Small Hydropower Market Size, Share, Trends, Industry Analysis Report: By Type (Micro Hydropower and Mini Hydropower), Capacity, Component, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5413

- Base Year: 2024

- Historical Data: 2020-2023

Small Hydropower Market Overview

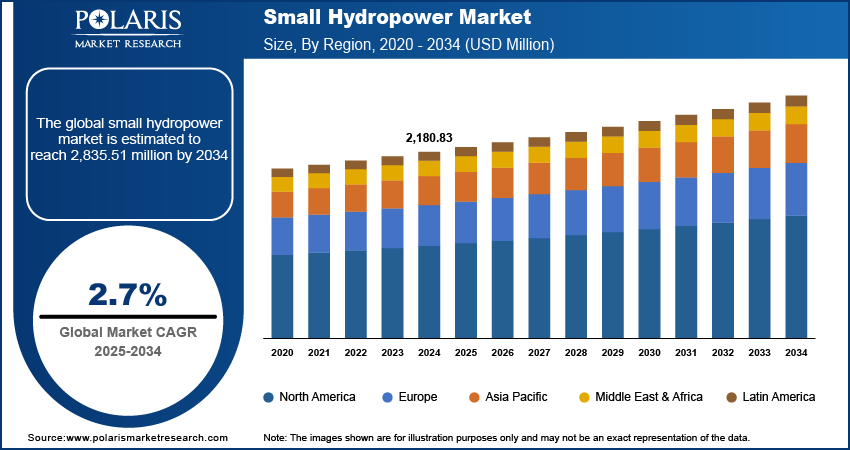

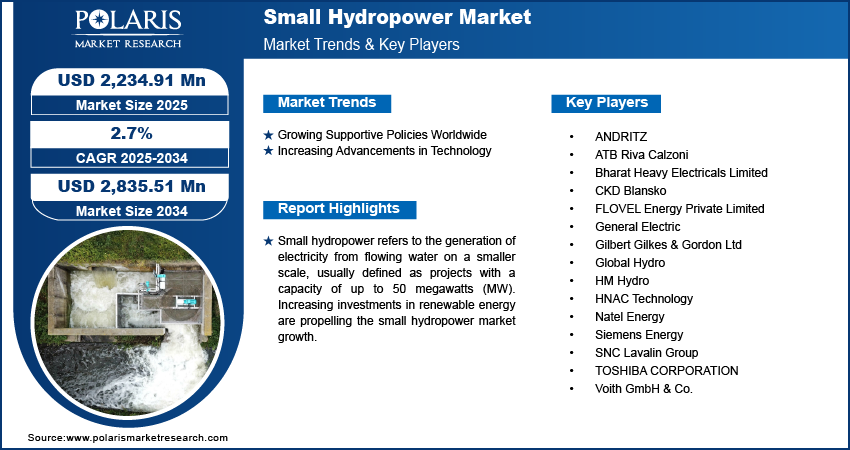

The global small hydropower market size was valued at USD 2,180.83 million in 2024. The market is projected to grow from USD 2,234.91 million in 2025 to USD 2,835.51 million by 2034, exhibiting a CAGR of 2.7% during 2025–2034.

Small hydropower refers to the generation of electricity from flowing water on a smaller scale, usually defined as projects with a capacity of up to 50 megawatts (MW). Small hydropower systems harness the kinetic energy of water in rivers, streams, or existing water infrastructure, converting it into usable electrical energy with minimal environmental impact. These systems are particularly beneficial in remote or rural areas where access to a national electricity grid may be limited or non-existent. They provide a reliable source of renewable energy, contributing to local energy needs while promoting sustainable development. The installation of small hydropower systems typically involves less civil construction work and utilizes existing structures such as dams or irrigation canals, which reduces costs and environmental disruption.

Increasing investments in renewable energy is propelling the small hydropower market growth. As per the data published by the International Energy Agency, USD 2 trillion was invested in renewable energy technologies and infrastructure in 2024. Increased funding drives governments and businesses to prioritize clean and sustainable energy sources such as wind energy, solar energy, and small hydropower. Small hydropower, with its lower carbon footprint, offers a consistent and scalable option, making it attractive for rural electrification, industrial applications, and grid stability. The increased investment also reduces the capital barriers for small hydropower projects, making them more accessible. Furthermore, advancements in technology and infrastructure, fueled by increased investment, enhance the efficiency and feasibility of small hydropower, making them more appealing to energy planners.

The small hydropower market demand is driven by the rising rural electrification initiatives. Many rural areas, particularly in developing countries, lack connection to centralized power grids, making decentralized energy solutions such as small hydropower highly attractive. In addition, small hydropower projects are cost-effective in comparison to wind and solar energy, which encourages governments, municipal corporations, and local bodies to invest in these projects to generate reliable and sustainable electricity for rural communities.

Small Hydropower Market Dynamics

Growing Supportive Policies Worldwide

Governments and regulatory bodies worldwide are introducing policies such as energy community policy guidelines, UNIDO initiatives for sustainable development, tax incentives, subsidies, grants, and feed-in tariffs to promote renewable energy, including small hydropower. These policies reduce the upfront costs and risks associated with small hydropower projects, making them more attractive to investors and developers. Supportive policies also prioritize the integration of small hydropower into national energy strategies, recognizing its role in achieving renewable energy targets and reducing carbon emissions. Additionally, streamlined approval processes and clear regulatory frameworks help overcome bureaucratic hurdles, accelerating the adoption of small hydropower projects. Therefore, the growing government-supportive policies are fueling the small hydropower market expansion.

Increasing Advancements in Technology

Innovations in turbine design, materials, and control systems have made small hydropower systems more efficient at converting water flow into electricity, even in low-head or low-flow conditions. These improvements allow small hydropower to operate in a wider range of locations, including remote and rural areas, where traditional hydropower systems may not be feasible. Smart grid integration and digital monitoring technologies further increase the appeal of small hydropower by enabling better management of energy output and grid stability. These technologies allow small hydropower systems to seamlessly integrate with other renewable energy sources, enhancing their reliability and contribution to energy mixes. Additionally, advancements in modular and prefabricated small hydropower systems reduce installation time and costs, making them more attractive to energy planners, municipal corporations, and local bodies.

Small Hydropower Market Segment Insights

Small Hydropower Market Evaluation by Type Insights

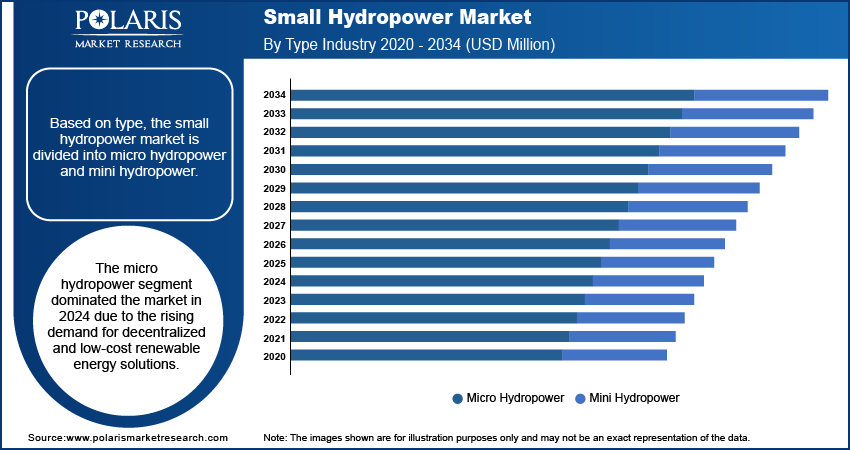

Based on type, the small hydropower market is divided into micro hydropower and mini hydropower. The micro hydropower segment dominated the small hydropower market share in 2024 due to the rising demand for decentralized and low-cost renewable energy solutions. Rural electrification initiatives, particularly in developing nations, have increased the adoption of micro hydropower due to its suitability for small rural communities and agricultural applications. Many governments and international organizations continue to fund micro hydropower projects to provide reliable electricity in off-grid locations. Technological innovations, including compact and modular turbine designs, have made installation and maintenance of micro hydropower more affordable and efficient. Growing environmental concerns also contribute to rising demand, as micro hydropower projects have minimal ecological impact and require fewer infrastructure modifications.

Small Hydropower Market Assessment by Capacity Insights

In terms of capacity, the small hydropower market is segregated into up to 1 MW and 1- 10 MW. The upto 1MW segment dominated the market in 2024 due to its versatility, cost-effectiveness, and suitability for decentralized energy systems. The ability of 1 MW small hydropower systems to cater to small communities, rural electrification projects, and industrial applications without requiring extensive infrastructure or large water resources has contributed to its wide adoption. The 1 MW systems are particularly attractive in developing regions, where they provide a reliable and sustainable energy solution for off-grid and remote areas. Additionally, governments and organizations have prioritized these smaller-scale projects due to their lower environmental impact, shorter development timelines, and ability to leverage local water resources efficiently. Supportive policies, such as subsidies and feed-in tariffs, have further accelerated the adoption of 1 MW systems.

Small Hydropower Market Regional Analysis

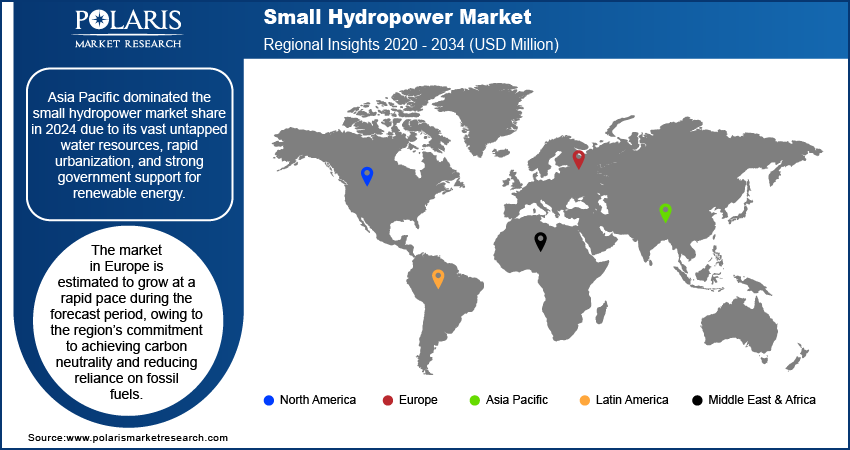

By region, the report provides the small hydropower market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the small hydropower market share in 2024 due to its vast untapped water resources, rapid urbanization, and strong government support for renewable energy. Countries such as China and India dominate the region owing to their extensive investments in clean energy infrastructure and renewable energy. The region’s focus on rural electrification and energy access in remote areas has fueled the adoption of small-scale hydropower systems, particularly in hilly and mountainous regions where water resources are abundant. Additionally, favorable policies, such as subsidies, tax incentives, and streamlined regulatory approvals, have encouraged both public and private sector participation, making Asia Pacific the dominant region in the small hydropower market.

The market in Europe is estimated to grow at a rapid pace during the forecast period, owing to its commitment to achieving carbon neutrality and reducing reliance on fossil fuels. The European Union’s stringent renewable energy targets and supportive regulatory frameworks, such as the Green Deal and national renewable energy action plans, are accelerating the deployment of small-scale hydropower projects. Norway is estimated to hold the largest market share within Europe due to its extensive expertise in hydropower technology and its focus on modernizing existing infrastructure to improve efficiency. The region’s emphasis on sustainability, coupled with advancements in turbine technology and environmental monitoring, drives demand for small hydropower projects, thereby contributing to the Europe small hydropower market expansion.

Small Hydropower Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the small hydropower market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The small hydropower market is fragmented, with the presence of numerous global and regional market players. Major players in the market include ANDRITZ, ATB Riva Calzoni, Bharat Heavy Electricals Limited, CKD Blansko, FLOVEL Energy Private Limited, General Electric, Gilbert Gilkes & Gordon Ltd, Global Hydro, HM Hydro, HNAC Technology, Natel Energy, Siemens Energy, SNC Lavalin Group, TOSHIBA CORPORATION, and Voith GmbH & Co.

ANDRITZ is a global supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, metalworking and steel industries, and solid/liquid separation in municipal and industrial sectors. ANDRITZ Hydro provides electromechanical equipment and services for hydropower plants. The company has a global presence with over 250 production locations. The company also provides services for small hydropower projects, which include project management, engineering, manufacturing, quality control, installation, and commissioning, and training and site measurement.

Bharat Heavy Electricals Limited, established in 1964, is a premier public sector enterprise in India, primarily engaged in the engineering and manufacturing of equipment for various sectors, including power generation, transmission, and renewable energy. The company has a diverse portfolio that includes thermal, hydro, gas, nuclear, and solar power generation technologies. BHEL's small hydropower offerings include a variety of turbine types, such as Pelton, Francis, and Kaplan turbines, which are suitable for different site conditions and water flow rates. BHEL also provides services for the modernization and upgrading of existing small hydro plants to enhance their efficiency and output.

List of Key Companies in Small Hydropower Market

- ANDRITZ

- ATB Riva Calzoni

- Bharat Heavy Electricals Limited

- CKD Blansko

- FLOVEL Energy Private Limited

- General Electric

- Gilbert Gilkes & Gordon Ltd

- Global Hydro

- HM Hydro

- HNAC Technology

- Natel Energy

- Siemens Energy

- SNC Lavalin Group

- TOSHIBA CORPORATION

- Voith GmbH & Co.

Small Hydropower Industry Developments

March 2024: The European Union introduced two new projects in Nigeria: Small Hydro Power Development for Agro-industry Use (SHP-DAIN) and Advancing Nigeria's Green Transition to Net Zero through Circular Economy Practices.

April 2023: The Arunachal Pradesh government announced its plan to build 50 mini hydropower projects along the border with China. These projects are being implemented in a phased manner, and under Phase I, 17 projects have been taken up.

February 2022: VerdErg launched a new low-cost micro hydropower product for generating cost-efficient and eco-friendly electricity from small rivers, wastewater outflows, lock gates, and canals.

Small Hydropower Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Micro Hydropower

- Mini Hydropower

By Capacity Outlook (Revenue, USD Million, 2020–2034)

- Up to 1 MW

- 10 MW

By Component Outlook (Revenue, USD Million, 2020–2034)

- Turbine

- Generator

- Electric Infrastructure

- Intake Valves and Penstock

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Small Hydropower Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,180.83 million |

|

Revenue Forecast in 2025 |

USD 2,234.91 million |

|

Revenue Forecast by 2034 |

USD 2,835.51 million |

|

CAGR |

2.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global small hydropower market size was valued at USD 2,180.83 million in 2024 and is projected to grow to USD 2,835.51 million by 2034.

The global market is projected to register a CAGR of 2.7% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are ANDRITZ, ATB Riva Calzoni, Bharat Heavy Electricals Limited, CKD Blansko, FLOVEL Energy Private Limited, General Electric, Gilbert Gilkes & Gordon Ltd, Global Hydro, HM Hydro, HNAC Technology, Natel Energy, Siemens Energy, SNC Lavalin Group, TOSHIBA CORPORATION, and Voith GmbH & Co.

The micro hydropower segment dominated the market in 2024.