Sleeping Aids Market Size, Share, Trends, Industry Analysis Report: By Product (Mattresses & Pillows, Sleep Laboratories, Medications, Prescription-Based Drugs, OTC Drugs, Herbal Drugs, and Sleep Apnea Devices), Sleep Disorders, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 117

- Format: PDF

- Report ID: PM2287

- Base Year: 2024

- Historical Data: 2020-2023

Sleeping Aids Market Overview

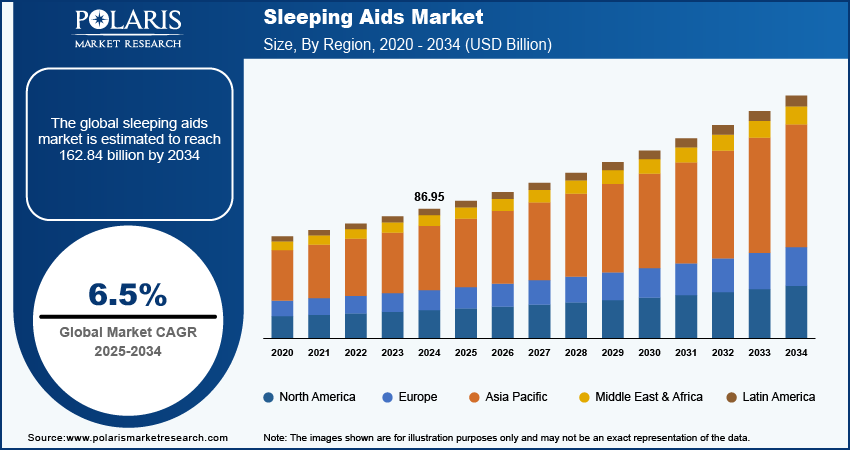

The sleeping aids market size was valued at USD 86.95 billion in 2024. The market is projected to grow from USD 92.39 billion in 2025 to USD 162.84 billion by 2034, exhibiting a CAGR of 6.5% during 2025–2034.

The sleeping aids market involves the production and distribution of products designed to help individuals improve sleep quality and manage sleep disorders. This market includes a range of products such as prescription medications, over-the-counter drugs, herbal supplements, and non-pharmaceutical devices such as sleep trackers and white noise machines. Key drivers of the market include the increasing prevalence of sleep disorders, rising stress levels, and growing awareness of the importance of sleep for overall health. Additionally, trends such as the rising adoption of natural and herbal remedies, as well as the use of wearable technology to monitor sleep patterns, are shaping the market. The demand for personalized sleep solutions and the integration of smart technology in sleeping aids are also contributing to the sleeping aids market growth.

To Understand More About this Research: Request a Free Sample Report

Sleeping Aids Market Dynamics

Increasing Prevalence of Sleep Disorders

The increasing prevalence of sleep disorders is significantly driving the growth of the sleeping aids market. According to a 2024 study by Health.com, approximately 12% of Americans suffer from chronic insomnia, a condition characterized by persistent difficulties in falling or staying asleep. Globally, insomnia affects around 50 million people, making it the second most severe neurological disorder after stroke, as reported by Arxiv.org in 2024. Additionally, sleep apnea, a disorder that causes repeated interruptions in breathing during sleep, affects about 20% of the U.S. population, according to Time.com in 2024. The rising awareness and diagnosis of these conditions have led to increased demand for sleeping aids, including medications, devices, and therapeutic solutions, as individuals seek effective ways to improve their sleep quality and overall health.

Rising Stress and Anxiety Levels

Increasing levels of stress and anxiety, particularly in urban populations, are propelling the sleeping aids market demand. Mental health challenges, such as anxiety and depression, often lead to sleep disturbances, creating a growing demand for products that address both the root causes of poor sleep and its symptoms. According to the American Psychological Association, over 75% of adults report experiencing moderate to high levels of stress, which directly impacts their sleep. The demand for sleep aids that offer stress relief, such as melatonin supplements, relaxation aids, and natural remedies, is consequently on the rise. Products that combine sleep support with anxiety relief, such as CBD-infused sleeping aids, are increasingly gaining popularity.

Growing Awareness of Sleep's Role in Health and Well-Being

There is a rising awareness regarding the importance of quality sleep for overall health and well-being, driving the sleeping aids market forward. Research highlighting the negative impacts of sleep deprivation on physical and mental health, such as a weakened immune system, impaired cognitive function, and increased risk of chronic conditions such as cardiovascular disease, is prompting individuals to seek solutions for better sleep. The World Health Organization has recognized the link between sleep and overall health, urging nations to prioritize sleep health. This awareness has prompted a surge in the use of sleep-improving products, with consumers increasingly turning to sleep aids that promote not just sleep, but holistic well-being. Furthermore, the global rise in health-conscious living is fueling demand for natural and organic sleep aids.

Sleeping Aids Market Segment Insights

Sleeping Aids Market Assessment by Product

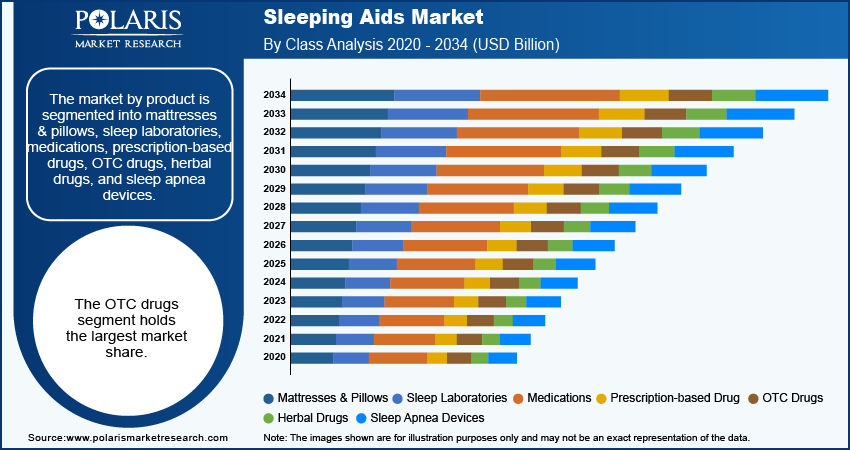

The market by product is segmented into mattresses & pillows, sleep laboratories, medications, prescription-based drugs, OTC drugs, herbal drugs, and sleep apnea devices. The OTC drugs segment holds the largest market share in the Sleeping Aids market due to its widespread accessibility and consumer preference for self-medication. OTC sleep aids, including melatonin supplements and antihistamine-based formulations, are commonly used for managing mild to moderate sleep disturbances. The availability of these products without a prescription, coupled with increasing awareness of sleep health, has contributed to their dominance. Additionally, the rising adoption of herbal and natural OTC formulations, perceived as safer alternatives to prescription medications, is further driving market expansion. The presence of multiple product variants catering to different consumer preferences, such as gummies, capsules, and liquid formulations, also supports the strong market position of OTC drugs.

The sleep apnea devices segment is experiencing the highest growth, driven by the increasing prevalence of sleep apnea and rising awareness of its long-term health risks. The adoption of CPAP and BiPAP devices is expanding, particularly in developed regions where sleep apnea diagnosis rates are improving. Technological advancements, such as smart CPAP machines with remote monitoring capabilities, are further driving growth in this segment.

Sleeping Aids Market Evaluation by Sleep Disorders

The sleeping aids market segmentation, based on sleep disorders, includes insomnia, sleep apnea, restless legs syndrome, narcolepsy, sleep walking, and others. The insomnia segment is expected to hold the largest sleeping aids market share. Insomnia, affecting a significant portion of the global population, is the primary driver of demand for sleep aids. According to a 2024 survey by the American Academy of Sleep Medicine, approximately 12% of Americans have been diagnosed with chronic insomnia. This widespread prevalence of insomnia, combined with the growing awareness of the importance of sleep, has driven the market for insomnia-related sleep aids to dominate in terms of both market share and consumption. Additionally, medications such as benzodiazepines and non-benzodiazepine sedatives are commonly prescribed, further solidifying the insomnia segment's leading position.

The sleep apnea segment is also experiencing the fastest growth, particularly due to the increasing recognition of the condition and advancements in treatment options. Additionally, the American Medical Association reports that about 30 million people in the United States in 2022 had sleep apnea, but only 6 million are diagnosed with the condition. As more people are diagnosed and treated, the demand for sleep apnea devices such as CPAP machines and oral appliances is growing rapidly. Technological innovations in sleep apnea devices, including smaller, quieter, and more comfortable machines, are contributing to the accelerated adoption of these products. Furthermore, the rising awareness of the links between sleep apnea and other health conditions, such as cardiovascular disease, has driven an increased focus on its treatment, fostering substantial market growth in this segment.

Sleeping Aids Market Regional Insights

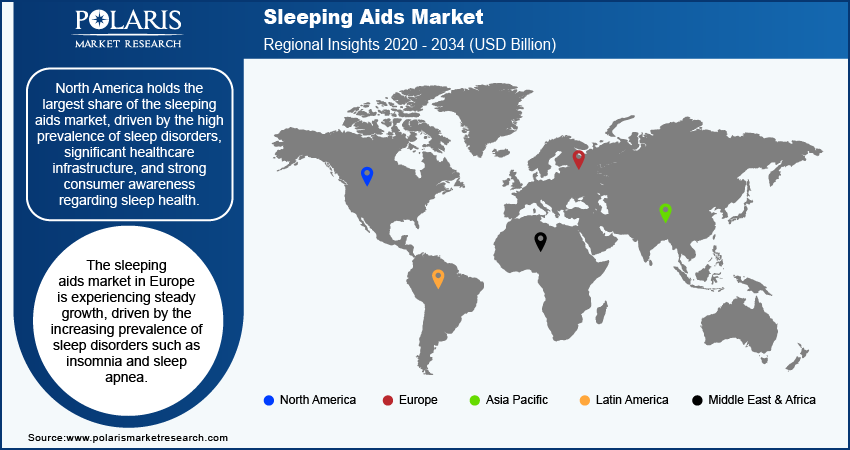

By region, the study provides sleeping aids market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the high prevalence of sleep disorders, significant healthcare infrastructure, and strong consumer awareness regarding sleep health. The US, in particular, is a major contributor to this market, with a large population suffering from conditions such as insomnia and sleep apnea. The growing demand for both pharmaceutical and non-pharmaceutical sleep aids, alongside the widespread use of sleep apnea devices such as CPAP machines, is further propelling market growth in the region. Additionally, the increased adoption of lifestyle interventions and technological advancements in sleep monitoring and treatment are supporting North America's dominant position. While Europe and Asia Pacific are also experiencing steady growth, North America’s robust healthcare systems and higher disposable incomes contribute to its leadership in market share.

The sleeping aids market in Europe is experiencing steady growth, driven by the increasing prevalence of sleep disorders such as insomnia and sleep apnea. European countries with well-developed healthcare systems, such as Germany, the UK, and France, are the primary contributors to this growth. There is a rising demand for both prescription medications and over-the-counter sleep aids, as well as an increasing adoption of sleep apnea devices due to growing awareness of the condition. The European market is also influenced by a shift towards natural and organic remedies in line with broader health and wellness trends. Additionally, the European Medicines Agency (EMA) plays a key role in regulating sleep aid products, ensuring safety and efficacy, which helps foster consumer trust in these products.

Asia Pacific is also witnessing significant growth in the sleeping aids market, driven by an expanding population and rising awareness of sleep-related health issues. Countries such as Japan, China, and India are key players in the market, with sleep disorders becoming more prevalent as urbanization, high stress levels, and changing lifestyles take a toll on sleep quality. The growing middle-class population in these countries is contributing to an increase in disposable incomes, allowing for higher spending on sleep aids. Additionally, the region is seeing a shift towards non-pharmaceutical solutions, such as herbal supplements and sleep devices. However, the market is still in the early stages of development compared to North America, with greater emphasis needed on public education and healthcare infrastructure to address the rising demand for sleep aids.

Sleeping Aids Market – Key Players and Competitive Insights:

Key players in the sleeping aids market include companies such as Pfizer Inc., which offers a range of sleep medications such as the popular product Zolpidem. GlaxoSmithKline (GSK) is another significant player, providing products such as the sleep aid Nytol. Johnson & Johnson, through its subsidiary McNeil Consumer Healthcare, is active with its over-the-counter sleep products, such as Unisom. Sanofi S.A. produces sleep aids such as Ambien, which is widely used for treating insomnia. Other key players include Merck & Co., Inc., known for its prescription drugs targeting sleep disorders, Mylan N.V., which offers a variety of sleep medications, and Teva Pharmaceutical Industries Ltd., which manufactures sleep aids and over-the-counter solutions. Bayer AG is a notable player, especially with its herbal sleep products like Valerian. Companies such as ResMed, which produces sleep apnea devices like CPAP machines, and Philips Healthcare, another player in the sleep apnea device sector, are also active in the market. Abbott Laboratories provides treatments for sleep-related disorders, while Eli Lilly and Co. offers sleep medication options. Nature’s Bounty is significant in the herbal supplement space with products like melatonin. Other participants include Sleep Innovations, which offers mattresses designed for better sleep, and Tempur-Sealy International, which manufactures specialty mattresses targeting sleep quality.

In terms of competitive positioning, pharmaceutical companies dominate the prescription medication market, with many focusing on the development of new formulations to address various sleep disorders. While companies such as Pfizer and Sanofi are key players in the prescription drug segment, over-the-counter options from companies including Johnson & Johnson and GlaxoSmithKline are also crucial in attracting consumers seeking non-prescription alternatives. ResMed and Philips Healthcare focus on sleep apnea, a growing concern in many developed nations, offering technologically advanced solutions such as CPAP machines and other therapeutic devices. These companies invest heavily in research and innovation to meet the growing demand for effective treatments. Teva and Mylan also provide a variety of generic medications, offering cost-effective alternatives to branded sleep aids, which positions them well in price-sensitive markets.

In the broader competitive landscape, companies in Asia Pacific are starting to make inroads, particularly in countries such as Japan, China, and India, where growing awareness of sleep health is driving demand for both pharmaceutical and non-pharmaceutical products. Nature’s Bounty and similar companies focused on herbal supplements are seeing increasing demand as consumers shift toward natural and holistic remedies. Meanwhile, the sleep technology segment, represented by companies such as ResMed and Philips, is becoming more competitive with advancements in connected devices, mobile apps, and personalized sleep solutions. This shift towards integrating technology with traditional sleep aids indicates the evolving nature of the market, where consumer preferences are moving toward more customized and tech-enhanced approaches to improving sleep.

Pfizer Inc. is a global pharmaceutical company that plays a prominent role in the sleeping aids market through its products, including Zolpidem, commonly prescribed to treat insomnia. The company is known for its research-driven approach to drug development, focusing on both prescription and over-the-counter treatments. Pfizer's presence in the sleep aids market is strengthened by its ability to innovate and offer products that address a range of sleep disorders.

ResMed Inc. is a leading provider of sleep apnea devices, including CPAP machines, which help individuals with sleep apnea manage their condition. The company’s sleep solutions are designed to improve both the quality of sleep and overall health by addressing conditions that disrupt sleep patterns. ResMed has a significant presence in the market due to its focus on developing advanced, connected devices for sleep therapy.

List of Key Companies in Sleeping Aids Market

- Pfizer Inc.

- GlaxoSmithKline (GSK)

- Johnson & Johnson (McNeil Consumer Healthcare)

- Sanofi S.A.

- Merck & Co., Inc.

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Bayer AG

- ResMed Inc.

- Philips Healthcare

- Abbott Laboratories

- Eli Lilly and Co.

- Nature’s Bounty

- Sleep Innovations

- Tempur-Sealy International

Sleeping Aids Market Developments

- December 2024: Pfizer announced a new initiative to expand its portfolio of sleep disorder treatments, focusing on non-habit forming alternatives to traditional medications.

- October 2024: ResMed introduced a new CPAP machine model that incorporates artificial intelligence to personalize sleep therapy. This marked a major step forward in the integration of technology with sleep health management.

Sleeping Aids Market Segmentation

By Product Outlook

- Mattresses & Pillows

- Sleep Laboratories

- Medications

- Prescription-Based Drug

- OTC Drugs

- Herbal Drugs

- Sleep Apnea Devices

By Sleep Disorders Outlook

- Insomnia

- Sleep Apnea

- Restless Legs Syndrome

- Narcolepsy

- Sleep Walking

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sleeping Aids Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 86.95 billion |

|

Market Size Value in 2025 |

USD 92.39 billion |

|

Revenue Forecast by 2034 |

USD 162.84 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The sleeping aids market has been segmented into detailed segments of product and sleep disorders. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the sleeping aids market focuses on expanding product offerings to meet the growing demand for both pharmaceutical and non-pharmaceutical solutions. Companies are increasingly investing in research and development to introduce innovative treatments, including natural sleep aids and advanced sleep apnea devices. Marketing strategies emphasize raising awareness about sleep disorders and the importance of quality sleep, targeting consumers through digital platforms and healthcare professionals. Partnerships with healthcare providers and technology companies are also being explored to integrate sleep aids with wearable devices and apps. Additionally, companies are focusing on regional expansion, particularly in emerging markets, to tap into the rising awareness of sleep health.

FAQ's

The sleeping aids market size was valued at USD 86.95 billion in 2024 and is projected to grow to USD 162.84 billion by 2034.

The market is projected to register a CAGR of 6.5% during the forecast period, 2025-2034.

North America had the largest share of the market.

The key players in the sleeping aids market include Pfizer Inc., GlaxoSmithKline (GSK), Johnson & Johnson (McNeil Consumer Healthcare), Sanofi S.A., Merck & Co., Inc., Mylan N.V., Teva Pharmaceutical Industries Ltd., and Bayer AG, which have a strong presence in the pharmaceutical and over-the-counter sleep aid segments.

The OTC drugs segment accounted for the larger share of the market in 2024.

The insomnia segment accounted for the larger share of the market in 2024.

Sleeping aids are products designed to help individuals improve their sleep quality and manage sleep-related disorders. These products include prescription medications, over-the-counter drugs, herbal supplements, and non-pharmaceutical devices such as sleep trackers and CPAP machines for sleep apnea. They are used to address conditions like insomnia, sleep apnea, restless legs syndrome, and other sleep disturbances. Sleeping aids work by promoting relaxation, improving sleep onset, or preventing wakefulness during the night, depending on the type of product. They are commonly used by individuals who struggle with getting adequate rest due to various health or lifestyle factors.

A few key trends in the market are described below: Rising Adoption of Natural and Herbal Products: Consumers are increasingly seeking natural sleep aids, such as melatonin, valerian root, and CBD-infused products, due to concerns over the side effects of pharmaceuticals. Technological Integration: The growing use of connected sleep devices, such as CPAP machines and sleep trackers, with mobile apps and AI-powered solutions for personalized sleep management. Focus on Non-Habit Forming Alternatives: There is a shift towards medications that are less likely to cause dependence or addiction, driving the development of non-habit forming sleep aids. Personalized Sleep Solutions: Customization of sleep aids, such as tailored CPAP therapy or sleep supplements based on individual health data, is gaining popularity.

A new company entering the Sleeping Aids market could focus on developing innovative, non-pharmaceutical solutions that appeal to consumers seeking natural and non-habit forming products. By investing in personalized sleep solutions, such as AI-powered sleep trackers and devices that integrate with mobile apps, the company can tap into the growing trend of tech-driven health management. Additionally, focusing on the sleep apnea segment with advanced, comfortable, and compact devices could differentiate the brand. Offering a range of products that combine sleep aids with stress relief, or focusing on regional markets where awareness is growing, could provide further competitive advantages. Prioritizing e-commerce platforms for easy access and customer engagement could also enhance visibility and sales.

Companies manufacturing, distributing, or purchasing sleeping aids and related products, and other consulting firms must buy the report.