Small Gas Engines Market Size, Share, Trends, Industry Analysis Report

: By Equipment, Engine Displacement, End User (Construction, Gardening, and Industrial), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3409

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

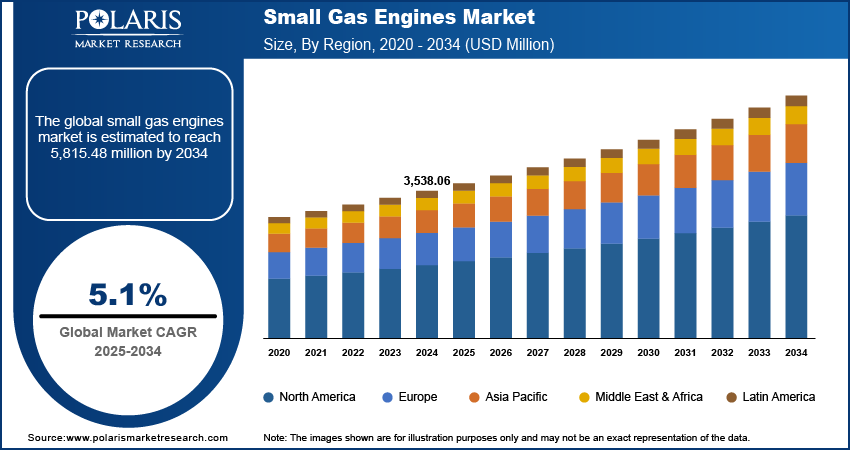

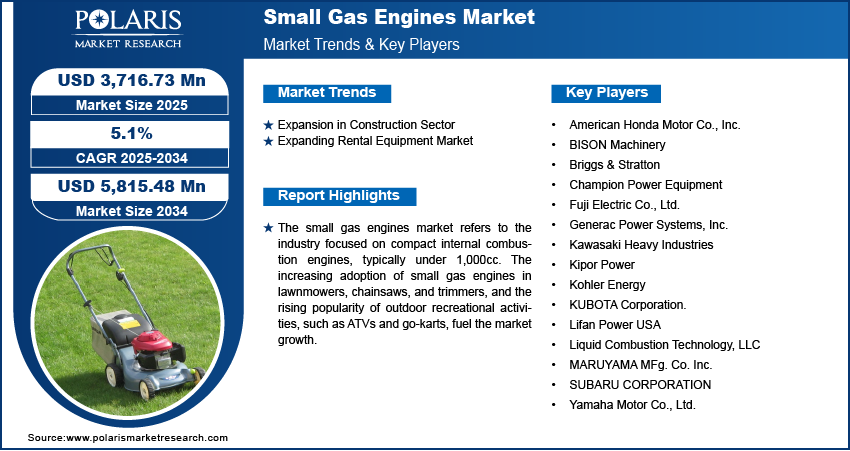

The global small gas engines market size was valued at USD 3,538.06 million in 2024, exhibiting a CAGR of 5.1% during 2025–2034. Key drivers fueling the market include rising demand from the gardening and outdoor recreation sectors, technological advances improving fuel efficiency and emissions, increased use in construction equipment amid urbanization, and growth in the rental equipment market for cost-effective, high-performance machinery.

Key Insights

- The lawnmower segment dominated the small gas engines market in 2024 due to rising urbanization, suburban housing growth, and increasing demand for efficient lawn maintenance, supported by advancements in fuel-efficient and low-emission engines and growing popularity of gardening and landscaping services.

- The gardening sector accounted for the largest market share in 2024, driven by the rise in home gardening, professional landscaping services, an increasing number of properties with large lawns, and improvements in engine fuel efficiency and emission reduction.

- North America held the largest market share in 2024, supported by strong residential and commercial landscaping demand, high participation in lawn and gardening activities, the presence of major manufacturers, a well-established retail network, and stringent regulations promoting fuel-efficient and low-emission engines.

- Asia Pacific is expected to experience significant market growth due to rapid urbanization, infrastructure development, increasing construction activity, an expanding middle class, government support for manufacturing, and rising popularity of outdoor recreational activities.

Industry Dynamics

- The growing gardening sector and rising outdoor recreational activities increase demand for small gas engines in lawnmowers, chainsaws, and trimmers.

- Technological advancements in fuel efficiency and low emissions, plus rising power outages boost portable generator demand.

- Growing preference for flexible rental models encourages manufacturers to create durable, efficient engines suitable for short-term use.

- Strict environmental regulations may limit traditional engine designs, increasing production costs and slowing adoption.

Market Statistics

2024 Market Size: USD 3,538.06 million

2034 Projected Market Size: USD 5,815.48 million

CAGR (2025–2034): 5.1%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The small gas engines market refers to the industry focused on compact internal combustion engines, typically under 1,000cc. The engines are used in applications such as lawn mowers, generators, chainsaws, pressure washers, and recreational vehicles, driven by demand for portable power solutions and outdoor equipment.

The increasing adoption of small gas engines in lawnmowers, chainsaws, and trimmers, driven by the expanding gardening sector, is contributing to the small gas engines market growth. The rising popularity of outdoor recreational activities, such as ATVs and go-karts, is further fueling the demand for small gas engines.

Technological advancements are driving the development of fuel-efficient, low-emission small gas engines, aligning with stringent environmental regulations, contributing to the small gas engines market development. Furthermore, the rising frequency of power outages is fueling the requirement for small gas engines, as portable generators powered by these engines turn out to be essential for backup power solutions.

Market Dynamics

Expansion in Construction Sector

The expansion of the construction sector is significantly contributing to the small gas engine market demand, as rising infrastructure projects drive the need for compact, gas-powered equipment. For instance, in 2024, construction expenditures reached USD 2,154.4 billion, 6.5% increase from USD 2,023.7 billion in 2023. Concrete saws, portable generators, and other small machinery are essential for efficient on-site operations, further fueling demand for small gas engines. The increasing emphasis on rapid urbanization and commercial development is boosting market growth, as contractors seek reliable and high-performance equipment to enhance productivity. Additionally, advancements in engine efficiency and durability are ensuring sustained adoption of small gas engines across various construction applications.

Expanding Rental Equipment Market

The expanding rental equipment market is fueling the small gas engines market expansion, as the rising preference for cost-effective, short-term equipment usage drives demand for gas-powered machinery. Construction and landscaping companies increasingly rely on rental services to access high-performance tools such as concrete saws, lawnmowers, and portable generators without the financial burden of ownership, which is contributing to market growth. Additionally, the growing adoption of flexible rental models is creating new growth opportunities for manufacturers to develop durable and efficient engine solutions tailored for rental applications.

Segment Insights

Assessment by Equipment Outlook

The global small gas engines market segmentation, based on equipment, includes lawnmower, portable generator, leaf blower, pressure washer, chainsaw, and others. In 2024, the lawnmower segment dominated the small gas engines market share due to increasing demand for residential and commercial redesigning solutions. Expanding urbanization and the rise of suburban housing developments have driven the need for efficient lawn maintenance equipment, further fueling market expansion. Additionally, advancements in fuel-efficient and low-emission engines align with environmental regulations, boosting market demand. The growing popularity of gardening activities, coupled with the proliferation of landscaping services, has made lawnmowers the dominant segment in the small gas engines market.

Evaluation by End User Outlook

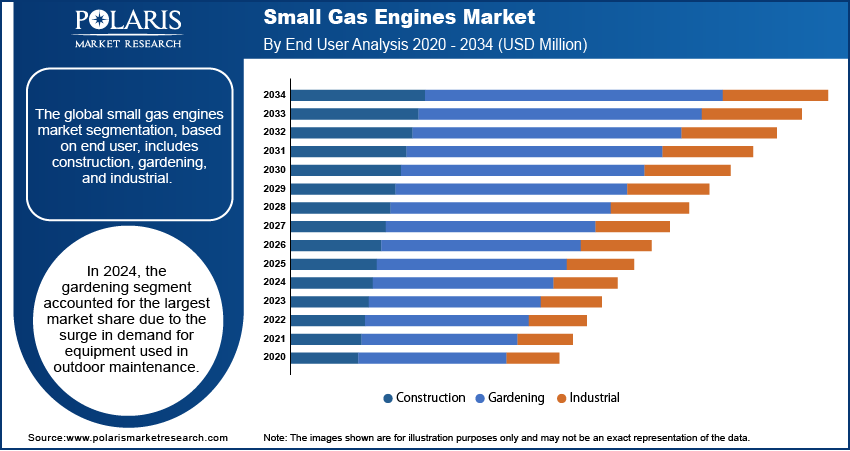

The global small gas engines market segmentation, based on end user, includes construction, gardening, and industrial. In 2024, the gardening segment accounted for the largest market share due to the surge in demand for equipment used in outdoor maintenance. Home gardening and professional landscaping services are growing; thus, gas-powered tools such as lawnmowers, leaf blowers, and trimmers have become essential for efficient operation. This trend is further supported by the increasing number of residential properties with expansive lawns and gardens, alongside the rise of commercial landscaping projects. Moreover, innovations in engine technology, which improve fuel efficiency and lower emissions, are enhancing the attractiveness and utility of small gas engines for gardening applications.

Regional Analysis

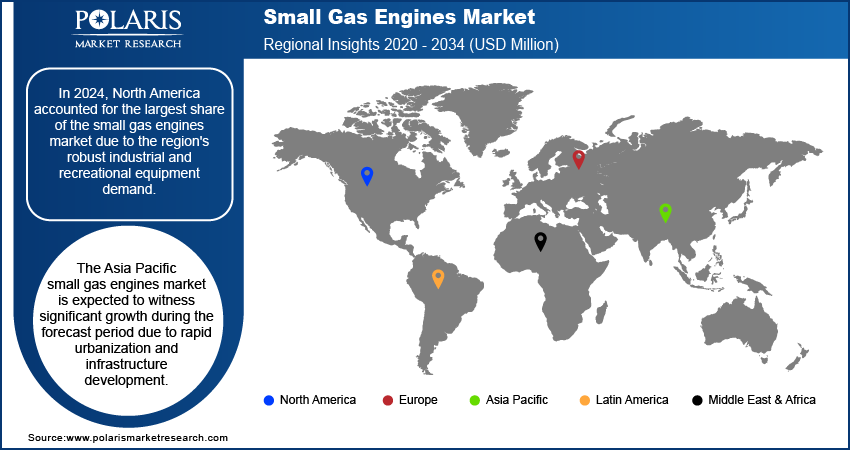

By region, the study provides small gas engines market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the region's robust industrial and recreational equipment demand. The expansion of residential and commercial landscaping services, along with the adoption of small gas-powered engines for outdoor activities, has significantly contributed to the market's growth. For instance, in 2022, according to the National Gardening Association's 2023 survey, 80% of US households participated in lawn and gardening activities, the highest level in five years. Average spending rose to USD 616 per household, a USD 74 increase from 2021. The presence of major manufacturers and a strong retail network also played a pivotal role in the North America small gas engines market expansion. Additionally, regulatory standards encouraging fuel efficiency and emissions reductions have prompted technological innovations, further enhancing the market's demand in North America. These factors combined have positioned North America as the leading market in 2024.

The Asia Pacific small gas engines market is expected to witness significant growth over the forecast period due to rapid urbanization and infrastructure development. Increased investments in construction and designing services are driving the adoption of gas-powered equipment, particularly in emerging economies. Additionally, the growing popularity of outdoor leisure activities, such as gardening, ATV riding, and boating, is fueling demand for small gas engines. The region's expanding middle class, coupled with government support for the manufacturing sector, presents a considerable opportunity for market growth.

Key Players & Competitive Analysis Report

The competitive landscape of the small gas engines market is characterized by a diverse range of global and regional players focusing on product innovation, strategic partnerships, and technological advancements. Key players in the market include manufacturers such as Honda Motor Co., Ltd.; Yamaha Motor Co., Ltd.; Briggs & Stratton Corporation; Kohler Co.; and others. These companies are leveraging advancements in fuel-efficient, low-emission technologies to meet evolving consumer preferences and regulatory requirements. Additionally, the increasing demand for small gas engines in sectors such as construction, landscaping, and recreational activities has prompted manufacturers to expand their product offerings. Strategic collaborations and mergers are also becoming common as companies aim to strengthen their market positions and access new growth opportunities. Furthermore, market leaders are prioritizing research and development (R&D) to introduce innovative solutions that improve engine performance and efficiency while adhering to environmental standards.

American Honda Motor Co., Inc., the North American associate of the Japanese Honda Motor Company, combines product service, sales, and corresponding functions of Honda in North America. The company was founded in 1959 and is headquartered in California, US. American Honda is engaged in the distribution, marketing, and sales of Honda Power Equipment products (generators and garden tools), Honda and Acura brand automobiles, Honda Marine engines, Honda Engines products, Honda Powersports products, and HondaJet aircraft. The company's product portfolio includes cars, trucks, SUVs, engines, home energy products, lawn-mowers, jets, trimmers, tillers, generators, outboard motors, multi-purpose utility vehicles (MUVs), personal watercraft, scooters, motorcycles, pumps, and snow blowers. Services provided by the company include financial services, such as retail and wholesale financing and leases related to the company’s products. American Honda has a significant presence in the US, with manufacturing plants, research and development operations, and a large network of dealerships. The company is engaged in the sale and distribution of Honda Power Equipment products, which include a range of garden tools and generators powered by small gas engines.

Yamaha Motor Co., Ltd.,,a Japanese mobility manufacturer, is engaged in the development, production, and marketing of a wide array of products, including motorboats, motorcycles, outboard motors, and other motorized products. The company was established in 1955 and is headquartered in Shizuoka, Japan. Motor's product portfolio includes motorcycles, scooters, all-terrain vehicles, snowmobiles, boats, outboard motors, personal watercraft, electric bicycles, automobile engines, generators, and industrial robots. The company provides services such as purchase financing and leasing of Motor products. Yamaha has a global presence with 137 consolidated subsidiaries. Yamaha Motor manufactures a range of multi-purpose engines and generators.

List of Key Companies

- American Honda Motor Co., Inc.

- BISON Machinery

- Briggs & Stratton

- Champion Power Equipment

- Fuji Electric Co., Ltd.

- Generac Power Systems, Inc.

- Kawasaki Heavy Industries

- Kipor Power

- Kohler Energy

- KUBOTA Corporation.

- Lifan Power USA

- Liquid Combustion Technology, LLC

- MARUYAMA MFg. Co. Inc.

- Subaru Corporation

- Yamaha Motor Co., Ltd.

Small Gas Engines Industry Developments

In January 2024, Northern Tool + Equipment launched a new series of NorthStar Engines, ranging from 180cc to 825cc. These engines enhance power, durability, and reliability across various NorthStar equipment, including air compressors, pressure washers, water pumps, sprayers, log splitters, and the newly introduced NorthStar Generators.

In April 2021, Northern Tool + Equipment acquired Jacks Small Engines. This acquisition strengthens Northern Tool's presence in the aftermarket parts market, enabling improved service and support for customers seeking high-quality components.

Small Gas Engines Market Segmentation

By Equipment Outlook (Revenue – USD Million, 2020–2034)

- Lawnmower

- Portable Generator

- Leaf Blower

- Pressure Washer

- Chainsaw

- Others

By Engine Displacement Outlook (Revenue – USD Million, 2020–2034)

- 20–100 CC

- 101–450 CC

- 451–650 CC

By End User Outlook (Revenue – USD Million, 2020–2034)

- Construction

- Gardening

- Industrial

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,538.06 million |

|

Market Size Value in 2025 |

USD 3,716.73 million |

|

Revenue Forecast in 2034 |

USD 5,815.48 million |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global small gas engines market size was valued at USD 3,538.06 million in 2024 and is projected to grow to USD 5,815.48 million by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

In 2024, North America accounted for the largest market share due to the region's robust industrial and recreational equipment demand.

A few key players in the market are Briggs & Stratton; Kohler Energy; Yamaha Motor Co., Ltd.; Kawasaki Heavy Industries; KUBOTA Corporation; Liquid Combustion Technology, LLC; Kipor Power; Champion Power Equipment; SUBARU CORPORATION; Lifan Power USA; MARUYAMA MFg.Co. Inc.; American Honda Motor Co., Inc.; Fuji Electric Co., Ltd.; BISON Machinery; and Generac Power Systems, Inc.

In 2024, the lawnmower segment accounted for the largest market share due to increasing demand for residential and commercial redesigning solutions.

In 2024, the gardening segment accounted for the largest market share due to the surge in demand for equipment used in outdoor maintenance.