Simulators Market Size, Share, Trends, Industry Analysis Report: By Application, Solution (Products and Services), Platform, Type, Technique, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5402

- Base Year: 2024

- Historical Data: 2020-2023

Simulators Market Overview

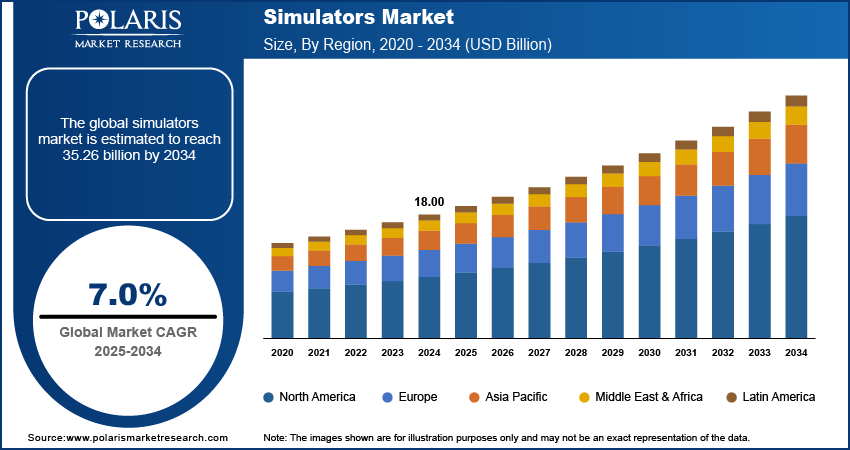

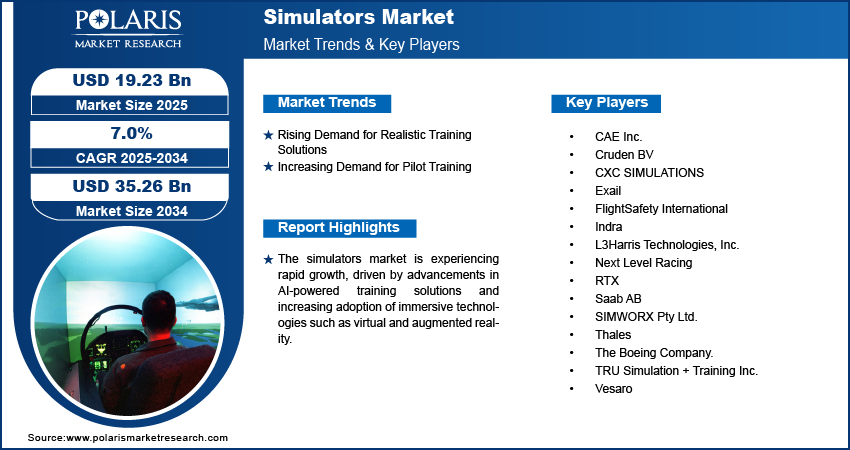

The global simulators market size was valued at USD 18.00 billion in 2024. The market is expected to grow from USD 19.23 billion in 2025 to USD 35.26 billion by 2034, at a CAGR of 7.0% during the forecast period.

Simulators are advanced systems that replicate real-world environments to train individuals, test equipment, and improve operational efficiency across various industries. The simulators market growth is attributed to continuous technological advancements. Innovations such as AI-driven analytics, virtual reality (VR), and augmented reality (AR) are revolutionizing the realism and interactivity of simulations, making them more effective for training and analysis. In December 2024, EON Reality launched EON-XR 10.6, featuring a Knowledge Simulator and AI-driven tools to transform immersive learning content creation, practice, and assessment in AI-assisted VR/AR knowledge transfer for industry and education. The integration of high-fidelity graphics, haptic feedback, and cloud-based simulation platforms has further expanded their applicability in the aviation, healthcare, defense, and automotive sectors. These advancements improve training effectiveness and also reduce operational risks and costs, improving the overall simulators market demand.

The simulators market development is influenced by strict safety regulations across industries where precision and risk mitigation are critical. In February 2025, NISC highlighted its use of the open-source Network Simulator 3 (ns-3) for public safety research, releasing modules for ProSe, MCPTT, UAV energy models, and a visualization tool. Market players are signing collaborations with universities to improve simulation capabilities for mission-critical communications. In sectors such as aerospace, healthcare, and defense, regulatory bodies minimize rigid training and assessment procedures, making simulation-based training an essential compliance requirement. Simulators provide a controlled and repeatable environment for personnel to develop expertise while ensuring compliance with safety protocols without real-world consequences. This regulatory-driven demand reinforces the adoption of simulation technologies, positioning them as essential tools for improving skill development and operational safety across multiple industries.

To Understand More About this Research: Request a Free Sample Report

Simulators Market Dynamics

Rising Demand for Realistic Training Solutions

Traditional training methods often fall short in replicating real-world complexities, making high-fidelity simulation technology essential for improving decision-making and response times in critical environments. Advanced simulators leverage advanced technologies such as artificial intelligence, virtual reality, and real-time data processing to create highly immersive and accurate training environments as industries increasingly prioritize hands-on, experiential learning to enhance skill development and operational efficiency. This trend is further supported by strategic collaborations aimed at advancing simulation capabilities across industries. In February 2025, Zen Technologies Limited collaborated with TXT Group to develop advanced pilot training solutions, combining Zen’s simulation expertise with TXT’s aerospace software capabilities to deliver cost-effective, innovative aviation simulators for global markets. This enables professionals in the aviation, defense, healthcare, and automotive sectors to gain practical experience without exposure to real-world risks. Thus, as industries focus on enhancing workforce competency and operational preparedness, the demand for realistic training solutions continues to drive the simulators market growth.

Increasing Demand for Pilot Training

Airlines and defense organizations require advanced training solutions to ensure pilot proficiency and operational safety with expanding global air travel and fleet modernization initiatives. The growing demand for high-quality, accessible training facilities has led to significant investments in state-of-the-art simulation centers worldwide. In October 2023, Simaero announced the opening of a state-of-the-art Training Center in Delhi, featuring eight simulator bays with A320, B737 Max, and ATR 72-600 devices to meet the growing demand for pilot training in India. Simulators provide a cost-effective and risk-free environment for pilots to develop critical skills, practice emergency procedures, and adapt to complex flight scenarios without real-world consequences. The integration of high-fidelity graphics film, artificial intelligence, and real-time scenario modeling further improves the effectiveness of simulation-based training. As aviation regulations continue to emphasize stringent training standards, the adoption of flight simulators remains essential for maintaining safety, compliance, and operational efficiency. Therefore, the rising demand for pilot training boosts the simulators market development.

Simulators Market Segment Insights

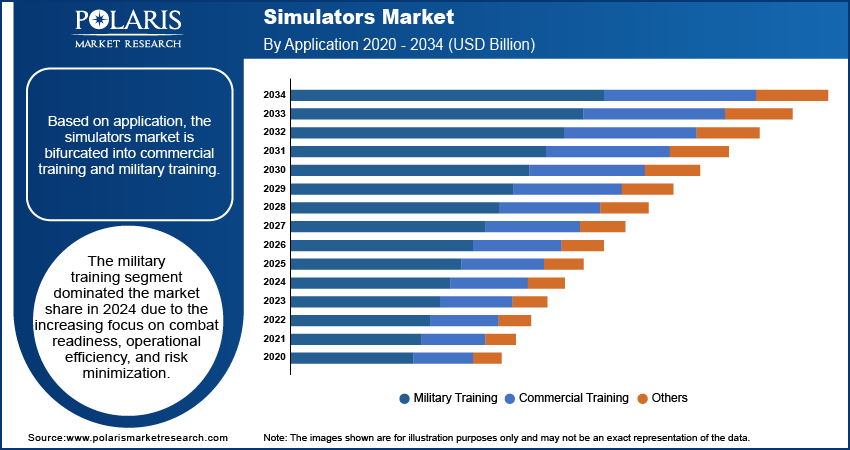

Simulators Market Assessment by Application Outlook

The global simulators market segmentation, based on application, includes commercial training, military training, and others. The military training segment dominated the simulators market share in 2024 due to the increasing focus on combat readiness, operational efficiency, and risk minimization. Defense organizations worldwide are prioritizing advanced simulation-based training programs to improve personnel proficiency in complex and high-risk scenarios. Military simulators provide realistic battlefield environments, allowing soldiers, pilots, and naval officers to develop tactical skills without live combat exposure. The integration of artificial intelligence, virtual reality, and real-time scenario replication further improves training effectiveness while reducing costs associated with live exercises. Therefore, as defense agencies continue to invest in modernizing training infrastructure, the demand for high-fidelity military simulators remains a key driver of simulators market growth.

Simulators Market Evaluation by Platform Outlook

The global simulators market segmentation, based on platform, includes airborne, land, and maritime. The maritime segment is expected to witness the highest growth rate during the forecast period due to the rising adoption of simulation technologies for naval operations, commercial shipping, and offshore industries. There is a growing need for advanced training solutions to improve navigational skills, emergency response, and vessel operation efficiency with increasing global maritime trade and strict safety regulations. Maritime simulators provide a controlled environment for training ship crews, naval officers, and port operators, allowing them to handle real-world challenges such as adverse weather conditions and emergencies. The integration of high-fidelity simulation models, augmented reality, and AI-driven analytics is further driving the adoption of maritime simulators, resulting in the simulators market expansion.

Simulators Market Regional Analysis

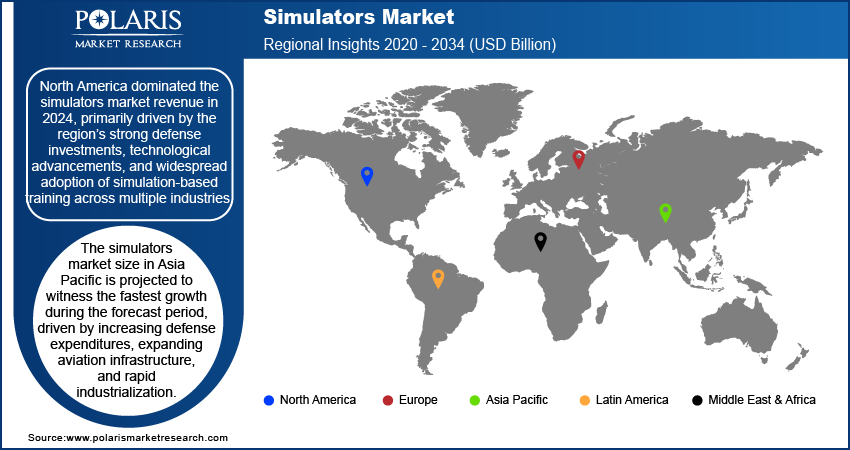

By region, the report provides the simulators market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the simulators market share in 2024, primarily driven by the region’s strong defense investments, technological advancements, and widespread adoption of simulation-based training across multiple industries. The presence of key market players, along with continuous innovation in simulation technologies, has contributed to the region’s leadership in this sector. The defense sector remains a major contributor, with government agencies investing heavily in next-generation training systems to enhance military preparedness. These investments are exemplified by high-value contracts aimed at modernizing defense capabilities. In January 2025, Lockheed Martin received a USD 270 million contract with the US Air Force to integrate advanced TacIRST sensors into the F-22 Raptor, enhancing its infrared threat detection and countermeasure capabilities through the Infrared Defensive System (IRDS). Additionally, the commercial aviation, healthcare, and automotive industries in North America are increasingly leveraging simulators to improve operational efficiency and safety standards. This well-established ecosystem of technological innovation and industry-wide adoption has reinforced North America’s position as the leading revenue contributor in the global simulators market revenue.

The Asia Pacific simulators market is projected to witness the fastest growth during the forecast period, driven by increasing defense expenditures, expanding aviation infrastructure, and rapid industrialization. Governments of the region are actively investing in simulation-based training programs to enhance military capabilities and support the growing commercial aviation sector. In November 2024, The Indian Air Force launched a C-295 Full Motion Simulator at Air Force Station Agra in November 2024. This advanced facility enables realistic mission training and emergency scenario practice, reducing actual flight hours while supporting India's self-reliant aerospace manufacturing initiative through domestic C-295 production. Additionally, advancements in healthcare, automotive, and maritime industries are driving demand for high-fidelity simulators to improve workforce training and operational efficiency. The rise of smart city initiatives, technological innovation, and the integration of virtual reality and artificial intelligence further contribute to the region’s expanding adoption of simulation technologies. As Asia Pacific continues to prioritize digital transformation and industry modernization, the simulators market demand is expected to grow at an accelerated pace during the forecast period.

Simulators Market – Key Players & Competitive Analysis Report

The competitive landscape comprises global leaders and regional players aiming to capture significant simulators market share through technological innovation, strategic collaborations, and regional expansion. Industry leaders such as CAE Inc., L3Harris Technologies, Thales Group, and others leverage strong R&D capabilities and extensive distribution networks to deliver advanced simulation systems across aviation, defense, healthcare, and industrial training applications. Simulators market trends indicate rising demand for high-fidelity training solutions, such as AI-driven simulators, virtual reality (VR)-based training modules, and cloud-based simulation platforms, reflecting advancements in immersive learning and operational readiness. The simulators market is projected to experience significant growth, fueled by increasing demand for cost-effective training, strict safety regulations, and advancements in AI and real-time analytics. Regional players focus on localized requirements by offering tailored and affordable simulation solutions, particularly in emerging markets. Simulators market competitive strategies include mergers and acquisitions, partnerships with defense and commercial training institutions, and the development of next-generation simulation technologies to meet the growing need for enhanced training efficiency and risk mitigation. These factors highlight the critical role of technological advancements, regulatory compliance, and regional investments in driving the expansion of the global simulators market. A few key major players are CAE Inc.; Cruden BV; CXC SIMULATIONS; Exail; FlightSafety International; Indra; L3Harris Technologies, Inc.; Next Level Racing; RTX; Saab AB; SIMWORX Pty Ltd.; Thales; The Boeing Company; TRU Simulation + Training Inc.; and Vesaro.

The Boeing Company, founded in 1916 by William E. Boeing, is an American multinational corporation specializing in aerospace. Headquartered in Arlington, Virginia, Boeing operates through three main divisions: Boeing Commercial Airplanes; Boeing Defense, Space & Security; and Boeing Global Services. The company designs and manufactures a wide range of products, such as commercial jetliners, military aircraft, rotorcraft, satellites, and defense systems, serving customers in over 150 countries. Boeing is recognized as the largest aerospace manufacturer and a leading defense contractor in the world. In addition to its manufacturing capabilities, Boeing invests heavily in simulation technology to enhance training and operational efficiency. The company offers advanced flight simulators that replicate real-world flying conditions for pilot training and aircraft testing. These simulators are integral to ensuring safety and proficiency among pilots and crew members, allowing for realistic practice without the risks associated with actual flight. Boeing's commitment to innovation and sustainability positions it at the forefront of the aerospace industry, continually adapting to meet emerging challenges and customer needs.

L3Harris Technologies, Inc. is an American aerospace and defense technology company formed through the merger of L3 Technologies and Harris Corporation in June 2019. The company specializes in a wide range of products and services, such as command and control systems, tactical radios, avionics, night vision equipment, and intelligence, surveillance, and reconnaissance (ISR) systems. L3Harris serves customers across government, defense, and commercial sectors in more than 100 countries with ∼USD 18 billion in annual revenue and around 48,000 employees. One of the key areas of expertise for L3Harris is its development of simulators and training devices designed for both military and commercial applications. These simulators play a crucial role in preparing personnel for real-world scenarios by providing realistic training environments. They encompass various domains, including aviation training systems, such as the Predator and Reaper Mission Aircrew Training System (PMATS), which has trained thousands of aircrew members annually. The company's commitment to innovation ensures that these simulators integrate advanced technologies to meet the evolving needs of its clients, thereby enhancing operational readiness and effectiveness in complex mission environments.

List of Key Companies in Simulators Market

- CAE Inc.

- Cruden BV

- CXC SIMULATIONS

- Exail

- FlightSafety International

- Indra

- L3Harris Technologies, Inc.

- Next Level Racing

- RTX

- Saab AB

- SIMWORX Pty Ltd.

- Thales

- The Boeing Company.

- TRU Simulation + Training Inc.

- Vesaro

Simulators Industry Development

November 2024: Aston Martin Aramco launched advanced motion simulators designed by Memento Exclusives, recreating the F1 racing experience with authentic technology for fans and gamers.

January 2024: Saudia Academy expanded its aviation training capabilities by launching two new A320neo flight simulators from L3Harris Technologies, increasing its total to five. This milestone reinforces its commitment to high-quality training and regional aviation development.

Simulators Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Commercial Training

- Military Training

- Others

By Solution Outlook (Revenue, USD Billion, 2020–2034)

- Products

- Services

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Airborne

- Land

- Maritime

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Full Flight Simulators

- Flight Training Devices

- Other

By Technique Outlook (Revenue, USD Billion, 2020–2034)

- Live

- Virtual & Constructive Simulation

- Synthetic Environment Simulation

- Gaming Simulation

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Simulators Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.00 billion |

|

Market Size Value in 2025 |

USD 19.23 billion |

|

Revenue Forecast by 2034 |

USD 35.26 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global simulators market size was valued at USD 18.00 billion in 2024 and is projected to grow to USD 35.26 billion by 2034.

• The global market is projected to register a CAGR of 7.0% during the forecast period.

• North America dominated the market revenue share in 2024

• A few of the key players in the market are CAE Inc.; Cruden BV; CXC SIMULATIONS; Exail; FlightSafety International; Indra; L3Harris Technologies, Inc.; Next Level Racing; RTX; Saab AB; SIMWORX Pty Ltd.; Thales; The Boeing Company; TRU Simulation + Training Inc.; and Vesaro.

• The military training segment dominated the market share in 2024.