Single-Serve Packaging Market Size, Share, Trends, Industry Analysis Report: By Product Type (Flexible Plastic, Paper and Paperboard, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5537

- Base Year: 2024

- Historical Data: 2020-2023

Single-Serve Packaging Market Overview

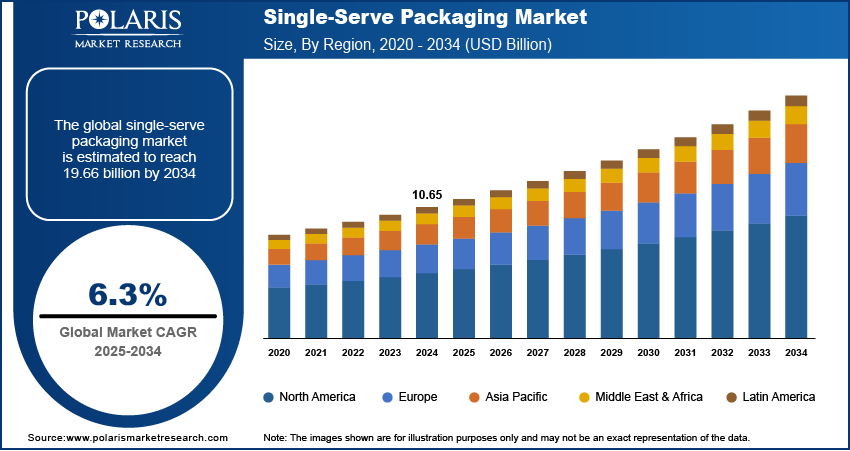

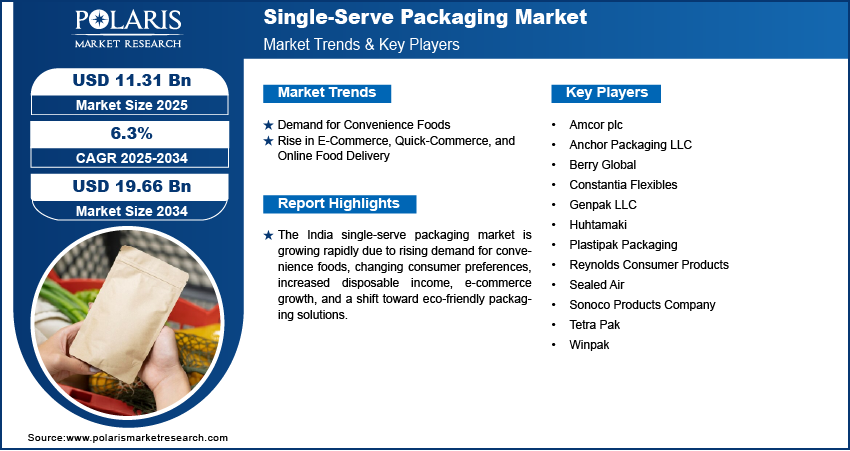

The global single-serve packaging market size was valued at USD 10.65 billion in 2024. The market is projected to grow from USD 11.31 billion in 2025 to USD 19.66 billion by 2034, exhibiting a CAGR of 6.3% during 2025–2034.

Single-serve packaging refers to packaging designed to hold a single portion or serving of a product, making it convenient for individual use. It is commonly used for items such as snacks, beverages, and personal care products.

Single-serve packaging has gained popularity due to its ability to meet the needs of modern consumers with fast-paced lifestyles. Consumers on the move, whether for work or travel, highly value the convenience of pre-portioned products that require no preparation. These small, easy-to-carry packages make it simple for consumers to grab a quick snack or drink without the hassle of opening large containers. Portability makes them ideal for busy individuals, parents, students, and anyone looking for a convenient way to enjoy products while on the go. This increased demand for convenience has driven growth across various industries, especially in snacks and beverages, thereby driving the single-serve packaging market demand.

To Understand More About this Research: Request a Free Sample Report

Sustainability has become a significant concern for both consumers and brands, influencing the growth of eco-friendly single-serve packaging. More people are seeking ways to reduce their environmental impact, making packaging made from recyclable, biodegradable, or compostable materials highly desirable. According to Trivium Packaging, 82% of consumers are willing to pay more for biodegradable packages, showcasing a shift in consumer behavior. Single-serve packaging aligns with this trend by offering a sustainable alternative to larger, wasteful packaging. Many brands are focusing on materials that are both functional and environmentally responsible, ensuring packaging reduces plastic waste while maintaining product quality. This shift toward greener packaging options is fueling the demand for single-serve solutions across various industries, thereby propelling the single-serve packaging market growth.

Single-Serve Packaging Market Dynamics

Demand for Convenience Foods

The demand for convenience foods is growing as busy lifestyles make cooking from scratch less appealing. Single-serve packaging is used for ready-to-eat meals, snacks, and drinks that can be consumed immediately without any preparation. According to the Auguste Escoffier School of Culinary Arts, in the US alone, 6 out of 10 people prefer takeout foods for adding convenience. Single-serve packaging for takeout food is increasingly common and beneficial for food safety, freshness, and convenience. The demand for these single-serve packaging continues to grow as more people seek quick meal and takeout options that fit into their hectic schedules, thereby contributing to the single-serve packaging market opportunities.

Rise in E-Commerce, Quick-Commerce, and Online Food Delivery

The rise of e-commerce, quick-commerce, and online food delivery has significantly boosted the demand for single-serve packaging. More people are purchasing food, drinks, and other products online, creating a need for packaging that is compact, easy to handle, and protects the product during shipping. According to the US Census Bureau, in the US alone, sales from e-commerce grew by 2.6% in the third quarter of 2024 compared to the second quarter of the same year, showcasing the growth of e-commerce. Single-serve packages are ideal for online retail as they take up less space, are easier to pack, and are more cost-effective for shipping. Consumers prefer smaller quantities, which makes single-serve packaging appealing to those who want to try new products without committing to larger sizes. Thus, the rising preference for single-use packaging in e-commerce, quick commerce, and online food delivery is driving the single-serve packaging market expansion.

Single-Serve Packaging Market Segment Analysis

Single-Serve Packaging Market Assessment by Product Type Outlook

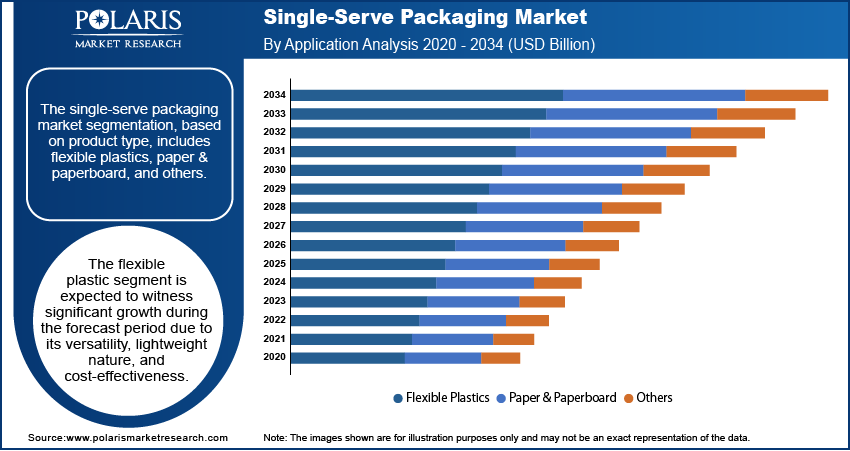

The single-serve packaging market segmentation, based on product type, includes flexible plastics, paper & paperboard, and others. The flexible plastics segment is expected to witness significant growth during the forecast period. Flexible plastics are becoming increasingly popular due to their versatility, lightweight nature, and cost-effectiveness. These materials are easy to manufacture, offer excellent protection for products, and are designed to preserve freshness. Flexible plastics provide an ideal solution for single-serve items like snacks, beverages, and personal care products as consumers demand more convenient, on-the-go packaging, thereby driving segmental growth.

Single-Serve Packaging Market Evaluation by Application Outlook

The single-serve packaging market segmentation, based on application, includes food & beverages, personal care, and others. The food & beverages segment dominated the single-serve packaging market revenue share in 2024, driven by the increasing consumer demand for convenient, ready-to-eat products that fit into busy lifestyles. Single-serve packaging offers an easy solution for on-the-go meals, snacks, and drinks, making it highly popular among busy individuals and families. Products such as bottled beverages, snack packs, and portioned meals benefit from this packaging, providing convenience, freshness, and portion control, thereby driving segmental growth.

Single-Serve Packaging Market Regional Analysis

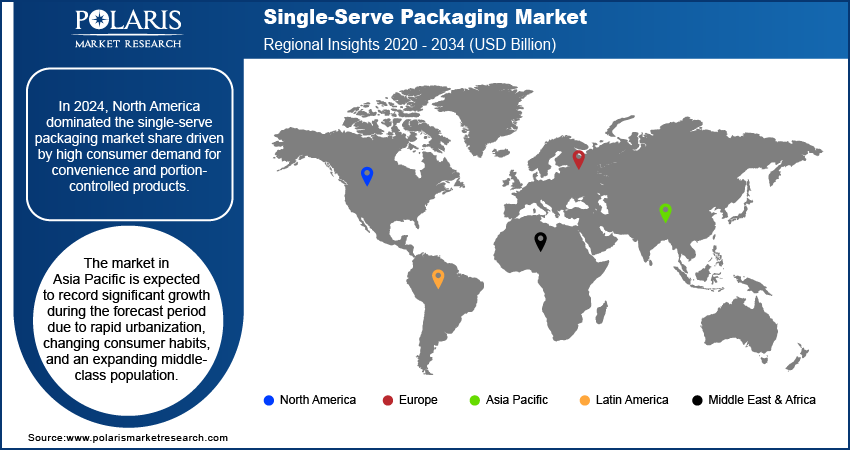

By region, the study provides the single-serve packaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market revenue share, driven by high consumer demand for convenience and portion-controlled products. Busy lifestyles, along with increasing health awareness, are pushing the demand for on-the-go food and beverage options, such as snacks and bottled drinks. The strong growth in e-commerce in the region requires compact and cost-effective packaging solutions. Furthermore, sustainable packaging solutions are becoming more important, prompting brands to focus on eco-friendly materials. The combination of convenience, health-conscious choices, and sustainability is driving the single-serve packaging market expansion in North America.

Asia Pacific is expected to record a significant single-serve packaging market share during the forecast period due to rapid urbanization, changing consumer habits, and an expanding middle-class consumer base. The demand for convenience foods and beverages, especially in busy cities, is rising significantly. Single-serve packaging provides an ideal solution for portion-controlled, easy-to-carry products, such as ready meals and beverages. The growing trend of online shopping in countries such as China and Japan is further boosting the demand for compact and secure packaging, thereby driving the single-serve packaging market growth in Asia Pacific.

The single-serve packaging market in India is experiencing substantial growth due to the increasing demand for convenience foods and beverages driven by the busy, urbanizing population. Consumers in both rural and urban areas are adopting ready-to-eat meals, snacks, and beverages packaged in single-serve formats, as they offer portability and ease of use. Additionally, the rise in disposable income and changing consumer preferences toward smaller, portion-controlled products are further fueling the demand for single-serve packaging, thereby driving the single-serve packaging market demand in India.

Single-Serve Packaging Market – Key Players & Competitive Analysis Report

The single-serve packaging market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the single-serve packaging market trends by introducing innovative products to meet the demand of specific sectors. According to the single-serve packaging market statistics, this competitive trend is amplified by continuous progress in product offerings. A few major players in the market are Amcor plc, Anchor Packaging LLC, Berry Global, Constantia Flexibles, Genpak LLC, Huhtamaki, Plastipak Packaging, Reynolds Consumer Products, Sealed Air, Sonoco Products Company, Tetra Pak, and Winpak.

Genpak LLC, founded in 1969, is a North American manufacturer of food service packaging solutions serving retail businesses and fast-casual restaurant chains. The company provides a range of packaging options, including foam containers, plates, plastic bowls, deli containers, and condiment cups. Genpak also offers eco-friendly packaging and custom-engineered solutions. Their product line includes items like the Harvest Fiber eco-friendly line and Smart Set Pro microwave-safe containers. Specializing in vacuum-formed plastic packaging, Genpak produces hinged containers, bakery containers, compartment trays, plates, cups, and bowls in various sizes, shapes, and colors for the food service and retail sectors. The company offers custom tooling, design, and engineering support, as well as printing and labeling services. Genpak operates 18 manufacturing facilities across the United States and Canada, with its corporate headquarters in Charlotte, NC.

Anchor Packaging LLC, founded in 1963, is a North American thermoform packaging producer known for its food service product designs and custom package capabilities. Headquartered in St. Louis, MO, the company has production and distribution facilities in Arkansas and Wisconsin. Anchor Packaging's product lines cater to hot, refrigerated, and ambient temperature protection, with capabilities up to 230 degrees. The company offers a range of rigid packages and cling film products, serving various channels, including restaurants, retail, supermarkets, convenience stores, businesses, and education. Their products include containers designed to maintain the quality of specific foods and tamper-evident containers for cold food. They also offer custom product development. Anchor Packaging specializes in rigid food containers and food service cling film. They use thermoforming, a plastic molding process that offers advantages such as lower tooling costs, less material wastage, and lower per-unit costs compared to injection molding. Anchor manufactures in the US, using polypropylene (PP) and PET, both recyclable plastic packaging materials. Anchor Packaging operates across the United States, with a presence in the Midwest and South.

List of Key Companies in Single-Serve Packaging Market

- Amcor plc

- Anchor Packaging LLC

- Berry Global

- Constantia Flexibles

- Genpak LLC

- Huhtamaki

- Plastipak Packaging

- Reynolds Consumer Products

- Sealed Air

- Sonoco Products Company

- Tetra Pak

- Winpak

Single-Serve Packaging Industry Developments

In February 2025, A recyclable single-coated paper cup designed for dairy products was launched by Huhtamaki. The cup, containing less than 10% plastic, was developed to be fully recyclable in Europe, meeting food safety requirements.

In September 2024, A new range of flexible compostable packaging solutions was launched by Pakka. The product line, designed for the food and beverage sector, offers superior barrier properties and heat/cold sealability for chocolates and confectioneries.

Single-Serve Packaging Market Segmentation

By Product Type Outlook (Revenue USD Billion, 2020–2034)

- Flexible Plastics

- Paper & Paperboard

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Food & Beverages

- Personal Care

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Single-Serve Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.65 billion |

|

Market Size Value in 2025 |

USD 11.31 billion |

|

Revenue Forecast in 2034 |

USD 19.66 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 10.65 billion in 2024 and is projected to grow to USD 19.66 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Amcor plc, Anchor Packaging LLC, Berry Global, Constantia Flexibles, Genpak LLC, Huhtamaki, Plastipak Packaging, Reynolds Consumer Products, Sealed Air, Sonoco Products Company, Tetra Pak, and Winpak.

The food and beverage segment dominated the market in 2024, driven by the increasing consumer demand for convenient, ready-to-eat products that fit into busy lifestyles.

The flexible plastic segment is expected to witness significant growth during the forecast period due to its versatility, lightweight nature, and cost-effectiveness.