Small Caliber Ammunition Market Share, Size, Trends, Industry Analysis Report: By Caliber Type, Bullet Type, Application, Lethality, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM5346

- Base Year: 2024

- Historical Data: 2020-2023

Small Caliber Ammunition Market Overview

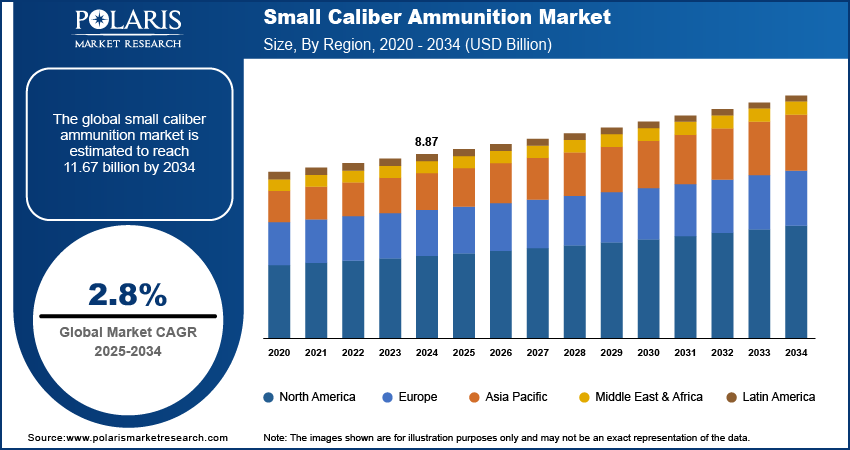

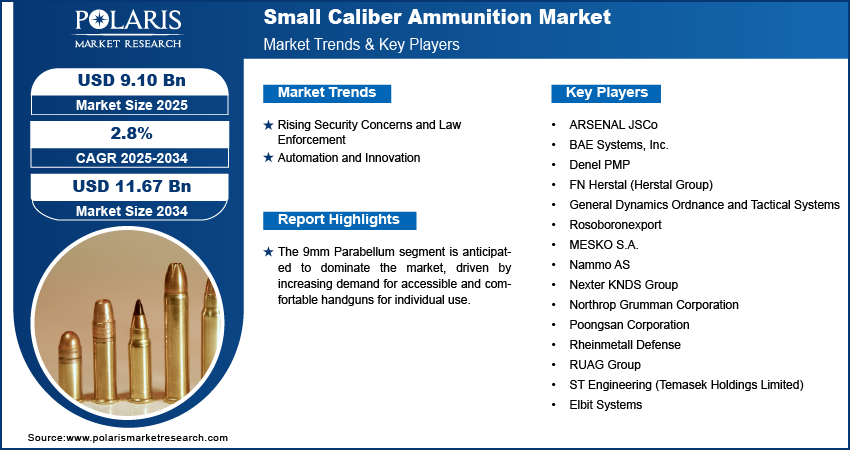

The small caliber ammunition market size was valued at USD 8.87 billion in 2024. The market is projected to grow from USD 9.10 billion in 2025 to USD 11.67 billion by 2034, exhibiting a CAGR of 2.8% during 2025–2034.

Small caliber ammunition refers to ammunition designed for firearms with a bore diameter of up to 0.50 inches. These ammunitions are commonly used in pistols, rifles, machine guns, and other small firearms due to their ease of operation. The small caliber ammunition market demand is on the rise owing to the increasing modernization of defense sectors. Additionally, the advancements in ammunition such as programmable airburst rounds and smart automation are significantly driving market growth.

To Understand More About this Research: Request a Free Sample Report

The implementation of government policies promotes the distribution of small caliber ammunition to civilians for use in various recreational activities such as hunting and shooting. This has led to an increased demand for ammunition with consistent performance, high accuracy, and reliability to enhance shooting proficiency. However, due to its lower caliber density, small caliber ammunition has reduced lethality, which ensures the safety of individuals. The growing demand from civilians is boosting the small caliber ammunition market expansion.

Small Caliber Ammunition Market Trends

Rising Security Concerns and Law Enforcement

The increased frequency of terrorist attacks and elevated crime rates resulted in economic instability in certain countries, leading to an increased demand for high-quality, advanced caliber ammunition. Security forces such as the military and homeland security require substantial stockpiles of smaller caliber ammunition to quickly address immediate threats. Furthermore, there is a growing need for ammunition with improved stopping power and reduced over-penetration risks, which is raising the demand for advanced ammunition. The advancements in small caliber ammunition are also rising due to security operations being conducted in diverse and challenging environments, including rough terrain and urban areas. Enhanced security measures foster innovation in the small caliber ammunition market, which drive the market growth.

In May 2024, a terrorist attack by Israel on Rafah resulted in a loss of lives among both civilians and the military. As a consequence, there was a surge in the demand for ammunition, including rifles, bullets, projectiles, and gunpowder, to enhance security measures in the affected regions. Thus, law enforcement to widen security operations is driving the small caliber ammunition market development.

Automation and Innovation

The rapid advancements in technology are fueling innovations in the small caliber ammunition market. Manufacturers are heavily investing in research and development, leading to the creation of advanced ammunition with improved performance, lethality, and versatility. The enhanced R&D efforts have resulted in improvements in propellants, casing materials, and manufacturing processes through the utilization of technology. Furthermore, technical features such as smart ammunition, programmable capabilities, embedded sensors, electronic fuzes, and others are enhancing operational efficiency. Therefore, the integration of technology in the development of small caliber ammunition is propelling the small caliber ammunition market expansion.

Small Caliber Ammunition Market Segment Insights

Small Caliber Ammunition Market Outlook, by Caliber Type Insights

The small caliber ammunition segmentation, based on caliber type, includes 9 mm Parabellum, 5.56 mm, 7.62 mm, 12.7 mm, 14.5 mm, .338 Lapua Magnum, .338 Norma Magnum, and others. The 9mm Parabellum segment is anticipated to dominate the market, driven by increasing demand for accessible and comfortable handguns for individual use. Its widespread use by law enforcement, military, and homeland security personnel is attributed to its reduced recoil, facilitating faster and more accurate target acquisition. Additionally, the 9mm caliber allows for higher capacity, enabling shooters to carry more ammunition. The growing popularity of the 9mm caliber can be attributed to its easy availability and comparatively lower prices, thereby fueling market expansion.

The 9mm caliber is extensively used by the US Army due to its high stopping power and effectiveness. This caliber type can kill the individual when targeted on specific areas, which increases demand for 9mm calibers.

Small Caliber Ammunition Market Evaluation, by Bullet Type Insights

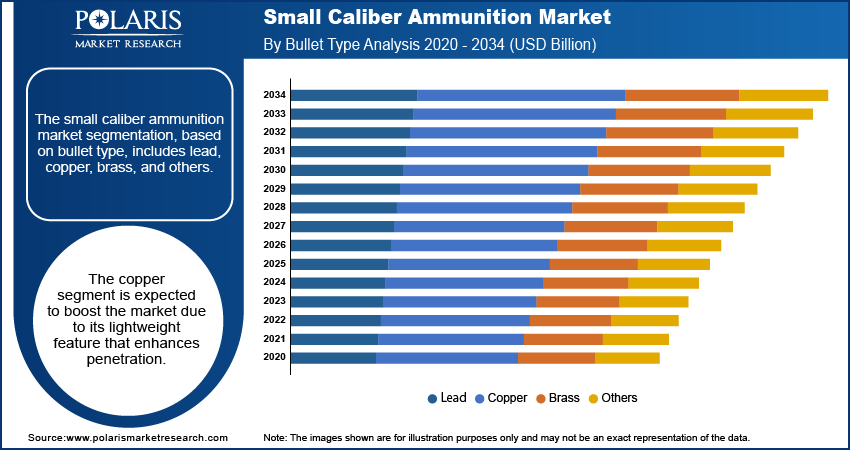

The small caliber ammunition market segmentation, based on bullet type, includes lead, copper, brass, and others. The copper segment is expected to boost the market due to its lightweight feature that enhances penetration. Moreover, copper bullets have a high melting point; hence, they do not melt when fired. Further, these bullets are widely used in hunting activities due to their prolonged exposure and easy availability in the market. Hence, copper bullets enhance the hunting experience, which is a key factor driving market growth.

Small Caliber Ammunition Market Regional Insights

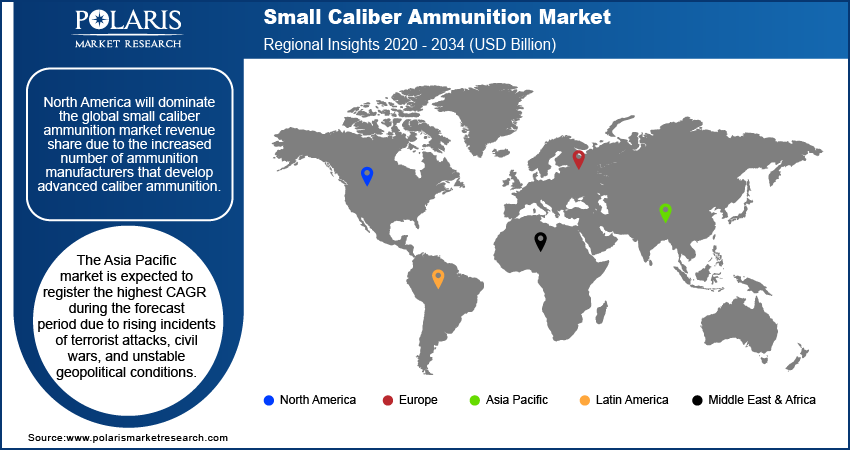

By region, the study provides the small caliber ammunition market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America will dominate the global small caliber ammunition market revenue share due to the increased number of ammunition manufacturers that develop advanced caliber ammunition. In addition, the presence of major companies such as General Dynamics Ordnance and Tactical Systems (General Dynamics Corporation), Nammo AS are offering their services, which further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the North America small caliber ammunition market expansion.

The US accounts for a significant market share due to increased participation in sports shooting applications. Moreover, the US small caliber ammunition market expansion is driven by the increasing utilization of ammunition for commercial purposes, particularly in sports and hunting activities in North America, particularly in the US. In addition, the implementation of government personal safety awareness programs has led to an increase in demand for firearms in the country, subsequently driving the demand for small ammunition nationwide. For instance, government-chartered initiatives such as the Civilian Marksmanship Program focus on promoting firearm safety training and rifle practice, with a special emphasis on youth. The proliferation of shooting ranges and the provision of firearms, ammunition, rental equipment, and training programs by major companies are anticipated to fuel the US civil and commercial small caliber ammunition market development.

The Asia Pacific market is expected to register the highest CAGR during the forecast period due to rising incidents of terrorist attacks, civil wars, and unstable geopolitical conditions. Moreover, the increased warfare activities led to the indigenous development of firearms in certain countries and is expected to significantly boost military ammunition expenditure in the coming years. The rise in terrorist attacks has led regional law enforcement agencies to increase weapon procurement to prevent security breaches and their resulting loss of life and property. Further, the surge in demand for new weapons is also driving the need for small caliber ammunition, as firearms are designed to work with specific calibers. Hence, ongoing modernization efforts within the region's armed forces are projected to further increase the demand for small caliber ammunition.

Small Caliber Ammunition Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the small caliber ammunition market grow even more. Market participants are also undertaking numerous strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, small caliber ammunition industry players must offer cost-effective products.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the small caliber ammunition market to benefit clients and increase the market sector. Major players in the small caliber ammunition market includes ARSENAL JSCo; BAE Systems, Inc.; Denel PMP; FN Herstal (Herstal Group); General Dynamics Ordnance and Tactical Systems (General Dynamics Corporation); Rosoboron export; MAXAMCorp Holding, S.L.; and others.

ARSENAL JSCo, headquartered in Bulgaria, is a manufacturer specializing in firearms and military equipment. The company's extensive product line encompasses small arms, artillery systems, ammunition, powders, and more. With a diverse portfolio, ARSENAL JSCo serves a wide range of sectors such as military, law enforcement, sports, hunting, and civilian applications.

Denel SOC Ltd, headquartered in South Africa, is a manufacturer of defense equipment with operations spanning security, aerospace, and other sectors. The company offers a range of products and services such as ammunition filling plants; aircraft maintenance, repair, and overhaul (MRO); and artillery systems.

List of Key Companies in Small Caliber Ammunition Market

- ARSENAL JSCo

- BAE Systems, Inc.

- Denel PMP

- FN Herstal (Herstal Group)

- General Dynamics Ordnance and Tactical Systems (General Dynamics Corporation)

- Rosoboronexport

- MESKO S.A.

- Nammo AS

- Nexter KNDS Group

- Northrop Grumman Corporation

- Poongsan Corporation

- Rheinmetall Defense

- RUAG Group

- ST Engineering (Temasek Holdings Limited)

- Elbit Systems

Small Caliber Ammunition Industry Developments

July 2024: Rosoboronexport launched a 125mm Mango round manufacturing plant in India. The 125 mm Mango round are designed to be fired from the guns of T-72 and T-90 MBTs.

June 2024: Rheinmetall signed a Memorandum with Ukraine to expand their strategic cooperation. The agreement aims to find and develop more areas for closer cooperation between the Ukrainian defense industry and the Düsseldorf-based technology group.

November 2023: The Belgian government approved the implementation of a long-term strategic partnership between Belgian Defense and FN Herstal. Belgian Defence partnered with FN Herstal to secure the supply of small caliber ammunition and maintain the Belgian army’s inventory.

Small Caliber Ammunition Market Segmentation

By Caliber Type Outlook (USD Billion, 2020–2034)

- 9 mm Parabellum

- 5.56 mm

- 7.62 mm

- 12.7 mm

- 14.5 mm

- .338 Lapua Magnum

- .338 Norma Magnum

- Others

By Application Outlook (USD Billion, 2020–2034)

- Military

- Homeland Security

- Civil & Commercial

By Bullet Type Outlook (USD Billion, 2020–2034)

- Lead

- Copper

- Brass

- Others

By Lethality Outlook (USD Billion, 2020–2034)

- Lethal

- Less-Lethal

By Regional Outlook (USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Small Caliber Ammunition Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.87 Billion |

|

Market Size Value in 2025 |

USD 9.10 Billion |

|

Revenue Forecast by 2034 |

USD 11.67 Billion |

|

CAGR |

2.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The small caliber ammunition market size was valued at USD 8.87 billion in 2024 and is expected to grow to USD 11.67 billion by 2034.

The market is projected to register a CAGR of 2.8% during 2025–2034.

North America accounted for the largest share of the market in 2024.

A few key players in the market are ARSENAL JSCo; BAE Systems, Inc.; Denel PMP; FN Herstal (Herstal Group); General Dynamics Ordnance and Tactical Systems (General Dynamics Corporation); Rosoboron export; MAXAMCorp Holding, S.L.; and others.

The 9 mm Parabellum segment dominated the market in 2024.

The military segment held the largest market share in 2024.