Top Selling Reports

Multi-access Edge Computing Market Size, Share 2024 Research Report

Industrial Refrigeration Systems Market Size, Share 2024 Research Report

Tacrolimus Market Size, Share 2024 Research Report

U.S. Metaverse Market Size, Share 2024 Research Report

U.S. Data Center Cooling Market Size, Share 2024 Research Report

FAQ's

The global Smart Meter market size is expected to reach USD 48,146.40 million by 2032

Key players in the market are ABB, Hubbell, Badger Meter, BMETER, Diehl, Honeywell, Itron, Jabil

Asia Pacific contribute notably towards the global smart meter market

The global smart meter market is expected to grow at a CAGR of 9.3% during the forecast period.

The smart meter market report covering key segments are type, technology, application, and region.