Smart Antenna Market Size, Share, Trends, Industry Analysis Report: By Type, By Technology (SIMO, MIMO, MISO), By Product, By Application, and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 120

- Format: PDF

- Report ID: PM1454

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

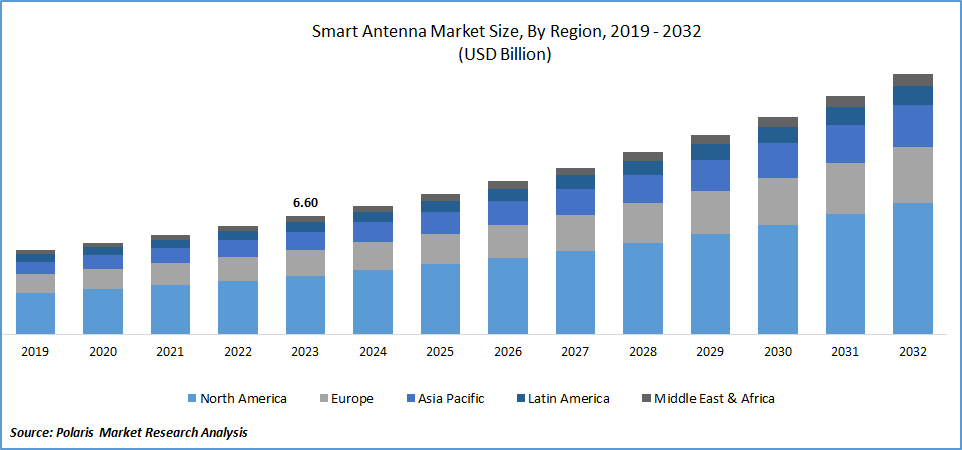

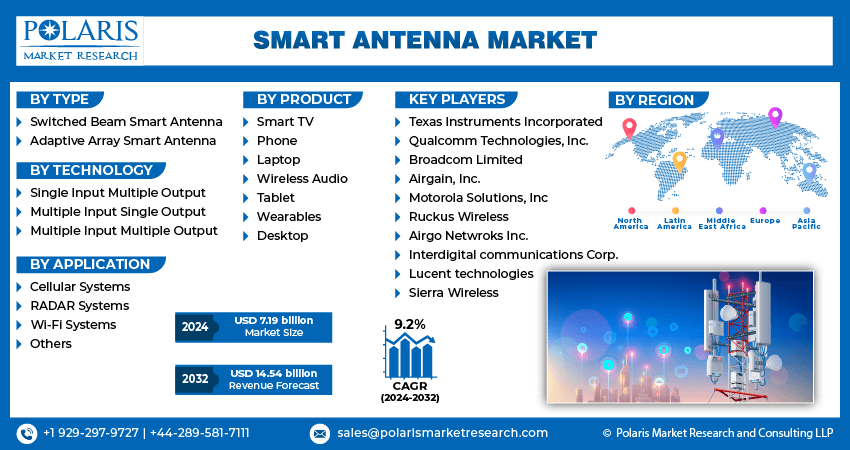

The global smart antenna market size was valued at USD 6.60 billion in 2023. The market is projected to grow from USD 7.19 billion in 2024 to USD 14.54 billion by 2032, exhibiting a CAGR of 9.2% during the forecast period.

The smart antenna is a technology that enhances wireless communication by improving signal quality, increasing data rates, and reducing interference in applications like mobile phones, Wi-Fi networks, and satellite communications.

The smart antenna market is experiencing robust growth driven by advancements in technology that enable secure and high-speed two-way communication. Moreover, the reliance of industries on rapid two-way communication due to modern technological advancements also boosts the smart antenna market growth.

To Understand More About this Research:Request a Free Sample Report

The growing demand for secure long-distance data transmission is another major contributor to the expansion of the smart antenna industry size. The market is expanding with the increased digital connectivity and the rising implementation of 5G millimeter-wave radio frequencies in devices such as mobiles, 5G smartphones, and others.

For instance, in October 2019, Qualcomm Technologies, Inc. launched its latest product offering by expanding the Qualcomm QTM052 millimeter wave antenna module lineup. These fully integrated 5G NR millimeter wave modules are designed for mobile devices and smartphones and are 25% smaller than the initial QTM052 millimeter wave antenna modules.

Smart Antenna Market Trends

Rising Internet of Things (IoT) Applications

Market CAGR for smart antenna is being driven by the growing proliferation of the IoT devices as they require reliable and efficient connectivity to transmit data over networks. Smart antennas provide connectivity by improving signal strength, enhancing coverage, and minimizing interference.

These antennas also enable IoT devices to maintain stable connections in challenging environments, ensuring seamless data transmission critical for real-time monitoring, analytics, and automation.

For instance, in December 2023, Quectel launched six new antennas specifically to enhance connectivity performance for IoT devices. These antennas cater to a diverse array of applications, spanning from 5G to non-terrestrial networks (NTNs), thereby offering customers innovative capabilities.

IoT applications are also expanding across various industries, such as healthcare, manufacturing, transportation, and smart cities, propelling the demand for robust wireless communication solutions.

Rising Adoption of 5G Technologies in Smart Antenna

The smart antenna market is experiencing significant growth, driven by the rising adoption of 5G technologies. 5G networks operate at higher frequencies and use new technologies, such as massive MIMO (Multiple Input Multiple Output), to achieve significantly faster data speeds and lower latency compared to previous generations.

For instance, in July 2022, according to the World Bank Asia Pacific Data, five out of the eight Asian countries’ 5G population coverage surpassed 50 percent as compared to 2020. The number of publicly announced 5G enterprise deployments has risen by 114 percent across the eight countries.

5G services support a massive increase in connected devices and applications, ranging from autonomous vehicles to smart cities and industrial automation. Smart antennas enable 5G networks to deliver reliable connectivity, improved coverage, and enhanced spectral efficiency, driving the smart antenna market revenue.

Segmental Analysis

Smart Antenna Market Breakdown by Technology Insights

The global market segmentation, based on technology, includes SIMO (Single Input Multiple Output), MIMO (Multiple Input Single Output), and MISO (Multiple Input Multiple Output). The MIMO segment is expected to register the highest CAGR in the market during the forecast period due to its ability to enhance wireless communication performance. MIMO increases data throughput, improves spectral efficiency, and enhances reliability by mitigating fading and interference.

The growing demand for high-speed data transmission in wireless networks makes MIMO a preferred choice in sectors such as telecommunications, Wi-Fi networks, and 5G deployments.

For instance, in February 2024, Ericsson deployed Massive MIMO 5G radios for Airtel in 12 telecom circles as part of Airtel’s MINI-LINK (microwave) and 5G Radio Access Network for mobile transport portfolios.

Smart Antenna Market Breakdown by Application Insights

The global market segmentation, based on application, includes Wi-Fi systems, cellular systems, WiMAX systems, RADAR systems, and others. The cellular systems segment dominated the market owing to its application in smart antennas. Cellular systems use a cluster of smart antennas to enhance signal strength and quality effectively. These systems, along with smart antenna, drive the implementation of 4G and 5G networks.

For instance, in November 2023, according to the Ministry of State for Communications, 5G networks were implemented in 738 districts across India, with a total of 3,94,298 base stations set up to serve up to 100 million subscribers utilizing 5G network, boosting the smart antenna market growth.

Global Smart Antenna Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Smart Antenna Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa. In 2023, the North America smart antenna market accounted for the largest market share owing to the presence of significant technology firms specialized in telecommunications and wireless technologies. This fosters innovation and rapid development of smart antenna systems.

For instance, in July 2024, Adant Technologies Inc. introduced the sMART-2E, an innovative, affordable smart antenna solution with a low-profile design, aimed at transforming connectivity for small and medium businesses (SMB), multi-dwelling units (MDU), and enterprise networks in the United States.

The key market players are deploying smart antennas in industries such as agriculture, construction, and others to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

For instance, in April 2022, Volvo Construction Equipment entered into a distribution agreement with Hemisphere GNSS to distribute their latest S631 GNSS smart antennas along with control and data transfer solutions to construction industries.

The Asia Pacific smart antenna market is expected to grow at the highest CAGR from 2024 to 2032 because smart antennas in this region are ensuring smooth wireless connectivity for high-speed communication systems. The rising adoption of 5G networks and the expansion of the IoT in this region is driving the expansion of the smart antenna market.

For instance, according to the 2023 Mobile Economy report, 5G will make up 41% of mobile connections in the Asia Pacific region by 2030, marking a tenfold increase from the 4% recorded in 2022. This growth is expected to bring in over US$133 billion to the regional economy.

Global Smart Antenna Market Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Telecommunications operators and network equipment manufacturers are rolling out 5G networks equipped with advanced MIMO capabilities, driving innovation and collaboration in the smart antenna market.

For instance, in June 2023, u-blox and Tallysman Wireless Inc. entered into an innovation agreement to collaborate on the development of advanced PointPerfect PPP-RTK smart antennas. The PointPerfect GNSS augmentation service will be accessible in Europe, North America, and specific areas of Asia Pacific.

Smart Antenna Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the smart antenna market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaborations with other organizations. To expand and survive in a more competitive and rising market climate, the smart antenna market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global market for smart antenna. In recent years, the market has offered some technological advancements. Major players in the smart antenna industry include Airgain Inc., Amphenol Corporation, Broadcom Limited, Galtronics USA Ltd., Intel Corporation, Linx Technologies, Molex LLC, Qualcomm Technologies, Inc., Sierra Wireless, and Sunway Communication.

Linx Technologies, headquartered in the United States, is a manufacturing company that specializes in wireless components, including RF connectors, antennas, modules, and remote controls. It makes wireless technology accessible for engineers through its products. In March 2023, Linx Technologies launched a line of cellular adhesive flexible printed circuit (FPC) antennas. These antennas are specifically crafted to cater to the needs of cellular IoT (LTE-M, NB-IoT), 5G New Radio, and LTE applications, providing an economical and adaptable antenna solution.

Qualcomm Technologies, Inc. is a company that develops and commercializes foundational technologies for the wireless industry. The company’s Snapdragon platforms are used to power the AR, VR, and MR devices. It has three reportable business segments: Qualcomm Technology Licensing, Qualcomm CDMA Technologies, and Qualcomm Strategic Initiatives. In February 2024, Qualcomm Technologies, Inc. introduced the Snapdragon X80 5G Modem-RF System, representing the seventh evolution of its 5G modem-to-antenna platform.

List of Key Companies in Smart Antenna Market

- Airgain Inc.

- Amphenol Corporation

- Broadcom Limited

- Galtronics USA Ltd.

- Intel Corporation

- Linx Technologies

- Molex LLC

- Qualcomm Technologies, Inc.

- Sierra Wireless

- Sunway Communication

Smart Antenna Market Developments

- May 2024: Point One Navigation and Calian GNSS collaborated to offer seamless Smart GNSS Antenna support for Polaris RTK to provide innovative healthcare, learning, communications, and cybersecurity solutions.

- April 2024: Leica Geosystems introduced the Leica iCON gps 120, a smart antenna that offers adaptable and versatile machine control solutions, at the construction trade show Intermat in France.

- October 2023: Zyxel Networks launched its latest Wi-Fi 7 AP, showcasing unparalleled speed, adaptive antenna technology, anti-noise shielding, and other cutting-edge capabilities.

Smart Antenna Market Segmentation

Smart Antenna Type Outlook

- Switched Beam Smart Antenna

- Adaptive Array Smart Antenna

- FPC Smart Antenna

- LDS Smart Antenna

- MPI Smart Antenna

- LCP Smart Antenna

Smart Antenna Technology Outlook

- SIMO (Single Input Multiple Output)

- MIMO (Multiple Input Single Output)

- MISO (Multiple Input Multiple Output)

Smart Antenna Product Outlook

- Smart TV

- Phone

- Laptop

- Wireless Audio

- Tablet

- Wearables

- Desktop

Smart Antenna Application Outlook

- Wi-Fi Systems

- Cellular Systems

- WiMAX Systems

- RADAR Systems

- Others

Smart Antenna Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Antenna Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 6.60 billion |

|

Market Size Value in 2024 |

USD 7.19 billion |

|

Revenue Forecast in 2032 |

USD 14.54 billion |

|

CAGR |

9.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global smart antenna market size was valued at USD 6.60 billion in 2023 and is projected to be valued at USD 7.19 billion in 2032.

The global market is projected to register at a CAGR of 9.2% during the forecast period, 2024-2032

North America had the largest share of the global market

The key players in the market are Airgain Inc., Amphenol Corporation, Broadcom Limited, Galtronics USA Ltd., Intel Corporation, Linx Technologies, Molex LLC, Qualcomm Technologies, Inc., Sierra Wireless, and Sunway Communication.

The MIMO (Multiple Input Single Output) category is expected to grow at the highest CAGR in the market.

The cellular system held the largest share of the global market