Smart Lock Market Share, Size, Trends, Industry Analysis Report

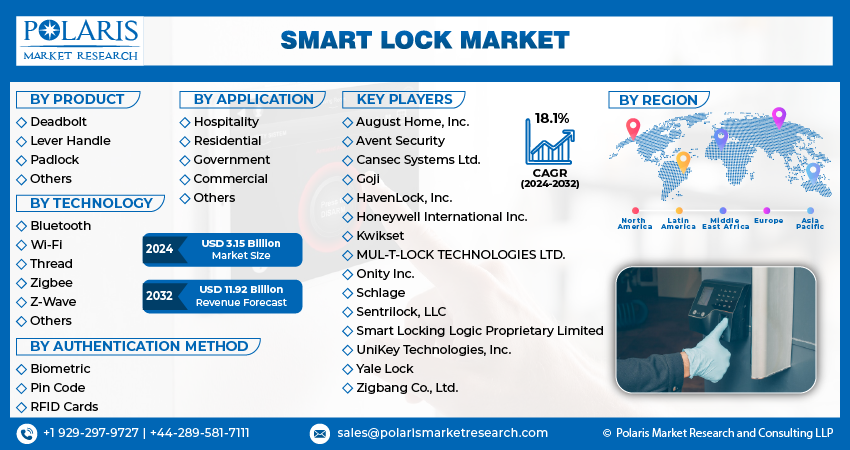

By Product (Deadbolt, Lever Handle, Padlock, Others); By Technology; By Authentication Method; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1049

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

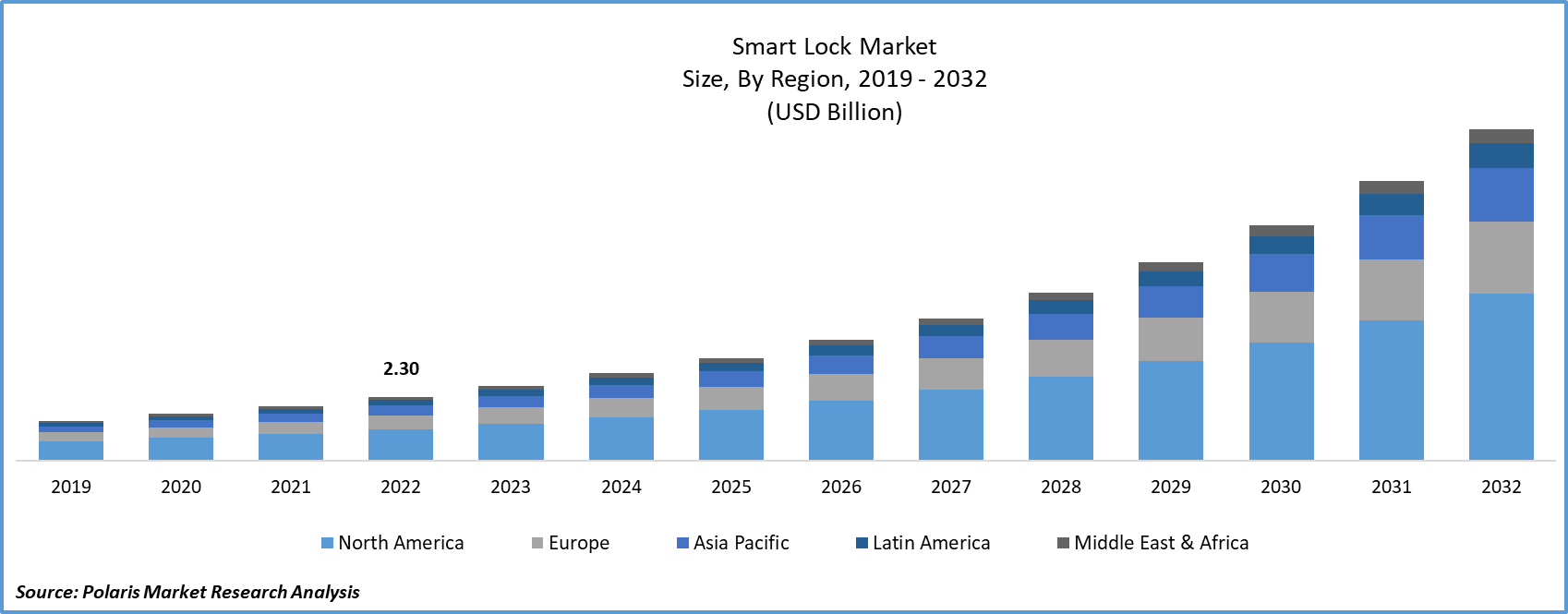

Global smart lock market size and share was valued at USD 2.69 billion in 2023 and is anticipated to generate an estimated revenue of USD 11.92 billion by 2032, exhibiting a CAGR of 18.10% Over the forecast period, 2024 – 2032

Smart Lock are innovative electronic locking systems designed to offer elevated security and convenience for regulating access to residences and other safeguarded spaces, smart Lock utilize diverse technologies, including Wi-Fi and Bluetooth, to establish communication with authorized users and interconnected devices.

To Understand More About this Research: Request a Free Sample Report

Several factors are driving the growth of the smart Lock market. Advancements in nanotechnology, bioelectronic sensors, and related fields are expected to drive market growth in the forecast period. Key manufacturers are making significant investments in incorporating Power over Ethernet (PoE) and NFC Technology with Artificial Intelligence in recent smart lock system developments. Additionally, risen concerns about personal security and safety, fueled by the rising crime rates worldwide, have intensified the global demand for advanced security solutions.

For instance, In September 2022, Yale Home launched the Yale Assure Lock 2, a cutting-edge series of smart Lock meticulously redesigned with modern technology for seamless daily access to smart homes. The Yale Assure Lock 2 utilizes Bluetooth and Wi-Fi connectivity, enabling remote control of the lock for enhanced convenience.

The surge in worldwide adoption of smart home technology and the invasion of companies specializing in home automation have been significant factors driving the smart Lock market. Leading industry players are devoted to delivering commercially viable products and developing cutting-edge solutions, such as the ability to open and lock doors and windows remotely. Furthermore, with the continuous boost in the number of households equipped with voice assistants, manufacturers are merging their products with these devices, allowing for voice-controlled lock operations.

The COVID-19 pandemic had a significant impact on the smart lock market. With the general adoption of social distancing measures and an increased focus on touchless technologies to alleviate the spread of the virus, the demand for smart Lock has seen a rise. As people became more conscious of hygiene and safety, the contactless nature of smart Lock, which allows users to unlock doors using their smartphones or other electronic devices, gained traction.

Moreover, the pandemic accelerated the adoption of smart home technologies as individuals spent more time at home and sought ways to enhance their living spaces. Smart Lock, integrated with home automation systems, became part of a broader ecosystem that included security cameras, thermostats, and lighting controls. This integrated approach not only provided users with enhanced convenience but also contributed to a holistic home security solution.

To Understand More About this Research: Request for Customized Report

However, the smart lock market also faced challenges during the pandemic, such as disruptions in the global supply chain and manufacturing processes. Lockdowns, restrictions, and economic uncertainties affected the production and distribution of smart lock components, leading to delays and supply chain blockages.

Another notable use of smart Lock is in the hospitality sector. Various hotels are choosing Wi-Fi or Bluetooth-enabled Lock over RFID Lock accessed through integrated circuit cards to enhance security measures on their premises. In the era of smart home technology, connectivity is established through communication technologies like Thread, Wi-Fi, Z-Wave, ZigBee, and others, all of which can be integrated into a single device.

Industry Dynamics

Growth Drivers

Increasing Investment in a Commercial Projects and Smart Cities Will Drive the Growth of the Market

The rising investment in smart cities and industrial projects will facilitate the growth of the smart Lock market. As industries continue to adopt automation and connectivity, the demand for advanced security solutions has surged, spurring increased investments in innovative technologies like smart Lock. These intelligent locking systems offer a seamless integration of digital capabilities, allowing for remote access control and monitoring. In smart cities, the rising trend of urbanization, associated with the imperative for sustainable and efficient urban management, has led to substantial investments in the incorporation of smart technologies, including smart Lock, in urban areas. The expansion of industrial projects and the evolution of smart cities thus form a coactive relationship with the smart Lock market, driving its growth and enabling the creation of more secure and technologically advanced environments.

The vast integration of smart home devices, facilitated by the implementation of smart Lock, has alleviated concerns among consumers who prioritize data privacy and security within their homes. Users can effortlessly connect Bluetooth or Wi-Fi devices, enabling access through a simple phone tap or voice command. These devices enhance security through refined presence detection, robust durability, and effective alert systems. The prevalence of easy access and swift authentication has become standard, significantly propelling the overall market demand for smart Lock.

Report Segmentation

The market is primarily segmented based on product, technology, authentication method application, and region.

|

By Product |

By Technology |

By Authentication Method |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The Deadbolt Segment Accounted for the Largest Revenue Share in 2022

The deadbolt segment accounted for the largest revenue share in the smart lock market. This is due to the increasing adoption of the product across diverse sectors and its user-friendly installation. Essential contributors to the rise of the deadbolt segment include low installation expenses, exceptional durability, and effective protection against intrusion. Additionally, companies are actively working on broadening their range of offerings. As an visual, Kwikset has enhanced its collection of cutting-edge deadbolts by incorporating features such as single-touch Lock, low battery alerts, and personalized user codes, garnering significant customer interest.

On the other hand, the lever handle segment is anticipated to witness substantial growth. The enhancement of security measures for tourists through modernization initiatives in the hospitality sector is anticipated to drive growth in this segment. Within commercials, smart lever handles are commonly used for interior doors. These handles distinguish themselves from competitors by offering straightforward locking and unlocking mechanisms, such as the push-down style handle, as opposed to the knob, which entails gripping and turning.

By Application Analysis

The Residential Segment Accounted for the Largest Market Share in 2022

The residential segment accounted for the largest market share. Its significant revenue generation can be ascribed to the rising global adoption of smart home technology and a surge in new construction and renovation projects. The rising affordability of contemporary security solutions, including motion detectors, door and window opening sensors, and remote door locking and unlocking, is anticipated to fuel further adoption. The emergence of Lock compatible with technologies such as Z-Wave, ZigBee, and BLE is gaining popularity, especially in mass-market residential applications, attracting an extensive base of clients.

On the other hand, hospitality segment is anticipated to experience fastest growth. Primarily driven by the increasing number of critical surgeries, including angioplasty, predominantly performed in hospital settings. Hospitals possess advanced facilities for complex procedural interventions, making them the preferred choice. Additionally, the segment's growth is further stimulated by the increasing number of partnerships with major market players. However, the outbreak of the coronavirus in 2020 has resulted in the postponement of several elective cardiac procedures, which may prime to relatively sluggish growth in this segment.

Regional Insights

North America Dominated the Largest Market in 2022

North America held the largest market in the smart Lock market. Rising concerns about security are fueling an ongoing surge in the widespread adoption of smart-lock systems in North America. Consumer investment in smart locking systems remains significant in this area. The escalating security concerns within North America serve as a pivotal factor propelling the demand for smart lock solutions. Additionally, the compatibility of intelligent lock technology with numerous infrastructures further contributes to the remarkable growth of the smart lock market in North America.

Asia Pacific region is accounted for the fastest growth in the smart Lock market. Substantial growth can be ascribed to a remarkable surge in both residential and commercial projects related to the continuous implementation of smart city initiatives in developing nations such as India. Furthermore, there has been significant growth in smart home adoption in Asia Pacific. Numerous entities in the APAC region are consistently innovating by introducing new functionalities for smart Lock.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- August Home, Inc.

- Avent Security

- Cansec Systems Ltd.

- Goji

- HavenLock, Inc.

- Honeywell International Inc.

- Kwikset

- MUL-T-LOCK TECHNOLOGIES LTD.

- Onity Inc.

- Schlage

- Sentrilock, LLC

- Smart Locking Logic Proprietary Limited

- UniKey Technologies, Inc.

- Yale Lock

- Zigbang Co., Ltd.

Recent Developments

- In March 2023, HavenLock Inc., a veteran-owned organization headquartered in Tennessee and known for developing the groundbreaking Haven Lockdown System, has announced the launch of the Power G version of their smart locking system designed for secure use in schools and commercial settings.

- In February 2023, Sentrilock, LLC, a prominent provider of electronic lockbox solutions in the real estate industry, has recently announced a new partnership with the Chesapeake Bay and Rivers Association of REALTORS® (CBRAR). Together, they aim to establish a cutting-edge marketplace for smart electronic lockbox solutions catering to the needs of REALTORS®.

- In December 2022, ASSA ABLOY Group has effectively acquired Janam Technologies, a prominent provider of handheld readers and mobile computers. This strategic move aims to integrate handheld readers into the smart lock solutions portfolio, enhancing the capability to scan tickets through RFID technology and barcodes.

Smart Lock Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.15 billion |

|

Revenue forecast in 2032 |

USD 11.92 billion |

|

CAGR |

18.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Technology, By Authentication Method, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Custom Market Research Services

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

The global smart lock market size is expected to reach USD 11.92 billion by 2032, according to a new study by Polaris Market Research

Key players in the market are August Home, Inc., Avent Security, Cansec Systems Ltd., Goji, HavenLock, Inc

North America contribute notably towards the global smart lock market

The global smart lock market is expected to grow at a CAGR of 18.0% during the forecast period.

The smart lock market report covering key segments are product, technology, authentication method application and region.