Singapore Customer Experience Business Process Outsourcing Market Size, Share, Trends, Industry Analysis Report: By Service (Inbound and Outbound), Outsourcing, Support Channel, and End-Use Industry – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5499

- Base Year: 2024

- Historical Data: 2020-2023

Singapore Customer Experience Business Process Outsourcing Market Overview

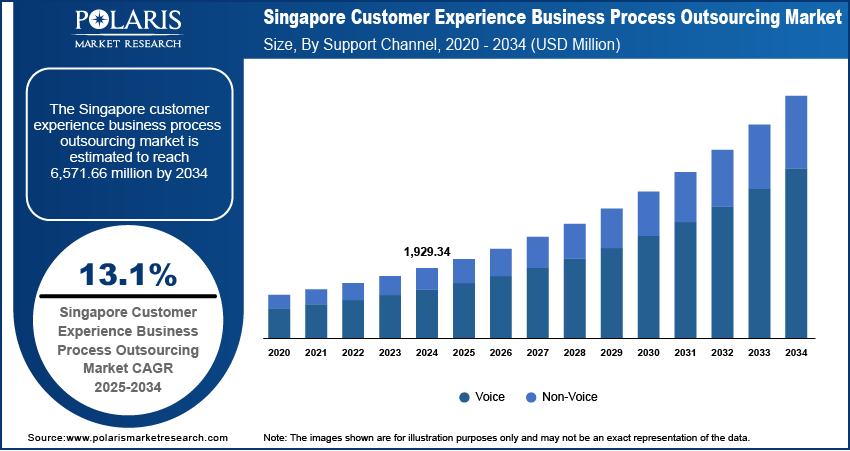

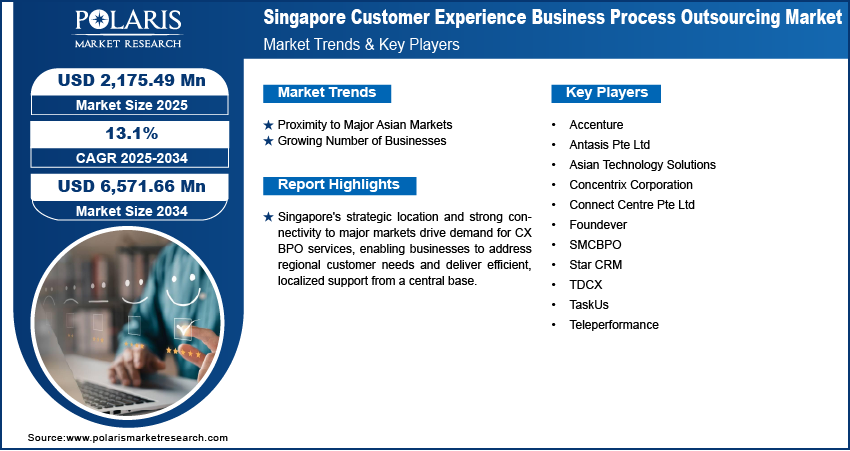

The Singapore customer experience business process outsourcing (CX BPO) market size was valued at USD 1,929.34 million in 2024. The market is projected to grow from USD 2,175.49 million in 2025 to USD 6,571.66 million by 2034, exhibiting a CAGR of 13.1% during 2025–2034.

Customer experience business process outsourcing (CX BPO) involves outsourcing customer service operations to third-party providers to improve interactions with customers across various touchpoints. This enables businesses to improve service quality, reduce costs, and focus on core operations while maintaining customer satisfaction.

Companies in Singapore are increasingly recognizing the importance of customer experience (CX), due to which many businesses are adopting customer-centric strategies to differentiate themselves in the marketplace. This growing focus on CX is driving organizations to outsource their customer service operations to specialized business process outsourcing (BPO) providers who deliver high-quality support. Prioritizing customer satisfaction and loyalty, companies are seeking efficient and innovative solutions to manage customer interactions, which is driving the Singapore customer experience business process outsourcing market growth.

To Understand More About this Research: Request a Free Sample Report

Singapore is known for its world-class technological infrastructure, which supports the demand for CX BPO services. High-speed internet; reliable connectivity; and advanced technologies such as cloud computing, artificial intelligence (AI), and data analytics are readily available across the country. These technologies enable CX BPO providers to offer fast, efficient, and data-driven customer support. Access to advanced tools helps businesses optimize customer interactions, streamline operations, and provide personalized experiences for their clients. The technological environment in Singapore makes it an attractive destination for companies aiming to improve their customer service using modern digital solutions, thereby driving the Singapore CX BPO market demand.

Singapore Customer Experience Business Process Outsourcing Market Dynamics

Proximity to Major Asian Markets

Singapore’s strategic location at the crossroads of Southeast Asia makes it an ideal hub for businesses seeking to expand across the region. The country’s strong connectivity to major markets such as China, India, and Indonesia enables companies to provide customer service to diverse populations. Outsourcing customer experience services to Singapore allows businesses to manage regional customer needs and deliver faster support efficiently. This geographical advantage increases the demand for CX BPO services, as companies aim to offer seamless, localized customer experiences across multiple countries while maintaining one central operational base in Singapore, thereby propelling the Singapore customer experience business process outsourcing (CX BPO) market development.

Growing Number of Businesses

The growth in the number of businesses in Singapore is fueling the demand for customer experience business process outsourcing (CX BPO) services. More companies establishing themselves in the country leads to an increasing need for efficient management of customer interactions and high-quality service. According to the Government of Singapore's Accounting and Corporate Regulatory Authority, Startups, and SMEs, in 2023, the number of businesses in the country rose to 588,701 in December from 571,045 in January, showcasing the growth in the number of businesses. This growth in business activity results in a higher demand for CX BPO services to ensure customer satisfaction, improve engagement, and reduce operational costs, thereby boosting the Singapore CX BPO market growth.

Singapore Customer Experience Business Process Outsourcing Market Segment Analysis

Singapore CX BPO Market Assessment by Support Channel Outlook

The Singapore customer experience business process outsourcing market segmentation, based on support channel, includes voice and non-voice. The voice segment dominated the Singapore CX BPO market share in 2024. Personalized customer service remains a priority for businesses, and voice interactions continue to be a crucial method for addressing customer needs effectively. For complex or urgent issues, customers prefer speaking to a representative, increasing the demand for voice support services. The rise in adoption of advanced technologies such as AI and voice recognition tools improves the efficiency and quality of voice support, thereby driving the segmental growth.

Singapore CX BPO Market Evaluation by Service Outlook

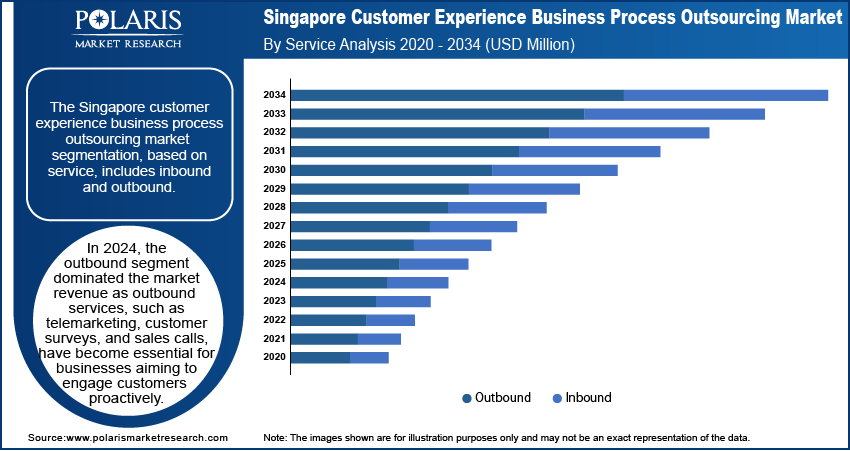

The Singapore customer experience business process outsourcing market segmentation, based on service, includes inbound and outbound. According to the Singapore CX BPO market statistics, the outbound segment dominated the market share in 2024. Outbound services, such as telemarketing, customer surveys, and sales calls, have become essential for businesses aiming to engage customers proactively. Outbound services allow companies to reach out directly to potential or existing customers, promote products, gather feedback, or solve issues. The growing need for customer engagement and lead generation has increased the demand for outbound services.

Singapore Customer Experience Business Process Outsourcing Market Players & Competitive Analysis Report

The Singapore customer experience business process outsourcing market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Major global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the Singapore CX BPO industry by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. A few major players in the market include Accenture, Antasis Pte Ltd, Asian Technology Solutions, Concentrix Corporation, Connect Centre Pte Ltd, Foundever, SMCBPO, Star CRM, TDCX, TaskUs, and Teleperformance.

Concentrix Corporation is a global provider of customer experience (CX) solutions and business process outsourcing (BPO) services headquartered in Newark, California. Founded in 1983, the company operates in over 70 countries. Initially a subsidiary of SYNNEX Corporation, Concentrix became an independent public company in December 2020 and was listed on the Fortune 500 in 2024. The company’s offerings are divided into several segments, including customer experience management (CXM), technical support services, sales and marketing solutions, back-office services, and consulting for performance optimization. Its CXM services focus on omnichannel support and customer engagement strategies, while its technical support segment provides troubleshooting for the technology and telecommunications sectors. The sales and marketing solutions segment includes lead generation and telemarketing, while back-office services cover administrative tasks such as payroll management and compliance. Concentrix also provides consulting services for process improvement and customer journey mapping. The company integrates digital transformation tools such as AI-driven automation and analytics into its solutions to enhance operational efficiency. Concentrix operates across the Americas, Europe, and Asia Pacific, serving clients from various industries including healthcare, finance, retail, and e-commerce. Concentrix transforms customer service with AI-powered omnichannel solutions. They offer multilingual support, customer care, and technical assistance to enhance customer experiences.

Accenture is a global professional services company that provides consulting, technology, and outsourcing services to various industries worldwide. The company operates in five segments: media & technology, communications, financial services, health & public service, products, and resources. Artificial intelligence (AI) is one of the focus areas for Accenture. The company offers various AI solutions to help clients optimize their operations, improve customer experiences, and drive business growth. These solutions include AI-powered automation, machine learning, natural language processing, and predictive analytics. Accenture has invested heavily in building a strong ecosystem of AI partners, including technology giants such as Google, Microsoft, and Amazon Web Services, as well as niche AI startups. The company's AI solutions are designed to integrate seamlessly with existing technology systems and processes, enabling clients to derive maximum value from their investments. Accenture is a leading partner for cloud professional services. The company serves over 34,000 cloud projects in nearly every industry to build secure cloud solutions. The company has a network of about 400 innovation centers, studios, and centers worldwide and has offices in more than 200 cities in 50 countries. Accenture offers BPO services for organizations to optimize costs and accelerate growth. They reinvent operations and drive value at scale with benefits such as higher margins and agile innovation.

List of Key Companies in Singapore Customer Experience Business Process Outsourcing Market

- Accenture

- Antasis Pte Ltd

- Asian Technology Solutions

- Concentrix Corporation

- Connect Centre Pte Ltd

- Foundever

- SMCBPO

- Star CRM

- TDCX

- TaskUs

- Teleperformance

Singapore Customer Experience Business Process Outsourcing Industry Development

March 2024: TaskUs launched AssistAI, a new knowledge-based assistant powered by TaskGPT, to enhance customer service efficiency, utilizing AI-driven solutions tailored to client knowledge bases and training materials.

Singapore Customer Experience Business Process Outsourcing Market Segmentation

By Service Outlook (Revenue – USD Million, 2020–2034)

- Inbound

- Outbound

By Outsourcing Outlook (Revenue – USD Million, 2020–2034)

- Onshore

- Offshore

- Nearshore

By Support Channel Outlook (Revenue – USD Million, 2020–2034)

- Voice

- Non-voice

By End-Use Industry Outlook (Revenue – USD Million, 2020–2034)

- Automotive

- BFSI

- Healthcare

- Manufacturing

- Others

Singapore Customer Experience Business Process Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,929.34 million |

|

Market Size Value in 2025 |

USD 2,175.49 million |

|

Revenue Forecast by 2034 |

USD 6,571.66 million |

|

CAGR |

13.1% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The market size was valued at USD 1,929.34 million in 2024 and is projected to grow to USD 6,571.66 million by 2034.

The market is projected to register a CAGR of 13.1% during the forecast period.

A few key players in the market are Accenture, Antasis Pte Ltd, Asian Technology Solutions, Concentrix Corporation, Connect Centre Pte Ltd, Foundever, SMCBPO, Star CRM, TDCX, Teleperformance, and TaskUs.

The outbound segment dominated the market in 2024 as outbound services, such as telemarketing, customer surveys, and sales calls, have become essential for businesses aiming to engage customers proactively.

The voice segment dominated the market in 2024 as personalized customer service remains a priority for businesses, and voice interactions continue to be a crucial method for addressing customer needs effectively.